Tradezella Review 2026: Features, Pricing, and Why Traders Choose Alternatives

Tradezella positions itself as a “gym for traders” with trade replay, backtesting, and the unique “Playbook” system for strategy tracking. At $288-$399/year with no free trial and strict no-refund policy, is it worth the investment? This review examines what Tradezella does well, technical limitations traders encounter, and why many choose free alternatives instead.

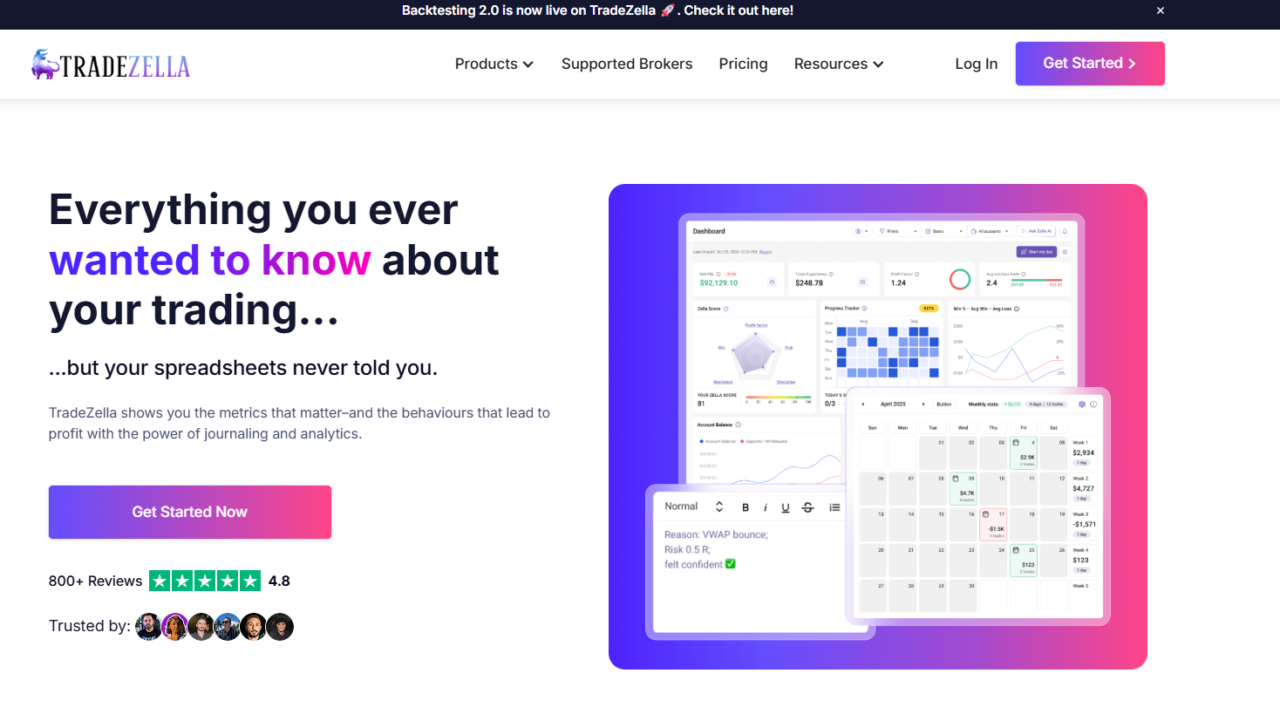

What is Tradezella?

Tradezella is a web-based trading journal designed around the “Playbook” paradigm. Instead of generic trade logging, it structures performance analysis around predefined strategies, separating the quality of your strategy from the quality of your execution.

Core capabilities:

- Automated trade imports from 50+ brokers

- Trade replay with 1-second tick data

- Backtesting sandbox with unlimited simulations

- Playbook system for strategy-specific analytics

- Mistake tracking with dollar cost quantification

- Prop firm dashboard for multi-account management

The Playbook System: Tradezella’s Core Innovation

Unlike traditional journals that simply log trades, Tradezella’s Playbook feature forces structure. Each trade is attributed to a specific strategy (Playbook) with predefined rules.

Why this matters:

You might lose money in a given month, but Playbook analytics can reveal your strategy has positive expectancy (60% win rate over 100 trades) while your execution deviated from rules in 40% of cases. This distinction between strategy quality and execution quality is Tradezella’s primary value driver.

Example use case:

- “Morning Breakout” Playbook: Different rules for stops and targets than “Afternoon Reversal” Playbook

- System tracks win rate, profit factor, R-multiple independently for each

- Prevents data pollution where bad scalping drags down good swing trading stats

Tradezella Pricing 2026

Monthly Plans:

- Basic ($29/mo): 1 broker account, 3 Playbooks, unlimited backtesting, standard trade replay

- Premium ($49/mo): Unlimited accounts, unlimited Playbooks, Sessions Trade Replay, 5GB storage

Annual Plans:

- Essential ($288/yr = $24/mo): Annual Basic with modest discount

- Pro ($399/yr = $33/mo): Annual Premium, best value for multi-account traders

Critical limitations:

- No free trial to test before committing

- Strict no-refund policy (unlike Edgewonk’s 14-day guarantee)

- Basic plan’s 1-account limit restricts traders with prop firm accounts

Trade Replay: The Signature Feature

Trade replay reconstructs your executed trades using 1-second tick data, showing candles printing bar-by-bar as if live.

