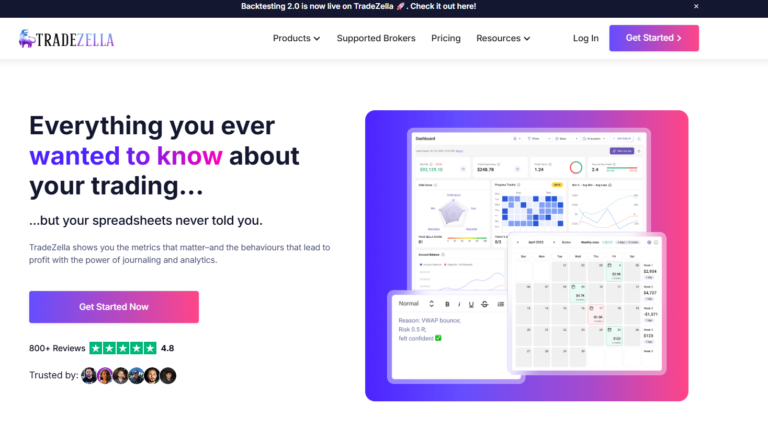

Tradezella Review 2026: Features, Pricing, and Why Traders Choose Alternatives

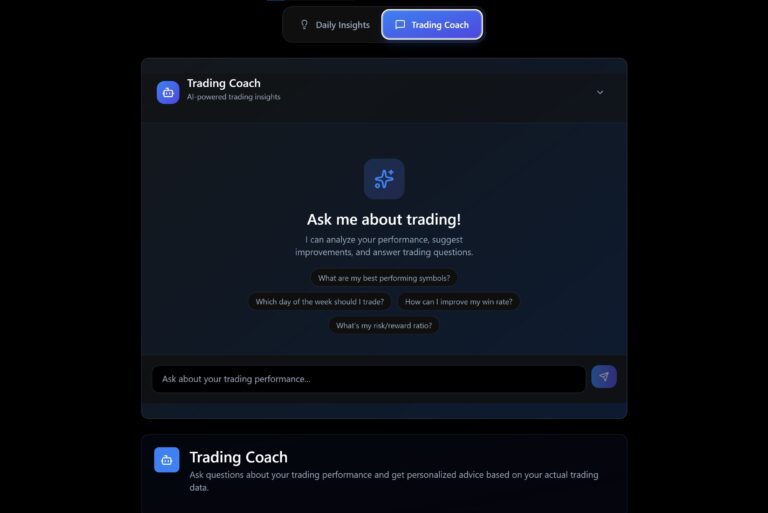

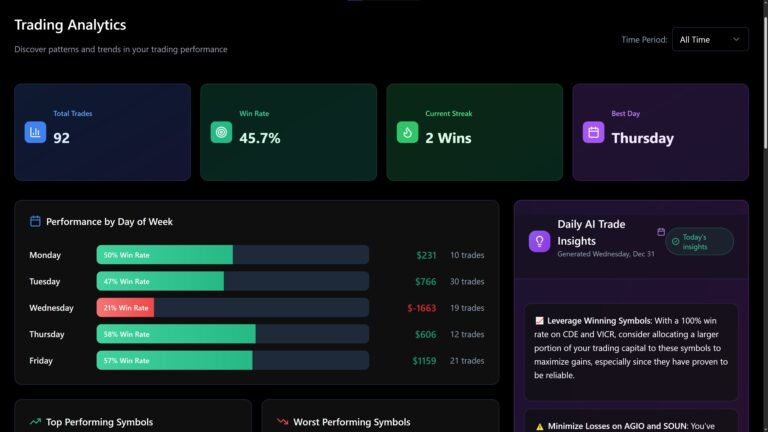

Tradezella positions itself as a “gym for traders” with trade replay, backtesting, and the unique “Playbook” system for strategy tracking. At $288-$399/year with no free trial and strict no-refund policy, is it worth the investment? This review examines what Tradezella does well, technical limitations traders encounter, and why many choose free alternatives instead. What is…