In the world of ETFs, QQQ and VTI have emerged as popular choices for investors seeking exposure to different segments of the stock market.

In this article, we’ll dive into the details of these ETFs, compare their performance, discuss the factors to consider when choosing between them, and provide insights into personalizing your investment strategy.

Overview of QQQ and VTI

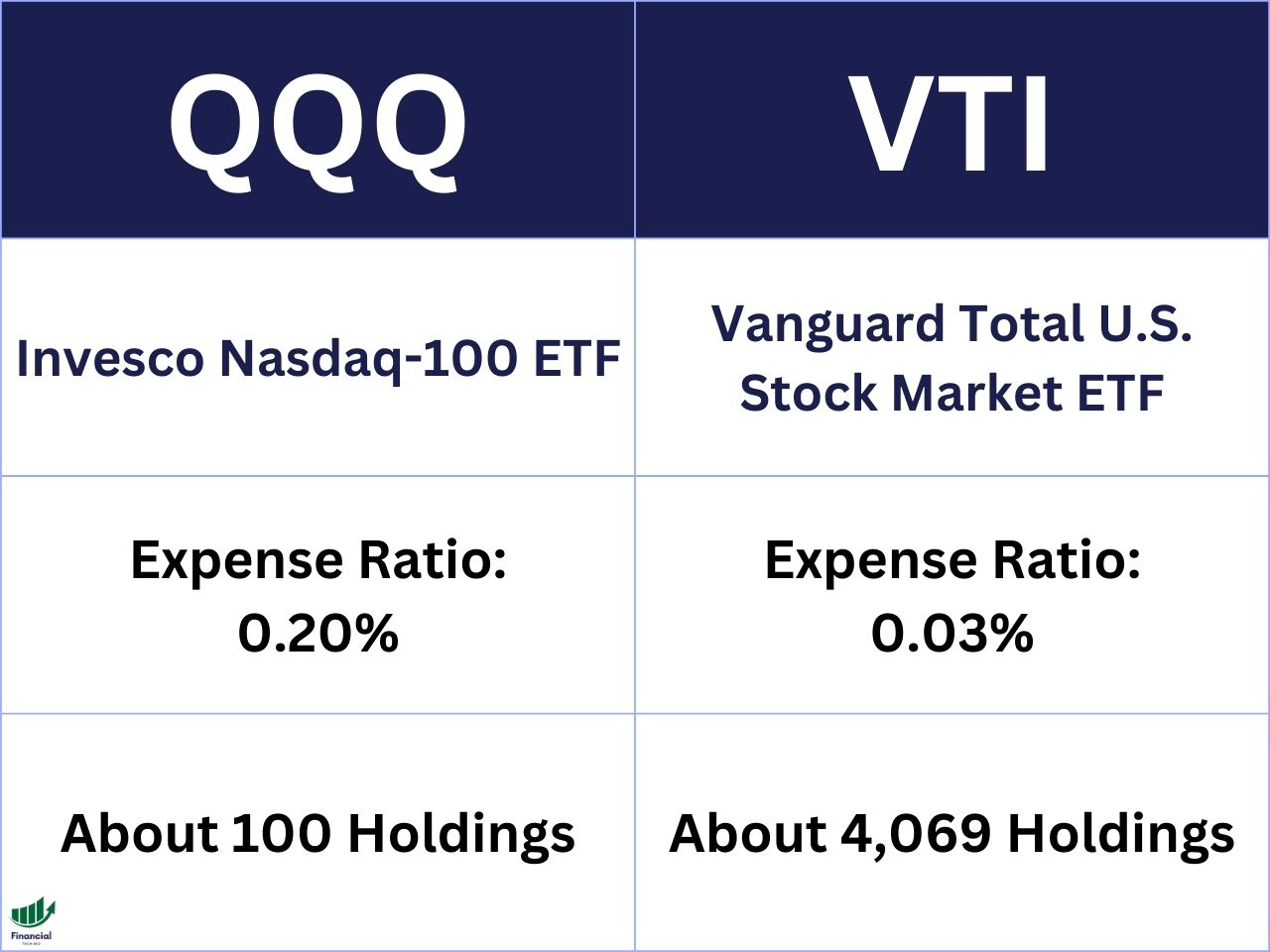

QQQ – Invesco QQQ Trust

- Investment Goals: QQQ aims to track a modified-weighted index of 100 NASDAQ-listed stocks, with a particular focus on non-financial-related stocks, especially in the technology sector.

- Number of Companies Held: 100

- Expense Ratio: 0.20%

- Key Points: QQQ offers an aggressive growth approach, primarily targeting the tech sector. However, it comes with higher volatility compared to VTI.

