TradingView Real-Time Data Explained

TradingView offers real-time data for popular stocks and cryptocurrencies to its free users at no cost. However, subscribers can also purchase data sourced directly from the exchanges.

For individuals who primarily track major stocks and ETFs such as SPY, acquiring additional real-time data may not be necessary. Conversely, for those actively trading multiple stocks, investing in real-time data could be worth it.

Furthermore, if your brokerage provides real-time data, it might be possible to integrate this with your TradingView account, enabling you to utilize this data within TradingView’s platform. Continue reading to learn more about TradingView’s real-time data.

You can watch the video I recorded that compares TradingView free data to thinkorswim’s real-time data so you can see first hand how delayed the TradingView free data really is. Continue reading to learn more about real-time data on TradingView.

Key Takeaways

- TradingView provides free real-time stock, forex, and cryptocurrency data whenever possible, but it can be delayed up to 15 minutes for free accounts.

- For access to full real-time data across a range of markets, including detailed futures and stock data, TradingView requires a subscription fee.

- TradingView real-time data costs are market- and user-type based, with professional costs far greater than those for non-professionals.

Exclusive Deal: 30-Day FREE Premium Access + Bonus Credit

Don’t Miss Out – Sign up for TradingView Now!

- Advanced Charts

- Real-Time Data

- Track all Markets

How to Purchase Real-Time Data on TradingView

In order to buy real-time data on TradingView, please follow these steps:

- Upgrade to a paid TradingView subscription.

- Navigate to Account Settings → Subscriptions → Market Data.

- Select exchanges and subscribe, choosing individual exchanges or bundled data sets.

TradingView paid subscribers can acquire real-time data directly from the exchanges through the market data page on the TradingView website. It’s important to note that real-time data is not available for purchase by free users, but you can use my affiliate link to start a free trial on TradingView to access this feature for 30 days without cost.

By default, TradingView offers real-time data for free wherever they can for stocks, forex, cryptocurrencies, and more. However, it’s important to note that the data available for free users may be delayed depending on the exchange and the instrument being viewed.

For instance, data for some assets could be delayed by up to 15 minutes, but on most popular stocks, it is pretty close to real-time in my experience.

Paid TradingView users can purchase real-time data directly from the exchanges by purchasing it from the market data page. It is important to note that free users are unable to purchase real-time data, but you can get a TradingView free frial to unlock the ability to purchase real-time data free for 30 days.

Obtaining Real-Time on TradingView

With a Paid Subscription on TradingView

If you don’t have an existing brokerage account or want additional real-time data, you can purchase data subscriptions directly from the exchanges through TradingView. They offer a range of data packages tailored to suit various needs, from individual stocks and forex pairs to entire exchanges.

Subscriptions on TradingView, such as the Essential, Plus, and Premium plans, not only enhance the charting tools and functions but also allow users to purchase additional real-time data from other exchanges. The plans also offer a 30-day free trial that features real-time data options, providing a convenient test time for users to assess the platform. To purchase a data subscription, visit the TradingView website, and go to the go pro page to view the various types of real-time market data you can purchase.

Connecting Your Brokerage Account

Users can link their existing brokerage accounts to TradingView so that they can utilize real-time data already available through their broker. This setup is particularly convenient for users who have brokerage accounts with brokers like Interactive Brokers or Optimus Futures.

Doing so lets you use the real-time data from the exchanges you have already purchased with your broker. To link your account, navigate to the Trading Panel on TradingView and connect your broker. You can read more about accessing real-time data through your broker on TradingView’s support article.

