Gravestone Doji: Understanding the Bearish Reversal Signal

Candlestick patterns play a pivotal role in technical analysis, helping traders identify potential price trends and make informed trading decisions.

One such pattern that garners the attention of traders is the gravestone doji. This article will explore the characteristics, interpretation, and practical application of this important bearish reversal signal.

Understanding the Gravestone Doji

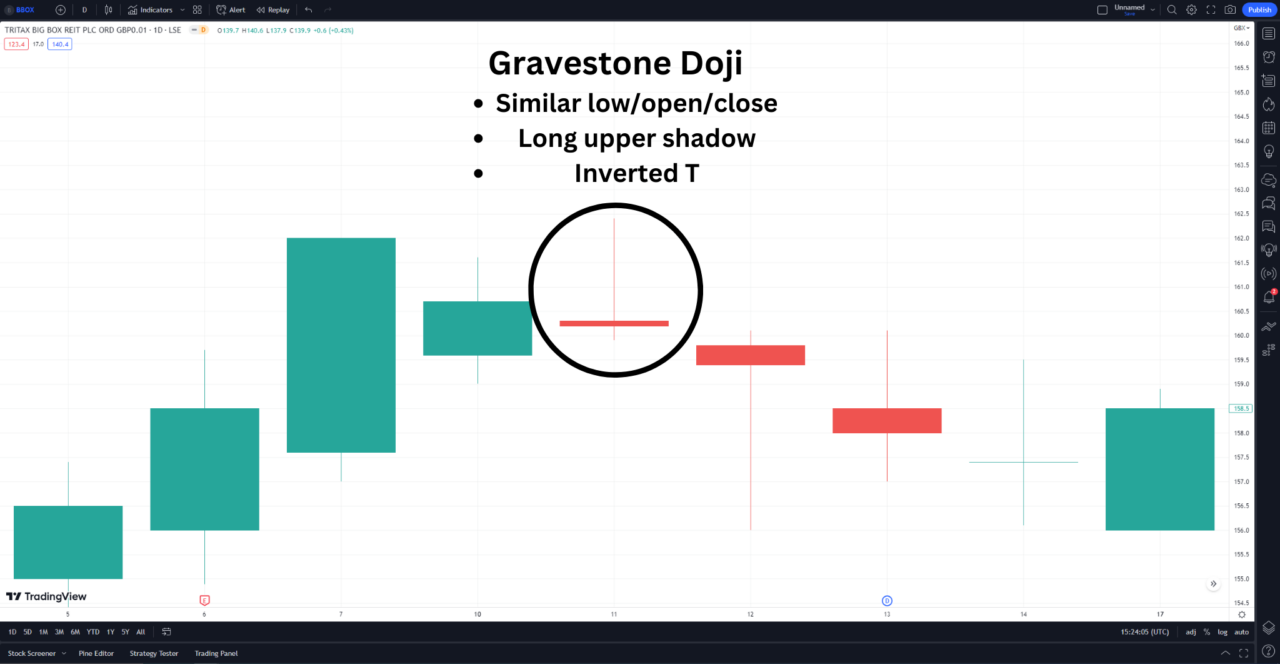

The gravestone doji is a candlestick pattern that signifies a potential bearish reversal in price action. It is characterized by the following features:

- Open, low, and closing prices are near each other.

- The candlestick has a long upper shadow.

- The pattern resembles an inverted “T.”

The gravestone doji often appears at the end of an uptrend and suggests that bullish momentum has been exhausted, leading to a potential change in trend direction.

Gravestone Doji: Bullish or Bearish?

The gravestone doji is considered a bearish reversal signal. It indicates that, despite initial buying pressure pushing prices higher during the session, sellers ultimately took control and pushed prices back down to the open level. This shift in sentiment suggests that bears may continue to dominate in subsequent trading sessions.

