Robinhood vs. TradingView Compared

When comparing online trading platforms, Robinhood and TradingView represent two fundamentally different approaches to the market. Robinhood is a commission-free brokerage platform where you execute trades, while TradingView is an advanced charting and analysis tool that helps you decide what to trade. This comprehensive comparison examines their features, costs, and how they work together—including whether you can connect Robinhood to TradingView for seamless execution.

To make your research easier, we manually found key data for Robinhood and TradingView across the internet and compiled it all in this article.

- Commission-free trading with zero account minimums

- Robinhood Legend desktop: 8 free charts + futures trading

- AI-powered Cortex for custom indicators via natural language

- 110+ drawing tools and 17+ advanced chart types

- Pine Script for custom indicators and backtesting strategies

- Global market access: stocks, forex, futures, crypto from all exchanges

Overview of Robinhood

Robinhood is a commission-free brokerage platform founded in 2013 that revolutionized retail investing by eliminating trading fees. Originally known for its mobile-first approach, Robinhood launched Robinhood Legend in 2025—a browser-based desktop platform designed for active traders who need advanced charting and execution capabilities. The platform allows you to trade stocks, ETFs, options, cryptocurrencies, and futures with zero commissions on most asset classes.

The Legend desktop platform represents a major evolution from Robinhood’s mobile roots, offering 8 simultaneous charts, a widget-based workspace for customization, and professional-grade tools like Depth of Market ladders and integrated options chains. For just $5 per month, Robinhood Gold members gain access to Level 2 market data, earn 4.5-5% APY on uninvested cash, and pay reduced futures fees of $0.50 per contract compared to the industry standard of $1.25-$2.50.

One of the platform’s most innovative features is Robinhood Cortex, an AI-driven tool that allows you to create custom indicators using natural language. Instead of learning to code, you simply type commands like “Show me a green arrow when the 50 SMA crosses above the 200 SMA” and Cortex generates the indicator automatically. The platform also includes approximately 100 built-in technical indicators including professional-grade tools like Ichimoku Cloud, Supertrend, and Schaff Trend Cycle.

Robinhood is Best For

Robinhood is best for cost-conscious traders who want a unified platform for analysis and execution. The Legend desktop platform makes it particularly attractive for active traders, scalpers, and futures traders who need professional-grade tools without subscription fees. The platform serves beginners exceptionally well with its intuitive interface and fractional shares feature, but it also appeals to experienced traders who value execution speed and low costs. However, traders requiring advanced scripting capabilities or historical backtesting should supplement Robinhood with TradingView.

Overview of TradingView

TradingView is an advanced charting and social trading platform founded in 2011 that has become the global standard for technical analysis. Unlike Robinhood, TradingView is not a brokerage—it’s a data visualization and analysis tool that connects with various brokers for trade execution. The platform offers unparalleled charting depth with 17+ chart types including Renko, Kagi, Point & Figure, and Volume Footprint displays that go far beyond standard candlestick charts.

TradingView’s true power lies in Pine Script, a proprietary programming language designed specifically for trading strategies. This allows you to create custom indicators, automate strategy backtesting, and tap into a community library of over 100,000 public scripts created by traders worldwide. Whether you need a divergence detector, harmonic pattern scanner, or liquidity zone indicator, chances are someone in the community has already built it.

The platform’s multi-chart layouts support up to 16 charts simultaneously on the Ultimate plan, and the desktop application bypasses browser limitations for true multi-monitor setups. TradingView covers global markets comprehensively, providing data from stocks, forex, futures, commodities, and cryptocurrencies across virtually every exchange worldwide.

TradingView is Best For

TradingView is best for serious technical traders who require institutional-grade charting tools, custom strategy development, and deep historical analysis. It’s ideal for swing traders, macro strategists, and algorithmic traders who need to backtest systems before risking capital. The platform’s broker-agnostic approach makes it valuable for traders who want to analyze markets without being locked into a single execution platform.

Can you connect Robinhood to TradingView?

