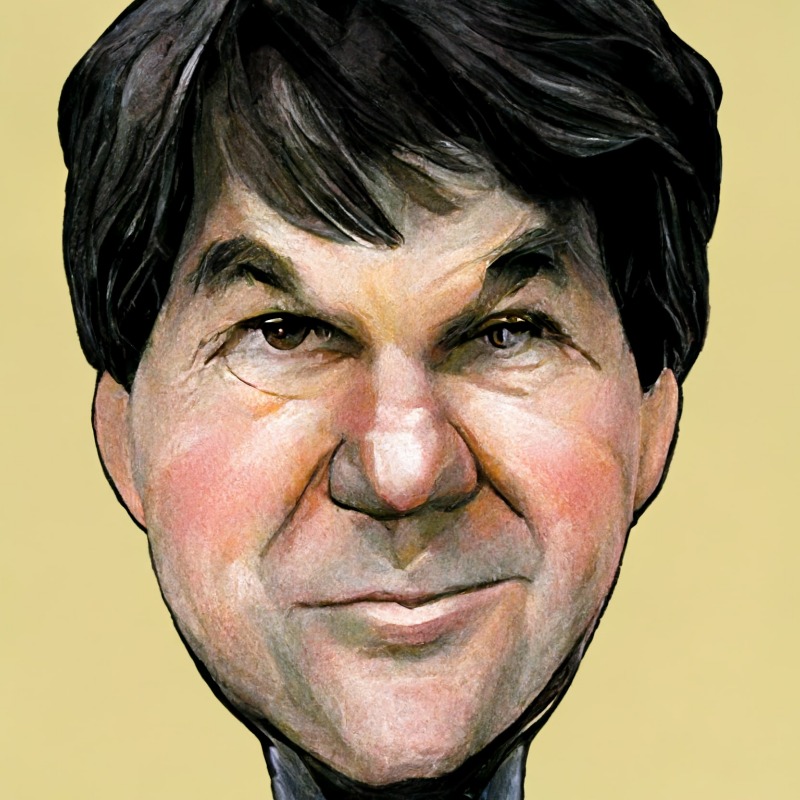

Dr. Michael Burry’s Net Worth: How Much is the Big Short Worth? (2024)

Dr. Michael Burry Net Worth – $300 Million

Michael Burry’s Net Worth

Dr. Michael Burry is the famous value investor featured in “The Big Short.” Burry predicted the 2007 mortgage crisis and the 2008 Economic Crisis.

While many banks folded and hedge funds collapsed, Burry’s fund profited heavily, earning his investors billions in profits. Dr. Michael Burry’s net worth is estimated to be $300 million as of 2024.

Dr. Michael Burry is an American physician, investor, and hedge fund manager. He became widely known as the founder of Scion Capital LLC. Through Scion, he correctly predicted the 2008 real estate market crash, making billions for his clients and earning a fortune in the process.

Burry appeared as one of the characters in Michael Lewis’s book, “The Big Short,” which would be later turned into a blockbuster with Christian Bale portraying Burry in the film.

After launching Scion Capital LLC in 2001, the fund saw a 55% return in the first year thanks to wise bets against tech stocks ahead of the internet bubble. By 2004 he had more than $600 million worth of assets under management with Scion.

Michael Burry’s Early Life

Michael Burry was born in San Jose, California, on June 19, 1971. At two years old, he lost his left eye due to retinoblastoma and was forced to wear an artificial eye throughout his life.

Growing up, Michael would fixate his attention on subjects to the point of obsession where he had to know everything about it. Later, he would discover that he was autistic.

Luckily, his range on the spectrum of autism was mild and did not restrict him from everyday activities. However, due to his condition, Michael developed an introverted personality and an ability to hold his concentration and focus while learning about advanced topics.

Michael Burry’s Education

As a teen, Burry attended Santa Teresa High School. Later, he enrolled at the University of California, Los Angeles, where he studied economics and pre-med.

Burry subsequently obtained his M.D. from the Vanderbilt University School of Medicine and began but did not complete a residency in neurology at Stanford University Medical Center.

Although he doesn’t practice, Burry has kept his license active with the Medical Board of California.

Michael Burry’s Path Toward Wealth

While off duty at Stanford, Burry worked on financial investing and became particularly successful in value investing. His skill did not go unnoticed, and soon, he caught the attention of companies such as White Mountains Insurance Group and Vanguard, as well as major investors such as Joel Greenblatt.

Burry has said that his investment style is based on the 1934 book “Security Analysis” and that all of his stock picking is entirely rooted in the concept of margin of safety.

By 2000, Burry decided a career in finance interested him more than a career in medicine, and he dropped out of Stanford before completing his residency.

He founded his hedge fund, Scion Capital, which was funded by both an inheritance and loans from his family.

Almost immediately, he was earning enormous profits for his investors. In his first full year in 2001, he was reportedly up 55%, while the S&P 500 fell 11.88%. The S&P 500 fell again the following year while Burry was up again.

In 2005, Burry began focusing on the subprime market. Burry told his investors to come in with him on a massive bet against the housing market.

Using his analysis of mortgage lending practices over the previous two years, he foresaw that the real estate bubble would collapse as early as 2007.

It took years for Michael’s predictions to play out.

However, Burry’s predictions eventually panned out, and he earned a personal profit of $100 million and a profit of over $700 million for his remaining investors. Moreover, Scion Capital had returns of 489.34% between 2000 and 2008.

Michael Burry’s Tweets

Michael Burry is well known in the stock community for his 2008 profits and for releasing strings of tweets on scary financial subjects.

He posts under the name of his wife Cassandra as his user on Twitter, and after a while, he will delete his tweets and block his account for weeks before resurfacing.

How to Learn More About the Stock Market

If you want to learn more about the stock market and becoming a profitable trader, you can join the Haikhuu Trading community for free!

Haikhuu Trading offers daily live calls, morning reports, access to a team of professional traders, and an AI trading bot that provides stock trading alerts. Don’t miss the opportunity to elevate your trading skills — join Haikhuu Trading today!

Before you go

If you want to keep educating yourself about personal finance and discover other deals on Amazon, you must check out these posts as well:

What is the Most Successful Options Strategy

Options Trading for Income: The Complete Guide