TradingView and MT4 are both trading platforms that allow you to access the forex market, but they are not brokers. You still need to open an account with a broker that supports these platforms and execute your trades through them.

However, these platforms are not exactly the same. They have different features, advantages, and disadvantages that you should consider before choosing one over the other. In this article, we will mainly focus on the charting features of TradingView and MT4.

TradingView Overview

TradingView is a web-based charting platform that was launched in 2011. It has quickly become one of the most popular and widely used charting tools among traders of all levels and markets. TradingView offers more than just forex trading; you can also access stocks, futures, cryptocurrencies, and other instruments on its platform.

TradingView has a modern and user-friendly interface that allows you to customize your charts with various tools, indicators, drawing tools, and timeframes. You can also access a large community of traders who share their ideas, strategies, and analysis on the platform.

When you use my affiliate link to sign up for TradingView, you can get a referral credit and a 30-day free trial of the premium features!

Get a TradingView Referral Credit & Free Trial

MT4 Overview

MT4 is a downloadable software platform that was launched in 2005 by MetaQuotes. It is one of the oldest and most widely used trading platforms in the forex industry. MT4 is designed specifically for forex trading, and it offers both trading and analytical features.

MT4 has a simple and customizable interface that allows you to create your own charts with various technical analysis tools, indicators, scripts, and expert advisors (EAs). You can also backtest your strategies and optimize your parameters on the platform.

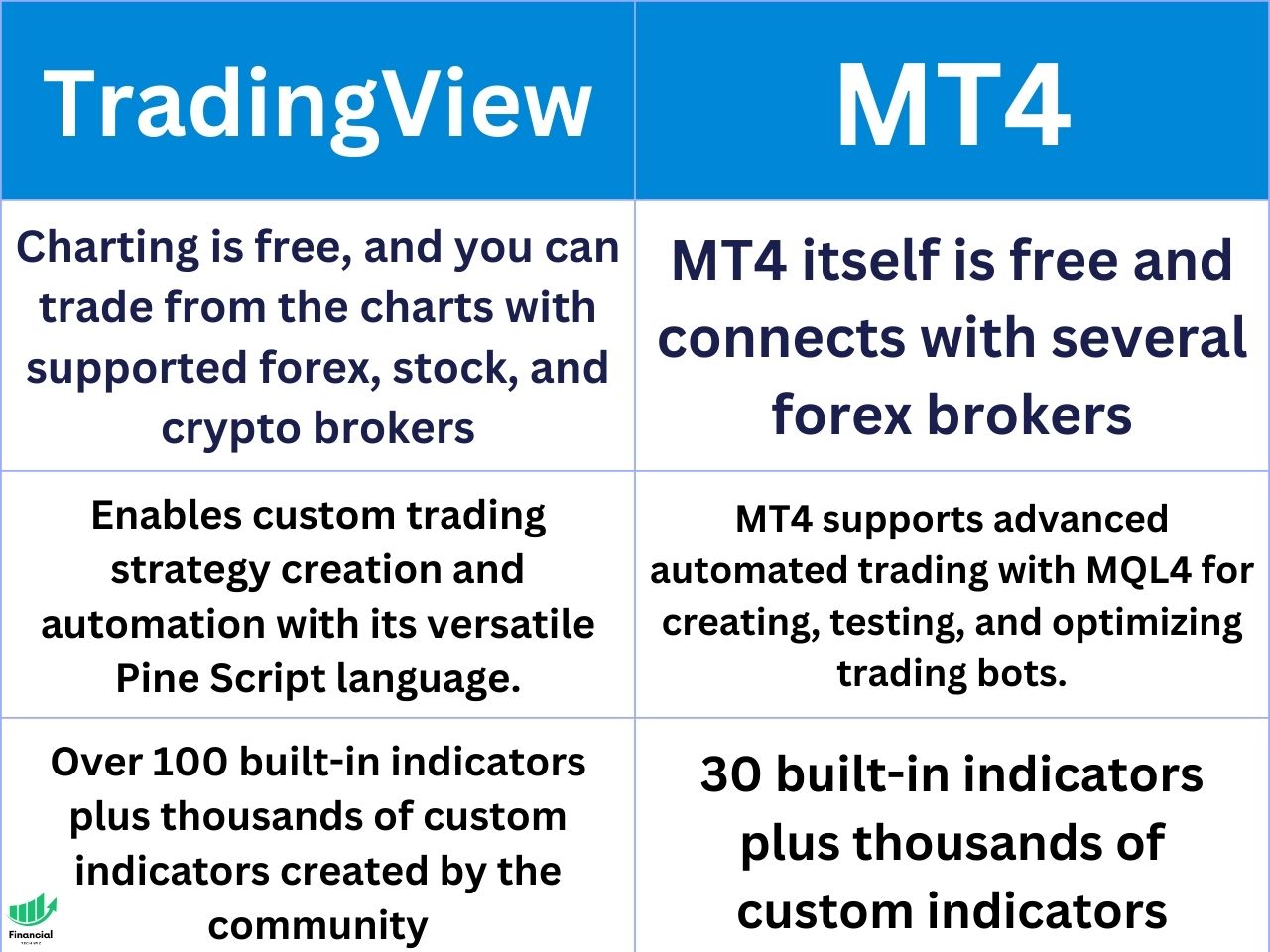

| Feature | TradingView | MetaTrader 4 |

|---|---|---|

| Indicators | Over 100 built-in indicators plus custom indicators with Pine Script. | 30 built-in indicators plus and ability to use thousands of custom indicators. |

