Backtesting options strategies can be difficult, but there are plenty of free and paid software to streamline the process.

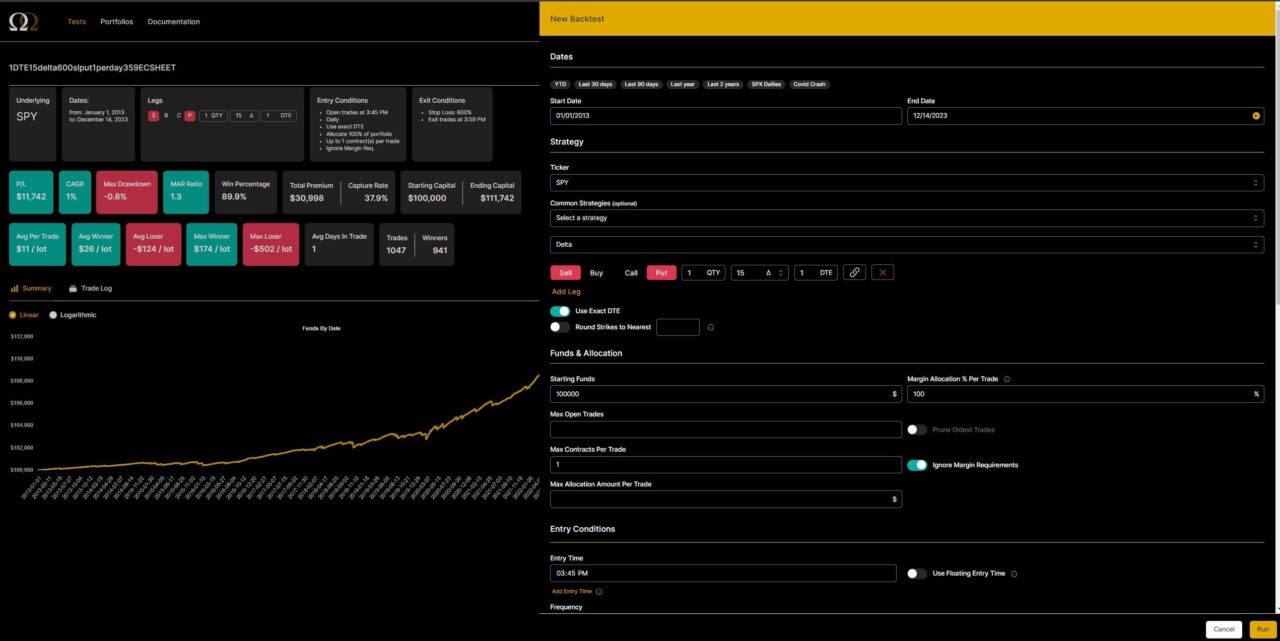

My favorite options backtesting software is Option Omega because it has one-minute data back to 2013, and works for nearly every strategy. Continue reading to learn about Option Omega and my other favorite options backtesting software.

Summary of the 3 Best Options Backtesting Software

Option Omega: Best overall with one-minute data back to 2013

tastylive Lookback: Best free options backtesting

OptionNET Explorer: Best for manual backtesting

Best Options Backtesting Software Compared

You can use the table below to compare my top picks for options backtesting software:

| Feature | Option Omega | tastylive Lookback | OptionNET Explorer |

|---|---|---|---|

| Link | Get 50% Off Option Omega | Visit tastylive Lookback | Get 10% Off OptionNET Explorer |

| Best For | Comprehensive and fast automated backtesting | Beginners and cost-sensitive users | Traders who prefer manual backtesting and integration with brokers |

| Historical Data | 1-minute data from 1/1/2013 to yesterday | Several tickers back to 1/1/2010 | 5-minute, connect with brokers for real-time |

| Tickers Covered | SPY, SPX, IWM, QQQ, TSLA | Most stocks, indices, and ETFs with options | Most stocks, indices, and ETFs with options |

| Key Features | Automated backtesting, Portfolio feature, Export to CSV | Free, Advanced trade parameters, Forward testing, Export to CSV | Connect with brokers, Real-time data access, Send orders to broker |

| Pricing | 7-day trial (limited to 2017 QQQ), $99/month, $599/year, 50% off first year with my affiliate link | Free | 10-day trial for £10, 3 months for £160, 12 months for £525 |

The 3 Best Options Backtesting Software Reviewed

1- Option Omega

Option Omega is my top pick for options backtesting because it is automated, has historical 1-minute data, and allows you to build portfolios to combine multiple strategies. You can read my full review of Option Omega to learn more.

