Option Omega Review

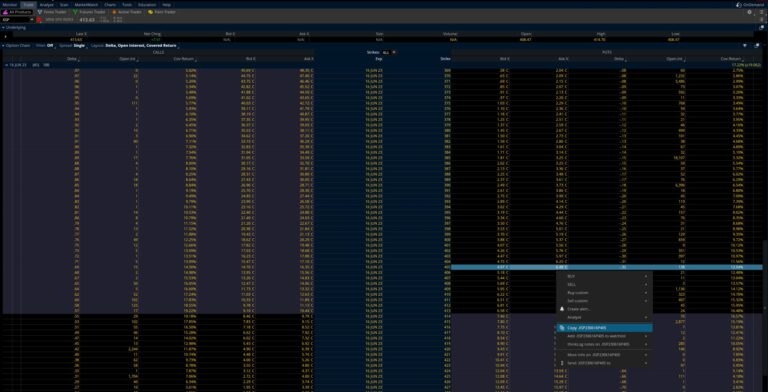

This review looks at the greatest strengths of Option Omega, including its application of 1-minute historical data, incredible speed, and ease of use, making it an ideal choice for traders who want to optimize and verify their options strategies in a very efficient manner. Continue reading to learn more about Option Omega, and why it…