Here are the key takeaways for the Russell 1000 vs. 2000 vs. 3000:

- The Russell 1000 includes large-cap companies with higher market capitalizations.

- The Russell 2000 focuses on smaller companies with lower market capitalizations.

- The Russell 3000 combines both, offering a comprehensive view of the market’s large-cap, mid-cap, and small-cap segments.

Key Differences Between Russell 1000, 2000, and 3000

- Market Capitalization Differences: The primary difference lies in the market capitalization of the companies each index represents.

- Sector and Industry Representation: While the Russell 1000 is skewed towards more stable, large-cap sectors, the Russell 2000 offers exposure to various small-cap sectors. The Russell 3000, in contrast, offers a blend of both.

- Performance Comparison: Historically, the Russell 1000 and 2000 are more stable, and the Russell 2000 is more volatile since it holds small-cap companies.

Visualizing the Returns of the Russell 1000, 2000, and 3000

In the TradingView chart below, all 3 of these indices are represented within the same chart, thanks to TradingView. TradingView allows you to compare multiple stocks, ETFs, cryptos, and more on a single chart.

As you can see, the Russell 1000 and 3000 are nearly identical, while the Russell 2000 is much more volatile. Note that this data is the total return and includes dividends when you click the “ADJ” button at the bottom right of the chart..

TradingView is a great way to compare assets on a single chart for free. Also, if you sign up for TradingView using our affiliate link, you can get a free trial and a discount on the premium subscriptions.

TradingView Limited Time Offer!

Exclusive Deal: 30-Day FREE Premium Access + Bonus Credit

Don’t Miss Out – Sign up for TradingView Now!

