How to Paper Trade on TradingView for Free

What is TradingView Paper Trading?

TradingView Paper Trading enables users to simulate trades in real time without risking their own money.

You can use TradingView’s paper trading to forward test any strategy, whether it’s based on indicator signals or even an alert service you have access to.

However, paper trading is not perfect, and there are many downsides you must pay attention to, which we will cover in this article.

Is TradingView Paper Trading Free?

Yes, paper trading on TradingView is accessible for free, regardless of your subscription level.

However, you need to have at least a free account on TradingView.

You can use our affiliate link to sign up for a free TradingView account, and if you ever decide, our link gives you access to a free trial and a discount on your subscription.

How to Use TradingView Paper Trading

To begin paper trading on TradingView, follow these simple steps:

- Open Any Chart: Choose a market or instrument you’re interested in.

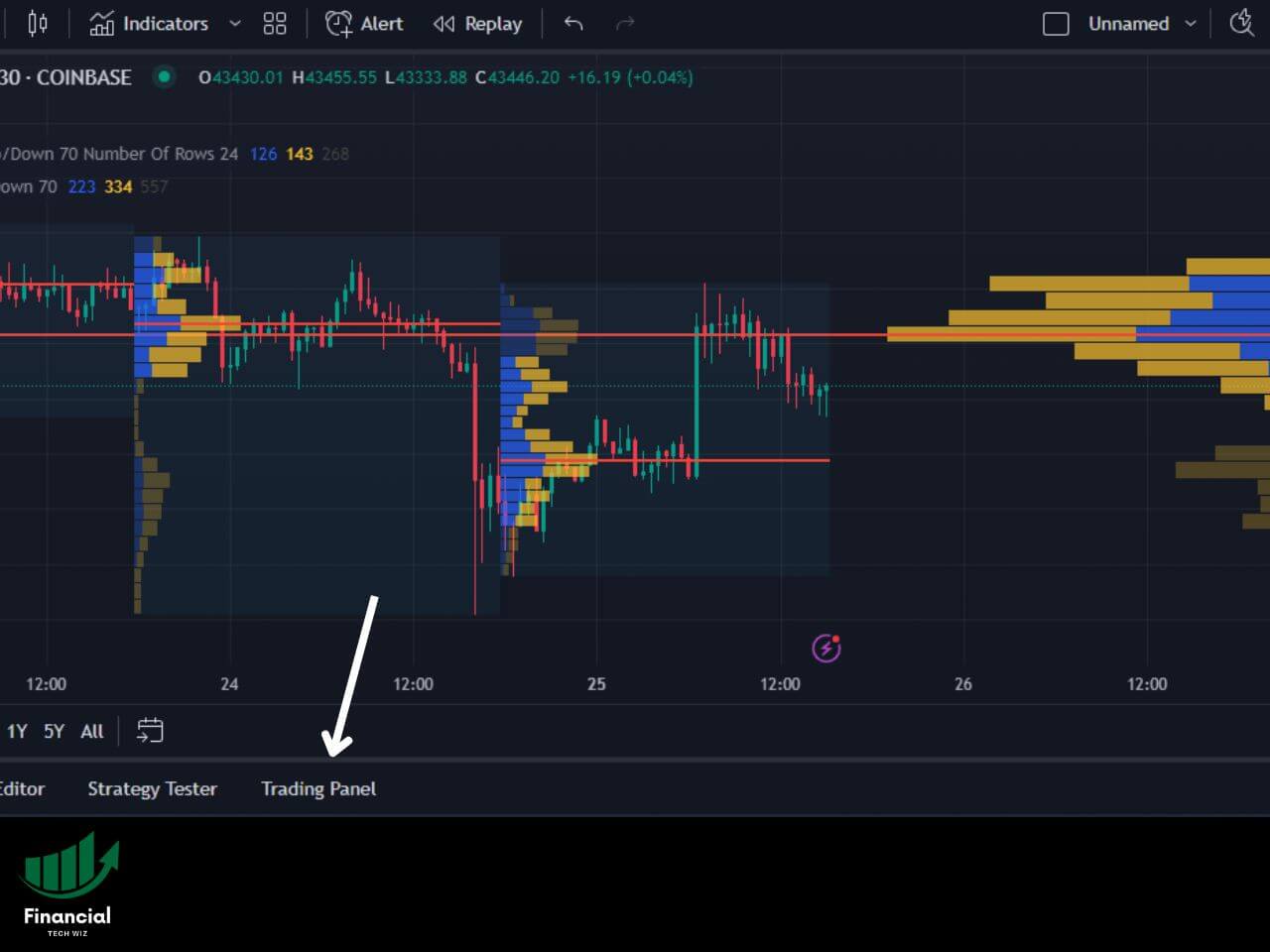

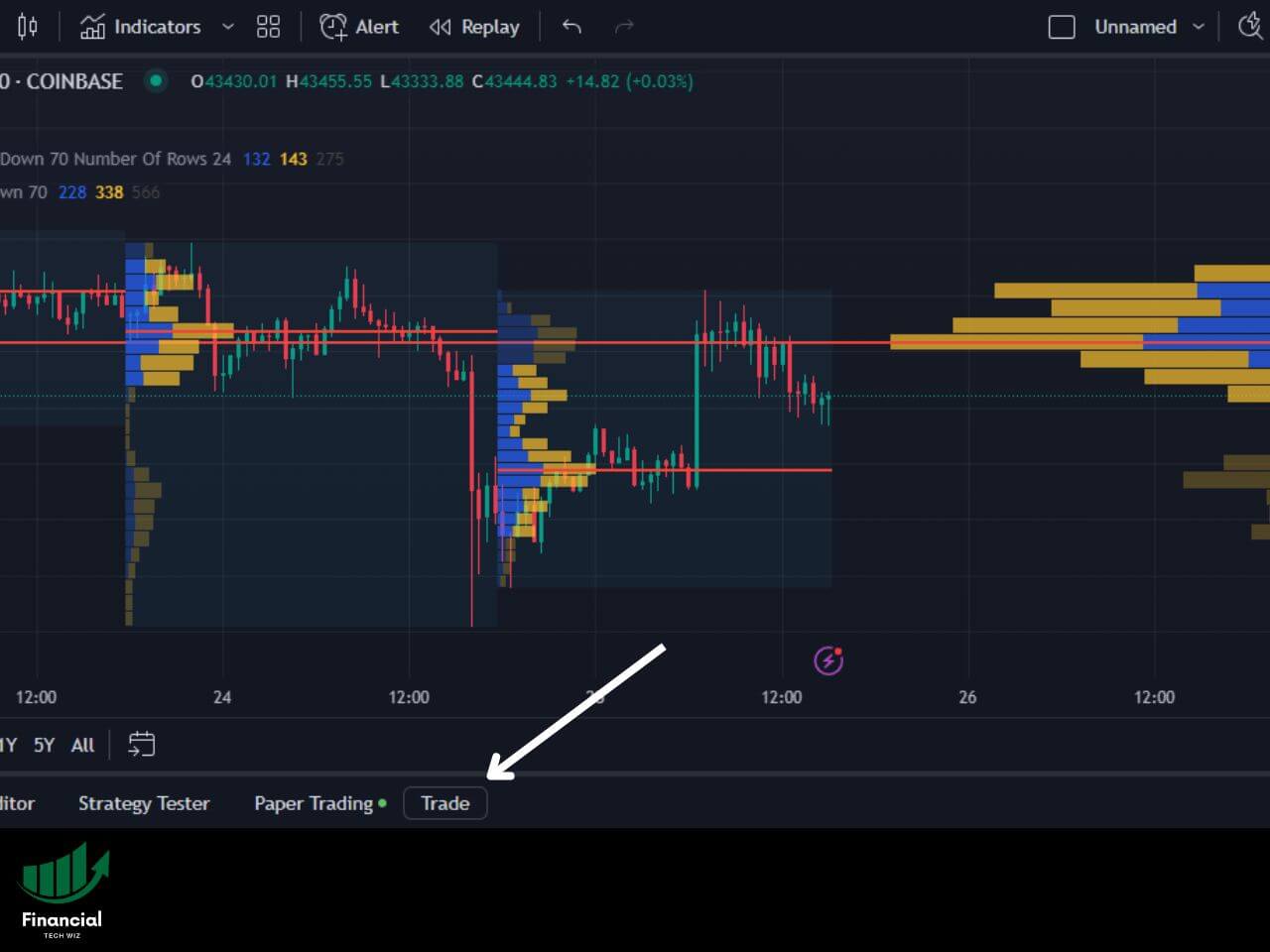

- Trading Panel Access: Click the trading panel located at the bottom of the chart.

