Financial Tech Wiz Trading Journal App: A Complete Guide

The Financial Tech Wiz Trading Journal is built for traders who want clarity, structure, and accountability in their trading process. Whether you are actively day trading, swing trading, or managing longer-term positions, properly tracking trades and portfolio performance is essential for improving consistency over time.

This guide walks through exactly how to use the Financial Tech Wiz Trading Journal App from initial setup to advanced analysis. You will learn how to enter your starting portfolio value, track daily account performance, log trades correctly, analyze results, and use built-in analytics and AI tools to better understand what is actually working in your trading.

By the end of this guide, you will understand the full workflow of the journal and how each section works together to give you a complete picture of your performance.

Getting Started: Initial Setup

Entering Your Starting Net Liquidity

The first and most important step is entering your Starting Net Liquidity.

You will find the Starting Net Liquidity input box on the Overview tab. This value should reflect your total portfolio value on the day you decide to begin logging trades inside the journal.

This number represents Day One of your journal. It is the baseline that powers many of the journal’s calculations and charts.

Your starting net liquidity is used for:

- Closed trades P/L charts

- Open P/L percentage calculations

- Allocation percentage metrics

- Stop loss risk percentage calculations

Because this value feeds directly into performance metrics across the app, accuracy is critical. An incorrect starting value will cause downstream metrics to be distorted, including allocation percentages, risk exposure, and portfolio performance calculations.

Logging Daily Portfolio Value (Net Liquidity)

Daily Net Liquidity Tracking

Once your starting net liquidity is set, the next step is logging your daily net liquidity.

Daily net liquidity is entered under the Portfolio Performance tab. For each trading day, simply:

- Select the date

- Enter your total portfolio value for that day

Tracking daily net liquidity allows you to see how your portfolio performs on a marked-to-market basis, not just based on closed trades.

This enables:

- Mark-to-market performance tracking

- Portfolio performance comparisons against benchmarks such as the S&P 500

- Accurate total return calculations

This step is essential for traders who want to understand true account performance instead of relying solely on closed trade results.

Matching Day One Values

Your first daily net liquidity entry must match your Starting Net Liquidity.

This establishes the correct performance baseline and tells the journal exactly when trade logging began. If these values do not match, calculations throughout the app can become inaccurate.

Skipping this step or entering mismatched values can cause portfolio charts, return calculations, and benchmark comparisons to break or display misleading data.

Bulk Importing Net Liquidity Data

For traders transitioning from the Financial Tech Wiz Google Sheets Trading Journal, daily net liquidity can be imported in bulk.

To do this:

- Copy Column A for Net Liquidity

- Copy Column B for Date

- Use the Bulk Import button inside the Portfolio Performance page

This allows you to move historical portfolio data into the app quickly without manual re-entry.

