MT4 vs Tradovate: Choosing the Right Platform

MT4 and Tradovate are often mentioned together, but they are built for very different types of traders. One is a long standing charting and execution platform most commonly used in forex markets. The other is a modern, futures focused brokerage designed around low commissions and active trading.

In this comparison, we break down how MT4 and Tradovate differ across supported markets, platform capabilities, pricing, and ideal use cases so you can decide which one actually fits how you trade.

All information below was manually researched and compiled from broker documentation and platform resources to keep things accurate and up to date.

- Works with a wide range of forex brokers

- Large indicator and script ecosystem

- Built in algorithmic trading support

- Low cost futures trading

- Native TradingView integration

- Advanced volume and market profile tools

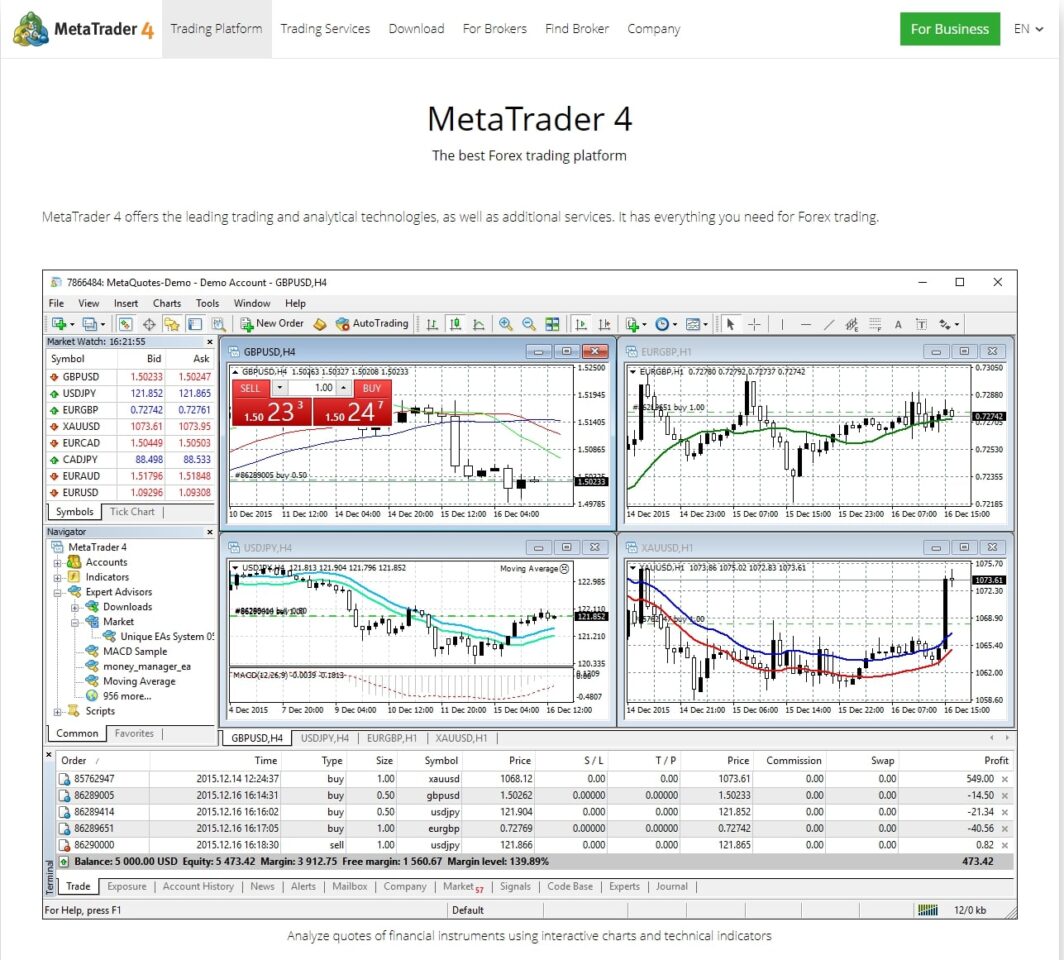

Overview of MT4

MetaTrader 4, commonly referred to as MT4, is a charting and trading platform that has been widely used in the forex market for many years. MT4 itself is not a broker. Instead, it connects to third party brokers that support the platform.