The value: Static charts show obvious outcomes. Replay restores the uncertainty you felt during execution, helping identify whether your “panic exit” was rational or emotional.

Sessions Trade Replay (Premium only): Replays entire trading sessions, showing not just trades taken but opportunities missed. Provides context for why a long trade failed (e.g., SPY melting down simultaneously).

Technical limitation: 1-second granularity works for day and swing traders but lacks sub-second precision scalpers need for reading tape. TraderSync offers 250ms updates + Level 2 data, making it superior for scalpers.

Backtesting Sandbox

Transform Tradezella from journal to strategy development lab. Trade historical data using the same interface as live journaling.

Use cases:

- Accelerated learning: Simulate a year of trading in a weekend

- Strategy validation: Test new Playbooks before risking capital

- Statistical flight time: Get reps when markets are closed

Data granularity debate: Sufficient for most traders, but high-frequency scalpers requiring Level 2 order flow should use TraderSync instead.

Broker Integration: The Reality Behind “Seamless Sync”

Tradezella supports 50+ brokers, but technical friction varies significantly:

Major integrations:

- ThinkOrSwim/Schwab: Deep integration but API refresh token expires every 6-7 days, requiring weekly re-authentication

- Interactive Brokers: Notoriously complex setup requiring Flex Web Service token configuration

- MetaTrader 4/5: Critical for Forex and prop firm traders, handles swap rates and time zones

- Crypto/Futures: Native support for Bybit, Binance, NinjaTrader, Tradovate

2026 Prop Firm Dashboard: Tracks “Days Traded” minimums and “Daily Loss Limits” across multiple evaluation accounts. Prevents rule breaches that disqualify funded traders.

What Tradezella Does Well

Structured Performance Analysis

The Playbook system forces discipline. Instead of vague “I need to trade better,” you get specific insights like “My Momentum Playbook has 65% win rate but I only follow the rules 40% of the time.”

Mistake Quantification

Structured mistake tracking calculates the dollar cost of bad habits. “Moving stop loss” tagged 15 times might represent $3,000 in preventable losses, making the $399 subscription trivial in comparison.

Clean Interface

Modern, calm design. Users report feeling less stressed using Tradezella compared to cluttered alternatives.

Zella AI Integration

Ask conversational questions: “Show me my worst three trades last week and what they have in common.” AI analyzes metadata and reveals patterns you missed.

Where Tradezella Falls Short

No Free Trial or Refunds

Competitors like TradesViz offer robust free tiers. Edgewonk provides 14-day money-back guarantee. Tradezella requires $288+ commitment before testing, creating financial risk if platform doesn’t fit your workflow.

Mobile Experience

Only offers Progressive Web App (PWA), not native mobile apps. TraderSync’s native iOS/Android apps provide superior on-the-go experience.

Limited for Scalpers

1-second tick data and no Level 2 replay makes Tradezella insufficient for order flow scalpers who need to read the tape.

Sync Reliability Issues

Reddit threads surface recurring complaints about trades not appearing after sync. While often broker-side issues (Schwab token expiry), users perceive it as platform failure.

Higher Cost for Basic Features

$29/mo for basic journaling feels expensive when free alternatives provide core functionality without financial risk.

Tradezella vs Better Alternatives

| Feature | Tradezella Pro | TraderSync Elite | Edgewonk | TradesViz | FTW Free |

|---|---|---|---|---|---|

| Annual cost | $399 | $834 | $169 | Free-$189 | Free |

| Free trial | No | 7 days | No | Yes (robust) | N/A |

| Refund policy | No refunds | Standard | 14-day guarantee | Standard | N/A |

| Trade replay | Yes (1-sec) | Yes (250ms + L2) | No | Yes (basic) | No |

| Mobile app | Web/PWA | Native iOS/Android | Desktop only | PWA | Sheets/Excel |

| Broker support | 50+ brokers | 240+ brokers | Auto + file | Auto + file | Manual/CSV |

| Best for | Discretionary day/swing | Scalpers needing L2 | Psychology focus | Data nerds/options | Budget traders |

| Unique strength | Playbook system | Level 2 replay | Tiltmeter psychology | Custom pivot tables | Data ownership |

When to Choose Alternatives

Choose TraderSync if:

- You’re a scalper requiring 250ms tick updates and Level 2 order flow replay

- You need native mobile apps for iOS/Android

- You trade with niche brokers (240+ supported vs Tradezella’s 50+)

Choose Edgewonk if:

- You struggle primarily with trading psychology

- You’re budget-conscious ($169/yr vs $399/yr)