The definitive answer is no—there is no native integration between Robinhood and TradingView as of 2025. This is one of the most frequently asked questions from traders who want to combine TradingView’s analytical power with Robinhood’s commission-free execution.

TradingView supports broker integration via REST API connections, allowing users to execute trades directly from TradingView charts. Brokers like TradeStation, Interactive Brokers, and OANDA have built these official bridges. Robinhood has chosen not to build this integration, primarily because their business model relies on keeping users within their ecosystem to maintain control over the user experience and monetize engagement.

Traders determined to automate TradingView signals into Robinhood use third-party middleware services, though these come with significant limitations. TradersPost is the most popular middleware option at approximately $49 per month. The service works by having TradingView alerts send webhooks to TradersPost, which then translates these signals into API orders sent to Robinhood. While this enables automated trading based on TradingView Pine Script logic, it adds latency, requires ongoing subscription costs, and carries “platform risk”—if Robinhood changes its API structure, the bot breaks.

For traders who need seamless TradingView execution, a better alternative is opening an account with a natively supported broker like TradeStation or Interactive Brokers rather than forcing an unofficial connection with Robinhood.

Key Characteristics of Robinhood and TradingView

| Platform | Platform Type | Tradeable Assets | Charting Features | Data | Premium Pricing |

|---|---|---|---|---|---|

| Robinhood | Brokerage + Execution Platform | Stocks, ETFs, Options, Crypto, Futures (2025) | Legend desktop platform: 8 free charts, ~100 indicators, Cortex AI, Volume Profile, VWAP. Mobile app syncs trendlines/indicators | Real-time data included free. Level 2 data with Gold ($5/mo) | Gold: $5/mo (Level 2 data, 4.5-5% APY, reduced futures fees) |

| TradingView | Charting + Analysis Platform | Not a broker—charts stocks, ETFs, futures, crypto, forex, and global markets | 17+ chart types, 110+ drawing tools, Pine Script for custom indicators, Strategy Tester for backtesting. Web, desktop app, and mobile | Real-time data for most markets. Exchange data packages available ($5-15/mo per exchange) | Essential: $15/mo, Plus: $30/mo, Premium: $60/mo (8 charts), Ultimate: $120/mo (16 charts) |

Trading Features and Tools

| Feature | Robinhood | TradingView |

|---|---|---|

| Platform Type | Brokerage + Charting | Charting + Analysis |

| Desktop Platform | Yes (Legend, browser-based) | Yes (Native app) |

| Mobile App | Yes (iOS/Android) | Yes (iOS/Android) |

| Simultaneous Charts (Free) | 8 charts | 1 chart |

| Custom Indicators | Yes (Cortex AI, natural language) | Yes (Pine Script) |

| Strategy Backtesting | No (Options simulation only) | Yes (Strategy Tester) |

| Trade Execution | Yes (Stocks, Options, Crypto, Futures) | Via connected brokers |

| Margin Trading | Yes (Gold: $1k interest-free) | N/A (Not a broker) |

| DRIP (Dividend Reinvestment) | Yes, no fees | N/A (Not a broker) |

| SIPC Insurance | Yes ($500k securities) | N/A (Not a broker) |

Trading Costs and Commissions Compared

| Fee Type | Robinhood | TradingView |

|---|---|---|

| Equity Commission | $0 | N/A (Not a broker) |

| Options Commission | $0 | N/A (Not a broker) |

| Futures Commission | $0.50/contract (Gold) $0.75/contract (Standard) | N/A (Not a broker) |

