Option Omega Review

This review looks at the greatest strengths of Option Omega, including its application of 1-minute historical data, incredible speed, and ease of use, making it an ideal choice for traders who want to optimize and verify their options strategies in a very efficient manner.

Continue reading to learn more about Option Omega, and why it is my favorite options backtesting software.

Key Features of Option Omega

- Backtest 10+ years of options strategies in minutes

- Ability to use 1-minute historical data for the most accurate results

- Supports CSV exports for customizable analysis

- Combine multiple backtests into a single portfolio

- Backtest SPY, SPX, QQQ, IWM, and TSLA

- Test back to 1/1/2013 – yesterday

Option Omega is normally $99 per month or $599 annually. However, with my discounted affiliate link, you can get 50% off your first year!

Get 50% Off Option Omega Now!Key Takeaways

- Option Omega provides detailed backtesting capabilities with over 10 years of 1-minute historical data, allowing precise strategy testing.

- The program supports a large number of tickers such as SPX, SPY, QQQ, IWM, TSLA, and AAPL and enables diverse tastes in trading.

- Traders have the ability to utilize sophisticated features such as realistic margin, slippage, and commission modeling to optimize the accuracy of backtest results.

Overview of Option Omega

Option Omega is an automated options backtesting software that enables traders to analyze the performance of their options strategies using historical data. It is particularly helpful for one day to expiration (1DTE) and zero day to expiration (0DTE) strategies and provides information on how these strategies will perform across many years.

The platform uses 1-minute data, making it perfect for backtesting 0 and 1-DTE strategies. The ability to run hundreds of 10+ year backtests in minutes is amazing and allows retail traders to build conviction in their options trading. There are tons of ways to modify the test to suit your style, and it is easy to spend hours on Option Omega tweaking your backtests.

Pros and Cons of Option Omega

Pros

- Very precise 1-minute backtesting.

- Sophisticated customization options for strategy testing.

- Good educational support by the Option Omega Academy and active community.

- Advanced portfolio management tools.

Cons

- Limited to specific major tickers.

- No support for morning expiry options on SPX.

- Sophisticated features could need a high learning curve.

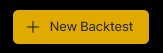

How to Backtest on Options Omega Walkthrough

To initiate a new backtest, users navigate the user-friendly dashboard to select the target tickers and specify the date ranges on which to backtest. This setup is made in a way that caters to both beginner and experienced traders.

Once you sign in, you will see tests and portfolios at the top left.

To begin your first backtest:

1- Click tests

2- Click the new backtest button

3- Begin setting your parameters

4- Be careful not to click off to avoid disrupting your parameters

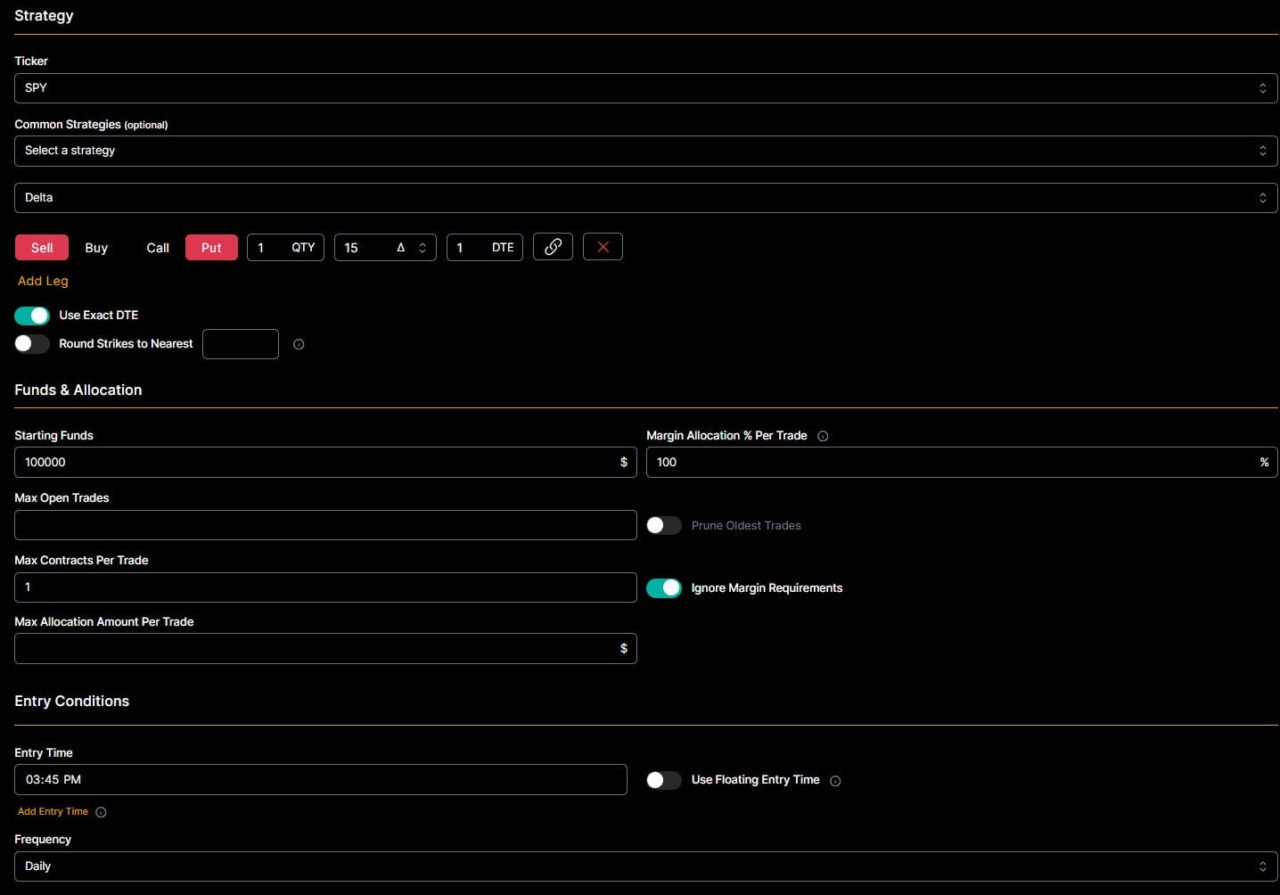

Setting up Backtesting Parameters

The parameters are incredibly customizable, and I highly recommend you test multi-leg strategies like iron condors and put credit spreads one leg at a time, then combine them in a portfolio. This isn’t necessary, but it can be more efficient and customizable.

Defining test parameters is necessary in order to enable the backtest to mimic real trading conditions. Parameters enable users to choose strike options, define entry and exit points, and adjust funds and allocation settings. Additional settings include defining commissions, slippage, and limiting profits or losses, providing an overall setup for each backtest.

Option Omega allows you to set up tons of specific testing parameters for your test. I will walk you through all of them in detail below.

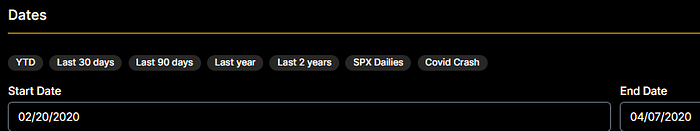

Date Range

You can choose any date range from 1/1/2013 to yesterday to run your backtest. The platform also offers specific date ranges for ease of use like the covid crash, YTD, last year, last 2 years, etc.

Ticker

Option Omega supports backtesting for SPX, SPY, QQQ, IWM, and TSLA.

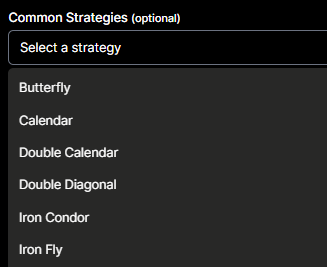

Common Strategies

You can optionally choose from a list of strategies like iron condors, calendars, iron flies, and more.

