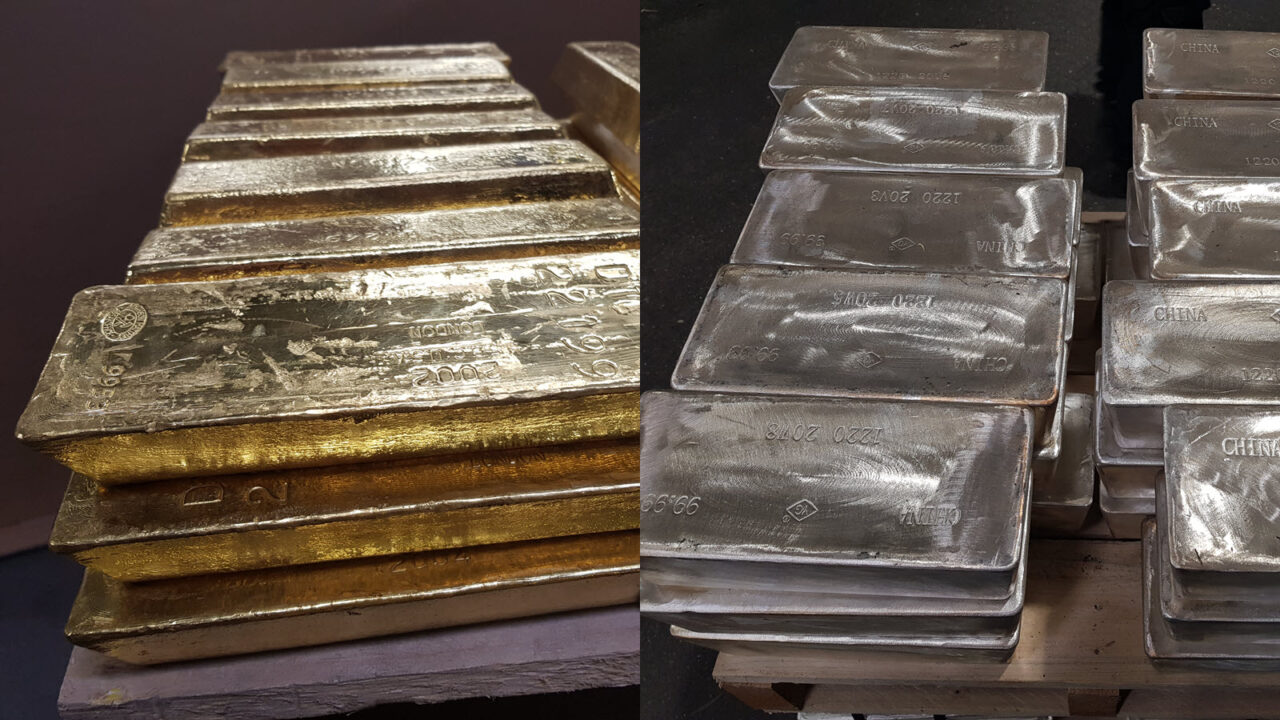

Gold and silver are two good options when it comes to investing in precious metals. Whilst volatility does exist they are generally viewed as strong assets that can offer an additional level of diversification for your portfolio.

Here we take a look at the similarities and differences of the two precious metals in detail, helping you make an informed decision about whether to invest in either or both of them.

Similarities between Gold and Silver

Before jumping into the differences between gold and silver, it would be good to take a look at some of the similarities between gold and silver:

- Effective against inflation: One of the main benefits includes their resilience against inflation, with the ability to maintain or increase their value. In the past they have increased value in turbulent times, bringing plenty of evidence that they are resilient in these times. Focus on the user mentions that gold has risen by an average of 14.9% during high inflation years since 1971.

- Precious metals: They both belong to the precious metals category, which notices their rarity, economic value and key investment value. They are both pure metals (as well as platinum), meaning they contain no iron and cannot rust.

Keep on reading to find out what the differences are between the two metals:

Difference 1: Gold is better for liquidity

One of the main differences is the fact gold is better for liquidity. Gold tends to rise when mainstream assets decline, which is one of the main reasons investors turn to gold during economic downturns. Meanwhile, silver is tied to the health of the overall economy or business cycle. Therefore if the market and economy is performing well then some investors may decide to invest in silver.

Silver is also estimated to hit a 10 year high and outperform gold according to CNBC.

Difference 2: Silver is more volatile than Gold

Another difference is that silver is more volatile than gold, meaning when the price does move it can move considerably. This represents an opportunity for investors looking to grow their allocation but for those looking for more stability in precious metals, having a larger allocation in gold may be the way to go.

Difference 3: Silver is more affordable

One of the other ways that gold and silver differ is in terms of pricing. Per ounce silver is cheaper, making it more accessible to smaller retail investors who wish to own metals as physical assets. This price difference is mainly down to scarcity. Gold is much rarer than silver and this imbalance in supply and demand between the two metals leads to a large gap in the price.

Difference 4: Gold is VAT Free

Gold is actually VAT free, in comparison to silver and platinum which have the VAT cost attached. This makes gold a popular choice amongst investors as it can represent better value for money.

It is worth noting that when bought through specific vaulted/stored methods, silver can also be VAT free, but when purchasing physical bullion and storing at home, will be subject to the tax.

The key difference and biggest cost factor between vaulted silver and holding smaller units at home, is that coins and small bars incur VAT and shipping costs, as well as being costly to add to home insurance.

Investment silver in the form of ‘Good Delivery’ bars stored and insured at low-cost in an LBMA-member vault is exempt from VAT and saves silver investors 20% in the UK even before any price spreads are taken into consideration.

What does this mean for your portfolio?

Overall, it is clear there are multiple differences between both gold and silver, with both bringing benefits based on your investment requirements. Buying effectively also means looking at the method you chose to invest in precious metals. Vaulted silver storage options like BullionVault give you the opportunity to buy at the cheapest possible price and investing in physical silver through vaults is VAT free. Make sure you do the proper research before committing large portions of your portfolio to any one metal.

This content is for informational purposes only and should not be taken as financial advice. Always consult a professional before making any investment decisions. Remember that investing involves risks and is not suitable for everyone. Past performance is not indicative of future results.