| Crypto Commission | $0 | N/A (Not a broker) |

| Account Minimum | $0 | N/A (Not a broker) |

| Robinhood Gold | $5/month | — |

| TradingView Premium | — | $60/month (8 charts) |

How Robinhood and TradingView work together

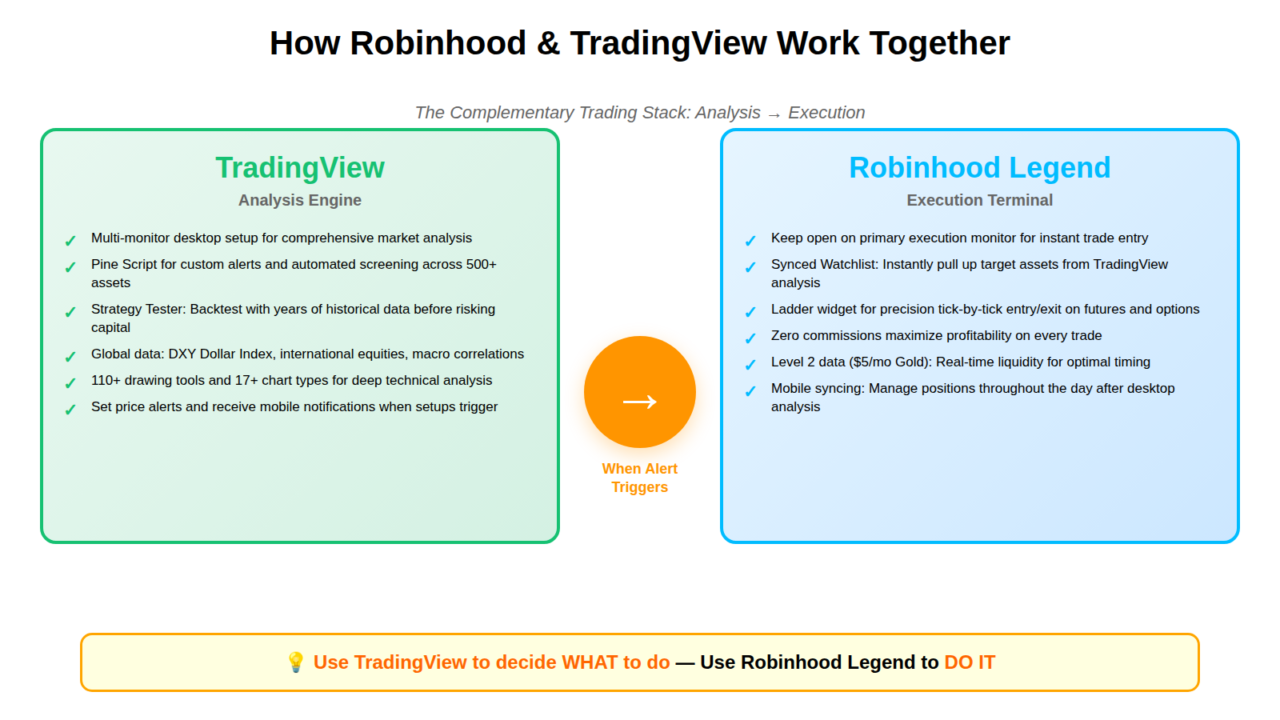

While no native integration exists, sophisticated traders use both platforms in a complementary workflow that leverages each platform’s unique strengths. The ideal approach treats TradingView as your analysis engine and Robinhood as your execution terminal.