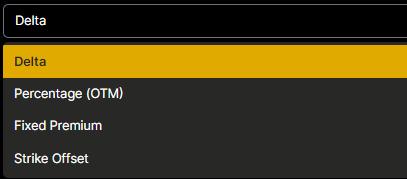

Strike Selection

For strike selection, you have the option to use delta, percentage OTM, fixed premium amount (i.e., always sell $1 option), or strike offset.

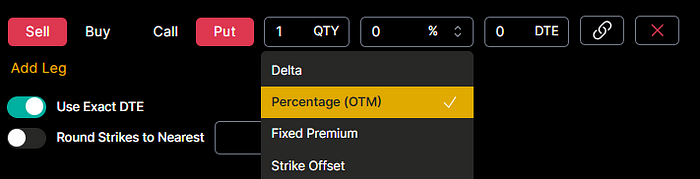

Add Leg

When you click add leg you will various options to determine which strike is bought or sold in the backtest. You can choose the following:

- Sell or buy to open the contract

- Call or put

- Quantity to sell or buy to open

- Which delta, % OTM, premium amount, or strike offset to use

- How many DTE to target (you can also specify to use exact DTE only)

- You can specify what number to round to the nearest strike

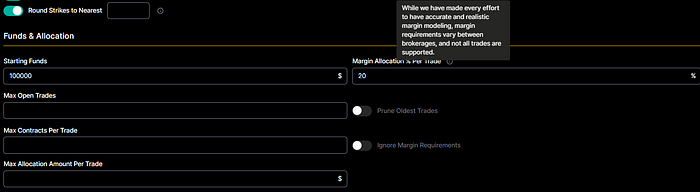

Funds & Allocation

You can choose the starting funds amount, a margin allocation % per trade, the number of max open trades, max contracts per trade, or a max dollar amount per trade.

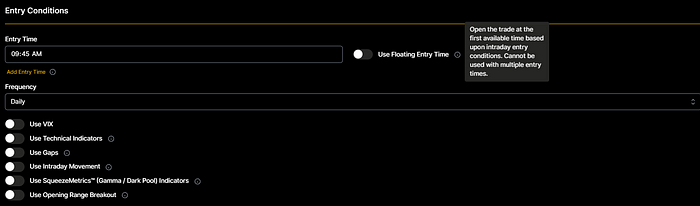

Entry Conditions

You can enter an entry time and frequency to keep your trades standardized. This is also helpful if you are only trading power hour strategies.

You can also implement the following entry conditions:

- VIX levels (max or min VIX levels)

- Technical Indicators (RSI, EMA, and SMA support)

- Gaps (only trade if there are gaps up or down)

- Intraday movement (only trade if there is a min or max movement up or down intraday)

- SqueezeMEetrics like Gamma and Dark Pool indicators

- Opening range breakout

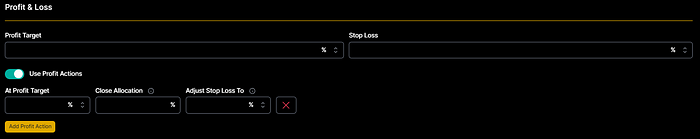

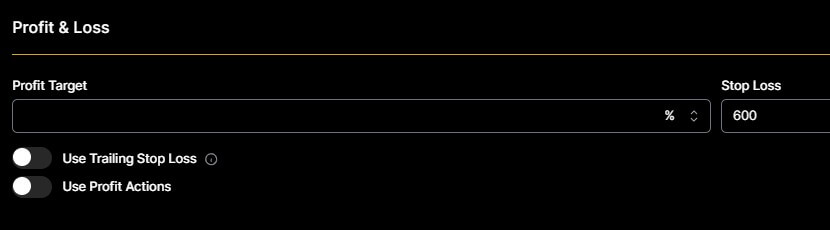

Profit & Loss

You can specify take profit levels in % or $ amounts. You can do the same for stop-loss levels. You can even adjust stop-loss levels when the trade hits a specific profit level.