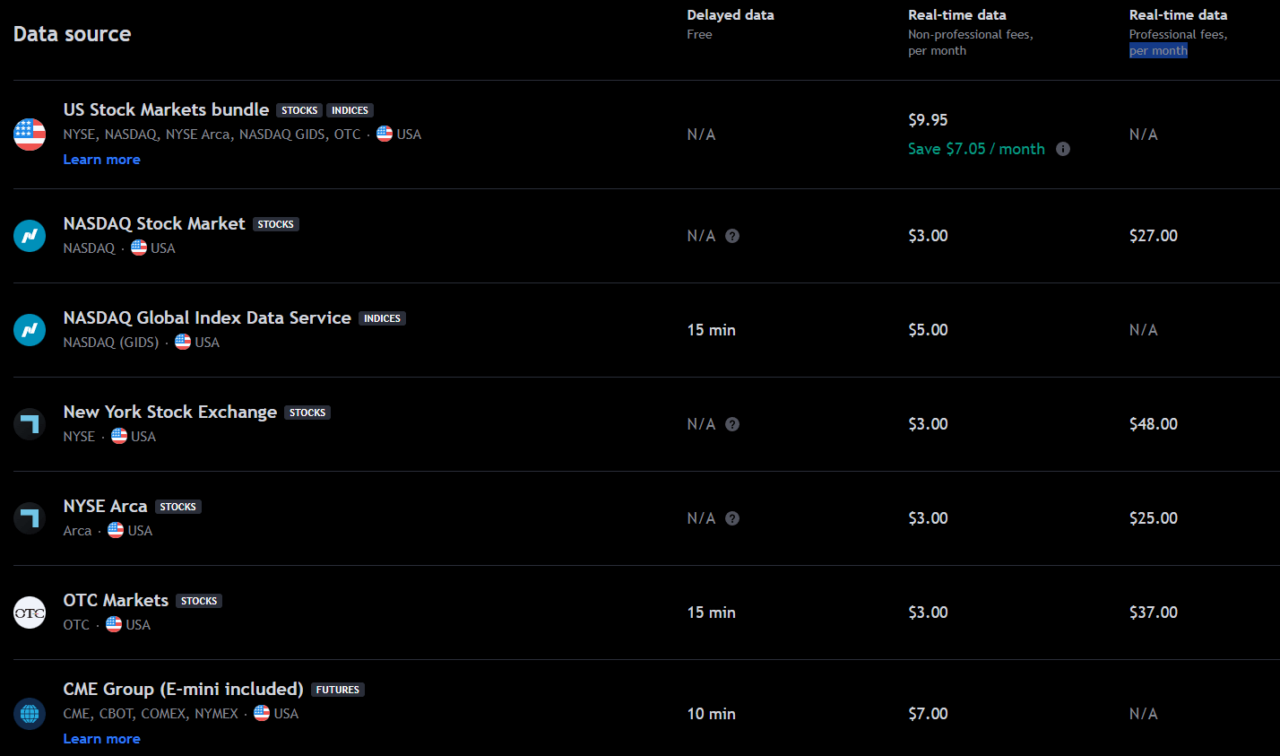

TradingView Real-Time Data Plans and Pricing

TradingView real-time data subscriptions range from $2-$10 per month depending on which markets you are interested in. A popular choice is the US Stock Markets Bundle that includes all of the major U.S. stock exchanges for $9.95 per month. You can also buy each exchange individually for just a few bucks per month. Consider reading my TradingView pricing article to learn more.

| Data Source | Delayed Data | Real-Time Data (Non-Professional, $/mo) | Real-Time Data (Professional, $/mo) |

|---|---|---|---|

| US Stock Markets Bundle (NYSE, NASDAQ, NYSE Arca, OTC) | N/A | $9.95 | N/A |

| NASDAQ | N/A | $3.00 | $27.00 |

| NASDAQ (GIDS) | 15 min | $5.00 | N/A |

| NYSE | N/A | $3.00 | $48.00 |

| NYSE Arca | N/A | $3.00 | $25.00 |

| OTC Markets | 15 min | $3.00 | $50.00 |

| CME Group (CME, CBOT, COMEX, NYMEX) | 10 min | $7.00 | N/A |

| NSE (India) | N/A | $0.00 | N/A |

| Bursa Malaysia (MYX) | 15 min | $2.00 | $2.00 |

| Thailand SET | 15 min | $2.00 | $18.00 |

| Tokyo Stock Exchange (TSE) | 20 min | $3.00 | $17.00 |

| Borsa Istanbul (BIST) | N/A | $1.00 | $8.00 |

Professional real-time data subscription on TradingView is significantly higher in price, a reflection of the density of data and the possible fiscal impact of being able to access the most up-to-date information available.

The importance of real-time data

In the fast-paced world of trading, every second counts. Having access to real-time data is crucial for making timely decisions, as it allows traders and investors to react to market fluctuations and identify emerging trends as they happen.

If you are an active trader, it is simply not possible to trade on delayed data. You will be trading in the past, and your indicators won’t be updated.

How Far Behind Is TradingView Data for Free Accounts?

Free account holders can experience TradingView data delays that significantly impact trading strategies. Stock data is typically delayed up to 15 minutes, but futures data can be delayed around 10 minutes. More liquid assets such as SPY are nearly real-time even on free accounts.

In the video below, I recorded live charts to compare TradingView’s free data to a real-time data source on thinkorswim. By watching this video, you will notice that the SPY data is pretty much real-time even without paying, but for other stocks, it may be slightly more delayed. However, it’s essential to be aware of potential delays when making trading decisions based on TradingView charts.

How much is TradingView data delayed?

For free users on TradingView, data delays vary depending on the exchange and the instrument being viewed. Some stock exchanges, for example, may have data delayed by up to 15 minutes.

The primary difference between free and paid data subscriptions on TradingView lies in the availability of real-time data. While free users may experience delays for certain exchanges and instruments, paid users with data subscriptions have access to real-time data, ensuring their charts are reflecting the current market prices.

How Accurate is TradingView Real-Time Data?