Key features:

- Automated backtesting for SPY, SPX, IWM, QQQ, TSLA

- 1-minute historical data so you can accurately test 0DTE and 1-DTE strategies

- Test from 1/1/2013 – yesterday

- Combine several backtests with the portfolio feature

- Export backtests to CSV file to analyze further

Pros and Cons of Option Omega

Here are the pros and cons of Option Omega:

| Pros | Cons |

|---|---|

| 1-minute historical data, as close to real-time as possible | Limited to only 5 tickers |

| Can run 10+ year backtests dating back to 2013 in minutes | Cannot manually backtest |

| Highly customizable parameters | |

| Available for $50 per month with my affiliate link, making it cheaper than OptionNET Explorer |

Option Omega Pricing

| Option Omega Pricing | Details |

|---|---|

| 7-day Free Trial | Limited to 2017 QQQ |

| Monthly Subscription | $99 per month |

| Annual Subscription | $599 billed annually |

| Discount Offer | 50% off your first year with my affiliate link |

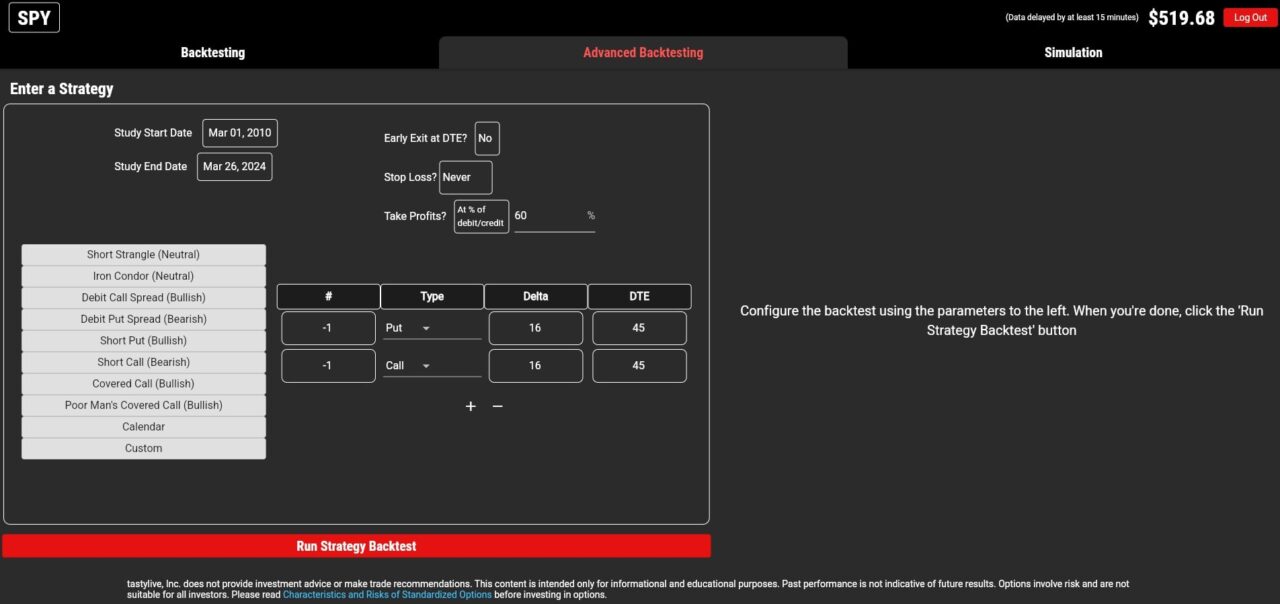

2- tastylive’s Lookback

tastylive’s Lookback is great if you want to get started with backtesting options for free. It includes every major ticker, and allows you to get a feel for automated backtesting software. However, if you want to set advanced parameters and have the most accurate data, Option Omega is better.

Key features:

- Lookback is free, allowing anybody to get started with no barrier to entry

- Ability to backtest individual trades

- Set basic trade parameters for automated backtesting

- Forward testing capabilities

- Test several tickers dating back to 1/1/2010

- Export results to CSV file

Pros and Cons

Here are the pros and cons of tastylive Lookback:

| Pros | Cons |

|---|---|

| Free to use | Less customizable parameters than Option Omega |

| Automatic backtesting with many tickers | Data is likely not 1-minute historical data |

| Ability to export data to CSV |

3- OptionNET Explorer (ONE)

OptionNET Explorer (ONE) is an excellent software to use if you run advanced multi-leg strategies that rely on several adjustments. Trades like the space trip trade (STT) and other advanced strategies require advanced software like ONE to track. Platforms like thinkorswim do a decent job at tracking these, but it becomes harder after a few adjustments.

Key features:

- 5-minute historical data

- Connect with thinkorswim, IBKR, and Tradier, to monitor your live positions

- Get free access to real-time data by connecting your brokers live data feed

- Ability to send orders directly to your broker

Pros and Cons

Here are the pros and cons of OptionNET Explorer:

| Pros | Cons |

|---|---|

| Connects with various brokers | No automated backtesting features |

| 5-minute historical data for manual backtesting | No monthly pricing option |

OptionNet Explorer Pricing

ONE costs 10GBP (~ $12) for a 10-day trial, 160GBP (~ $200) for 3 months, and 525GBP (~ $660) for one year.

| OptionNet Explorer Pricing | Details |

|---|---|

| 10-day Trial | 10 GBP (about $12) |

| 3 Months Subscription | 160 GBP (about $200) |

| Annual Subscription | 525 GBP (about $660) |

Manual Backtesting vs. Automated Backtesting Software

Automated backtesting is when you set trade parameters and let the backtesting software do all of the work for you. A manual backtest is when you open, close, and stop out of all of your trades one by one while logging your results.

Automated backtesting is generally preferred since it takes much less time, but it gives you less control over the results. Manual backtesting is best for testing complex multi-leg strategies since automated software may skew the results if some trades incur wide bid-ask spreads.

For example, if your strategy only involves selling naked puts, automated backtesting will be fine. However, if you want to test an iron condor strategy, which involves four legs, manual backtesting will give you more control.