Top 10 Best Days in Stock Market History For SPY & QQQ

The stock market has seen some incredible one-day rallies, where both the S&P 500 (SPY) and Nasdaq 100 (QQQ) indices experienced massive percentage gains in a single trading session. These explosive gains are often fueled by major market events, such as central bank interventions, government stimulus measures, or economic recovery signals after a period of heavy selling.

In this article, we’ll break down the top 10 best days in stock market history based on the largest single-day percentage gains for both SPY and QQQ. For each of these days, we measured the percentage change from the previous day’s close to the next day’s close.

Key Takeaways

- Bear-market bounces dominate: 9 of 10 rallies erupted during the dot-com bust, the 2008 credit crisis, the 2020 COVID-19 crash, or the 2025 tariff scare.

- Tech-Driven Rallies: QQQ, tracking the Nasdaq 100, saw some of the highest percentage gains during these periods, especially when tech stocks were leading the way.

- Unprecedented Rebounds: Some of the largest jumps came after significant drops, showing the market’s ability to rebound sharply from periods of fear and uncertainty.

Now, let’s take a look at the top 10 best days in stock market history for SPY and QQQ, ranked by the largest percentage gains.

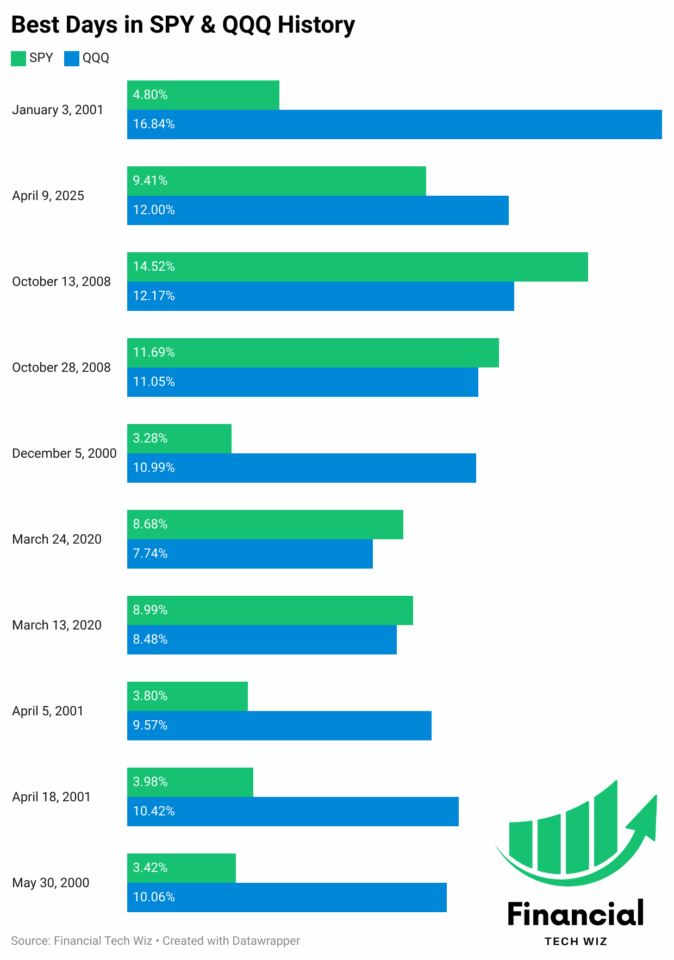

