Discover our detailed comparison of Schwab and thinkorswim to help determine which is best for you. Whether you’re a seasoned trader or just starting out, choosing the right platform can significantly impact your trading experience.

To make your research easier, we manually found key data for Schwab and thinkorswim across the internet and compiled it all in this article.

Key Characteristics of Schwab and thinkorswim

| Provider | Platform Type | Tradeable Assets | Charting Features | Data | Premium Pricing |

|---|---|---|---|---|---|

| Schwab Visit Site | Brokerage Platform | Stocks, ETFs, Mutual Funds, Options, Index Options, Futures, Futures Options, Bonds | thinkorswim platform | Real-time data with funded account | No premium features |

| thinkorswim Learn More | Trading Platform (Schwab) | Stocks, ETFs, Mutual Funds, Options, Index Options, Futures, Futures Options, Bonds | Downloadable desktop platform and web app | Real-time data with funded account | No premium features |

Overview of Schwab

Charles Schwab is a well-established brokerage firm known for its wide range of investment products and services. Schwab also provides a user-friendly online platform and mobile app, along with educational resources to help clients make informed investment decisions. Additionally, they offer banking services, retirement accounts, and access to financial advisors.

Overview of thinkorswim

thinkorswim was founded by Tom Sosnoff in the late 90s, and is one of the most popular trading platforms today. thinkorswim allows you to use advanced charting tools, custom indicators, screeners, trade options, and more! thinkorswim itself is not a brokerage, but is compatible with Schwab and TD Ameritrade customers.

Who is Schwab Best For?

Schwab is a great brokerage for long-term investors and active traders alike. With its recent acquisition of TD Ameritrade and the thinkorswim platform, Schwab is suitable for anybody looking to trade and invest in the stock market.

Who is thinkorswim Best For?

thinkorswim is best for traders who already use Schwab or TD Ameritrade, and want an excellent trading platform for technical analysis, options trading, news, and more!

Trading Features and Tools

| Provider | DRIP | Margin Trading | Insurance | Mobile App |

|---|---|---|---|---|

| Schwab Visit Site | Yes, no fees | Yes | SIPC/FDIC Insured | Yes |

| thinkorswim Learn More | Yes, no fees | Yes | Not a broker | Yes |

Trading Costs and Commissions Compared

| Fee Type | Schwab Visit Site | thinkorswim Learn More |

|---|---|---|

| Equity Commission | Free | Free |

| Option Commission | $0.65 per contract | $0.65 per contract |

| Futures Commission | $2.25 per contract | $2.25 per contract |

| Futures Options Commission | $2.25 per contract | $2.25 per contract |

| Option Exercise Fee | None | None |

Schwab vs thinkorswim – Bottom Line

Choosing between Schwab and thinkorswim depends on your specific trading needs, preferred trading tools, and the type of assets you’re interested in.

Both platforms offer distinct advantages, but by considering the detailed comparison above, you can select the one that aligns best with your trading strategy and goals.

For more detailed reviews and comparisons, continue exploring our other articles on brokerage platform comparisons.

What is the Overall Best Charting Software?