Depending on the broker you use, MT4 can be used to trade forex, CFDs, and in some cases stocks or other instruments. Its biggest strengths are its indicator ecosystem and support for algorithmic trading through Expert Advisors.

Key Strengths

- Compatible with many forex and CFD brokers

- Extensive library of indicators and scripts

- Built in support for automated trading systems

Who MT4 Is Best For

MT4 works best for traders who already have a broker that supports it and rely on custom indicators or automated strategies. For traders starting from scratch, newer platforms like TradingView or TrendSpider often provide a better charting experience with less setup and fewer limitations.

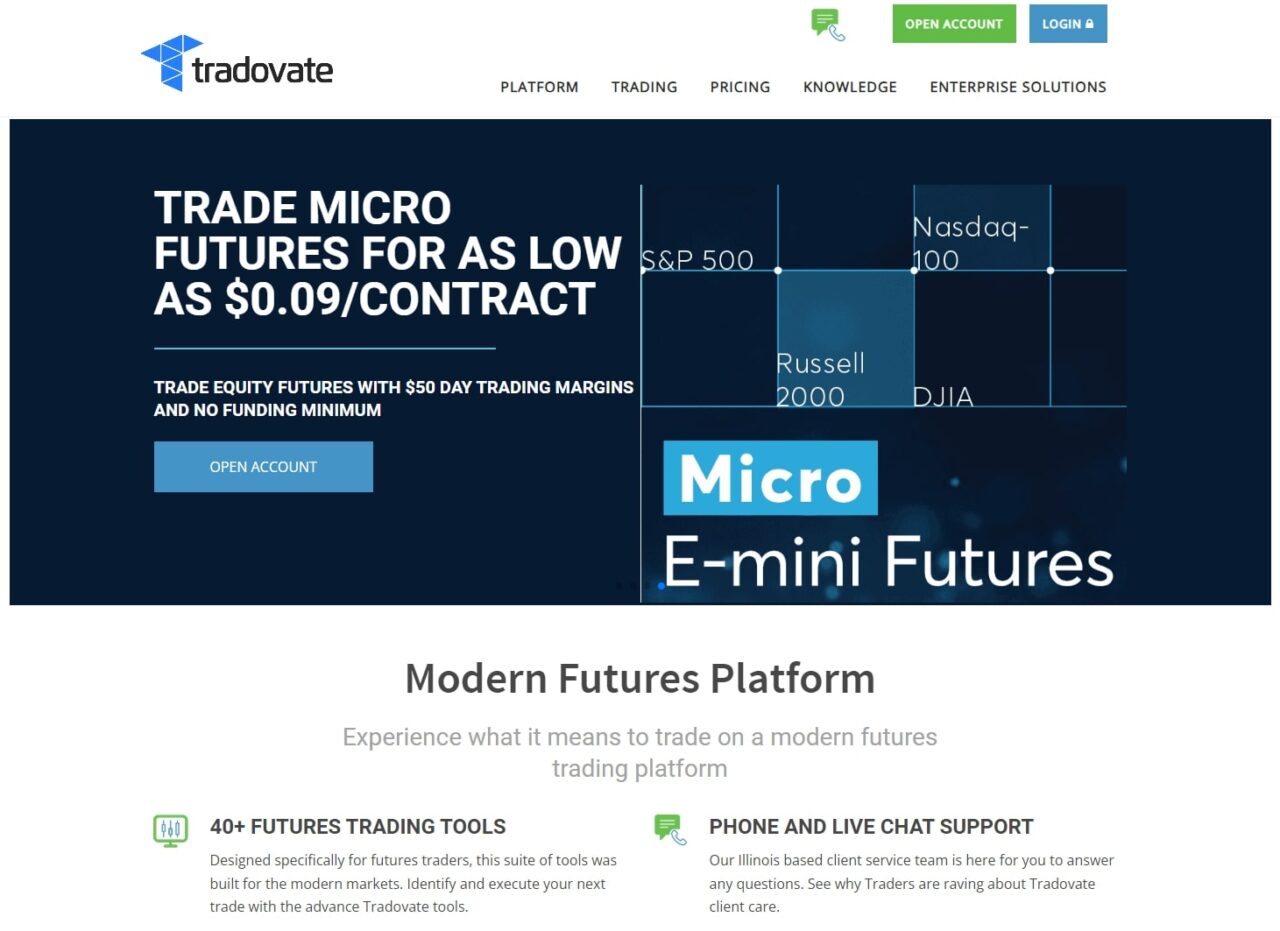

Overview of Tradovate

Tradovate is a futures brokerage platform built specifically for active traders. It offers competitive commissions and the ability to reduce trading costs through monthly or lifetime pricing plans.

One of Tradovate’s main advantages is access to micro futures contracts, which allows traders to participate in futures markets with relatively low capital. The platform includes solid charting tools and also integrates directly with TradingView for traders who prefer that environment.

Key Strengths

- Low cost futures trading

- Direct TradingView integration

- Advanced volume and market profile indicators

Who Tradovate Is Best For

Tradovate is best suited for traders who focus primarily on futures and trade frequently enough to benefit from reduced commission plans. It is not designed for equities, ETFs, or long term investing, so traders looking for broader market access will need an additional platform.

Core Differences Between MT4 and Tradovate

| Feature | MT4 | Tradovate |

|---|---|---|

| Platform Type | Charting and execution software | Futures brokerage |

| Broker Included | No | Yes |

| Tradable Assets | Depends on broker | Futures, futures options, forex |