VTI – Vanguard Total U.S. Stock Market Fund

- Investment Goals: VTI seeks to track the overall performance of the U.S. stock market, including mid-sized and small-sized companies.

- Number of Companies Held: 4,069

- Expense Ratio: 0.03%

- Key Points: VTI provides broad exposure to the U.S. stock market, appealing to investors looking for diversification across various sectors.

Performance Comparison

Looking at the long-term performance of QQQ and VTI, we find some interesting insights. Since June 2001, QQQ has delivered an impressive total return of 342%, while VTI has generated a solid total return of 176%, including dividends. For a visual representation, check out the TradingView chart showcasing the performance of these ETFs over time.

To see the performance of any ETF on the same chart, you can use the TradingView widget below, you can compare multiple funds and ETFs on a single chart, making your research much easier. Feel free to compare any ETFs you’d like using the widget.

Factors to Consider When Choosing Between QQQ and VTI

Making the right choice between QQQ and VTI requires careful consideration of several factors:

- Risk and Volatility Tolerance:

- QQQ: With its tech-focused approach, QQQ tends to be more volatile, suiting investors with a higher risk tolerance.

- VTI: VTI, providing broad exposure to the overall stock market, offers a comparatively lower level of volatility.

- Investment Approach and Goals:

- QQQ: If you seek aggressive growth and have a preference for tech stocks, QQQ might align well with your investment approach.

- VTI: VTI suits investors looking for diversified exposure across different sectors and market segments.

- Preference for Specific Sectors or Market Segments:

- QQQ: With its concentration in the tech sector, QQQ offers an attractive option for those seeking exposure to the tech industry’s growth potential.

- VTI: VTI covers a wide range of sectors, appealing to investors who prefer a more balanced and diversified portfolio.

- Diversification and Conservative Investing:

- VTI: If you prioritize diversification and a conservative investing approach, VTI’s broad exposure to the U.S. stock market, including mid-sized and small-sized companies, could be suitable for your portfolio.

Personalizing the Investment Strategy

Crafting an investment strategy that aligns with your goals is essential. Consider the following suggestions:

- Blend Both ETFs: Some investors opt for a mixture of QQQ and VTI, striking a balance between aggressive growth and broad market exposure.

- Understand Your Risk Appetite: Evaluate your risk tolerance and investment goals to determine which ETF suits your needs.

- Seek Professional Advice: Consulting with a financial advisor can provide personalized guidance based on your unique circumstances.

Related ETF Comparisons

To further expand your understanding of ETFs and enhance your investment knowledge, consider exploring the following articles on your website:

- VOO vs. SCHD: This article provides an in-depth comparison between VOO and SCHD, helping you make informed decisions regarding large-cap stocks and dividend-focused investments.

- JEPI vs. SCHD: Discover the differences and similarities between JEPI and SCHD, two ETFs that offer exposure to high-dividend-yielding equities.

- JEPI vs. JEPQ: Dive into the comparison between JEPI and JEPQ, exploring their distinct approaches to achieving investment goals and their potential benefits for your portfolio.

- QYLD vs. JEPI: Uncover the nuances between QYLD and JEPI, two ETFs focusing on generating income through covered call strategies and high-dividend stocks.

- VUG vs. QQQ: Discover which growth ETF is right for you.

Feel free to click on the links to access these informative articles and gain valuable insights into various ETF comparisons.

The Financial Tech Wiz ETF Comparison Tool

You can use the ETF comparison tool below to compare over 2,000 ETFs and mutual funds with data I manually collected:

QQQ vs. VTI | Bottom Line

In the battle of QQQ vs. VTI, each ETF has its own strengths and considerations. QQQ offers aggressive growth potential, especially within the tech sector, but comes with higher volatility. VTI, on the other hand, provides broad exposure to the U.S. stock market, accommodating a more diversified investment approach.

When making your investment decisions, carefully evaluate your risk tolerance, investment goals, and preference for specific sectors or market segments. Consider personalizing your strategy by blending ETFs or seeking professional advice to optimize your portfolio.

Remember, the key to successful investing lies in understanding your objectives and making informed choices. Use tools like TradingView to analyze performance trends and investigate relevant articles that compare different ETFs.

Before you go

If you want to keep educating yourself about personal finance, you must check out these posts as well:

What is the Most Successful Options Strategy

Options Trading for Income: The Complete Guide

Mark Minervini's Trading Strategy: 8 Key Takeaways

The Best Options Trading Books

The Best Laptops and Computers for Trading

How to Get a TradingView Free Trial

The Best TradingView Indicators

This article contains affiliate links I may be compensated for if you click them.