- Advanced Charts

- Real-Time Data

- Track all Markets

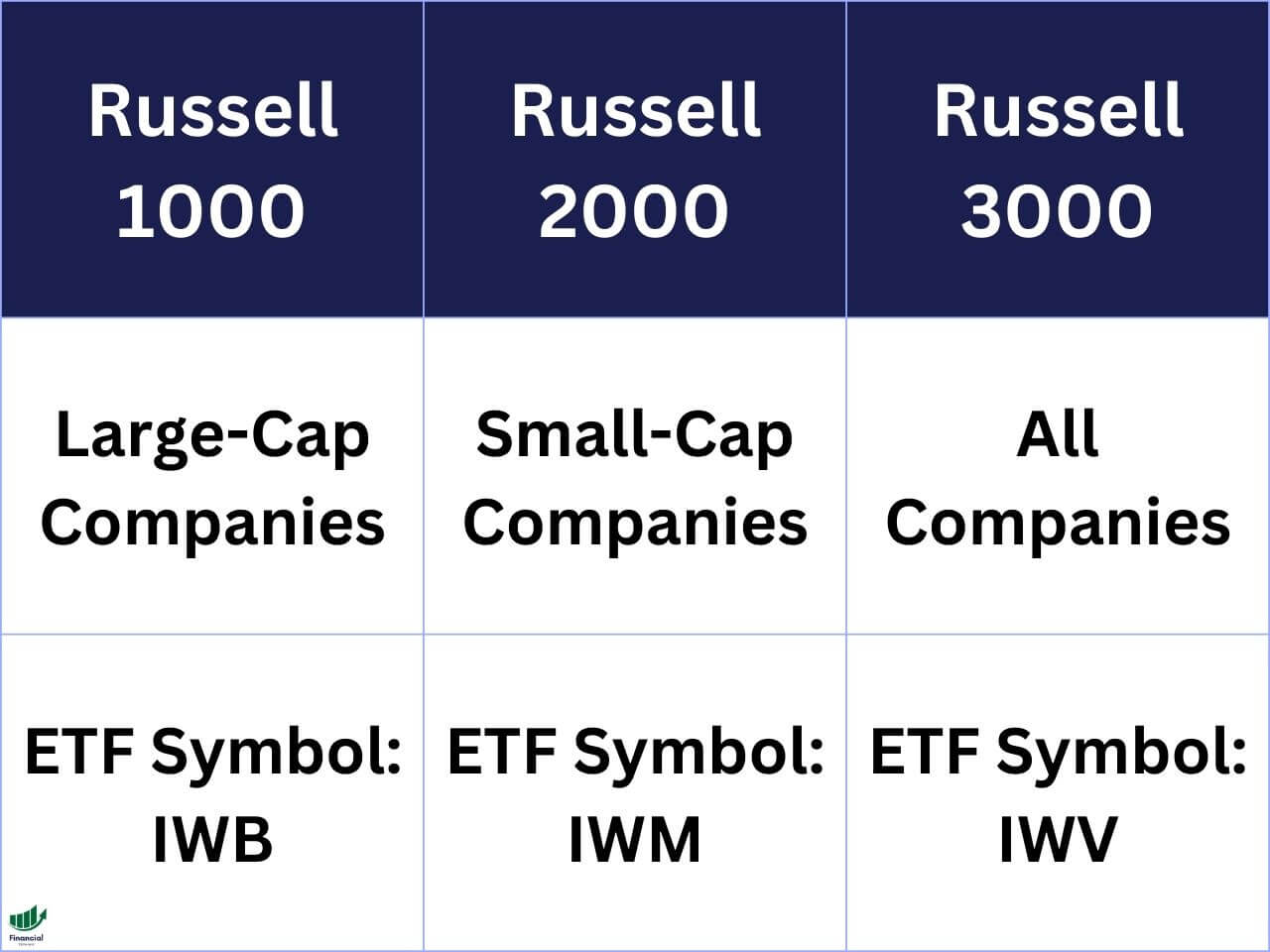

Russell 1000 vs. 2000 vs. 3000 ETF Symbols

- Russell 1000: IWB

- Russell 2000: IWM

- Russell 3000: IWV

What is the Russell 1000 Index?

- Definition and Composition: The Russell 1000 Index represents the top 1000 U.S. companies based on market capitalization. It is a subset of the Russell 3000 Index and accounts for about 90% of the market capitalization of the U.S. stock market.

- Types of Companies Included: This index predominantly includes large-cap companies, showcasing the highest-valued corporations in the United States.

- Performance Characteristics: The Russell 1000 is known for its stability and includes well-established companies. It’s often used as a benchmark for large-cap investments.

What is the Russell 2000 Index?

- Definition and Composition: The Russell 2000 Index tracks the performance of 2000 smaller companies in the U.S. stock market, making it a small-cap index.

- Focus on Small-Cap Companies: This index provides a comprehensive view of the small-cap market, offering insights into lesser-known but potentially fast-growing companies.

- Performance Trends: The Russell 2000 is known for its volatility and potential for high growth, making it an attractive option for risk-tolerant investors.

What is the Russell 3000 Index?

- Definition and Composition: The Russell 3000 Index is a market-capitalization-weighted stock market index that includes the largest 3000 U.S. stocks, covering about 98% of the U.S. equity market.

- Overall Market Representation: It combines the characteristics of both the Russell 1000 and 2000, offering a comprehensive view of the broader U.S. stock market.

Investment Strategies Based on Russell Indices

Each index serves different investment needs:

- Russell 1000: Suitable for investors seeking stability and lower risk.

- Russell 2000: Attracts those looking for growth potential in small-cap stocks.

- Russell 3000: Ideal for investors seeking a total stock market index.

Comparing ETFs With TradingView

When comparing ETFs, it is crucial that you are comparing the total return to include dividend payments. TradingView allows you to compare several stocks and ETFs at once on a single chart adjusted for dividends.

You can simply sign up for a free TradingView account and type the stock ticker you want to compare. Next, click the plus sign next to the ticker at the top left of the chart to add symbols to compare.

Finally, ensure you click the ‘ADJ’ at the bottom to adjust the returns for dividends!