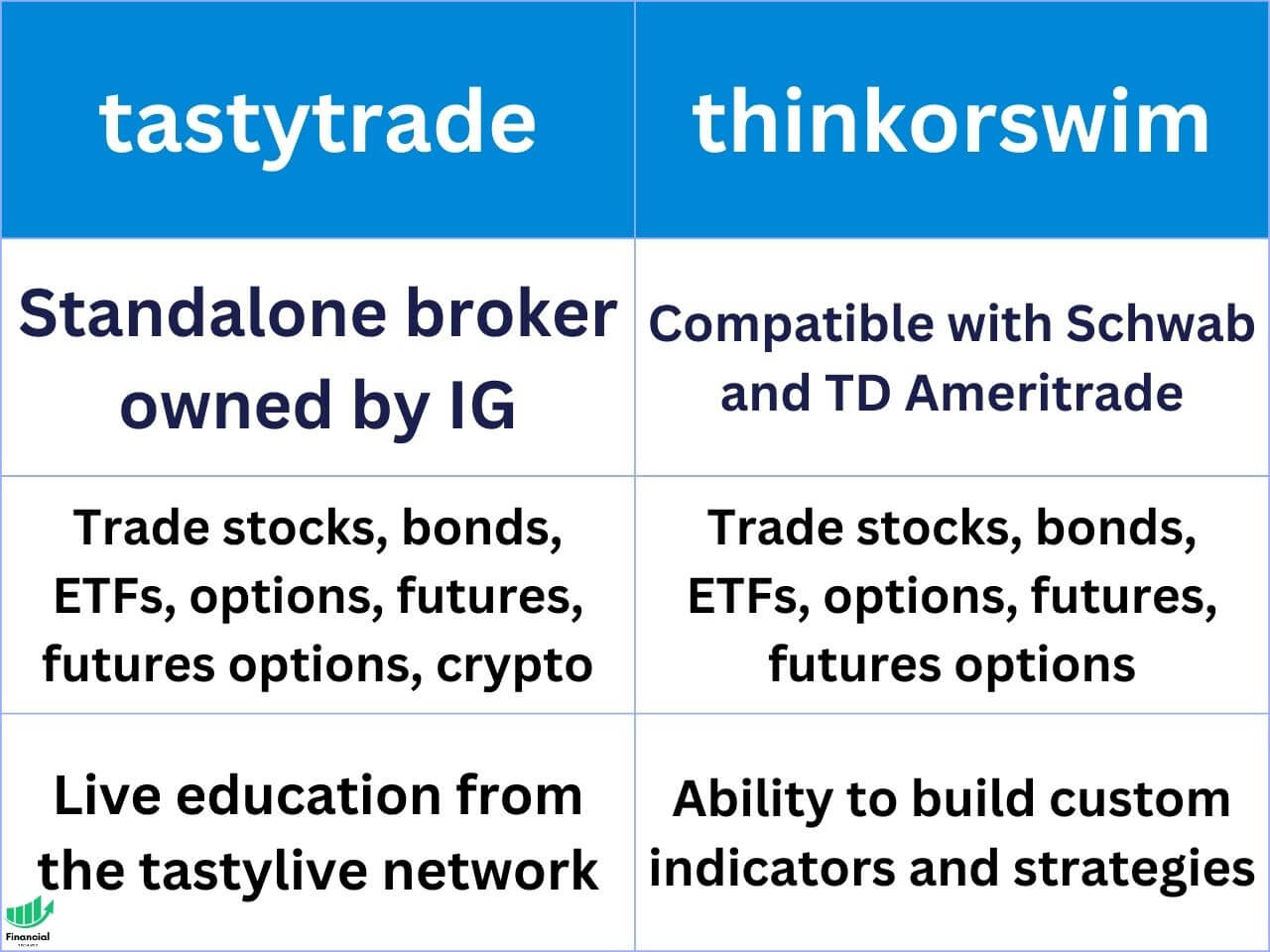

I have used thinkorswim and tastytrade personally, and they are both great platforms for both active traders and long-term investors. tastytrade offers lower commissions for futures trading, but lacks in charting features compared to thinkorswim. Another difference is thinkorswim is owned by Schwab, giving you access to banking and other additional features tastytrade does not offer. tastytrade also offers crypto trading, while thinkorswim and Schwab do not.

