Webull vs tastytrade: Which Broker Fits Your Trading Style?

Webull and tastytrade both offer commission friendly access to stocks and options, but they are built with different priorities. Webull leans toward a clean, beginner friendly experience with surprisingly capable charting and paper trading. tastytrade is designed for active traders, especially options traders who care about chain analysis, trade management, and derivatives pricing.

In this guide, we compare Webull vs tastytrade across features, supported assets, costs, and the type of trader each platform is best for.

All details below were manually compiled from public broker documentation and platform resources.

- Commission free stocks and options

- Paper trading and simulations

- Desktop, web, and mobile platforms

- Options first trading platform

- Efficient derivatives pricing

- Built for active traders

Webull Overview

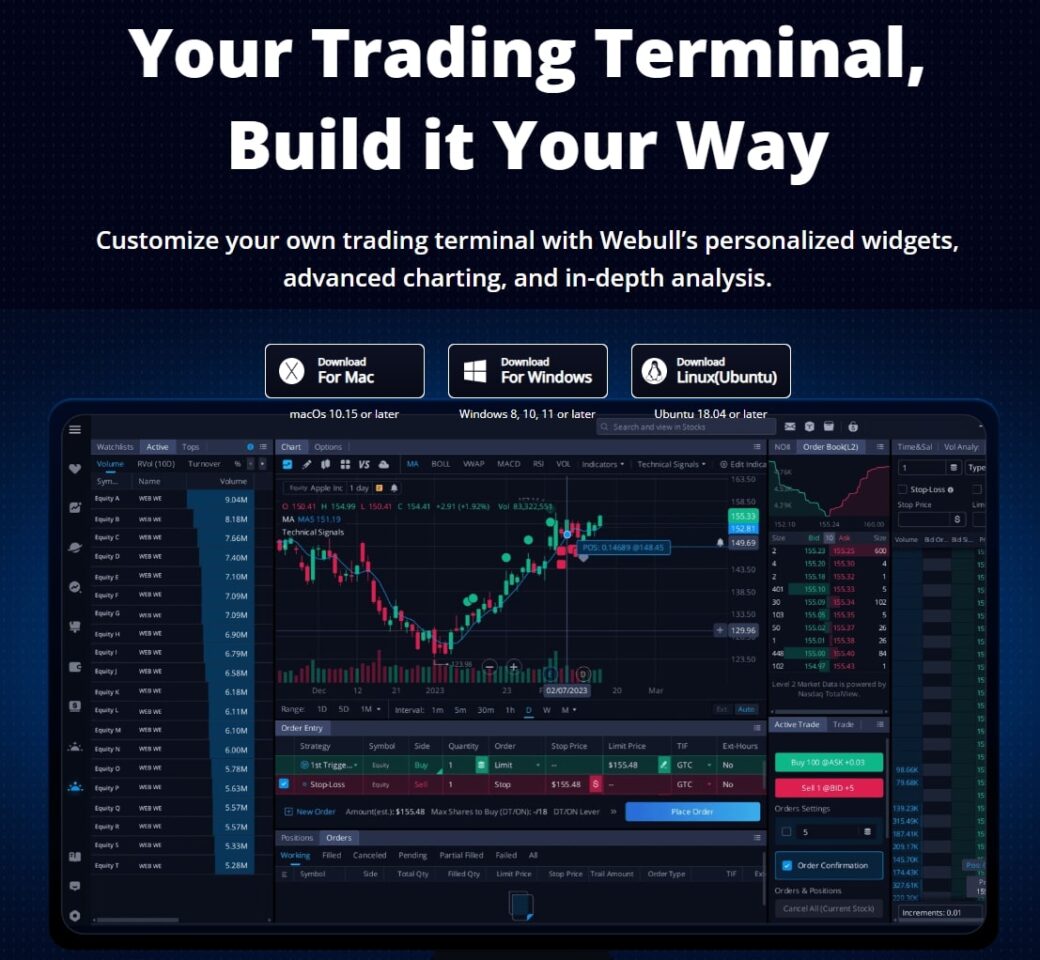

Webull is a commission free online brokerage founded in 2017. It became popular as an alternative to Robinhood by offering a modern interface while also providing more advanced tools, including a downloadable desktop platform.

Webull supports stocks, ETFs, options, index options, and crypto. It also includes paper trading, which is useful for learning the platform, testing strategies, or building confidence before going live.

Key Strengths

- No commissions on stocks and standard options

- Paper trading features for practice

- Solid charting on desktop, web, and mobile

Who Webull Is Best For

Webull is a strong fit for traders who want a relatively simple platform but still want real charting tools and a desktop experience. It works especially well for stocks and options traders who value a clean UI, commission free trading, and the ability to simulate trades.

