Technical analysis is the study of price movements and patterns in financial markets, using charts and indicators to identify trends, signals, and opportunities.

In this article, we will review the 7 best technical analysis books that every trader should read.

Whether you are a beginner or a seasoned trader, these books will help you improve your trading performance and achieve your financial goals.

Additionally, we recommend TradingView for technical analysis, as it is the best charting software for all markets.

The 7 Best Technical Analysis Books

1- Getting Started in Technical Analysis

2- How to Make Money in Stocks: A Winning System in Good Times and Bad

3- Japanese Candlestick Charting Techniques

4- Encyclopedia of Chart Patterns

5- Technical Analysis Using Multiple Timeframes

6- Technical Analysis For Dummies

7- Technical Analysis of Stock Trends

Getting Started in Technical Analysis

Getting Started in Technical Analysis is a great introduction to technical analysis for beginners. It explains the basic concepts and techniques of technical analysis in a clear and simple way. It covers topics such as trends, trading ranges, chart patterns, and more. Getting Started in Technical Analysis also provides in-depth coverage of:

- Trading systems-trend-following, counter-trend, pattern recognition.

- Software for charting and analysis.

- The challenges of trading illiquid and thinly traded markets.

- How to avoid false signals and whipsaws.

- Risk control strategies.

- The psychological aspects of trading discipline, commitment, confidence, and more.

Getting Started in Technical Analysis is a comprehensive and practical guide to the art and science of technical analysis. It is suitable for anyone who wants to learn how to use charts and indicators to make better trading decisions.

How to Make Money in Stocks: A Winning System in Good Times and Bad

How to Make Money in Stocks: A Winning System in Good Times and Bad is a national bestseller that has taught over 2 million investors how to build wealth through the stock market. It is based on a major study of market winners from 1880 to 2009.

How to Make Money in Stocks is not just a book about technical analysis. It is also a book about fundamental analysis, market psychology, portfolio management, and trading philosophy. It teaches you how to use O’Neil’s famous CAN SLIM system to identify and buy the best growth stocks in any market condition.

How to Make Money in Stocks is a must-read for anyone who wants to learn how to beat the market consistently and achieve financial freedom.

Japanese Candlestick Charting Techniques

Japanese Candlestick Charting Techniques is the most comprehensive and trusted guide to this essential technique. It is written by a pioneer trader who has done years of research on candlestick charting. It covers everything you need to know, including hundreds of examples that show how candlestick techniques can be used in all of today’s markets.

Japanese Candlestick Charting Techniques will teach you how to:

- Recognize and interpret the most common candlestick patterns

- Combine candlestick analysis with other technical tools such as moving averages, trendlines, support and resistance levels

- Apply candlestick techniques to various time frames and markets such as stocks, forex, futures

- Use candlestick signals to identify trading opportunities and manage risk

- Enhance your trading performance with advanced candlestick concepts such as continuation patterns, reversal patterns, gaps, windows, harami, doji, shooting star, hammer, morning star, evening star, dark cloud cover, piercing line, engulfing pattern, and more.

Japanese Candlestick Charting Techniques is a classic book that every technical analyst should have in their library. It is not only a reference book but also a trading manual that will help you master one of the most powerful and effective methods of chart analysis.

Encyclopedia of Chart Patterns

Encyclopedia of Chart Patterns updates the classic with new performance statistics for both bull and bear markets and 23 new patterns, including a second section devoted to ten event patterns.

The author tells you how to trade significant events, such as quarterly earnings announcements, retail sales, stock upgrades and downgrades, and more!

Encyclopedia of Chart Patterns will show you how to:

- Identify and profit from the most reliable chart patterns

- Use pattern recognition to filter out noise and focus on the most important price movements

- Measure the strength and reliability of each pattern with performance rankings and failure rates

- Optimize your entry and exit points with precise trading rules and guidelines

- Avoid common mistakes and pitfalls that can ruin your trades

Encyclopedia of Chart Patterns is a comprehensive and authoritative reference book that covers over 100 chart patterns, including classic patterns, event patterns, rare patterns, and failed patterns. It is an invaluable resource for any technical trader who wants to improve their pattern recognition skills and increase their trading success.