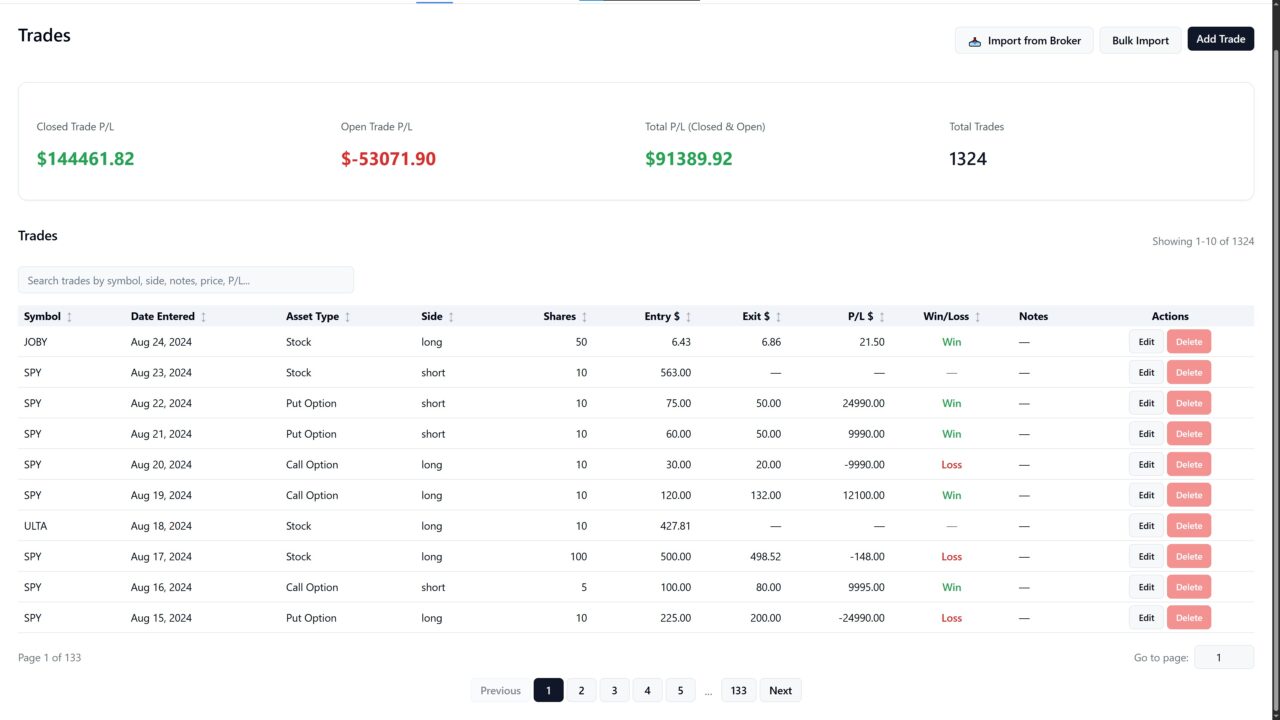

Logging Trades in the Trading Journal

Accessing the Trades Page

All trade entries are handled inside the Trades page, which can be found in the left-hand sidebar. This page controls the logging, editing, and tracking of every trade in your journal.

Trade Entry Fields Explained

When entering a trade, you can input:

- Symbol

- Date entered

- Time entered (in 24 hour format)

- Time exited (in 24 hour format)

- Date exited, or leave blank if the trade is still open

- Long or short position

- Number of shares or quantity for other asset types

- Entry price

- Exit price if the trade is closed

- Fees if applicable

- Notes

The notes field is highly recommended. It can be used to tag strategies, record trade rationale, or add post-trade reflections.

In addition to trade-specific notes, there is also a separate Notes page where you can store general notes and screenshots for future reference.

Using the Notes Field Effectively

Consistently using notes helps with:

- Organizing trades by strategy

- Reviewing performance later

- Identifying patterns in behavior and execution

Over time, notes become one of the most valuable tools for improving decision-making and can be used to filter specific trades from the search bar in the trades page.

Bulk Importing Trades

For traders switching from the free Financial Tech Wiz Google Sheets Trading Journal, trades can be imported in bulk.

To do this:

- Copy Cells A3 to X3 and all rows below for all of your trades from the Trade Log tab in the Sheets journal

- Paste directly into the bulk import feature inside the trading journal app

This allows for a seamless transition without losing historical trade data.

Internal Resource Reference

There is a dedicated blog post that explains trade logging in greater detail here.

