TradingView Options Trading Features Explained

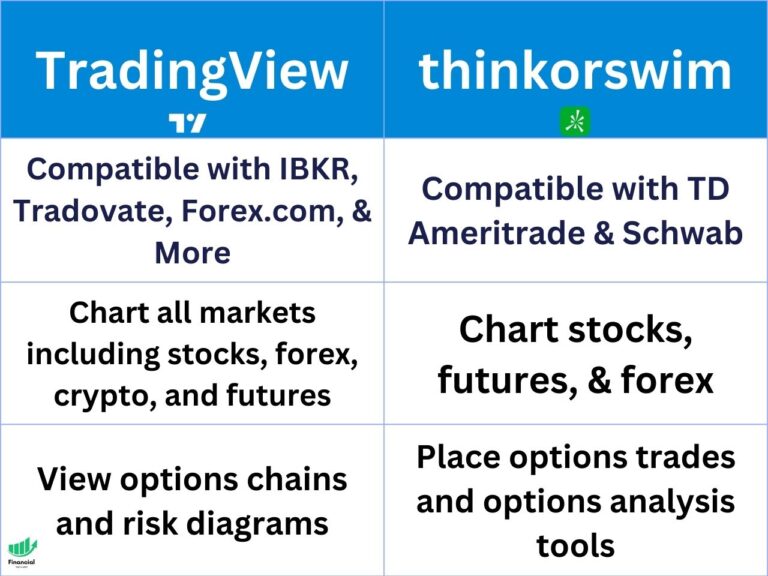

While TradingView does not offer direct trading capabilities for options, it provides extensive tools for tracking options prices and analyzing potential trades using risk diagrams. TradingView’s options tools allow you to view a near real-time options chain, risk diagrams, volatility levels, and more.

Can You Trade Options on TradingView?

TradingView allows you to view various data for options contracts, but you can not trade them directly on the platform. Either way, it would be better to trade options directly through your broker since the pricing may differ on TradingView.

If you want a broker built for options trading, consider signing up for tastytrade or Schwab so you can access a good options trading platform.

Exclusive Deal: 30-Day FREE Premium Access + Bonus Credit

Don’t Miss Out – Sign up for TradingView Now!

- Advanced Charts

- Real-Time Data

- Track all Markets

How to Acess TradingView’s Options Tools

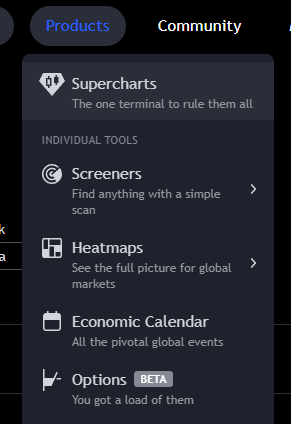

1- Start by navigating to the TradingView homepage and hovering over ‘Products,’ and selecting ‘Options.’

2- From here, you can access the TradingView options chain, strategy builder, and volatility charts.

Here is an overview of all of these options:

- Strategy Builder: Allows you to view options risk diagrams based on the type of strategy you want to employ. Choose your desired symbol, expiration, and strike price, then press create. You can view the risk diagram and adjust the pricing based on the fills you get on your brokerage account.

- Chain: TradingView’s options chain allows you to view live options pricing for options on futures and supported stock options. Most of the stocks are NSE, but you can track American futures contracts like the S&P 500 and Nasdaq futures options.