Summary of the Best Days in Stock Market History for SPY and QQQ

| Date | SPY | QQQ |

|---|---|---|

| 1/3/2001 | 4.80% | 16.84% |

| 4/9/2025 | 9.41% | 12.00% |

| 10/13/2008 | 14.52% | 12.17% |

| 10/28/2008 | 11.69% | 11.05% |

| 12/5/2000 | 3.28% | 10.99% |

| 3/24/2020 | 8.68% | 7.74% |

| 3/13/2020 | 8.99% | 8.48% |

| 4/5/2001 | 3.80% | 9.57% |

| 4/18/2001 | 3.98% | 10.42% |

| 5/30/2000 | 3.42% | 10.06% |

Top 10 Best Single-Day Gains for SPY and QQQ

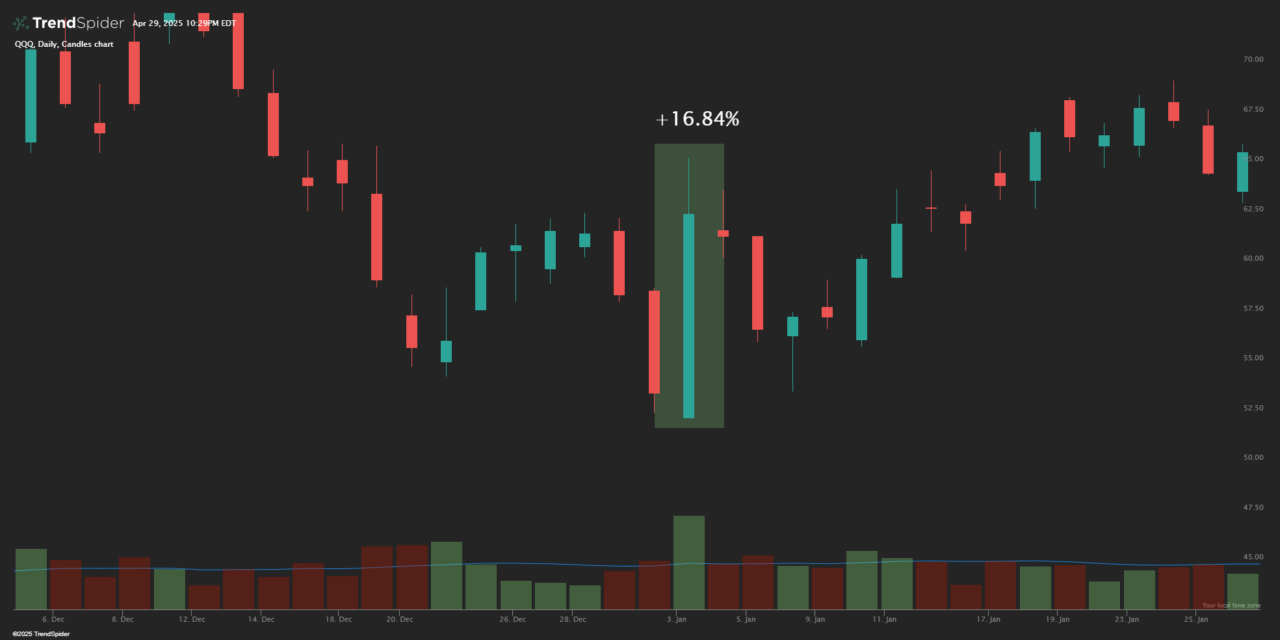

1. January 3, 2001

- SPY: +4.80%

- QQQ: +16.84%

Amid the bursting of the dot-com bubble, the Federal Reserve surprised markets with an emergency rate cut. The tech-heavy Nasdaq 100 exploded upwards, with QQQ surging 16.84% in one session – the largest one-day gain in QQQ’s history. It was a “sizzling” rally that lifted the Nasdaq Composite by 324 points (+16.84%). SPY also jumped 4.80% on the news, a big move though far less dramatic than QQQ’s tech-driven spike.

2. April 9, 2025

- SPY: +9.41%

- QQQ: +12.00%

Stocks roared back in the spring of 2025 with a historic rally. On this day, the S&P 500 ripped +9.41% (one of its highest gains ever) and QQQ skyrocketed +12.00% by the close. It marked the third-largest single-day percentage gain on record for the Nasdaq index. This massive rebound came after a series of steep declines, as investors reacted to Trump announcing a 90-day tariff suspension.