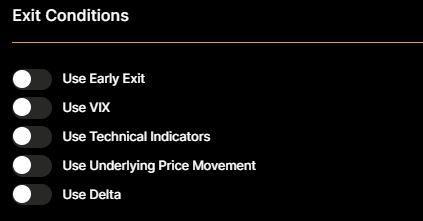

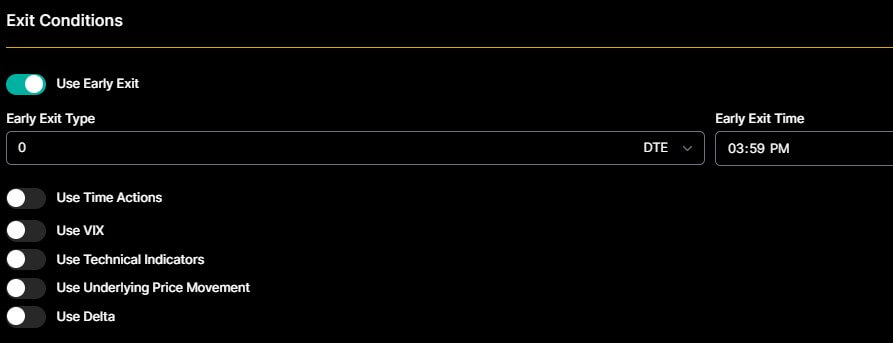

Exit Conditions

You can specify when to exit a trade in the backtest based on DTE, time in the trade, VIX levels, delta, technical indicators, and price movement. For example, if your strategy calls to exit if the delta reaches a certain level or to exit before the market closes, you can easily set this up.

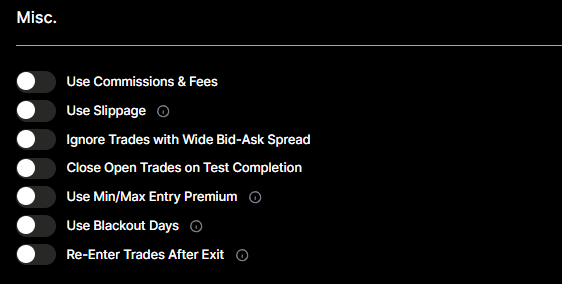

Misc

Under the misc. category you can set slippage amount, commissions, bid-ask spread filters, re-enter trades right after exit, and if you want to close active trades when the test completes.

Advanced Testing Options

Option Omega also provides advanced testing capabilities that feature technical indicators, SqueezeMetrics, and strategies like the Opening Range Breakout (ORB). These are meant to provide more insight and more detailed control to traders over their backtest conditions, enhancing the predictive quality of their trading strategies.

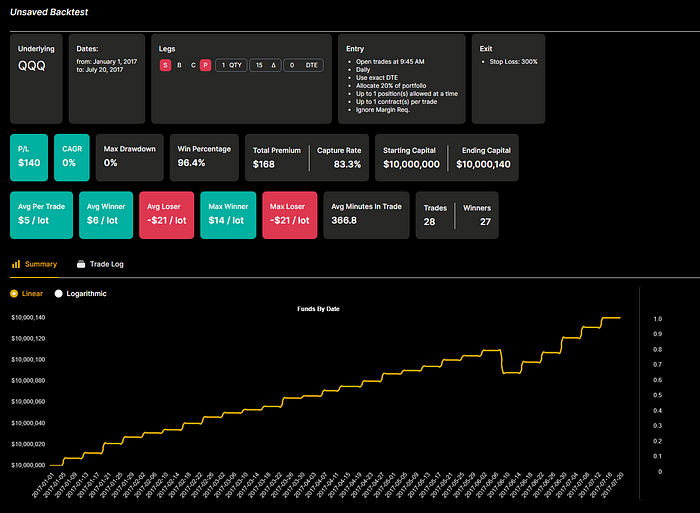

Analyzing Backtest Results

After conducting a backtest, Option Omega provides a complete analysis of the result, including critical metrics such as Profit/Loss, Compound Annual Growth Rate (CAGR), and Maximum Drawdown (MDD). Users can customize the trade log, replay trades, and export results in CSV for further examination.

