Tradovate vs Webull: Futures Execution vs Retail Brokerage

Tradovate and Webull are built for very different types of traders. Tradovate is a futures focused trading platform designed around low commissions and active execution. Webull is a commission free brokerage aimed at stocks, options, and newer traders who want a modern interface with solid tools.

In this comparison, we break down how Tradovate and Webull differ in supported assets, pricing, tools, and ideal use cases so you can decide which platform actually fits how you trade.

All information below was manually researched from official platform resources and public documentation.

- Futures focused trading platform

- Native TradingView integration

- Advanced volume based tools

- Commission free stocks and options

- Paper trading and simulations

- Desktop, web, and mobile platforms

Tradovate Overview

Tradovate is a futures brokerage platform built specifically for active traders. It offers transparent commissions and optional pricing plans that can reduce per trade costs for higher volume traders.

One of Tradovate’s biggest advantages is access to micro futures contracts, which allows traders to participate in futures markets with relatively low capital. The platform includes built in charting with volume profile and market profile tools and also integrates directly with TradingView for traders who want more advanced analysis.

Key Strengths

- Low cost futures commissions

- Direct TradingView integration

- Advanced futures focused charting tools

Who Tradovate Is Best For

Tradovate is best suited for traders who focus primarily on futures and trade often enough to benefit from reduced commission plans. It is not designed for stocks or ETFs, so traders looking for broader market access will need an additional platform.

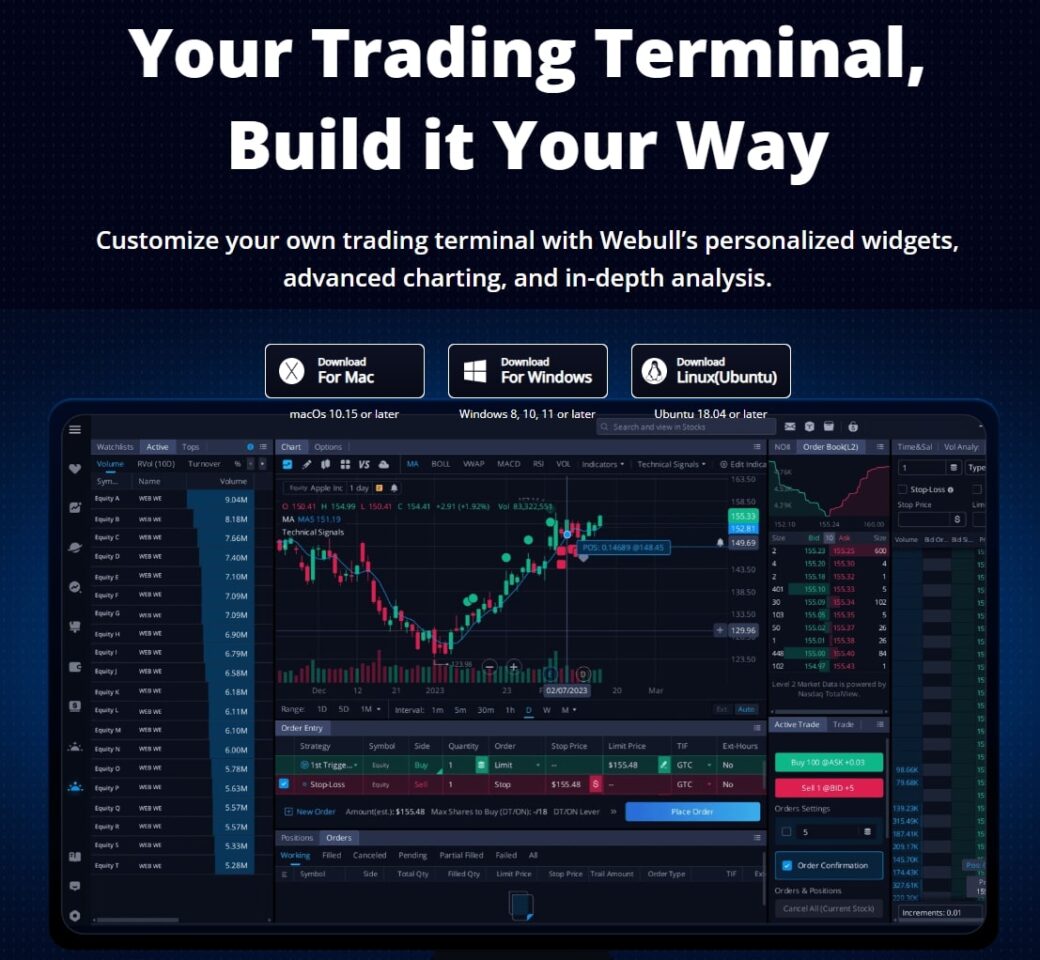

Webull Overview

Webull is a commission free online brokerage founded in 2017. It gained popularity by offering a modern trading experience similar to Robinhood, but with more advanced tools and a desktop trading platform.

Webull supports stocks, ETFs, options, index options, and cryptocurrencies. It also offers paper trading, making it appealing for newer traders who want to practice strategies without risking real capital.

Key Strengths

- No commissions on stocks and standard options

- Paper trading and simulated accounts

- Solid charting across desktop, web, and mobile

Who Webull Is Best For

Webull is a good fit for traders who want a relatively simple platform but still value technical analysis tools. It works well for active stock and options traders who want commission free trading and a cleaner interface than many legacy brokers.

Key Differences Between Tradovate and Webull

Platform Capabilities

| Feature | Tradovate | Webull |

|---|---|---|

| Platform Type | Futures brokerage | Retail brokerage |

| Tradable Assets | Futures, futures options, forex | Stocks, ETFs, options, index options, crypto |

| Charting | Futures charting with volume and market profile | Desktop, web, and mobile charting |

| Market Data | Real time data with funded account | Real time data with funded account |

| Premium Pricing | $99 per month or $1,499 lifetime for lower commissions | No premium tiers |

Trading Tools and Account Features

| Feature | Tradovate | Webull |

|---|---|---|

| DRIP | Not available | Available with no fees |

| Margin Trading | Yes | Yes |

| Insurance | Not insured | SIPC insured |

| Mobile App | Yes | Yes |

Trading Costs and Commissions

| Fee Type | Tradovate | Webull |

|---|---|---|

| Stock Trades | Not supported | Free |

| Options | Not supported | $0, index options $0.55 per contract |

| Futures | $1.29 per contract, $0.35 micro | Not supported |

| Futures Options | Typically same as futures | Not supported |

| Option Exercise Fees | None | None |

Final Verdict: Tradovate vs Webull

Tradovate and Webull are not direct competitors. They serve different segments of the trading market.

Tradovate is built for futures traders who care about commissions, execution, and access to micro contracts. It works best as a specialized futures platform rather than an all in one brokerage.

Webull is a strong option for stock and options traders who want commission free trading, modern tools, and a clean interface. It is especially appealing for newer traders or those who do not need futures access.

The right choice depends entirely on what markets you trade and how you prefer to trade them.

Related Trading Platform Comparisons

Get Your Free Trading Resources

Grab the free trading journal template plus the same tools we use to stay organized, consistent, and objective.

- Free trading journal template

- Custom indicators, watchlists, and scanners

- Access our free trading community

Enter your email below to get instant access.

No spam. Unsubscribe anytime.