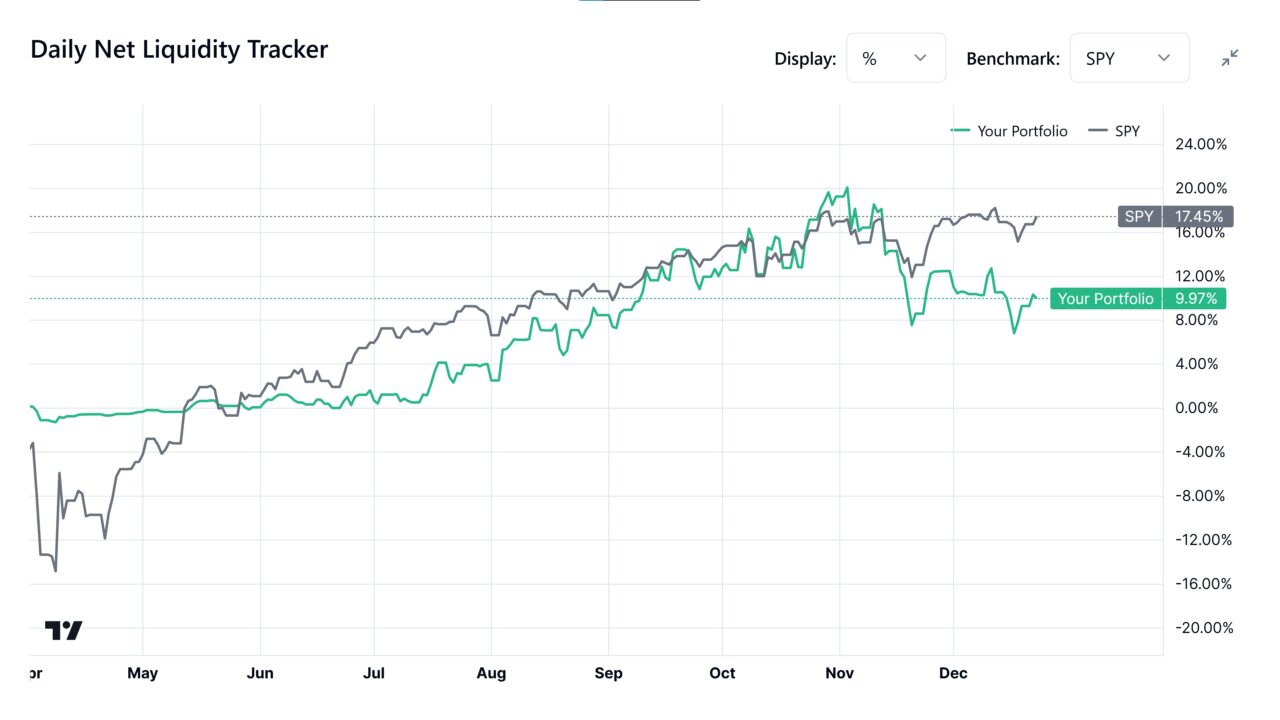

Viewing Performance Charts

Portfolio Performance Charts

Under the portfolio performance tab, you can view portfolio performance based on daily net liquidity. This shows how your account value changes over time and allows comparison against benchmarks such as the S&P 500.

This view reflects true marked-to-market portfolio performance.