Once you set all your parameters and run your test, you will see a nice equity curve built into the platform of how the strategy performed. Option Omega will also tell you the following metrics:

- CAGR

- Overall P/L

- Win percentage

- Premium capture rate

- Max and average winner

- Max and average loser

- Total number of trades and winners

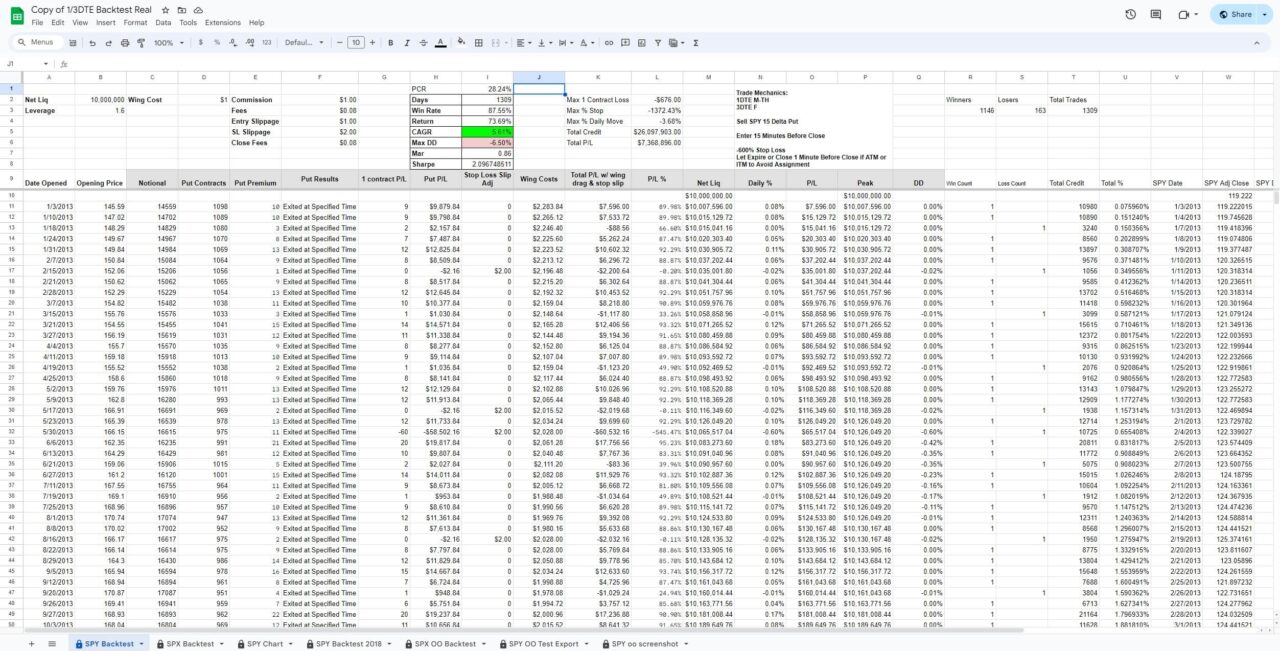

SPX/SPY 1DTE Backtest Example

In our example, we will test a 1-DTE short-put strategy on the SPX and SPY. To account for the weekend when the market is closed, we will have to run a separate 3DTE test for Friday’s “1-DTE” trades.

So, in Option Omega, I simply select the start date as 1/1/2013 and the end date of yesterday. Next, I choose SPX, then add a leg. The leg will be:

- Sell

- Put

- 1 QTY

- 15 Delta

- 1 DTE (Separate 3DTE Friday only test)

- Daily frequency 15 minutes before close (Weekly, then click for Friday 3DTE)

- -600% stop loss

- Early exit at one minute before close

- 1 max contract per trade

- Ignore margin requirements

I will check “use exact DTE” to ensure it only does the 1DTE trades. For starting funds, I usually go with a high number, like $10,000,000, for the most flexibility.

I will use 1 contract per day to remain consistent, and later in Google Sheets, we will be able to adjust the number of contracts sold based on account size. You can do this by exporting the backtest data from Option Omega. You can view my Google Sheet for this SPY/SPX 1DTE backtest and make a copy if you’d like to use the template for your own Option Omega exports.