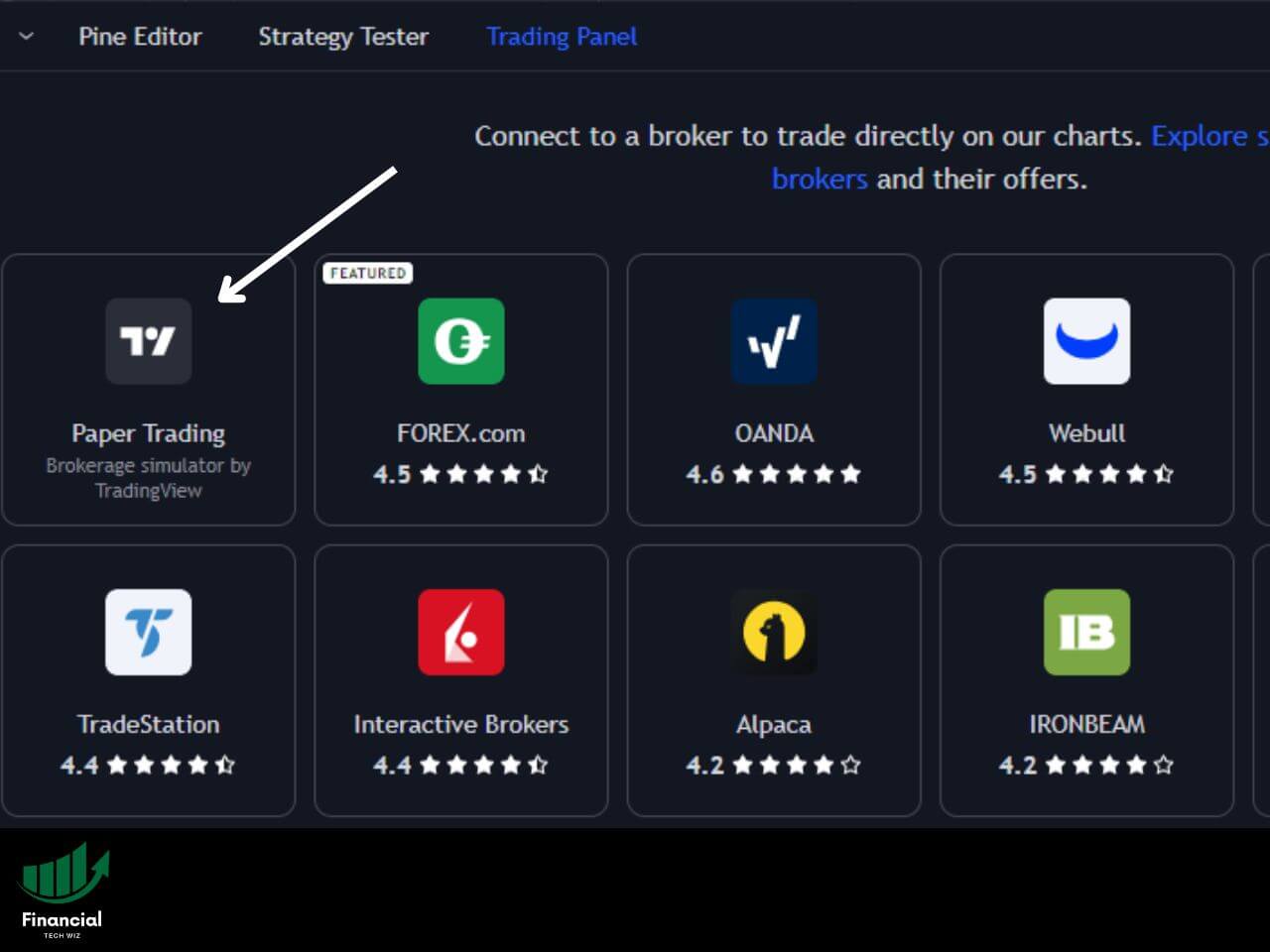

- Select TradingView Paper Trading: Choose the paper trading option or a broker if you have one linked.