| Backtesting | Ability to backtest, paper trade, and optimize trading strategies. | Ability to backtest using the strategy tester and trading bots. |

| Stock screeners | Advanced screeners to filter several assets based on many criteria | No stock screeners are available. |

| Trading execution | Support trading from charts with supported brokers. | Execute trades from the chart with supported brokers. |

| Broker availability | Support various brokers, including IBKR, Forex.com, Oanada, and more. | Supports brokers, including Oanda, Forex.com, FXCM, and more. |

| Other features | Heatmap, economic calendars, alerts, paper trading, backtesting, mobile app. | Free trading robots, expert advisors (EA), mobile trading. |

TradingView Pros & Cons

Pros

- TradingView is free to use and sign up. However, if you want to unlock more advanced features, such as more indicators, alerts, multiple charts per layout, etc., you can upgrade to one of its paid plans: Essential, Plus, or Premium.

- TradingView offers a free trial to test all of its premium features for 30 days. You can cancel anytime if you are not satisfied with the service.

- TradingView has a wide range of instruments that you can trade on its platform. You can access more than just forex; you can also trade stocks, futures, cryptocurrencies, commodities, indices, bonds, CFDs, and more.

- TradingView has a modern and intuitive interface that makes it easy to use and navigate. You can customize your charts with various tools, indicators, drawing tools, timeframes, layouts, themes, etc.

- TradingView has more advanced charting tools and indicators than MT4. You can access over 100 built-in indicators, including some unique ones created by TradingView users. You can also create your own indicators using Pine Script, a programming language designed for TradingView.

- TradingView has more features that enhance your trading experience, such as heatmaps, screeners, economic calendars, watchlists, trading alerts, paper trading, backtesting, etc.

Cons

- TradingView isn’t great for trading options, but you can view options chains and risk diagrams.

- You will need to execute your trades through a broker that supports TradingView or trade on a separate broker while using TradingView for charts only.

MT4 Pros & Cons

Pros

- MT4 is free to download and use. However, you will need to open an account with a broker that supports MT4 and execute your trades through them.

- MT4 is reliable and stable. It has been around for a long time and has proven its performance and functionality in the forex market. It rarely crashes or freezes, and it can handle high volumes of data and orders.

- MT4 supports automated trading. You can use EAs to automate your trading strategies and execute them on the platform. You can also backtest your EAs and optimize your parameters on the platform.

Cons

- MT4 is outdated and limited. It has not been updated or improved much since its launch in 2005. It lacks some of the features and tools that modern traders need, plus it looks old.

- MT4 has a lack of instruments. It only supports forex trading, and it does not offer access to other markets or instruments, such as stocks, futures, cryptocurrencies, etc.

- MT4 has a lack of chart timeframes compared to TradingView. On MT4, you can only access nine standard timeframes: M1, M5, M15, M30, H1, H4, D1, W1, and MN. On TradingView, you can access more than 20 timeframes, including custom ones, such as M2, M3, M10, H2, H8, etc. You can also access tick charts on TradingView, which show every price movement in the market.

- MT4 has a lack of indicators compared to TradingView. On MT4, you can only access about 30 built-in indicators, and some of them are outdated or redundant. On TradingView, you can access over 100 built-in indicators, including some unique ones created by TradingView users. You can also create your own indicators using Pine Script, a programming language designed for TradingView.

- MT4 has an outdated and complex interface that makes it hard to use and navigate. You may need to spend some time and effort to learn how to use the platform and customize it to your preferences.

TradingView vs MT4 – Bottom Line

TradingView and MT4 are both popular and widely used trading platforms for forex traders. However, they have different features, advantages, and disadvantages that you should consider before choosing one over the other.

TradingView is a web-based charting platform that offers more advanced charting tools and indicators than MT4. It also offers access to more instruments and markets than MT4. It has a modern and user-friendly interface that makes it easy to use and navigate. It also has a large and active community of traders who share their ideas and analysis on the platform.

MT4 is a downloadable software platform that offers both trading and analytical features for forex trading. It is reliable and stable, and it supports automated trading with EAs. It is customizable and flexible, and it supports multiple languages and platforms. However, it is outdated and limited in terms of charting tools, indicators, timeframes, and instruments.

Ultimately, the best platform for you depends on your personal preferences, trading style, and goals. However, it is clear that TradingView is a better all around trading and charting platform.

If you want to try TradingView for yourself and see how it compares to MT4, you can sign up for a free account here and get a free trial of TradingView. When you use my affiliate link, you will also get a discount on your membership!

When you use my affiliate link to sign up for TradingView, you can get a referral credit and a 30-day free trial of the premium features!

Get a TradingView Referral Credit & Free Trial

I hope this article has helped you understand the differences between TradingView and MT4 charting tools and make an informed decision on which one is best for you.