| Charting | Free charting and indicators | Charting with volume and market profile |

| Market Data | Provided by connected broker | Real time data with funded account |

| Premium Pricing | Free platform | $99 per month or $1,499 lifetime for lower commissions |

Trading Tools and Account Features

| Feature | MT4 | Tradovate |

|---|---|---|

| DRIP | Not applicable | Not available |

| Margin Trading | Broker dependent | Yes |

| Insurance | Broker dependent | Not insured |

| Mobile App | Yes | Yes |

Trading Costs and Commissions

| Fee Type | MT4 | Tradovate |

|---|---|---|

| Stock Trades | Not supported | Not supported |

| Options | Not supported | Not supported |

| Futures | Broker dependent | $1.29 per contract, $0.35 micro |

| Futures Options | Broker dependent | Typically same as futures |

| Option Exercise Fees | Broker dependent | None |

MT4 vs Tradovate – Bottom Line

MT4 and Tradovate serve very different purposes, and the right choice depends entirely on what you trade and how you trade it.

MT4 remains a solid option for forex traders who already use a compatible broker and rely heavily on custom indicators or automated strategies. Its flexibility comes from its ecosystem rather than its user experience.

Tradovate is a strong choice for futures traders who want low commissions, access to micro contracts, and modern integrations like TradingView. It is narrowly focused, but within that focus it delivers a clean and efficient trading experience.

Choosing the right platform comes down to aligning the tool with your market, not forcing your strategy into the wrong system.

Related Trading Platform Comparisons

Interactive Brokers vs Vanguard

Get Your Free Trading Resources

Grab the free trading journal template plus the same tools we use to stay organized, consistent, and objective.

- Free trading journal template

- Custom indicators, watchlists, and scanners

- Access our free trading community

Enter your email below to get instant access.

No spam. Unsubscribe anytime.