Why I Have Conviction in my SPX Options Trading Strategy

A strategy is useless if you lack conviction.

What exactly is my SPX trading strategy?

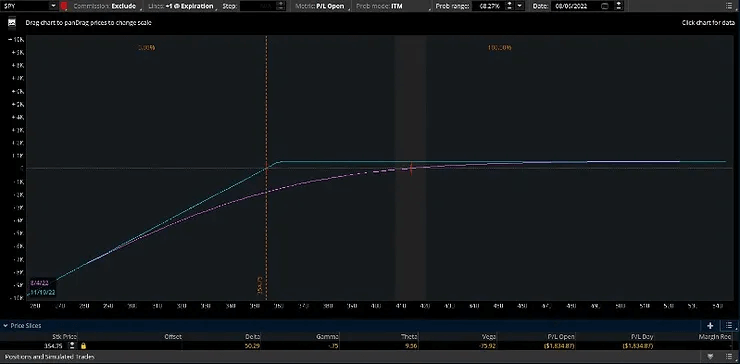

I replicate a long SPY portfolio by selling put options on either /MES, SPY, or SPX. Depending on the week, I use a SPY puts strategy and will generally sell to open about 1–2 contracts which are dependent on my account size and risk tolerance at the time.

The idea is that I am trying to generate a higher sharpe ratio than the market utilizing an SPX trading strategy instead of just owning shares of an S&P 500 fund.

I do this by shorting puts and controlling my delta exposure by rolling the contracts when I feel it is a good time. Additionally, you can use the S&P 500 futures options to sell puts instead of SPX.

Additionally, I spend some of my premium from selling puts to purchasing long puts to hedge.

What do financial advisors recommend?

Many people will go to a financial advisor to manage their money because they do not want to deal with the stock market. Most advisors will put you in an index fund that will perform similar to the S&P 500. Depending on your age, they may also put some of your money in the bond market.

Many famous investors, such as Warren Buffet, also recommend that most people simply invest in the indexes and hold them long-term. If American companies continue to do well, this index has proven it will go up over time. However, deciding to trade stocks vs options is a decision depending on each person’s situation.

As you can see in the TradingView chart above, the market has had rough times but always recovers. The same thing cannot be said about all stocks, though. A great example is the company General Electric (GE), as you can see in the chart below. This company used to be one of the top S&P 500 companies, but now it has fallen and never recovered to its previous highs.

The point here is that those safe companies can quickly turn into losers depending on when you buy them. If you stick to trading the indexes like the S&P 500, all bad companies are automatically removed, so you don’t have to worry about stock picking.

Put selling with risk management backtests well

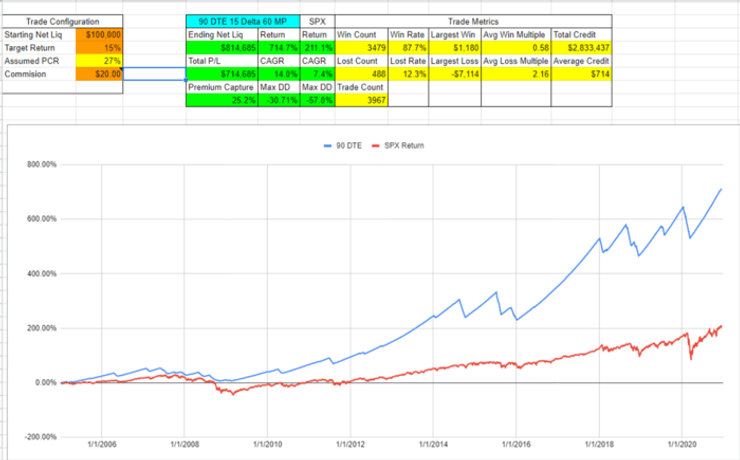

There have been many backtests done on SPX trading strategies, but I believe the best resources have been provided by David Sun. You can view his website here, and I will link this 90 DTE SPX trading strategy backtest here.

This backtest sells 15 delta puts closest to 90 dte. The management uses a 60% take profit level and a -200% stop loss. I won’t go into all of the details, but it is clear that selling puts on the index can beat buy and hold.

Volatility risk premium (VRP)

The volatility risk premium is the idea that implied volatility tends to be higher than actual volatility. In layman’s terms, people generally overestimate how much the stock market will move in the short term. When this happens, put options become overpriced since people speculate that the market will fall harder than expected.

Implied volatility — the price of options.

Actual volatility — how much the market actually moves.

When implied volatility ends up being higher than how much the market moves, the option sellers win. Most of the time, this will be the case, but you must manage your risk when the market draws down more than expected.

My SPX trading strategy combines proven ways of making money

So far, we have learned that the safest ways to make money in the stock market are to buy and hold an index or sell option premium. You can sell options on single stocks, but this requires constant speculation, and you could be wrong.

A superior stock market strategy is formed by combining holding an index and selling options. Many traders attempt to beat the S&P 500 index using single stocks, but you can easily trade an options strategy on the index itself in an attempt to beat it.

Trading the indexes will also provide the most conviction. There is a much greater chance that an index will provide steady returns than any single company. You will never have to worry about bad news reports or industry analysis since the index will pick all the stocks for you. The indexes have always recovered previously, and if you are looking for consistency, an index will be the best option to trade.

Buy and hold wasn’t good enough for me

I wanted to find an excellent way to beat buy and hold while having more control of my portfolio. I developed a strategy with positive expectancy that is also correlated to a buy-and-hold approach.

Bottom line

Historically, the surest way to make money on the stock market is to buy and hold the S&P 500 and sell option premium. I combine these approaches by simulating a long S&P 500 stock portfolio by selling put options with an SPX trading strategy.

Selling premium has been backtested by many people, and due to the volatility risk premium, it has positive expectancy over time. Anybody can learn about options trading, especially with a guide like this post called puts and calls for dummies.

– Free trading journal template & cheat sheet PDFs

– Custom scanners, watchlists, & market commentary

– Access our free trading course and community