Discover a comparison of IEMG vs. MGK to determine which is best for you! Use the table below to compare their key characteristics.

IEMG vs. MGK Key Characteristics

| Metrics | IEMG | MGK |

|---|---|---|

| 1-Year Annual Return | 11.31% | 51.56% |

| 5-Year Annual Return | 4.24% | 20.22% |

| Expense Ratio | 0.09% | 0.07% |

| Dividend Yield | 2.89% | 0.46% |

| Number of Holdings | 2,940 | 88 |

You can compare these funds in real time using the TradingView chart below. Ensure to click the “ADJ” button at the bottom right of the chart to adjust the data for dividends!

Overview of IEMG

IEMG, the iShares Core MSCI Emerging Markets ETF, is an exchange-traded fund managed by BlackRock. This ETF aims to track the investment results of the MSCI Emerging Markets Investable Market Index, which is composed of large, mid, and small-cap emerging market equities. The ETF encompasses a wide range of companies in emerging markets, which typically include countries with developing economies such as China, India, Brazil, South Africa, and Russia, among others.

Overview of MGK

The Vanguard Mega Cap Growth ETF, trading under the ticker symbol MGK, is an exchange-traded fund managed by Vanguard. It is designed to track the performance of the CRSP US Mega Cap Growth Index. This index focuses on mega-cap companies in the U.S. equity market that exhibit growth characteristics.

Performance Comparison of IEMG vs. MGK

The total return performance including dividends is crucial to consider when analyzing different investment funds.

As of 1/15/2024, IEMG has a one year annualized return of 11.31%, while MGK has a five year annualized return of 51.56%.

IEMG vs. MGK Dividend Yield

Both IEMG and MGK pay dividends to their shareholders from the earnings of their underlying stocks. The dividend yield is a measure of how much a company pays in dividends relative to its share price.

As of 1/15/2024 the dividend yield of IEMG is 2.89%, while the dividend yield of MGK is 0.46%.

IEMG vs. MGK Expense Ratios

The expense ratio is a measure of how much an ETF charges its investors for managing the fund. It is expressed as a percentage of the fund’s assets per year.

The expense ratio is one of the most important factors to consider when choosing an ETF because it directly affects your returns over time. The lower the expense ratio, the more money you get to keep from your investment.

As of 1/15/2024 IEMG has an expense ratio of 0.09%, while MGK has an expense ratio of 0.07%.

IEMG vs. MGK Holdings

A fund’s holdings are the basket of individual securities that it owns and tracks. It is crucial for investors to analyze a fund’s holdings because they are effectively what you are investing in by purchasing the fund.

As of 1/15/2024 IEMG holds 2,940 securities, while MGK holds 88.

ETF Comparison Tool

I created an ETF comparison tool you can use with the chart below. Simply search for multiple ETFs or mutual funds to easily compare the key metrics of over 2,000 funds.