You can customize the commissions and fees to your own broker, plus you can control the leverage based on notional value. For example, selling one SPY 400 strike put is $40,000 of notional value. Changing the leverage to the spreadsheet to 1 will sell 1 contract for every $40,000 of net liquidity. You can also change the account net liq size.

My sheet will calculate the following for you based on your Option Omega export results:

- PCR (premium capture rate): Total profit / Total premium sold

- Win rate %

- Total return

- CAGR: Compound annual growth rate

- Max drawdown

- Mar ratio

- Sharpe ratio

- Max % stop loss hit

- Max one contract loss

- Max daily % drawdown

Combining Tests in Portfolios

Since I ran two backtests in this case (1 & 3DTE for Friday entries), to combine them into a single test, we can use the portfolios feature. Simply click portfolios at the top left, and then click New Portfolio.

You will be able to customize the starting funds and the start and end dates for the portfolio test. Next, I will check the two backtests I want to combine, then click run.

This will combine the 1 and 3DTE tests together in a single test. Next, you can click “Trade Log” and then use the export to CSV option if you want to analyze the data in Google Sheets. The Benefit of using Google Sheets is you can easily change commissions and leverage based on net liquidity, which you can do in my Google Sheets template.

Option Omega Academy

There is also a vibrant community of real traders who offer courses through the Option Omega Academy. There is a wide range of courses in topics like 0-DTE strategies, spreadsheeting, power hour strategies, and tons more. The academy and a supporting Discord community demonstrates that the platform is built by traders, for traders.

Option Omega Free Trial

New users can use my affiliate link to get an Option Omega free trial. It allows you to test out how the platforms works, but you can only backtest QQQ options during the year 2017. Even with the limitations, you will definitely be able to tell if the platform is right for you. You will be able to use all of the backtesting specifications to ensure it can properly backtest your strategies.

Option Omega Pricing

Option Omega costs $99 per month or $599 per year. You can also get 50% off by using my discounted affiliate link using the button below.

| Plan | Regular Price | Discounted Price (with Affiliate Link) |

|---|---|---|

| Monthly | $99 per month | $49 per month |

| Annually | $599 per year | $299 per year |

Option Omega Alternatives

| Platform | Pricing | Key Features |

|---|---|---|

| Option Omega | $99 per month or $49 with discount $599 per year or $299 with discount |

|

| Option Alpha | $79-$199 per month |

|

| OptionNet Explorer | $200 for 3 months $660 per year (10% off with affiliate link) |

|

Final Thoughts: Is Option Omega Worth It?

Option Omega is an excellent resource for options traders looking to build conviction in their strategies. Option Omega is definitely worth a shot if you want automated backtesting software with accurate 1-minute historical data. If you’re not 100% sold on it yet, I would recommend starting a free trial so you can test it out for yourself.

With its large amount of data, robust capabilities, and useful learning materials, Option Omega is particularly suitable for professional traders who would like to maximize their options trading strategy. The ability to have a free trial and lower rates makes it a convenient option to experiment with prior to subscribing to the fee.

Consider reading my article about using my Option Omega discount code to score a discount as well.

Frequently Asked Questions (FAQ)

- How precise is the 1-minute data? Option Omega’s 1-minute data is carefully sourced to provide high precision, with dependable backtesting results.

- What is Floating Time Entry and IMSL? IMSL is an abbreviation of a stop loss condition which is intra-minute tested to have full control over exiting trades.

- How does it work? Floating time entry allows entering positions based on specified conditions rather than at a predetermined time, offering more freedom in strategy execution.

- Can I export data to analyze somewhere else? Data from backtests can be exported to CSV files to be further analyzed in such programs as Excel or Google Sheets.

- How should the best margin and allocation settings be handled? Option Omega provides users with avenues to correctly model margin and allocation from realistic situations of trading which can be altered to suit varied trading strategies.

– Free trading journal template & cheat sheet PDFs

– Custom scanners, watchlists, & market commentary

– Access our free trading course and community