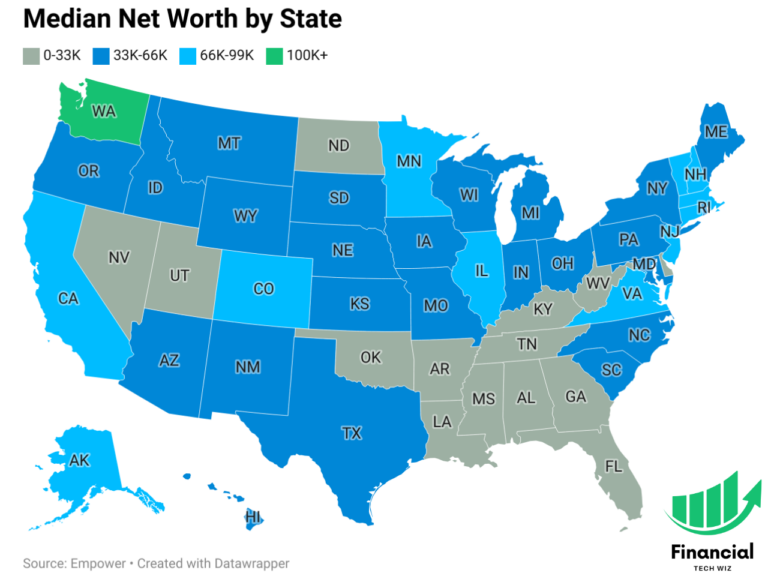

Median & Average Net Worth by State

Understanding wealth distribution across different states is crucial for evaluating financial health on both individual and collective levels. By examining net worth, which is calculated by subtracting liabilities from assets, we can gain insights into the financial landscape of each state. Below, you’ll find visual representations of average and median net worth by state, offering…