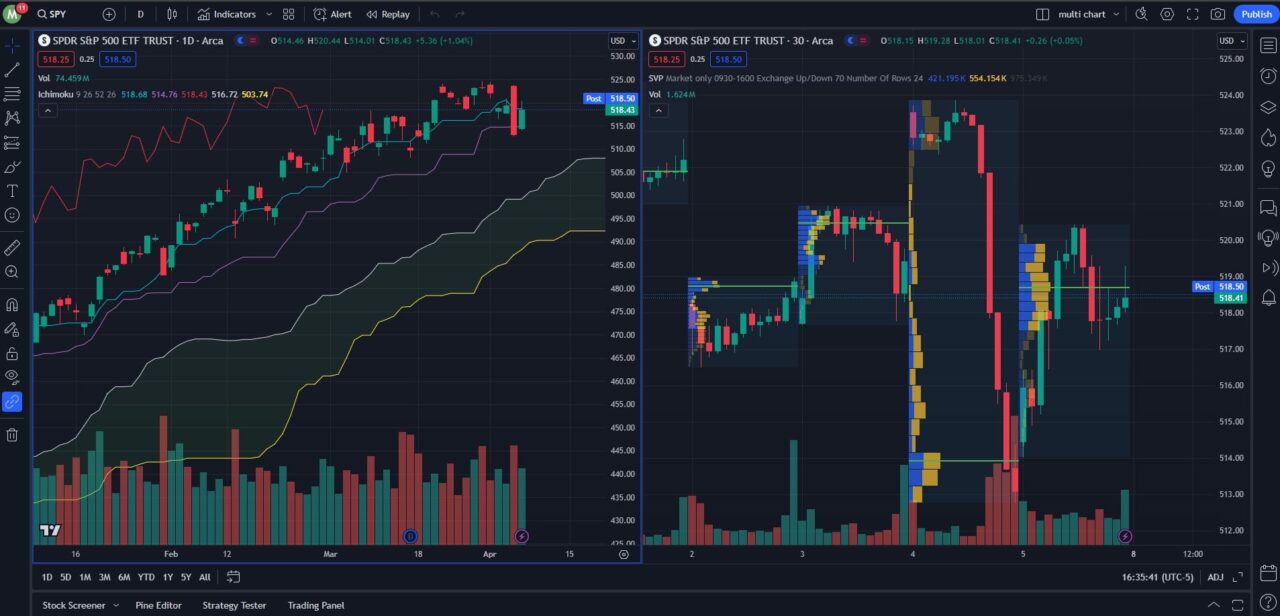

On TradingView, you run a multi-monitor setup with the desktop application to analyze markets comprehensively. You employ Pine Script for custom alerts and automated screening across hundreds of assets simultaneously. You perform deep macro analysis on instruments Robinhood doesn’t carry, such as the DXY Dollar Index or international equities. You backtest strategies using the Strategy Tester with years of historical data to validate your approach before risking capital.

On Robinhood Legend, you keep the platform open on your primary execution monitor ready for fast trade entry. When TradingView alerts notify you of a setup, you switch to Robinhood and use the synced Watchlist feature to instantly pull up the target asset. The Ladder widget provides precision entry and exit for futures and options trades, while the zero-commission structure maximizes profitability on each trade.

Consider a typical workflow: On Sunday evening, you scan 500+ stocks using TradingView’s Global Screener with custom Pine Script filters. Monday morning, you review candidates in detail, drawing support and resistance levels on TradingView’s superior charting engine. Throughout the week, you set price alerts in TradingView. When an alert triggers, you open Robinhood Legend and execute the trade with zero commissions while benefiting from Level 2 data for optimal entry timing.

Charting capabilities compared

Charting is where the platforms diverge most dramatically. TradingView offers 17+ chart types including time-independent displays like Renko and Kagi that filter market noise, along with exotic visualizations like Point & Figure and Volume Footprint. These specialized chart types are essential for specific trading strategies that move beyond standard candlestick analysis. TradingView provides 110+ drawing tools spanning trend analysis, Fibonacci suites, Gann tools, Elliott Wave analysis, and harmonic pattern recognition.

Robinhood Legend provides approximately 5 chart types including Candle, Line, Heikin Ashi, and their proprietary “Metal” candles with high-contrast rendering. The drawing tools library includes basics like trend lines, horizontal rays, Fibonacci retracements, and recently added professional tools like Anchored VWAP and Volume Profile. What Legend lacks in exotic chart types, it partly compensates for through value—the platform offers 8 simultaneous free charts, a feature that costs $60 per month on TradingView Premium.

For most traders using standard technical setups on major liquid instruments, Robinhood Legend provides 90% of necessary charting utility for 8% of TradingView Premium’s cost. However, TradingView remains essential for traders using exotic chart types or requiring extensive drawing tool libraries.

