MA vs. EMA vs. SMA vs. WMA – Moving Average Indicators

Moving averages are fundamental tools used by traders and analysts in financial markets to understand and predict price trends.

This article explains the primary types of moving averages: Simple Moving Averages (SMA), Exponential Moving Averages (EMA), and Weighted Moving Averages (WMA), highlighting their differences and practical applications.

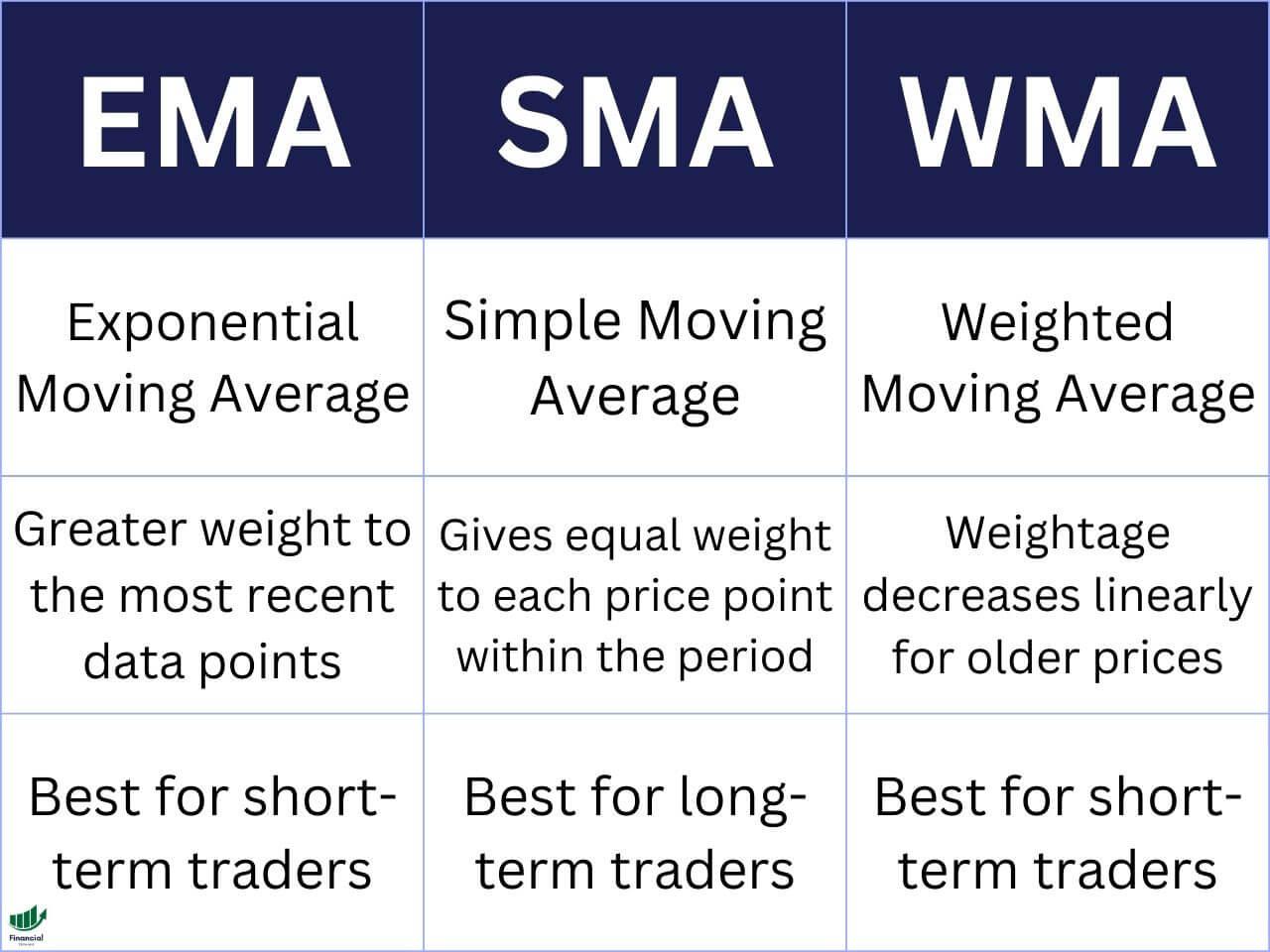

EMA vs. SMA vs. WMA at a Glance

| EMA | SMA | WMA |

|---|---|---|

| Exponential Moving Average | Simple Moving Average | Weighted Moving Average |

| Greater weight to the most recent data points | Gives equal weight to each price point within the period | Weightage decreases linearly for older prices |

| Best for short-term traders | Best for long-term traders | Best for short-term traders |

Start Using MA, EMA, SMA, & WMAs on TradingView For Free!

Enhance Your Trading Strategy – Sign up for TradingView Today!