Technical Analysis Using Multiple Timeframes

Technical Analysis Using Multiple Timeframes is written by a trader and author for traders. It provides real-world examples of price action. It is considered a short textbook that offers practical knowledge. The author developed a method called Squeeze Dynamics Theory, which uses technical analysis and multiple timeframes.

Technical analysis using multiple timeframes involves analyzing stock price charts in different time frames. Higher time frames can help identify trends, while lower time frames can help identify entry and exit points.

Technical Analysis Using Multiple Timeframes will help you:

- Understand the principles of technical analysis and how to apply them to any market

- Learn how to use multiple timeframes to identify the best trading opportunities

- How to develop your own trading plan

- Trade with confidence and discipline using clear and objective rules

- Avoid emotional mistakes and overcome psychological barriers

Technical Analysis Using Multiple Timeframes is a book that will change the way you look at the markets. It will teach you how to combine different perspectives and tools to create a holistic and profitable trading approach.

Technical Analysis For Dummies

Technical Analysis For Dummies helps you take a realistic look at what securities prices are actually doing rather than what economists or analysts say they should be doing.

The book teaches you how to:

- Determine how markets are performing and make decisions using real data

- Spot investment trends and turning points

- Improve your profits and your portfolio performance

Technical Analysis For Dummies is a friendly and easy-to-understand guide that introduces you to the basic concepts and techniques of technical analysis. It covers topics such as:

- Chart types, patterns, indicators, oscillators, and signals

- Trend analysis, trendlines, channels, support and resistance levels

- Trading systems, strategies, styles, and tactics

- Risk management, money management, position sizing, and stop-loss orders

- Technical analysis tools, software, platforms, and resources

Technical Analysis For Dummies is a book that will help you get started with technical analysis in a fun and simple way. It will also help you avoid common pitfalls and misconceptions that can hinder your trading success.

Technical Analysis of Stock Trends

Technical Analysis of Stock Trends is widely considered to be one of the seminal works of the discipline. It was published in 1948 and is exclusively concerned with trend analysis and chart patterns.

It remains in use to the present. It is clear that chart analysis was the main method of technical analysis in the early days because computers did not have enough processing power for statistical analysis.

Technical Analysis of Stock Trends will teach you how to:

- Identify the major trends of the market using the Dow Theory

- Analyze price movements using bar charts, point-and-figure charts, line charts, candlestick charts

- Recognize and trade various chart patterns such as triangles, rectangles, head-and-shoulders, double tops, double bottoms, wedges, flags, pennants, and more.

- Use volume, breadth, sentiment, moving averages, trendlines, support and resistance levels to confirm or refute chart signals

- Apply technical analysis to different time frames, markets, sectors, industries, and stocks

Technical Analysis of Stock Trends is a book that every serious technical analyst should read. It is a classic book that has stood the test of time and has influenced generations of traders. It is a book that will help you understand the logic and psychology behind price movements and chart patterns.

The Best Technical Analysis Tools

Technical analysis is not only about reading books and learning theories. It is also about using the right tools to apply your knowledge and skills to the real markets.

There are many technical analysis tools available in the market, but not all of them are created equal.