- You don’t need trade replay (Edgewonk lacks replay engine)

- You want the Tiltmeter and Exit Analysis for mental equity tracking

Choose TradesViz if:

- You’re an options trader needing Greeks exposure and payoff diagrams

- You want custom pivot tables and 3D data visualization

- You need a capable free tier (3,000 executions/month)

- You’re a quantitative analyst who slices data in custom ways

Choose Financial Tech Wiz if:

- You want to start completely free with zero financial risk

- You value data ownership and spreadsheet transparency

- You prefer upgrading to AI insights only when automation adds value

- You don’t need trade replay or backtesting

Technical Friction Points Traders Encounter

Schwab/ThinkOrSwim Token Expiry

API refresh token expires every 6-7 days, forcing weekly manual re-authentication. While Tradezella lobbies for longer token life, the limitation sits with Schwab.

IBKR Flex Query Complexity

Syncing Interactive Brokers requires generating “Flex Web Service” token with precise data field configuration. Missed fields or token duration under 365 days cause sync failures. High barrier for less technical traders.

No CSV Export Flexibility

Unlike TraderSync and TradesViz which allow easy Excel export, Tradezella limits export functionality to keep users within ecosystem.

Who Should Buy Tradezella?

Buy Tradezella if:

- You’re a discretionary day or swing trader needing structure

- You trade multiple funded prop accounts (Pro plan essential)

- You value the Playbook system for separating strategy quality from execution quality

- You need trade replay but don’t require Level 2 data

- You’re willing to pay $288-$399/year for all-in-one ecosystem

Skip Tradezella if:

- You want to test before $300+ commitment (no free trial)

- You’re a scalper needing sub-second data and Level 2 replay

- You’re budget-conscious and don’t need replay ($169 Edgewonk or free TradesViz)

- You need native mobile apps (only PWA available)

- You trade with niche brokers (only 50 supported vs TraderSync’s 240+)

Final Verdict

Pros:

- Playbook system separates strategy quality from execution quality

- Clean, modern interface reduces trading stress

- Unlimited backtesting at all price tiers

- Zella AI for conversational analytics

- Prop firm dashboard for multi-account risk management

Cons:

- No free trial or refunds ($300+ blind commitment)

- 1-second replay insufficient for scalpers

- Weekly Schwab re-authentication friction

- Only 50 broker integrations vs competitors’ 240+

- Web/PWA only, no native mobile apps

Rating: 3.5/5

Tradezella delivers a holistic solution for discretionary traders who value structure. The Playbook system genuinely helps separate “my strategy sucks” from “I’m not following my strategy.” However, the lack of free trial, strict no-refund policy, and technical friction points (Schwab tokens, IBKR complexity) create unnecessary barriers.

For most traders, starting with a free alternative makes more sense. Test if journaling actually improves your results before committing $300+/year.

Frequently Asked Questions

Does Tradezella offer a free trial?

No. Tradezella requires payment upfront with no free trial period, unlike TradesViz (robust free tier) or TraderSync (7-day trial).

Can I get a refund if it doesn’t work for me?

No. Tradezella maintains a strict no-refund policy, contrasting with Edgewonk’s 14-day money-back guarantee.

Is trade replay worth the extra cost?

Trade replay helps day traders review execution by restoring the uncertainty of live price action. However, the 1-second granularity is insufficient for scalpers who need Level 2 order flow (available in TraderSync Elite at 250ms updates).

What’s the Schwab token issue?

ThinkOrSwim/Schwab API tokens expire every 6-7 days, forcing weekly manual re-authentication. This is a broker limitation, not Tradezella’s fault, but creates recurring friction.

What’s better for scalpers?

TraderSync Elite. It offers 250ms tick updates, Level 2 market depth replay, and Time & Sales data critical for reading the tape. Tradezella’s 1-second data misses the micro-structure scalpers need.

What’s the cheapest alternative?

Edgewonk at $169/year (47% cheaper than Tradezella Pro) or TradesViz with a robust free tier (3,000 executions/month). Financial Tech Wiz offers a completely free Google Sheets journal with performance charts and S&P 500 benchmark comparison.

Better Alternative: Start Free, Upgrade Smart

Instead of risking $288-$399 on Tradezella without testing, start with the Financial Tech Wiz free trading journal:

Free Google Sheets journal includes:

- Automatic performance charts vs S&P 500

- Win rate, profit factor, holding period metrics

- Full data ownership and customization

- Works with all asset classes

Upgrade to AI-powered app when ready:

- AI trading coach trained on your trades

- Live P/L visualization on TradingView charts

- Daily performance insights

- Multiple benchmark comparisons

After signing up, you’ll receive the free spreadsheet and can explore the AI-powered app with a free trial if you want automation.

Get Your Free Trading Resources

Grab the free trading journal template plus the same tools we use to stay organized, consistent, and objective.

- Free trading journal template

- Custom indicators, watchlists, and scanners

- Access our free trading community

Enter your email below to get instant access.

No spam. Unsubscribe anytime.