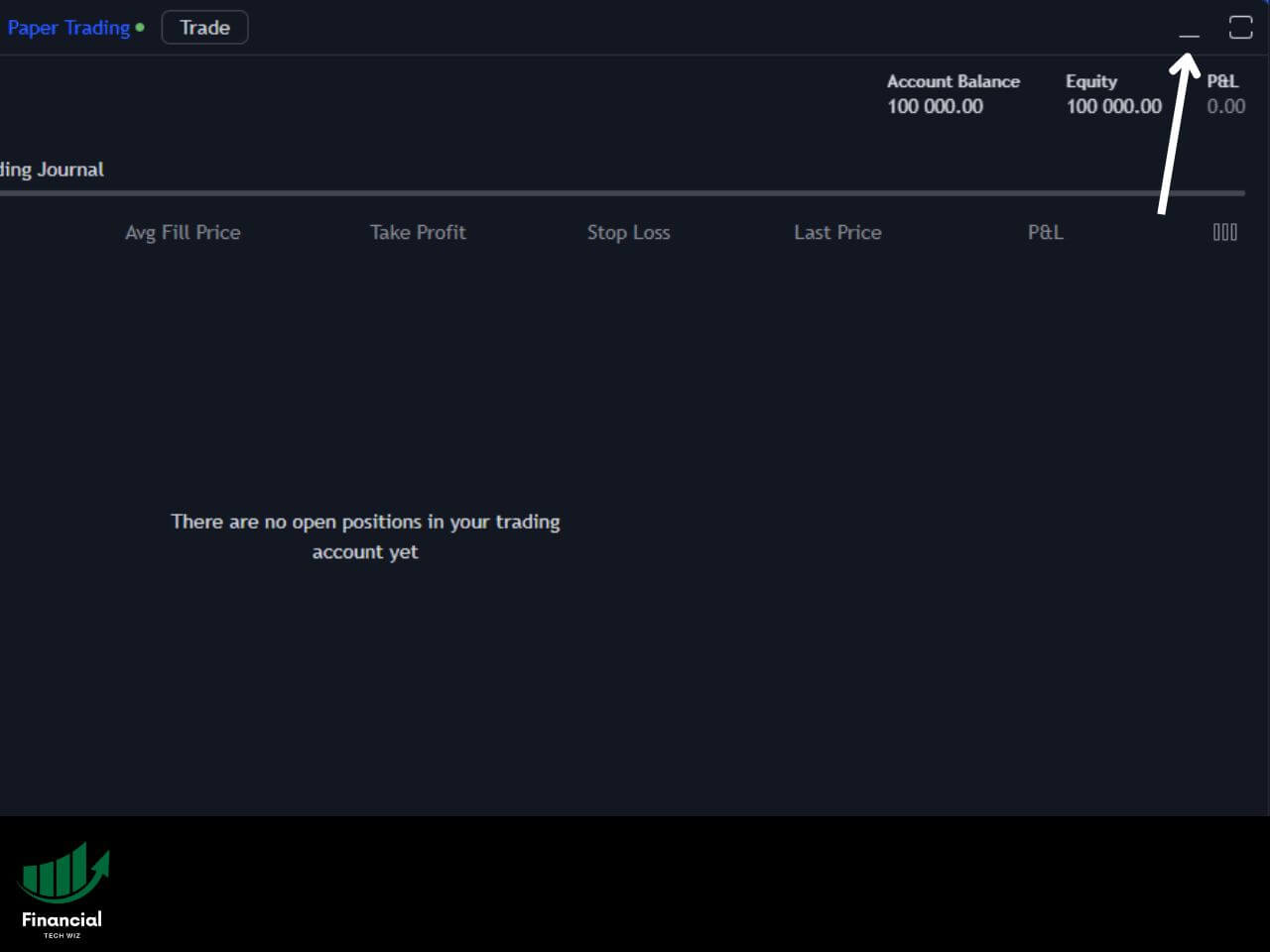

- Minimize the New Window: Close the new window by clicking the top right minimize icon.

- Trade from the Chart: When viewing a chart, click ‘trade’ at the bottom of the screen to open the order window.