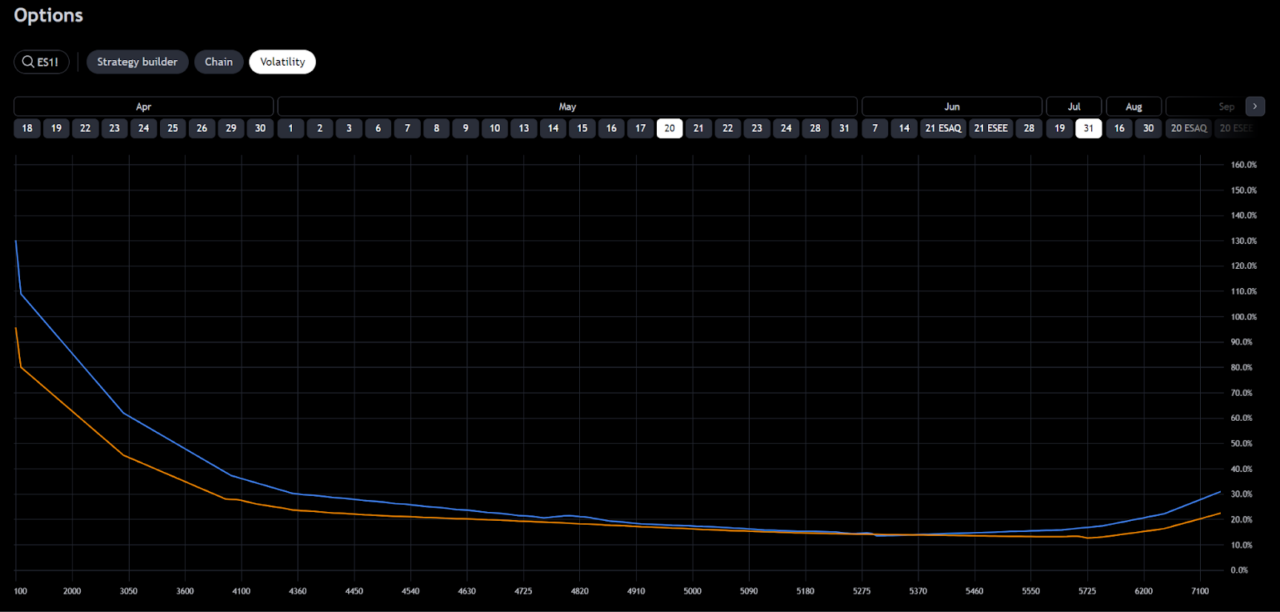

- Volatility: The volatility tab allows you to view IV levels for several different expiration dates. This is helpful for tracking volatility levels across various strike prices and dates on a single chart.

Can You Chart Options on TradingVIew?

While you cannot chart the price of an option on a regular TradingView chart, you can view the risk diagram chart of an options contract on TradingView to analyze the potential price outcomes along with the Greeks. If you want to chart an options contract, brokers like tastytrade and Schwab (with thinkorswim) allow you to view option prices on a chart.

Supported Options and Analysis Tools

TradingView supports a wide range of options, including:

- ES & MES S&P 500 futures options

- NQ Nasdaq futures options

- RTY Russell 2000 futures options

- YM Dow Jones futures options

- NIFTY options

- Bitcoin options

- Many stocks on the NSE

TradingView’s Strategy Builder Risk Diagram Review

TradingView’s risk diagram works well, and you can manually adjust the price of the options contract since it may not directly match your broker. The risk diagram chart allows you to visualize the potential profit and loss for different options strategies on the TradingView platform.

You can simulate future pricing based on volatility and DTE (days to expiration) using the “What if” dropdown list. For example, you can simulate how options pricing would change if 5 days pass or if IV increases by 2%. You can also track most of the Greeks on the risk diagram by toggling through the options you can find above the risk diagram.

TradingView’s Options Chain Reviewed

TradingView’s options chain is nothing fancy, but it does the job if you just want to view the delta and pricing of options contracts. It also updates live, even if you do not pay for real-time data or a premium subscription.

You can view the IV %, bid, ask, delta, and gamma on the options chain, and likely more to be added in the future.

TradingView’s Options Pricing Accuracy

Comparisons with other platforms like tastytrade show that TradingView’s options pricing is reliable but just a tad off. I took a screenshot of my tastytrade brokerage and the TradingView options chain at the exact same time and compared the pricing of an ES contract in the image below:

The 5000 ES contract for the same expirations was as follows on both platforms:

- TradingVIew: 29.25

- tastytrade: 30.75

I also took this screenshot at 8:30 PM CST, meaning the U.S. equity markets are closed, and I also did not have real-time data purchased on this TradingView account. While the price is slightly off, I was quite impressed with how close it was, considering TradingView hasn’t catered to options traders in the past.

TradingView’s Options Volatility Tab Reviewed

The volatility tab on TradingView allows you to track the volatility levels by strike price and expiration date on a single chart. You can plot several different expirations, allowing you to compare IV levels for several time frames on one chart.

Can You Backtest Options Trading on TradingView?

No, you cannot backtest options on TradingView. However, this may change in the future as TradingVIew continues to improve the platform and add new features. You can backtest equity on TradingVIew using the bar replay and strategy tester.

TradingView Options Tools – The Bottom Line

Though TradingView does not support direct options trading, its comprehensive suite of tools offers significant value for tracking and analyzing options. You can track the real-time prices of options, view risk diagrams, and analyze volatility by expiration date.

If you aren’t already a TradingView user, you can sign up for a free account and start charting stocks for free. I believe that TradingVIew is the best charting software for stocks and a great way to track the financial markets. When you use my affiliate link, you can get a free trial of a premium subscription and a credit toward your subscription.

Exclusive Deal: 30-Day FREE Premium Access + Bonus Credit

Don’t Miss Out – Sign up for TradingView Now!

- Advanced Charts

- Real-Time Data

- Track all Markets