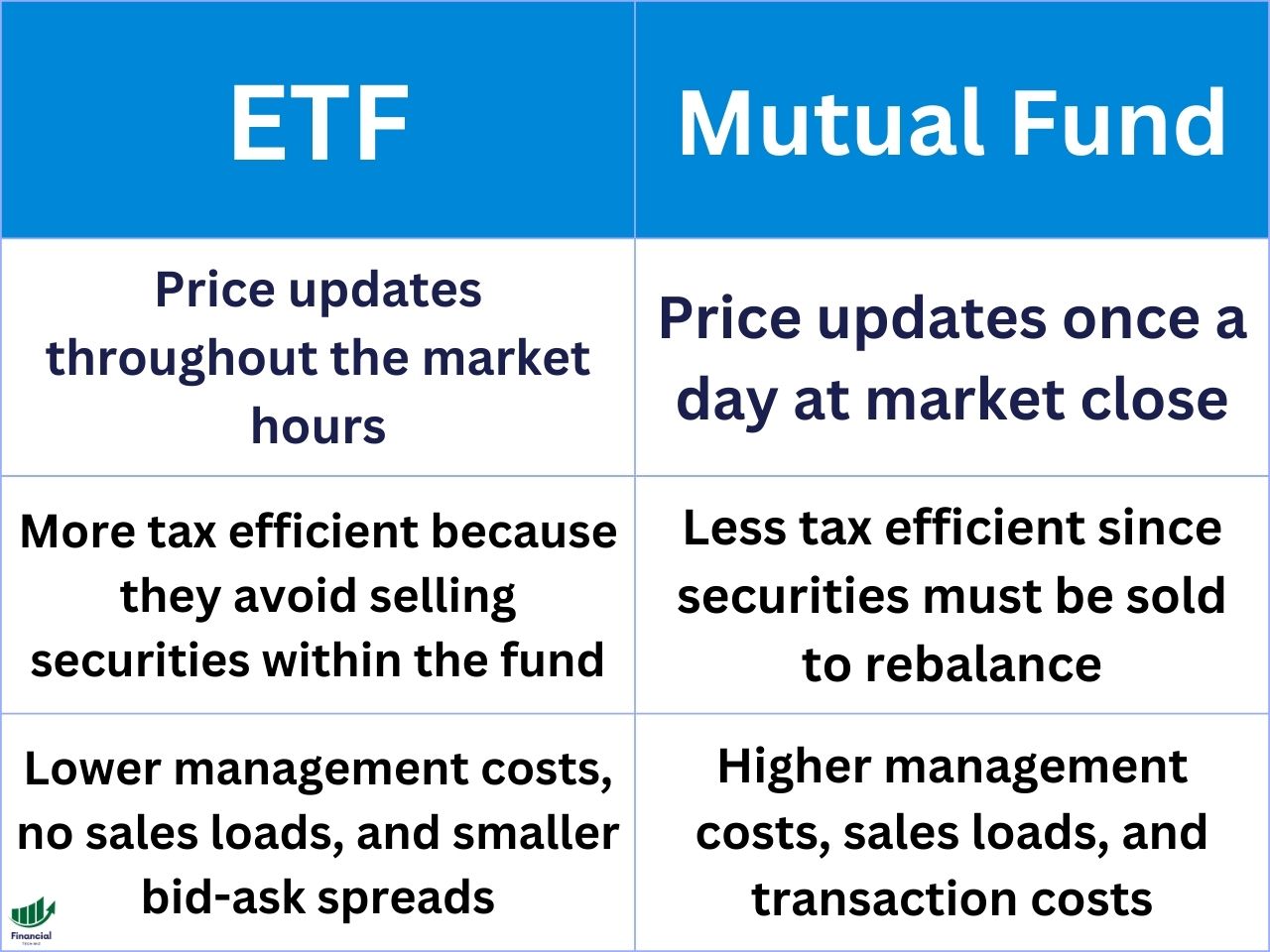

Mutual Funds vs. ETFs

When comparing investment funds, you may be confused about the difference between an ETF and a mutual fund. Keep in mind, an index fund is a specific type of mutual fund. ETFs are tradeable during the stock market hours, while mutual funds only update once per day.

Mutual funds are pooled investment vehicles that are managed by a fund company or an investment advisor. They issue and redeem shares directly to investors at the end of each trading day based on their net asset value (NAV). Investors can buy and sell mutual fund shares through the fund company or a broker.

ETFs are also pooled investment vehicles that are managed by a fund company or an investment advisor. However, they trade like stocks on an exchange throughout the trading day at market prices that may differ from their NAV. Investors can buy and sell ETF shares through a broker.

Some of the advantages and disadvantages of mutual funds vs ETFs are:

- Mutual funds may offer more convenience and flexibility for investors who want to invest a fixed amount of money or set up automatic investments or withdrawals.

- Mutual funds may require a larger minimum investment.

- ETFs may incur bid-ask spreads and premiums or discounts to their NAV, which can affect their trading efficiency and performance.

- Mutual funds may be less tax-efficient than ETFs, as they may distribute more capital gains to their shareholders due to their redemption mechanism.

- ETFs may be more tax-efficient than mutual funds, as they may avoid realizing capital gains through their creation and redemption mechanism.

IEMG vs. MGK - Bottom Line

Ultimately, both IEMG and MGK are solid investment choices. The choice between the two ultimately depends on the exposure you want and the amount of risk you are willing to take.

Hopefully, the information in this article helps you decide which is better for your portfolio. To continue your research, check out our other fund comparison articles as well!

Comparing ETFs With TradingView

When comparing ETFs, it is crucial that you are comparing the total return to include dividend payments. TradingView allows you to compare several stocks and ETFs at once on a single chart adjusted for dividends.

You can simply sign up for a free TradingView account and type the stock ticker you want to compare.

TradingView Limited Time Offer!

Exclusive Deal: 30-Day FREE Premium Access + Bonus Credit

Don't Miss Out - Sign up for TradingView Now!

- Advanced Charts

- Real-Time Data

- Track all Markets

Next, click the plus sign next to the ticker at the top left of the chart to add symbols to compare.

Finally, ensure you click the ‘ADJ’ at the bottom to adjust the returns for dividends!

As you can see in the TradingView chart below, you can compare multiple funds and ETFs on a single chart, making your research much easier. Feel free to compare any ETFs you'd like using the widget. Alternatively, sign up for a free TradingView account and use the main website for a better experience.

Other ETF Comparisons

IEMG vs SPYG

VVIAX vs VYM

FZROX vs VHYAX

AGG vs VGK

IEMG vs IWF