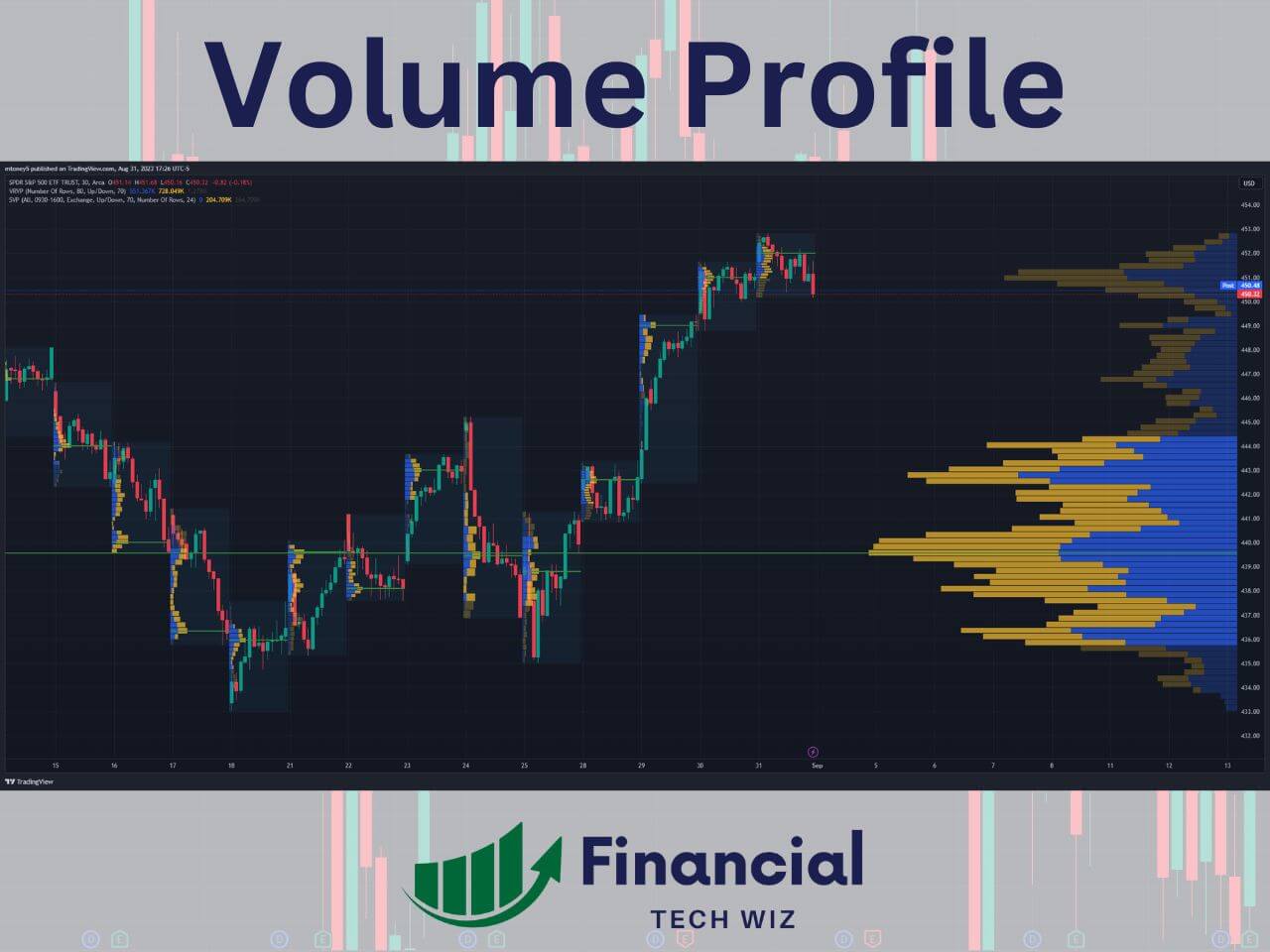

I have reviewed and used nearly every trading platform available, and I believe that TradingView is the best overall charting software available. Here are some reasons why:

- All of TradingView’s key features are free to use

- TradingView provides real-time data for free whenever possible

- You are not tied to a single broker and can use whichever you want while charting on TradingView

- You can track all markets on a single platform, including stocks, ETFs, crypto, forex, and futures.

- TradingView has an excellent economic calendar and various screeners

TradingView Limited Time Offer!

Exclusive Deal: 30-Day FREE Premium Access + Bonus Credit

Don’t Miss Out – Sign up for TradingView Now!

- Advanced Charts

- Real-Time Data

- Track all Markets

If you sign up for a TradingView account using my affiliate link, you can get a 30-day free trial of its premium features plus a $15 credit toward your subscription. However, signing up for a free trial is not required, and you can use nearly all of its features with a basic free account. You can read my full review of TradingView to learn more.

Related Trading Platform Comparisons

TC2000 vs tastytrade

MT4 vs Schwab

Interactive Brokers vs TC2000

MT4 vs Vanguard

WeBull vs tastytrade