Dragonfly Doji vs. Gravestone Doji

The dragonfly doji is the bullish counterpart to the gravestone doji. While both patterns signal potential reversals, they differ in structure and interpretation:

- Dragonfly Doji:

- Open, high, and closing prices are near each other.

- Long lower shadow.

- Resembles the letter “T.”

- May indicate a bullish reversal at the end of a downtrend.

- Gravestone Doji:

- Open, low, and closing prices are near each other.

- Long upper shadow.

- Resembles an inverted “T.”

- May indicate a bearish reversal at the end of an uptrend.

Success Rate of the Gravestone Doji

The success rate of the gravestone doji depends on several factors, including market context and confirmation. Traders should consider the following points:

- Confirmation: A single gravestone doji is not sufficient to make a trading decision. Traders should wait for subsequent candles to confirm the reversal.

- Trading Volume: Higher-than-average trading volume during the formation of the gravestone doji may increase its reliability.

- Market Conditions: The overall trend, support and resistance levels, and other technical indicators should be considered alongside the gravestone doji.

Practical Application: Using the Gravestone Doji in Trading

When using the gravestone doji in trading, keep the following tips in mind:

- Look for confirmation from the next candle (e.g., a bearish candle closing below the gravestone doji).

- Use other technical indicators (e.g., moving averages, RSI) to support your analysis.

- Set stop-loss levels above the high of the gravestone doji to manage risk.

- Take profits at key support levels or based on price targets derived from other analyses.

Analyzing the Gravestone Doji with TradingView

TradingView is a powerful platform for conducting technical analysis and charting the financial markets. With its user-friendly interface and advanced charting tools, TradingView provides traders with the resources they need to identify patterns like the gravestone doji and make informed trading decisions.

One of the best features of TradingView is that you can get started for free! TradingView offers a free tier with access to basic charting tools and a wealth of community insights. This makes it an ideal choice for traders who are just beginning to explore the world of technical analysis.

If you’re looking to unlock the full potential of TradingView, consider upgrading to a premium subscription. With a premium plan, you’ll gain access to additional features such as advanced technical indicators, more alerts, and the ability to create custom watchlist.

Gravestone Doji | Bottom Line

The gravestone doji is a powerful bearish reversal pattern that can help traders anticipate changes in price direction. By understanding its structure, comparing it to the dragonfly doji, and considering its success rate, traders can enhance their decision-making process.

FAQ

What does a gravestone doji indicate?

The long upper shadow indicates that the bears gained the upper hand over the bulls by the time the session closed. This often comes just before a longer-term bearish downtrend.

What is the difference between hammer and gravestone doji?

A hammer candle’s long lower shadow shows that the bulls resisted the bearish drop at the start of the session and pushed the price up by the close. This often comes just before a longer-term bullish uptrend. A gravestone doji is the opposite of a hammer, as it indicates a bearish reversal instead of a bullish one.

What is the success rate of gravestone doji?

The success rate of gravestone doji depends on various factors. A true gravestone doji is rare, as it requires the open, high, and closing prices to be nearly equal. A gravestone doji is more reliable when it occurs at the end of an uptrend when it is accompanied by higher-than-usual volume, and when it is followed by a bearish candle that confirms the reversal.

What is the difference between a shooting star and gravestone doji?

A shooting star is a bearish reversal candlestick pattern that is similar to a gravestone doji, but it has a small body instead of no body. A shooting star has a small body near the low of the session with a long upper shadow. A gravestone doji has no body or a very small body near the high of the session with a long upper shadow. Both patterns indicate that the bulls failed to sustain the upward momentum and that the bears took control by the end of the session.

This article contains affiliate links I may be compensated for if you click them.

Get Your Free Trading Resources

Grab the free trading journal template plus the same tools we use to stay organized, consistent, and objective.

- Free trading journal template

- Custom indicators, watchlists, and scanners

- Access our free trading community

Enter your email below to get instant access.

No spam. Unsubscribe anytime.