- Comprehensive Moving Average Tools

- Real-Time Data Analysis

- Customizable Chart Indicators

What is a Moving Average (MA)

A Moving Average (MA) is a statistical tool used to analyze data points by creating a series of averages from different subsets of the complete dataset.

SMAs, EMAs, and WMAs are types of MAs.

The MA smooths out price data on a chart to create a single flowing line, making it easier to identify the direction of the trend.

MA vs. EMA Compared

When comparing MA and EMA, the primary difference lies in sensitivity. The EMA is more sensitive to recent price changes than the MA, which can lead to early signals for entering or exiting trades.

SMA vs. EMA Compared

SMA and EMA are both types of moving averages but differ in their calculation. The SMA assigns equal weight to all values, while the EMA gives more weight to recent data, offering a quicker response to price changes.

SMA vs. MA Compared

The SMA is a type of MA with a specific method of calculation – it calculates the average price over a set period without weighting. In contrast, other MAs, like the EMA and WMA, apply different weightings.

WMA vs. EMA Compared

Both WMA and EMA give more importance to recent data but differ in their approach. The WMA uses a linear weighting method, while the EMA uses an exponential approach, making the EMA quicker to react to recent price movements.

Join for FREE: Access tons of free educational material!

Don’t miss out – Join now and start learning!

- Free Educational Material

- Community for Like-Minded Traders

- Personalized Trading Education

What is the Simple Moving Average (SMA)

The Simple Moving Average (SMA) is the most basic form of the moving average. It is calculated by taking the arithmetic mean of a given set of prices over a specified period.

The SMA gives equal weight to each price point within the period. The SMA is most commonly used by swing traders and investors with longer timeframe trades and investments.

Common Lengths for SMAs

The most common SMAs utilized are the 50 and 200-day simple moving averages, also known as the 50 and 200-day moving averages.

You can access these on TradingView by adding ‘Moving Average Simple’ twice to your indicators. Then, you must set the length of one to 50 and the other to 200 and use the daily timeframe.

When the 50-day SMA crosses above the 200-day SMA, this is called a golden cross.

What is the Exponential Moving Average (EMA)

The Exponential Moving Average (EMA) is a type of moving average that places a greater weight and significance on the most recent data points.

Unlike the SMA, it reacts more quickly to price changes, making it a preferred choice for traders looking for sensitivity to recent price movements, such as day traders.

Common Lengths for EMAs

Common lengths for EMAs include 9,12, and 26.

You can access EMAs on TradingView by adding the ‘Moving Average Exponential’ to your chart. You can check out my full article about adding moving averages to TradingView for more information.

You can then adjust the length in the indicator settings to whichever you prefer. Generally, when a short-term EMA like the 9-EMA crosses over a longer one like the 26-EMA, this is considered a bullish crossover.

What is the Weighted Moving Average (WMA)

The Weighted Moving Average (WMA) assigns a heavier weighting to more recent data points. The weightage decreases linearly for older prices, making it similar to the EMA but with a different method of calculation and emphasis.

The WMA is much less popular than the SMA and EMA indicators. Additionally, if you’d like to save your moving average settings on TradingView, you can consult my article about saving your chart layouts on TradingView.

How to Use Moving Averages to Trade Effectively

Moving averages are pivotal in trading strategies. They can indicate potential buy or sell signals and help in identifying support and resistance levels.

Traders often use two moving averages together for a crossover strategy, where the crossing of a shorter period MA over a longer period MA indicates a potential trend reversal.

The Best Lengths for Moving Averages

The best length for a moving average depends on the trader’s objectives and the market’s volatility.

Short-term traders might prefer shorter periods, like 5 or 10 days, for more sensitivity, while long-term investors might opt for 50 or 200 days to filter out market noise.

Additionally, long-term traders may prefer SMAs, while short-term traders may prefer EMAs since they use more recent price data.

Which Moving Average is Best for Day Trading?

For day trading, where quick decisions are crucial, shorter-period MAs like the 5 or 10-day EMA or WMA are typically preferred due to their responsiveness to recent price changes.

The most common moving average for day trading is the combination of the 9-EMA with the 26-EMA.

MA vs. EMA vs. SMA vs. WMA – Bottom Line

Each moving average – MA, EMA, SMA, and WMA – has its unique features and applications. Which you should use depends on your strategy, the time frame of trading, and the specific market conditions.

Understanding these differences is key to employing these tools effectively in trading scenarios.

If you’d like to get better at technical analysis, you should create a free TradingView account to analyze all markets within a single platform.

If you sign up for TradingView using my link, you will also get a discount on your subscription if you choose to upgrade to a premium plan.

Disclaimer: Financial Tech Wiz is a TradingView affiliate and will be compensated if you use our link to purchase a TradingView subscription.

– Free trading journal template & cheat sheet PDFs

– Custom scanners, watchlists, & market commentary

– Access our free trading course and community