Robinhood vs tastytrade: Which Trading Platform Is Better?

Robinhood and tastytrade are both popular brokerages, but they are built for very different types of traders. Robinhood focuses on simplicity and accessibility, while tastytrade is designed for active traders who want deeper control over options, futures, and advanced strategies.

In this comparison, we break down how Robinhood and tastytrade differ across trading tools, costs, supported assets, and ideal use cases so you can decide which platform fits your trading style best.

- Commission free stock and options trading

- Simple, beginner friendly mobile app

- Supports stocks, options, and crypto

- Built specifically for options traders

- Low, transparent derivatives pricing

- Advanced desktop and web platform

Overview of Robinhood

Robinhood is a commission-free brokerage founded in 2013 that helped popularize zero-commission stock and options trading. Its biggest strength is simplicity. The platform removes friction from the investing process and makes it easy for new users to place trades quickly from a mobile device.

Robinhood supports stocks, ETFs, options, and crypto, along with features like fractional shares and extended hours trading. However, its charting, order types, and analytics are very basic compared to platforms built for active trading.

Key strengths

- No commissions on stocks and options

- Clean, beginner-friendly interface

- Fractional shares and extended trading hours

Limitations

- Very limited charting and technical analysis

- Few advanced order types

- Not designed for frequent or complex trading strategies

Robinhood is best for

Robinhood is best for beginners and long-term investors who value simplicity over depth. It works well for buy-and-hold investing, light options trading, and casual market participation. Active traders will likely outgrow it quickly.

Overview of tastytrade

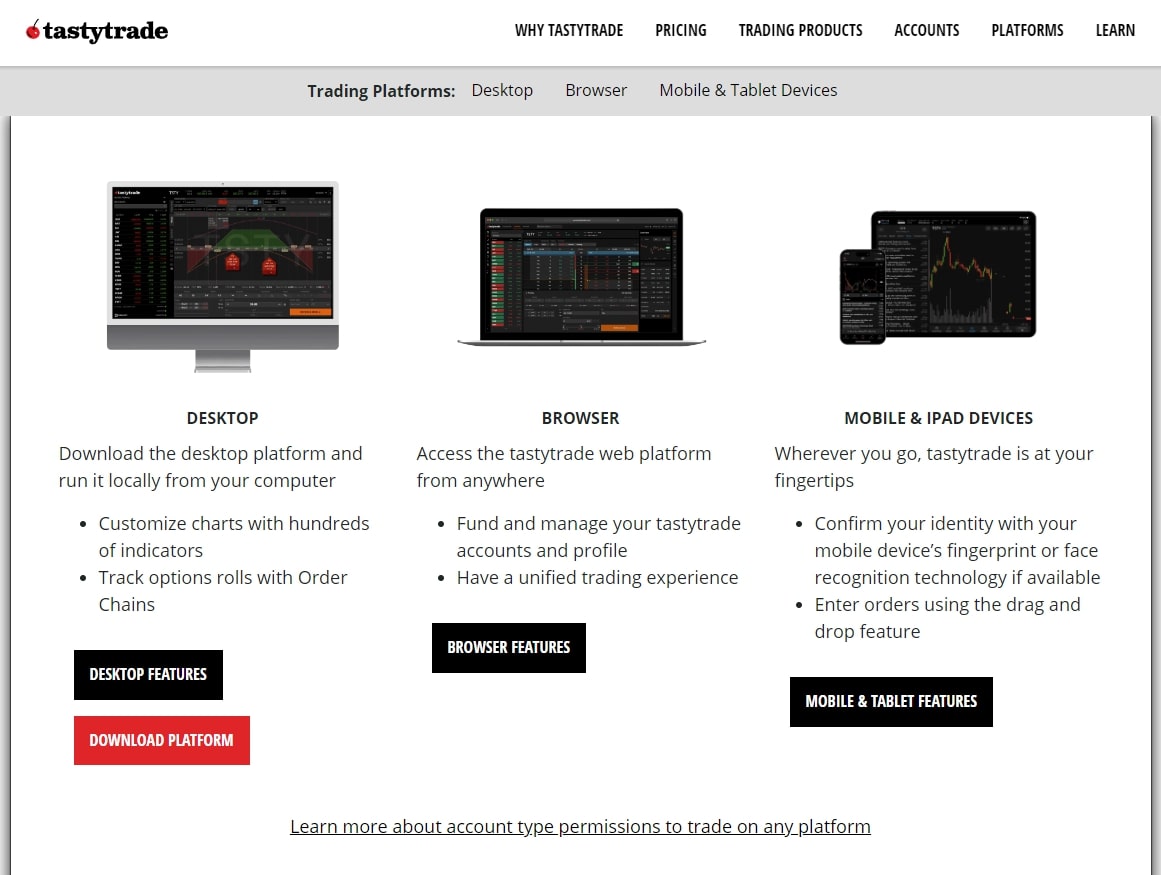

tastytrade is a brokerage created specifically for active traders, with a heavy emphasis on options and futures trading. It was founded by Tom Sosnoff, who also created the thinkorswim platform, and it carries that same trader-first philosophy.

Unlike Robinhood, tastytrade prioritizes strategy-building, risk management, and execution efficiency. The platform offers robust options chains, probability metrics, advanced order management, and low-cost futures trading.

Key strengths

- Excellent options and futures trading tools

- Simple and transparent pricing model

- Desktop platform built for active traders

Limitations

- Interface can feel overwhelming to beginners

- Less emphasis on long-term investing features

- Charting is functional but not best-in-class

tastytrade is best for

tastytrade is ideal for traders who actively trade options or futures and want detailed control over position sizing, risk, and strategy execution. It is especially strong for traders using spreads, iron condors, and other multi-leg options strategies.

Key Characteristics Compared

| Feature | Robinhood | tastytrade |

|---|---|---|

| Platform type | Brokerage | Brokerage |

| Primary focus | Simple investing | Active trading |

| Assets supported | Stocks, ETFs, Options, Crypto | Stocks, ETFs, Options, Futures, Crypto, Bonds |

| Charting | Basic | Intermediate |

| Desktop platform | Limited | Yes |

| Mobile app | Yes | Yes |

| Premium pricing | $5 per month for Gold | None |

Trading Features and Tools

| Feature | Robinhood | tastytrade |

|---|---|---|

| DRIP | Yes | Yes |

| Margin trading | Yes | Yes |

| Insurance | SIPC | SIPC |

| Paper trading | No | Limited |

Trading Costs and Commissions

| Fee Type | Robinhood | tastytrade |

|---|---|---|

| Stock trades | Free | Free |

| Options trades | Free | $1 to open, free to close |

| Futures trades | Not supported | $1.25 per contract, lower for micros |

| Options exercise | Free | $5 |

Robinhood vs tastytrade: Bottom Line

Robinhood and tastytrade serve very different traders.

Robinhood is best if you want the simplest possible way to invest in stocks, options, and crypto with minimal learning curve. It is excellent for beginners and casual investors, but lacks the tools needed for serious or frequent trading.

tastytrade is built for traders who actively manage positions and care about execution, pricing transparency, and strategy design. If options or futures are a major part of your trading approach, tastytrade is the stronger platform.

Related Trading Platform Comparisons

Interactive Brokers vs Ninjatrader

Get Your Free Trading Resources

Grab the free trading journal template plus the same tools we use to stay organized, consistent, and objective.

- Free trading journal template

- Custom indicators, watchlists, and scanners

- Access our free trading community

Enter your email below to get instant access.

No spam. Unsubscribe anytime.