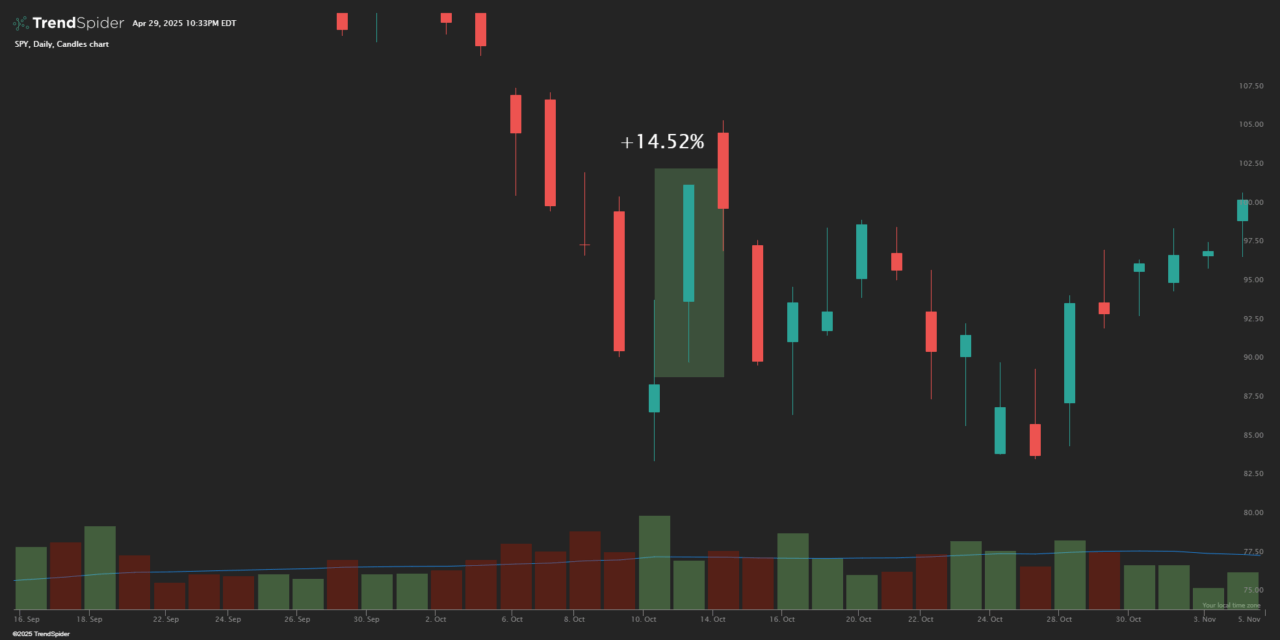

3. October 13, 2008

- SPY: +14.52%

- QQQ: +12.17%

In the depths of the 2008 financial crisis, Wall Street saw one of its best days in history. Governments unveiled bank rescue plans, triggering a relief rally that sent SPY up 14.52% and QQQ up 12.17% by the close. It was the S&P 500’s largest single-day percentage gain on record. Investors “roared back” into stocks after the worst week ever, as news of capital injections into banks restored some confidence. This stunning surge — with both indices up over 12% — underscores how bear market rallies can be explosively large.

4. October 28, 2008

- SPY: +11.69%

- QQQ: +11.05%

Just two weeks after the prior entry, another huge rally hit on Oct 28, 2008. SPY spiked +11.69% (its second-biggest gain on record), and QQQ jumped +11.05%. This rebound came amid ongoing volatility in the 2008 crisis; investors reacted to efforts to unblock credit markets and a wave of bargain-hunting after massive declines. Nasdaq stocks also soared +11.05% that day, as tech participated in the broader snap-back rally.

5. December 5, 2000

- SPY: +3.28%

- QQQ: +10.99%

During the collapse of the dot-com bubble, tech stocks staged a fierce one-day comeback on Dec 5, 2000. The Nasdaq 100 (QQQ) rocketed +10.99%, one of its biggest gains amid the 2000–2002 bear market. The Nasdaq Composite index jumped 274 points that day. SPY also rose +3.28% intraday (a solid gain but not close to a record for the S&P). This rally was short-lived relief in a larger downtrend, but it goes to show how even in prolonged bear markets, there are days of spectacular upside volatility.