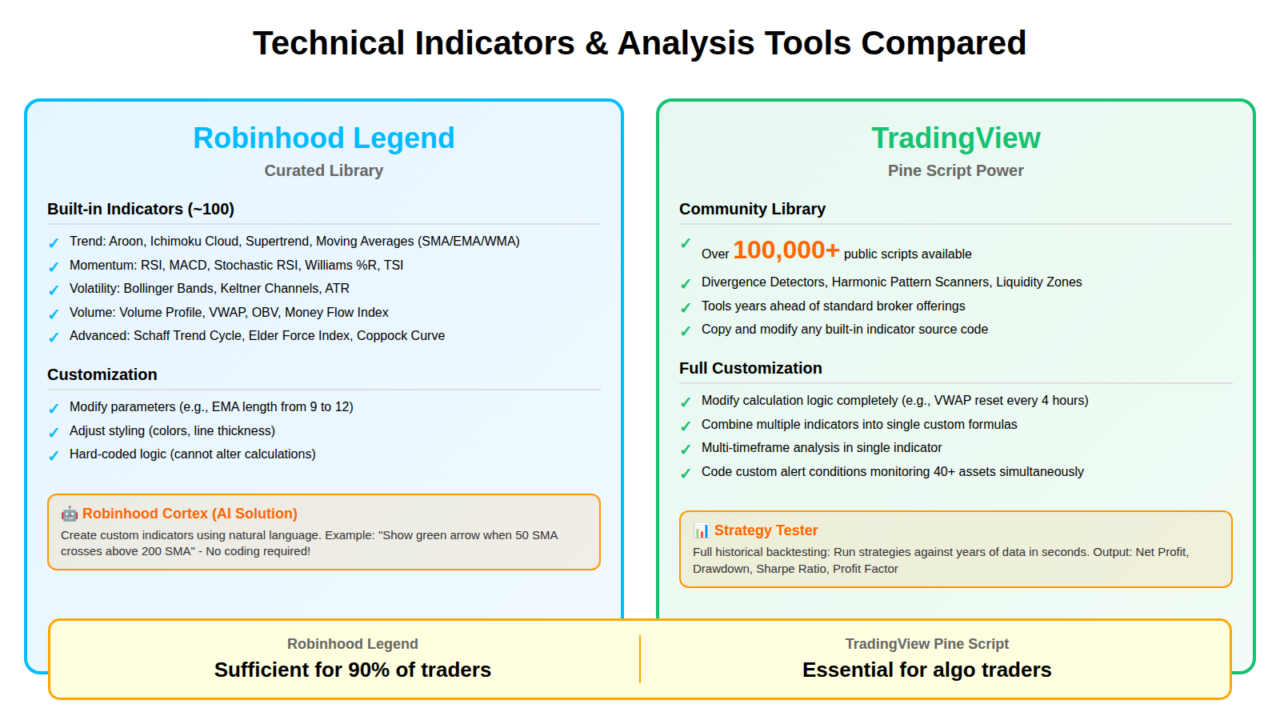

Technical indicators and analysis tools

Robinhood Legend offers approximately 100 built-in indicators covering most discretionary trading needs. The trend indicators include Aroon, Ichimoku Cloud, Supertrend, and various moving averages. For momentum analysis, you have RSI, MACD, Stochastic RSI, and Williams %R. Volatility traders can use Bollinger Bands, Keltner Channels, and Average True Range. Volume analysis includes Volume Profile, VWAP, and On-Balance Volume. The platform even includes advanced niche indicators like Schaff Trend Cycle and Elder Force Index.

The limitation is that indicators are “hard-coded.” You can modify parameters and styling but cannot alter the underlying calculation logic. This is where Robinhood Cortex bridges the gap—an AI tool that uses natural language processing to create custom indicators. You type commands in plain English, and Cortex generates the indicator without requiring coding knowledge.

TradingView’s dominance is anchored in Pine Script, a specialized programming language for trading strategies. The platform hosts over 100,000 public scripts in its community library. You can copy any built-in indicator’s source code and modify the calculation logic to suit your needs. Pine Script also allows comprehensive strategy backtesting—you write a strategy, and TradingView runs it against years of historical data in seconds, outputting metrics like Net Profit, Maximum Drawdown, and Sharpe Ratio.