Full disclousure, the links to tastytrade in this article are my referral link, and will give you a sign-up bonus. I may also receive a referral bonus at no extra cost to you.

Overview of thinkorswim

thinkorswim is a trading platform that is currently available for Charles Schwab and TD Ameritrade account holders. thinkorswim offers one of the best platforms for active traders thanks to its advanced charting features, active trader, and customizability make it an excellent platform for active day traders and long-term investors alike.

tastytrade and thinkorswim were both founded by Tom Sosnoff. TD Ameritrade bought the thinkorswim platform in 2009 for $750m, and IG bought tastytrade in 2021 for $1b.

Overview of tastytrade

tastytrade (formerly tastyworks) is a brokerage platform owned by IG. It was designed to specialize in options trading and has the tastylive education network streaming live on the platform every day. tastytrade is an excellent platform for active traders, providing competitive futures and options pricing, an active trader tab, and live education.

Pros and Cons

thinkorswim Pros

– Advanced charting and analytical tools catering to traders of all levels.

– Wide range of investable assets, including stocks, options, futures, and more.

– Highly customizable interface and trading environment.

thinkorswim Cons

– The platform’s extensive features might overwhelm new traders.

– Requires a TD Ameritrade account, which might be a barrier for some international traders.

tastytrade Pros

– Specializes in options trading with comprehensive tools and resources

– Offers the tastylive network for daily live trading education and insights.

– Competitive pricing structure for active traders.

tastytrade Cons

– May have a steeper learning curve for beginners not focused on options.

– Limited in terms of asset variety compared to more comprehensive platforms.

Options Trading on thinkorswim and tastytrade

thinkorswim and tastytrade are both excellent platforms for options traders. Both provide options chains with tons of customizability, allowing you to view the option data that matters to you whether it is delta, volume, or open interest. Both platforms also offer competitive pricing options and futures options.

thinkorswim vs. tastytrade Pricing

| Feature | thinkorswim Pricing | tastytrade Pricing |

|---|---|---|

| Option Commissions | $0.65 per contract | $1 to open, free to close ($.07 fee per contract) |

| Futures Commissions | $2.25 (+$1.40 fee) per contract | $1.25 (+$0.30 fee) per contract |

| Futures Options Commission | $2.25 (+$0.57 fee) per contract | $2.50 to open (+$0.30 fee per contract), free to close |

| Micro Futures | $2.25 (+$0.37 fee) per contract | $0.85 (+$0.30 fee) per contract |

| Micro Futures Options | $2.25 (+$0.22 fee) per contract | $1.50 to open (+$0.30 fee per contract), free to close |

The main difference is that thinkorswim is more cost-effective if you plan to let your option contracts expire since tastytrade frontloads the pricing when you open.

Technical Analysis and Charting

thinkorswim takes the lead in technical analysis and charting, offering a more extensive array of tools and indicators than tastytrade. Its platform is designed to accommodate the needs of technical traders with customizable charts, a wide range of technical indicators, and drawing tools.