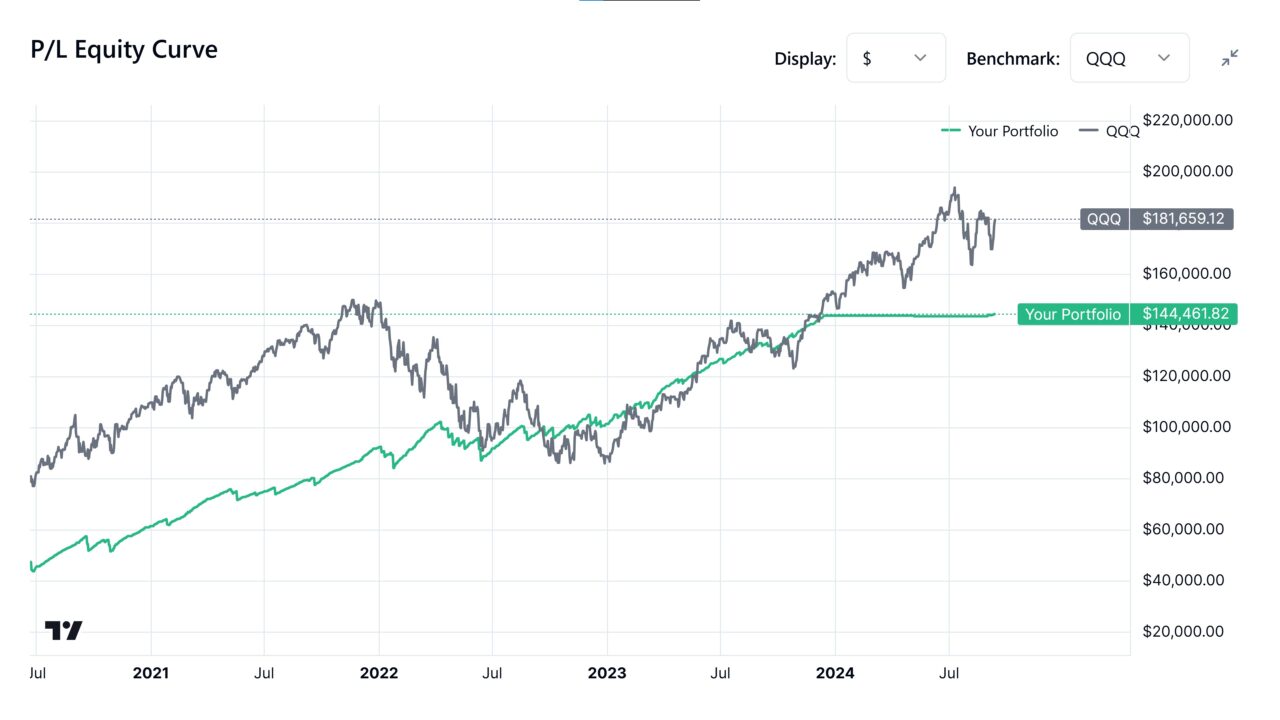

Closed Trades Performance Charts

Closed trades performance charts display results from completed trades only. These charts use line visualizations and can also be compared against a benchmark to evaluate strategy effectiveness over time.

Open Trades Performance Charts

Open trades charts pull live stock data to show:

- Real-time open P/L

- How far each trade is from entry

- Stop loss risk levels if a stop loss was entered

An open positions chart displays both P/L and stop loss exposure, while a separate line chart shows closed trade performance compared to a benchmark.

Analyzing Trades and Performance

Analysis via the Charts Tab

Trades can be analyzed visually through:

This gives a high-level view of how capital and strategies are performing.

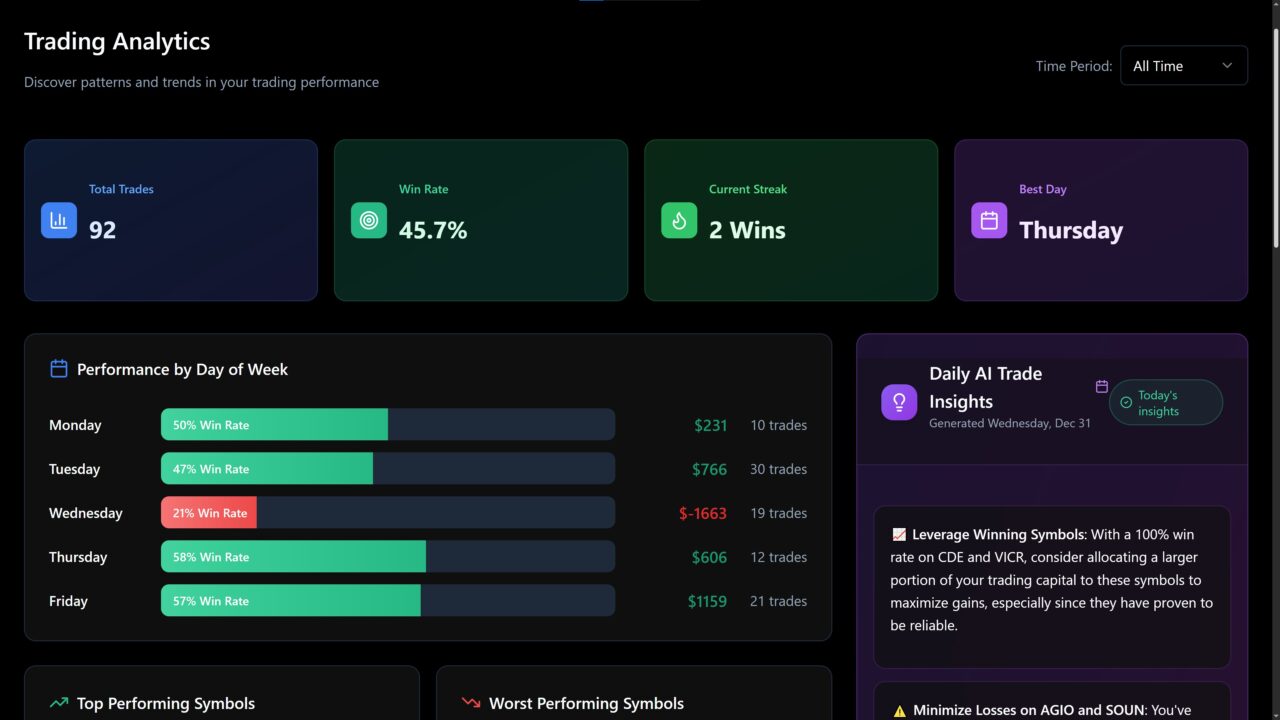

Analytics Page Breakdown

The Analytics page allows deeper performance analysis, including:

- Performance by day of week

- Top-performing symbols

- Worst-performing symbols

- Performance by trade duration

- Monthly performance breakdown

- Performance by asset type such as stocks, options, and crypto

These insights help identify strengths, weaknesses, and patterns across different dimensions of trading behavior.