For discretionary traders using standard indicators, Robinhood Legend’s library suffices. For systematic traders developing custom strategies or algorithmic traders requiring robust backtesting, TradingView’s Pine Script is non-negotiable.

Tradeable assets and market access

Robinhood provides access to US stocks and ETFs with real-time data included free, extended hours trading from 4:00 AM to 8:00 PM Eastern, and fractional shares. The platform offers American-style stock options with zero commission, and cryptocurrencies including BTC, ETH, SOL, and over 20 others with 24/7 trading availability.

The biggest 2025 addition is futures trading on major contracts including S&P 500 futures (/ES and micro /MES), Oil (/CL), Gold (/GC), and Bitcoin futures. Robinhood’s futures pricing at $0.50 per contract for Gold members is highly competitive compared to traditional brokers charging $1.25-$2.50. Futures accounts avoid the Pattern Day Trader rule requiring $25,000 minimum balance, and benefit from the 60/40 tax rule where 60% of gains are taxed as long-term capital gains regardless of holding period.

TradingView provides data analysis across virtually all global markets. The platform covers US and international stock exchanges, 180+ forex currency pairs, futures from all major exchanges, and cryptocurrency data from every exchange worldwide including Binance, Coinbase, and Kraken. TradingView’s global scope is essential for international traders, forex specialists, and anyone analyzing macro correlations across asset classes.

Robinhood’s asset coverage serves 95% of US retail traders’ needs, especially with 2025’s futures addition. TradingView’s global scope is essential for international market analysis.

Robinhood vs TradingView – Bottom Line

Choosing between Robinhood and TradingView depends on your specific trading needs, preferred trading tools, and the type of assets you’re interested in.

Both platforms offer distinct advantages, but by considering the detailed comparison above, you can select the one that aligns best with your trading strategy and goals.

For more detailed reviews and comparisons, continue exploring our other articles on brokerage platform comparisons.

Frequently asked questions

Can I use TradingView charts with Robinhood execution?

Yes, but not through native integration. The workflow requires manually switching between platforms—analyze setups on TradingView, then open Robinhood Legend to execute trades. Some traders use TradersPost middleware at approximately $49 per month to automate this via webhooks, though this adds cost, latency, and platform risk.

Does Robinhood Legend work on mobile devices?

Robinhood Legend is a browser-based desktop platform not available on mobile. However, as of 2025, trendlines and indicators drawn on Legend sync instantly to the Robinhood mobile app, allowing you to analyze at home and manage positions throughout the day on your phone.

Which platform is better for complete beginners?

Robinhood is better for complete beginners due to its intuitive interface, guided onboarding, fractional shares, and commission-free structure. TradingView’s advanced features can overwhelm new traders who haven’t learned technical analysis fundamentals. Start with Robinhood to learn basics, then add TradingView as skills develop.

Can I backtest trading strategies on Robinhood?

No, Robinhood Legend does not support historical backtesting of technical strategies. The platform does offer “Simulated Returns” for options positions, modeling forward-looking profit and loss under different scenarios, but this is options-specific modeling rather than systematic backtesting. TradingView’s Strategy Tester is required for rigorous historical validation.

Is Robinhood Gold worth the $5 monthly fee?

For active traders, Robinhood Gold provides exceptional value. The Level 2 market data alone typically costs $10-30 monthly at competitors. The 4.5-5% APY on uninvested cash means a $10,000 cash balance earns $450-500 annually, paying for 90 months of the Gold subscription. Add reduced futures fees and interest-free margin on the first $1,000, and Gold delivers far more value than its cost.

Related Trading Platform Comparisons

Get Your Free Trading Resources

Grab the free trading journal template plus the same tools we use to stay organized, consistent, and objective.

- Free trading journal template

- Custom indicators, watchlists, and scanners

- Access our free trading community

Enter your email below to get instant access.

No spam. Unsubscribe anytime.