tastytrade Overview

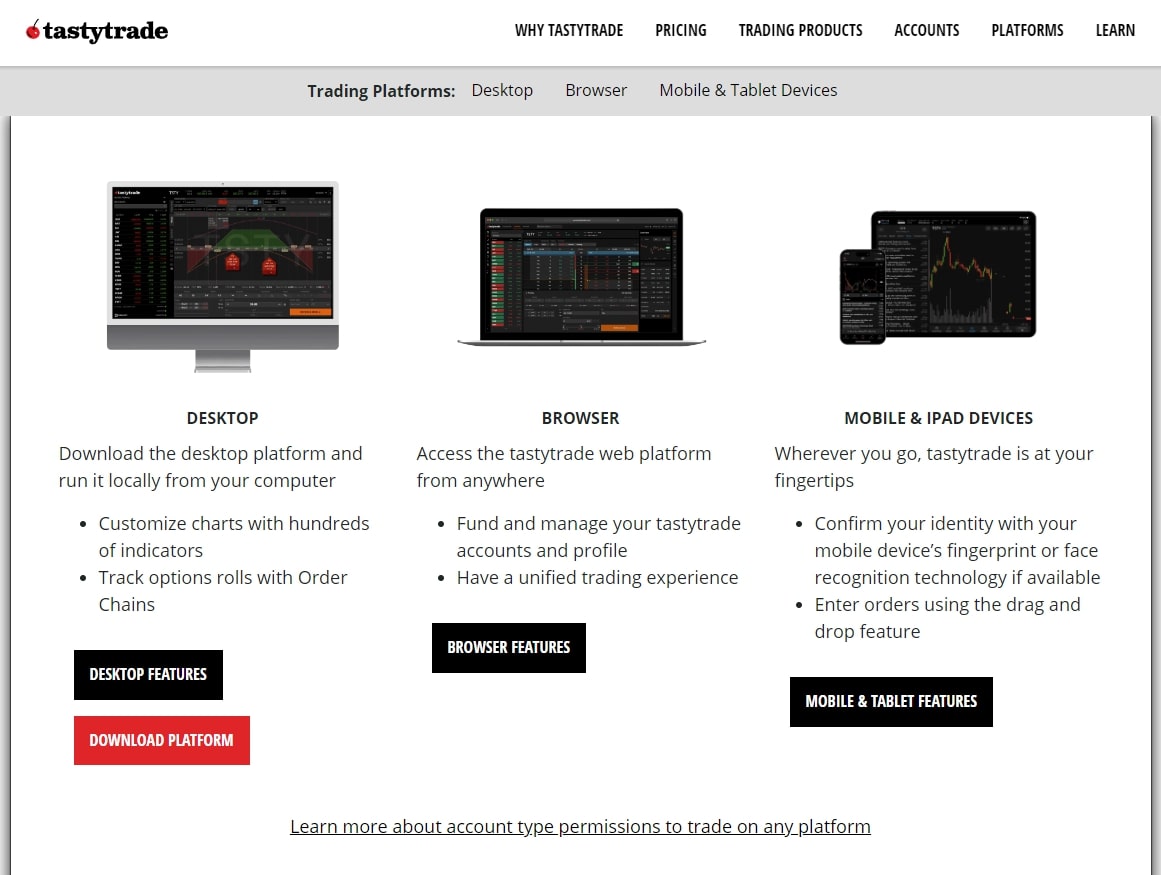

tastytrade is a brokerage platform built specifically for active traders, with a heavy focus on options. It was founded by Tom Sosnoff, who also founded thinkorswim. tastytrade was later acquired by IG, while Sosnoff remains a key personality through tastylive.

The platform emphasizes trade mechanics, options chain workflows, and derivatives execution. It also offers access to futures, futures options, stocks, ETFs, index options, crypto, and bonds.

Key Strengths

- One of the best platforms for options trading workflows

- Competitive pricing for derivatives

- Full featured platform for active traders

Who tastytrade Is Best For

tastytrade is best for active traders, especially those who trade options and futures and want a platform designed around derivatives. It is also usable for longer term investors thanks to features like fractional shares and access to multiple asset classes, but its main advantage is how well it handles active trade management.

Key Differences Between Webull and tastytrade

Platform Capabilities

| Feature | Webull | tastytrade |

|---|---|---|

| Platform Type | Brokerage | Brokerage |

| Tradable Assets | Stocks, ETFs, options, index options, crypto | Stocks, ETFs, options, index options, futures, futures options, crypto, bonds |

| Charting | Desktop, web, and mobile | Desktop and web |

| Market Data | Real time data with funded account | Real time data with funded account |

| Premium Pricing | No premium tiers | No premium tiers |

Trading Tools and Account Features

| Feature | Webull | tastytrade |

|---|---|---|

| DRIP | Yes, no fees | Yes, no fees to enable, clearing fee to sell fractional shares |

| Margin Trading | Yes | Yes |

| Insurance | SIPC insured | SIPC insured |

| Mobile App | Yes | Yes |

Trading Costs and Commissions

| Fee Type | Webull | tastytrade |

|---|---|---|

| Stock Trades | Free | Free |

| Options | $0, index options $0.55 per contract | $1 to open, free to close |

| Futures | Not supported | $1.25 per contract, $0.85 micro, $0.25 smalls |

| Futures Options | Not supported | $2.50 per contract, $1.50 micro |

| Option Exercise Fees | None | $5 fee |

Bottom Line: Webull vs tastytrade

Choosing between Webull and tastytrade comes down to what you trade and how active you are.

Webull is a great all around choice for stock and options traders who want a clean platform, paper trading, and solid charting without paying commissions on standard options. It is easy to get started and still capable enough to grow with.

tastytrade is a better fit for active derivatives traders, particularly options traders who want a platform built around chains, probabilities, and trade management. If futures and futures options are part of your plan, tastytrade also gives you access that Webull does not.

Related Trading Platform Comparisons

Get Your Free Trading Resources

Grab the free trading journal template plus the same tools we use to stay organized, consistent, and objective.

- Free trading journal template

- Custom indicators, watchlists, and scanners

- Access our free trading community

Enter your email below to get instant access.

No spam. Unsubscribe anytime.