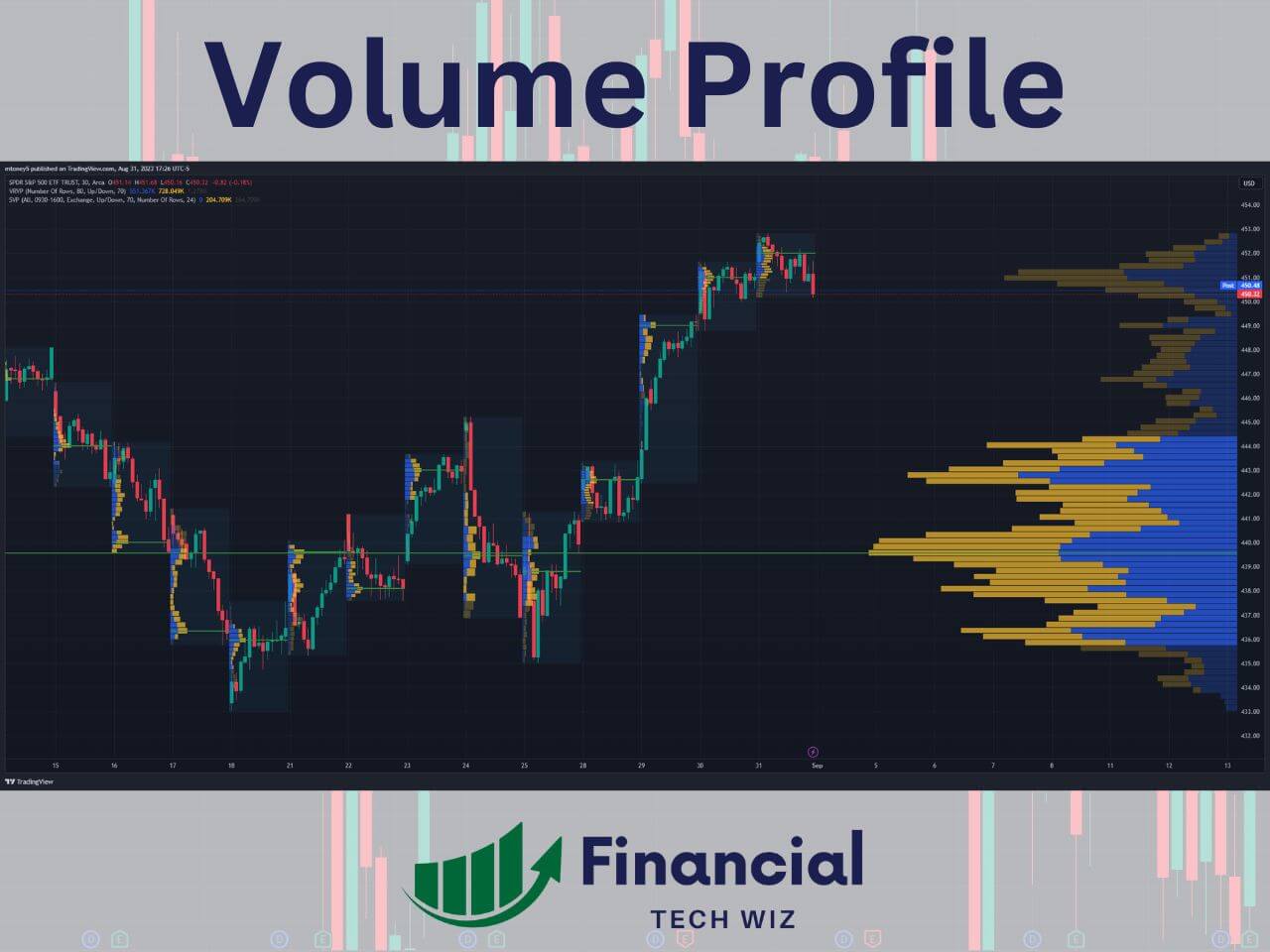

tastytrade does provide some solid charting tools, but it lacks advanced indicators like the volume profile and level II data.

Mobile Apps

tastytrade and thinkorswim offer solid mobile apps, but overall the tastytrade app provides a better user experience. The thinkorswim app seems a bit dated and overly complex, while the tastytrade app is more modern and provides a less clunky interface.

Fundamental Analysis Data & News

tastytrade and thinkorswim provide financial data and news directly in the platform, but thinkorswim is overall better when it comes to finding news articles per ticker and accurate fundamental data.

thinkorswim provides real-time fundamental data like market cap and shares outstanding. tastytrade also offers similar features, but it is newer and seems not to be as consistent.

thinkorswim has an excellent news widget where you can type a ticker and view relevant news stories for any company. tastytrade has some news available on its dashboard, but it doesn’t offer company-specific news.

Data & Trading Execution

thinkorswim offers level II data, while tastytrade does not, giving thinkorswim the edge when it comes to advanced data availability. However, both platforms offer real-time data for free with a funded account.

Both platforms also offer an active trader tab, allowing you to get in and out of trades quickly.