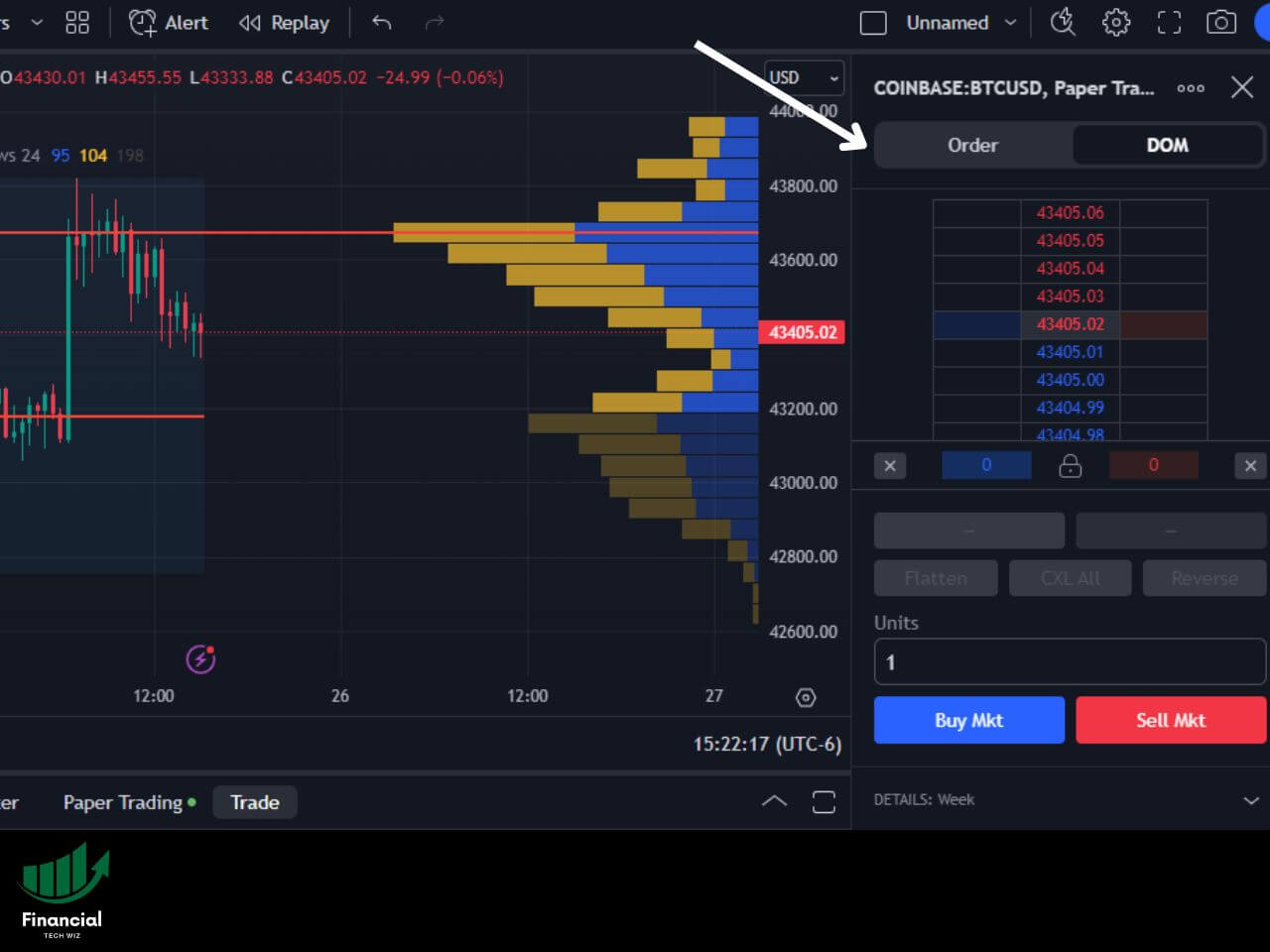

- Placing Trades: Use the DOM to place trades, set up stop-loss, limit orders, and take profit orders.

Mistakes to Avoid While Paper Trading on TradingView

Paper trading can be a great way to gain some experience with a strategy before using real money, but there are many factors that can give you false expectations, such as:

1- Failing to account for slippage and liquidity

If you are paper trading, you must understand that when you place a buy or sell order with real money, you will not get filled at the exact current price. This is especially true for assets like less than ideal liquidity, such as low-volume stocks and cryptocurrencies.

Failing to account for slippage will make your strategy perform much better than it will with real money. Therefore, TradingView paper trading should NOT be the main deciding factor when testing your strategies.

2- Lack of emotions

When you are paper trading with fake money, it is impossible to feel the real emotional impacts of losing or making money. Losing a lot of your actual money can cause you to make much different decisions than “losing” fake money. Therefore, that is why it is crucial to backtest and develop a trading plan that you can follow.

3- Breaking your strategies rules

When paper trading, it is easy to break your rules. Say your strategy calls for a -1 % stop-loss. If you decide to break this rule and let a trade go to -2 %, and it recovers and becomes a winning trade, you have effectively broken your rules and built a bad habit, thanks to paper trading.

4- Building false confidence

If you decide to paper trade a strategy, and every trade plays out perfectly, this doesn’t necessarily mean your strategy is flawless. Continuing paper trading until you have seen losses and wins is optimal to ensure you don’t build a bias that negatively impacts you.