TradingView real-time data is generally accurate, directly pulled from exchanges. However, internet connection, exchange latency, and data provider uptime may impact the accuracy of the data.

TradingView After-Hours Data

TradingView has after-hours trading data, allowing traders to view after-hours market activity. This feature is critical for news traders and event traders who operate during non-trading hours.

Does TradingView have live futures data?

Yes, TradingView does provide live futures data. The platform offers data on various futures contracts, including those related to commodities, indices, and other financial instruments.

To access live futures data on TradingView, users must have a data subscription for the specific futures market they’re interested in. Once subscribed, you can view real-time futures data by entering the appropriate futures contract symbol in the search bar or browsing the platform’s futures market section.

API and Automation: Can You Download Real-Time Data?

While the TradingView API can be used to integrate with alert systems and trading bots, it is not designed to download real-time data in bulk. It’s designed to create custom tools and refine trading strategies with real-time data inputs.

Is TradingView Real-Time Data Worth It?

For active swing and day traders, the advantages of TradingView’s real-time data—such as timely market entrances and exits and accurate backtests—make the additional subscription costs worthwhile. However, casual traders could manage with the free version.

Futures Traders: Real-Time Data Considerations

TradingView futures traders may purchase the CME data package to gain full access to futures markets. It should also be understood how Level I and Level II data differ from each other:

- Level I data provides the best bid and offer prices.

- Level II data provides full market depth, showing all orders that exist in the market.

Is TradingView OTC data real-time?

TradingView does offer real-time OTC data for some markets. However, the availability of real-time data may depend on the specific OTC market and whether you have a data subscription for that particular market.

To access real-time OTC data on TradingView, you’ll need to purchase a data subscription for the OTC market you’re interested in. Once subscribed, you can access real-time OTC data by searching for the relevant instrument symbol or browsing the platform’s OTC market section.

TradingView Real-Time Data: The Bottom Line

In conclusion, TradingView provides extensive real-time data for various financial markets, crucial for traders needing up-to-date market insights. To access this data, users must subscribe to one of TradingView’s plans, which might involve additional fees for data from specific exchanges.

While TradingView strives to offer accurate and reliable data, potential external factors may impact its precision. If you’re considering this service, you can use my affiliate link to get a TradingView free trial and a credit toward your subscription, allowing you to access real-time data for free for the first 30 days.

FAQ About TradingView Real-Time Data

Q: Does TradingView provide real-time data?

- A: Yes, TradingView offers real-time data on its platform for various financial markets, including stocks, cryptocurrencies, forex, and more. Real-time data allows traders and investors to access up-to-the-minute information, including price quotes, volume, and market depth.

Q: How can I access real-time data on TradingView?

- A: To access real-time data on TradingView, you can subscribe to a plan that offers the ability to buy real-time data as part of its features. Upgraded plans like Essential, Plus, and Premium allow you to buy real-time data from exchanges.

Q: Are there any additional fees to access real-time data on TradingView?

- A: While TradingView provides real-time data for certain markets as part of its upgraded plans, it’s important to note that some exchanges may require separate subscriptions or fees to access their real-time data. TradingView offers the ability to add extra real-time and intraday data for exchanges such as NASDAQ, NYSE, OTC, and more. These additional data subscriptions may involve extra charges depending on the exchange.

Q: How reliable is the real-time data on TradingView?

- A: TradingView strives to provide reliable real-time data, but it’s essential to understand that the accuracy and reliability of data may be influenced by factors beyond TradingView’s control. Factors such as exchange latency, internet connectivity, and data provider accuracy can impact the reliability of real-time data. It’s advisable to cross-reference data from multiple reputable sources and consider the potential for delays or discrepancies.

Q: Can I see after-hours data on TradingView?

- A: Yes, TradingView allows users to access after-hours data for supported markets. After-hours trading refers to the extended trading hours beyond regular market hours. During this time, you can view price movements, volume, and other relevant information for stocks and other instruments traded outside of normal market hours.

Q: Is TradingView’s real-time data worth it?

- A: The value of TradingView’s real-time data depends on individual trading needs and preferences. Real-time data enables traders to stay updated with the latest market movements, make timely decisions, and execute trades more effectively. It can be particularly useful for active day traders and short-term traders who rely on up-to-the-minute information. Assess your trading style, strategies, and goals to determine if the benefits of real-time data align with your requirements.

Q: Can I extract live data from TradingView for analysis or automation purposes?

- A: TradingView provides an API (Application Programming Interface) that allows developers and advanced users to access live data and build custom applications, perform data analysis, and automate trading strategies. The TradingView API offers various endpoints and functionalities to interact with real-time and historical data, empowering users to create their own trading tools and systems.

– Free trading journal template & cheat sheet PDFs

– Custom scanners, watchlists, & market commentary

– Access our free trading course and community