Diversify your investments with passive real estate investing.

Passive vs. active investing

You can invest in real estate in multiple ways, including on the stock market or by directly purchasing properties. Investing in real estate on the stock market is a passive investment while buying properties is an active investment.

Active investing is great for somebody with a lot of time, while passive real estate investing works for people who do not want to manage properties themselves. Examples of passive real estate investing strategies include REITs, money lending, real estate funds, and real estate syndications.

What is passive real estate investing?

Passive real estate investing is when you allocate capital to assets that own real estate, so you don’t have to deal with the properties at all. You can make passive income without acting as a landlord, dealing with tenants, or taking care of properties.

Also, passive real estate investing allows you to invest in expensive properties with little money. A lower barrier to entry will enable investors who do not have a ton of capital to invest in these large cash-flowing properties.

How do you start passive real estate investing?

You can use various methods to start passive investing in real estate, including REITs, real estate syndications, and money lending. The one you choose should depend on your lifestyle and goals.

REITs and real estate syndications are great for people with smaller amounts of capital. On the other hand, money lending requires a lot of capital to loan out, but you can make good returns doing it.

– REITs

The easiest way to invest in real estate passively is through REITs on the stock market. REITs are real estate investment trusts that can be bought and sold via an ETF on the stock market. Investing in REITs can be done on any brokerage app, and the barrier to entry is just $1 if your brokerage offers fractional shares.

– Real estate syndications

Real estate syndications are when investors pool their money to invest in real estate properties. As an investor, you will not have to worry about managing the property and will receive cash distributions each month or quarter as passive income.

– Money lending

If you have a reliable borrower, money lending is an excellent way for investors with a lot of capital to make a good return. Some investors may not be able to get a traditional mortgage from a bank and will be willing to accept a higher interest rate from you.

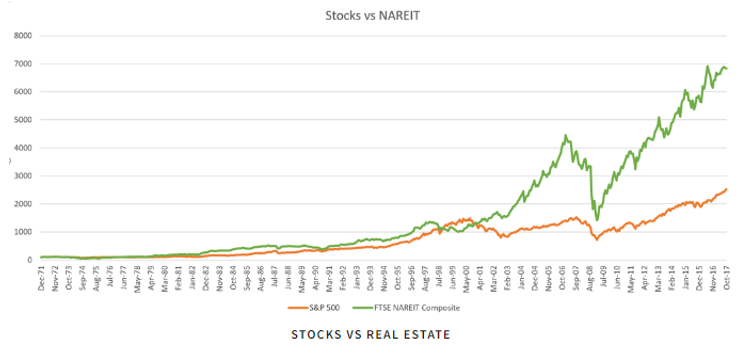

Passive real estate investing vs. stock investing

Passive real estate investing and stock investing can vary depending on your chosen methods. Investing in REITs is virtually identical to investing in stock mutual funds. The only difference is that REITs only do business in real estate, while other stocks can be in various types of business.

However, the process of investing in REITs and stocks is precisely the same. You create a brokerage account and buy shares; it’s that easy. If you are investing for retirement, you will receive REIT dividends tax-free when you purchase them in a ROTH IRA. Just remember that you can’t cash out until you are 59.5.