When you use my affiliate link to sign up for TradingView, you can get a referral credit and a 30-day free trial of the premium features!

Get a TradingView Referral Credit & Free Trial

Transitioning From Paper Trading to Real Trading

When you have become comfortable after backtesting and paper trading, you may continue to implement it with real money. To ensure you have a smooth and profitable transition, ensure that you follow these tips:

1- Assess your readiness

Ensure you have analyzed your backtests and done enough paper trading so you know exactly what to expect, even in the most volatile market conditions.

2- Start small

Sizing is a crucial aspect when it comes to trading your strategy, as it lowers emotional decisions and limits your loss potential while you are just starting out.

3- Stick to your plan

After spending hours paper trading and backtesting, it would be counterproductive to break your rules. Always stick to your plan even when your hunches tell you to deviate.

FAQs

Does TradingView paper trading support options?

No, TradingView paper trading does not currently support options trading.

TradingView Paper Trading – Bottom Line

Paper trading on TradingView is a great way to test your strategy, given you are aware of its limitations. It is a great way to simulate the trading experience, but failing to account for common paper trading pitfalls such as slippage and commissions can give you unrealistic expectations.

If you haven’t already, I highly recommend you sign up for a free TradingView account so you can try out paper trading yourself. Using our link to sign up, you can also get a free trial of TradingView’s premium subscriptions!