AI-Powered Tools

Daily AI Insights

The AI Tools page provides daily AI insights based on closed trade performance. These insights summarize what is happening in your trading and highlight trends worth paying attention to.

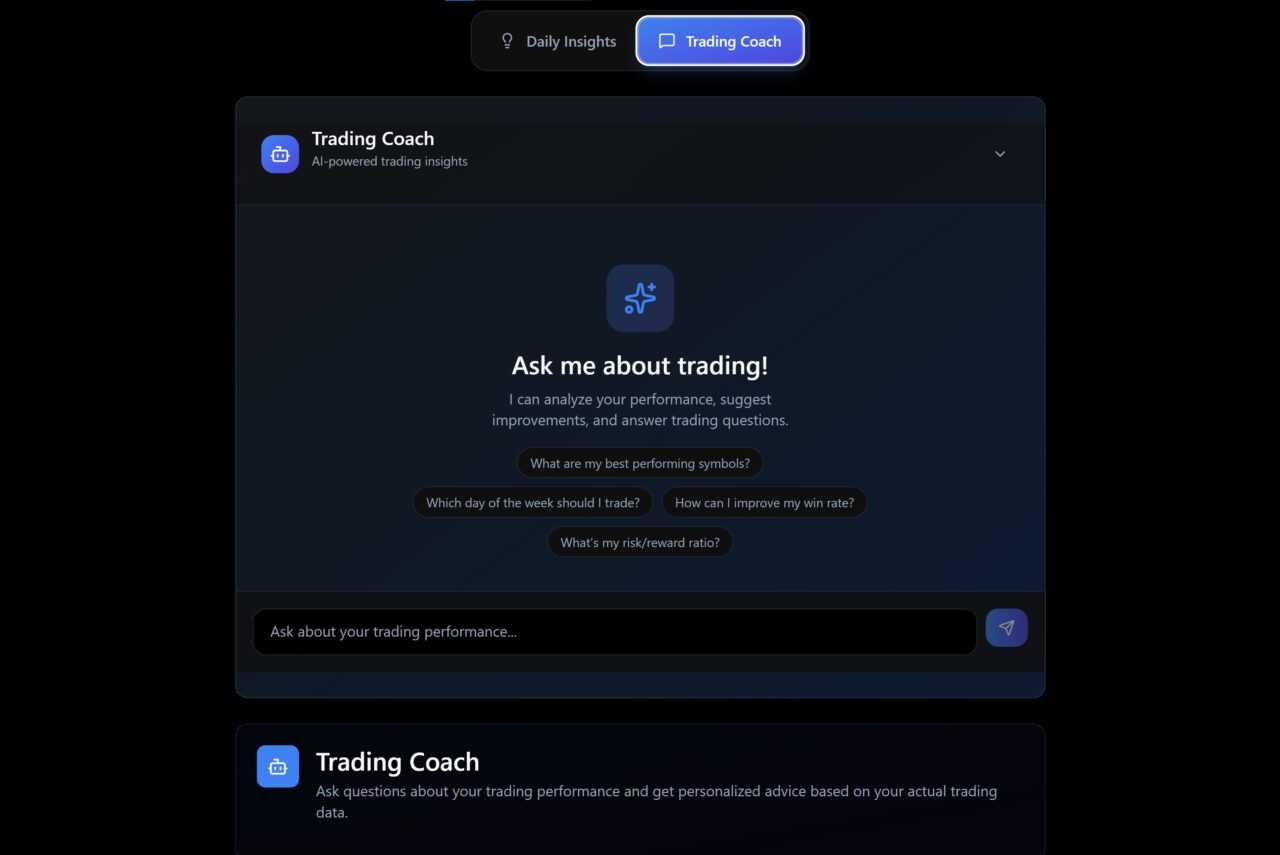

AI Trading Coach

The AI Trading Coach is a chat-based assistant with access to all of your trade data.

You can ask questions such as:

- Which symbols are performing best

- How win rate can be improved

- What patterns exist in losing trades

This tool supports trade review, self-analysis, and continuous improvement using your actual data.

Statistics Tab Overview

The Statistics tab provides a complete numerical breakdown of trading performance.