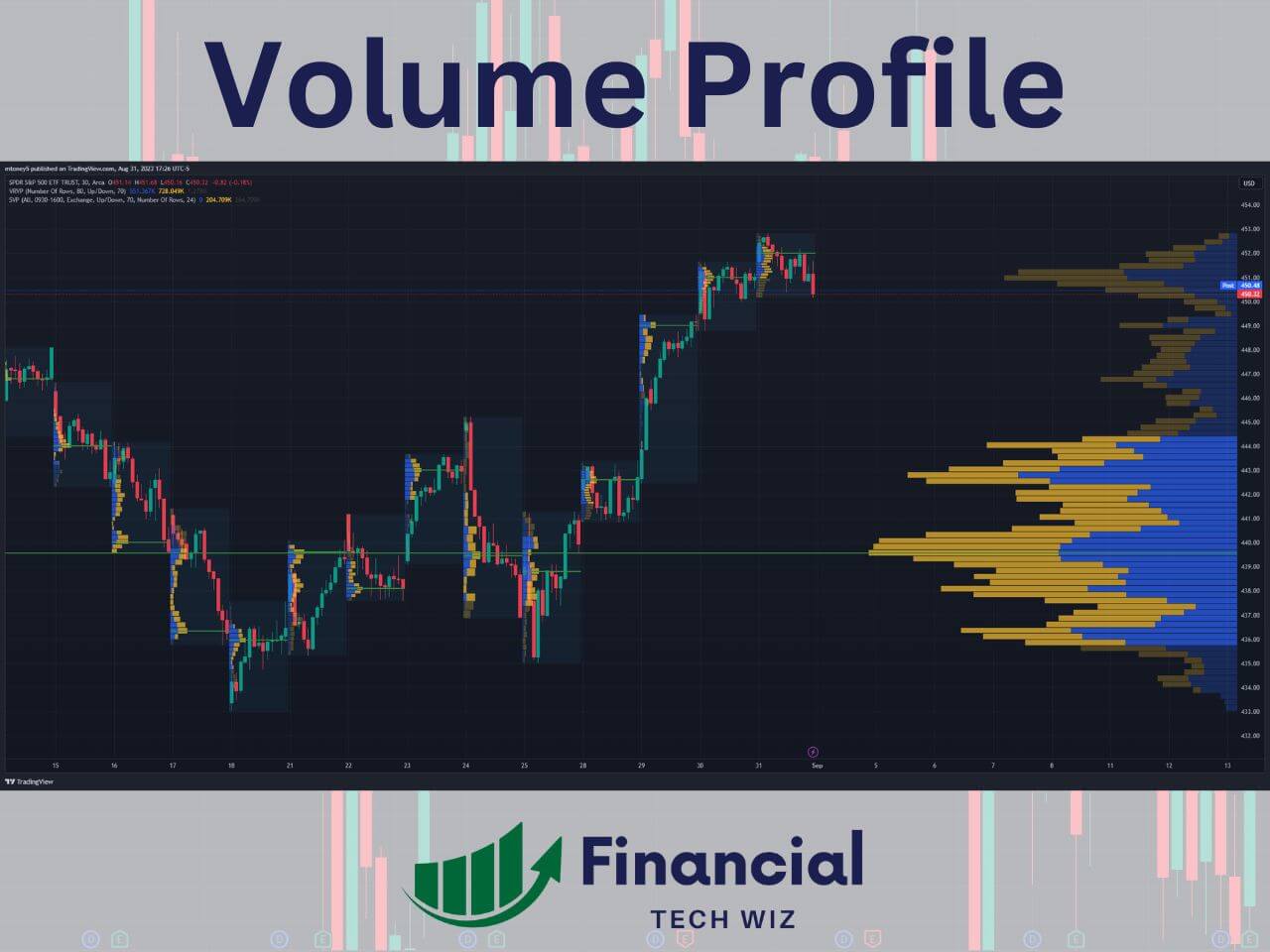

TradingView is a web-based platform that allows you to use hundreds of indicators and draw patterns on your chart. TradingView supports stocks, forex, futures, cryptocurrencies, and more.

It also has a powerful backtesting and paper trading feature that lets you test your trading system before risking real money.

TradingView is completely free to use, but if you want to access more features and benefits, you can upgrade to a premium plan.

If you are serious about trading, you can test out the premium features by using our link to sign up for a free trial. You will also get a discount on your subscription if you sign up using our link.

TradingView is the best technical analysis tool that we have ever used. It is easy to use, reliable, and versatile. It can help you improve your trading skills and results in any market. We highly recommend it to anyone who wants to take their trading to the next level.

Related Articles

Disclosure: This post contains affiliate links from Amazon and TradingView. As an Amazon Associate, I earn from qualifying purchases. This means that if you click on these links and make a purchase, I will receive a small commission at no extra cost to you.