6. March 24, 2020

- SPY: +8.68%

- QQQ: +7.74%

Stocks rebounded sharply in the early 2020 pandemic crash after unprecedented Fed and Congressional action. On 3/24/2020, the S&P 500 surged +8.68%, and QQQ jumped +7.74%. This came as the U.S. Congress neared passage of a $2 trillion stimulus package and the Federal Reserve announced bold liquidity programs, sparking a wave of buying. Although fears were far from over, that “turnaround Tuesday” proved that even after brutal sell-offs, markets can stage eye-popping one-day rallies.

7. March 13, 2020

- SPY: +8.99%

- QQQ: +8.48%

Just days prior, on Friday the 13th of March 2020, the market also spiked higher. The U.S. had just declared a national emergency over COVID-19, and investors rushed back in after a historic plunge the day before. SPY leapt +8.99% and QQQ +8.48% by the close. All the major indexes closed with massive gains that day, as a late-afternoon rally (aided by President Trump’s emergency announcements) flipped panic into euphoria. Notably, analysts cautioned that one good day didn’t signal a bottom – and indeed, more volatility lay ahead.

8. April 5, 2001

- SPY: +3.80%

- QQQ: +9.57%

The spring of 2001 saw fierce bear-market rallies as the Fed continued cutting rates. On April 5, 2001, the Nasdaq 100 roared back +9.57%. This was a continuation of the rally sparked by the Fed’s rate cuts, as investors responded positively to the prospect of easier monetary policy. SPY also rose +3.80% that day as broader stocks climbed, though the move was far more pronounced in tech shares.

9. April 18, 2001

- SPY: +3.98%

- QQQ: +10.42%

Just two weeks later, the Fed executed another surprise 0.5% rate cut between meetings (the second that year), igniting a strong one-day rally. The Nasdaq surged +10.42% that day. SPY gained +3.98% as well. This date’s pop helped claw back some losses in what was otherwise a brutal 2001 bear market. The twin emergency rate cuts (in January and April 2001) gave brief relief rallies – April 18’s being notable enough to rank among QQQ’s top gain days.

10. May 30, 2000

- SPY: +3.42%

- QQQ: +10.06%

Coming off Memorial Day weekend in 2000, investors staged a huge tech rally. The Nasdaq soared +10.06%, which at the time was the Nasdaq’s largest single-day percentage gain ever since its inception in 1971. The surge followed a steep decline in the weeks after the March 2000 peak. The S&P 500 rose a more modest +3.42% that day, while the Dow climbed about 2%+, led by tech components. This spectacular post-holiday rally was a standout moment in the volatile unwinding of the dot-com bubble.

Why These Days Matter

Missing just one of these “outside-tail” sessions can slash an investor’s long-term CAGR. Conversely, panicking after steep drops risks locking in losses days before historic rebounds. History’s lesson: bear markets punish nerves—but they also pay contrarians willing to stomach the volatility.

Conclusion

The top 10 best days in stock market history for the S&P 500 (SPY) and the Nasdaq 100 (QQQ) showcase some truly massive single-day gains. These rallies often took place after periods of intense selling, with major news events or policy actions acting as the catalysts for these rebounds. Understanding these exceptional days helps us recognize the power of the markets to bounce back, even after some of the worst declines. As history has shown, the biggest gains often follow the most challenging times, offering a stark reminder that volatility can create both risk and reward in equal measure.

Get Your Free Trading Resources

Grab the free trading journal template plus the same tools we use to stay organized, consistent, and objective.

- Free trading journal template

- Custom indicators, watchlists, and scanners

- Access our free trading community

Enter your email below to get instant access.

No spam. Unsubscribe anytime.