Core Performance Metrics

- Closed trade P/L

- Open P/L

- Total P/L including open and closed trades

- Total fees paid

Trade Outcome Metrics

- Win rate

- Number of winning trades

- Number of losing trades

- Total trades taken

- Average win in dollars and percentage

- Average loss in dollars and percentage

Risk and Efficiency Metrics

- Profit factor

- Reward-to-risk ratio

- Total stop loss risk in dollars and percentage

- Total P/L if all stop losses were hit

Position and Allocation Metrics

- Number of long trades

- Number of short trades

- Average days in trade

- Total dollar amount allocated

- Percentage of portfolio allocated to open positions

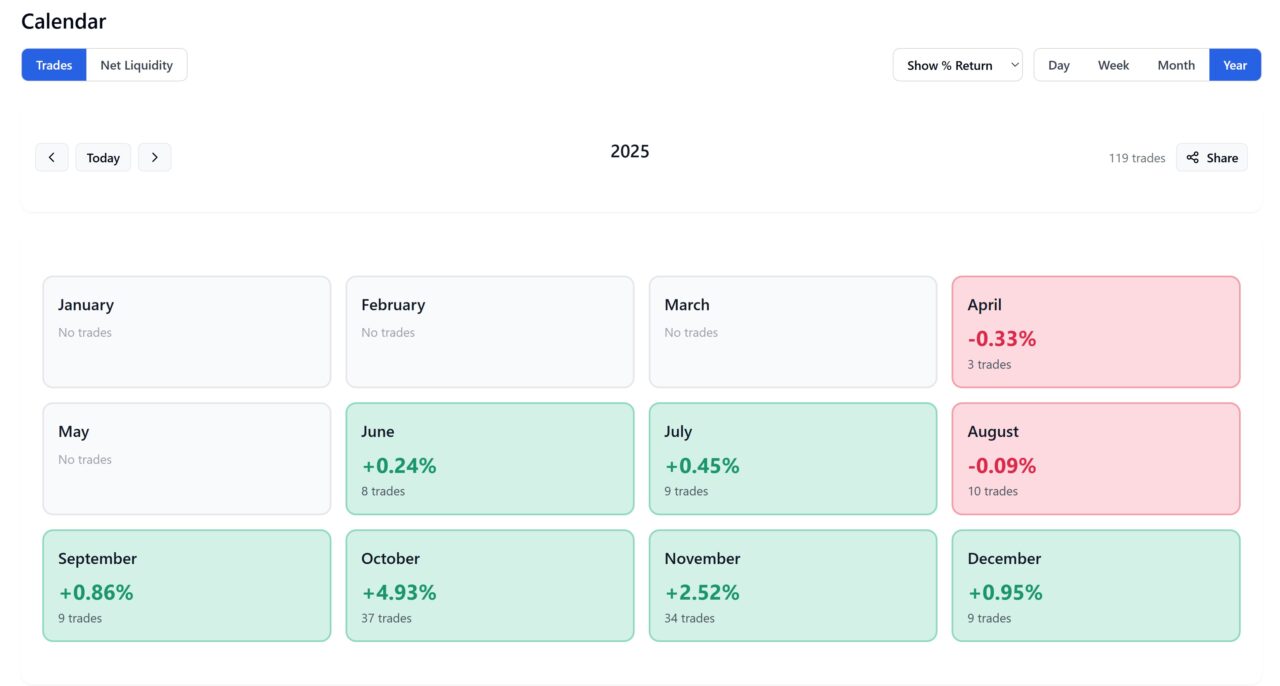

Calendar Views

Trades Performance Calendar

The Trades calendar displays daily, weekly, monthly, and yearly views based on actual trades. It shows open and closed trades but is not marked to market.

This view is ideal for reviewing trading activity by date.

Net Liquidity Calendar

The Net Liquidity calendar is based on daily portfolio value and reflects true account performance. This is the most accurate measure of how much your trading is actually making or losing over time.

Sharing Performance

For both portfolio and trade performance, you can click the share button on any:

- Day

- Week

- Month

- Year

This generates a shareable social image for performance over that timeframe.

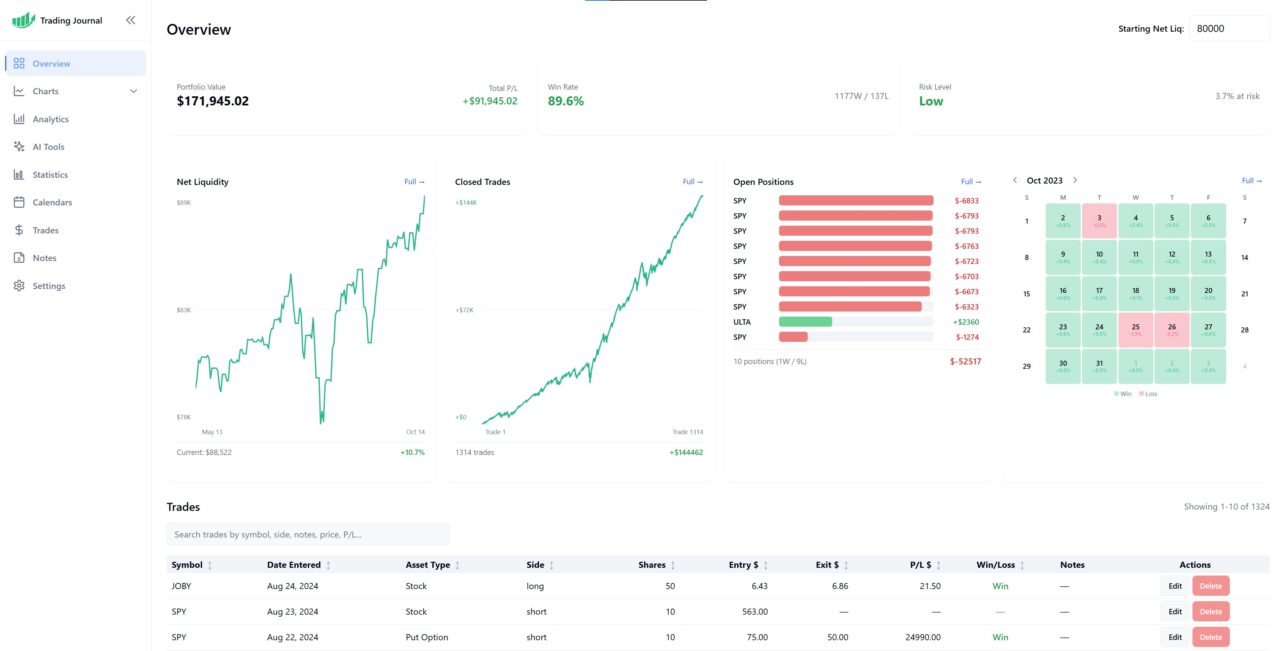

Overview Dashboard

Purpose of the Overview Page

The Overview tab serves as a central dashboard that combines all major data points into a single view.

What the Overview Includes

The Overview page shows:

- Portfolio value based on starting net liquidity plus total P/L

- Win rate

- Stop loss risk exposure

- Portfolio performance chart

- Closed trade performance chart

- Real-time open positions

- Mini performance calendar

- Trades table

This dashboard is designed for quickly checking overall performance at a glance.

Notes Tab

The Notes page allows you to:

- Attach screenshots

- Select a note category such as general, strategy, trade ideas, market analysis, lessons learned, or watchlist

- Write and store notes for future reference

This feature helps organize qualitative insights alongside quantitative data.

Settings Page

Data Management

Inside the Settings page, you can:

- Wipe all net liquidity data

- Wipe all trades data

This is useful when resetting the journal or starting a new tracking period.

Display Preferences

You can also switch between light mode and dark mode to match your preferred viewing experience.

Closing Section

The Financial Tech Wiz Trading Journal App is built around a simple but powerful workflow:

- Set your starting net liquidity

- Track daily portfolio value

- Log every trade

- Analyze performance using charts, analytics, statistics, and AI insights

Consistency and accuracy are what unlock the real value of a trading journal. When used correctly, the Financial Tech Wiz Trading Journal gives you a clear, data-driven view of your trading and helps you make better decisions over time.

If you are ready to take control of your trading performance, the next step is to sign up and start logging your trades inside the Financial Tech Wiz Trading Journal.

Get Your Free Trading Resources

Grab the free trading journal template plus the same tools we use to stay organized, consistent, and objective.

- Free trading journal template

- Custom indicators, watchlists, and scanners

- Access our free trading community

Enter your email below to get instant access.

No spam. Unsubscribe anytime.