Tradezella vs Tradervue: Which Trading Journal is Better in 2026?

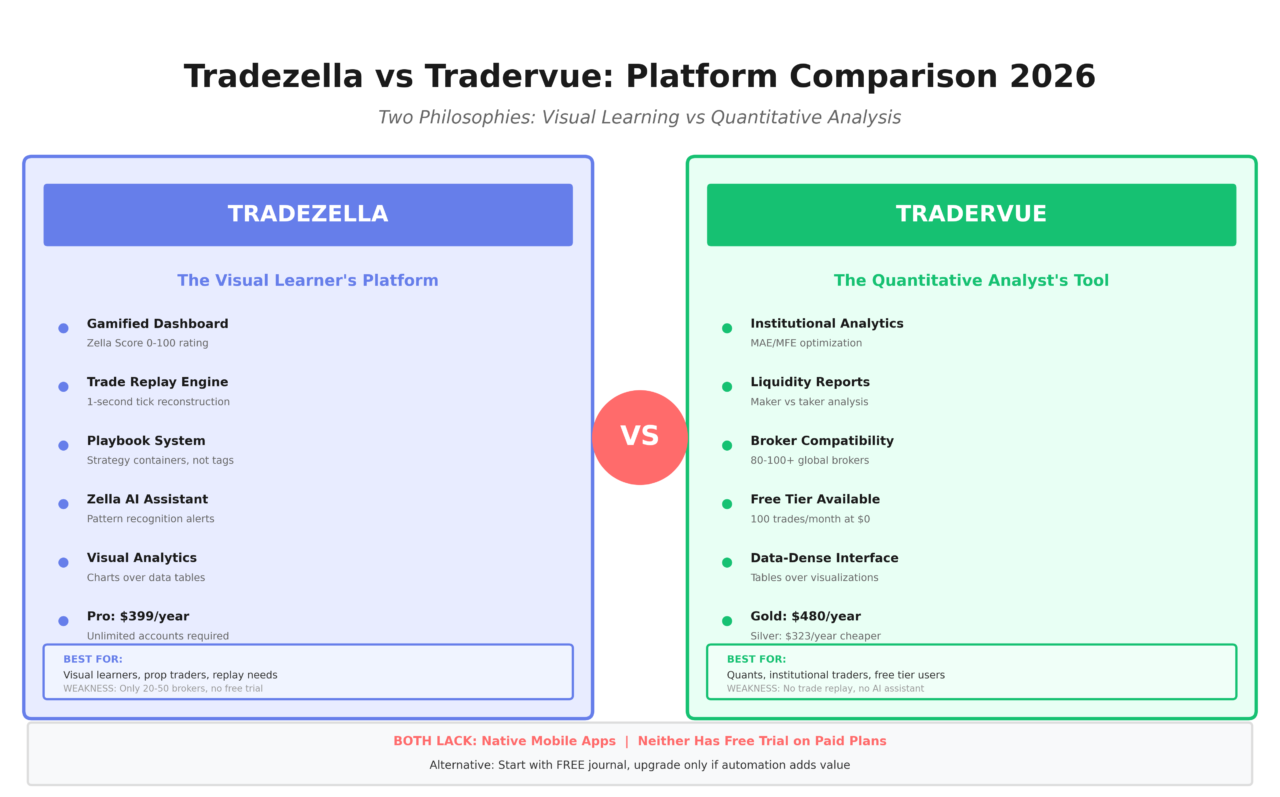

Tradezella and Tradervue represent two philosophies: gamified visual learning versus quantitative data analysis. This comparison examines pricing, features, and technical differences to help you choose the right platform—or skip both for a free alternative.

The Core Difference

Tradezella = Modern “Trading Operating System” with trade replay, playbooks, and gamification. Built for visual learners and prop traders.

Tradervue = Quantitative workspace with institutional-grade analytics, liquidity reports, and dense data tables. Built for quants and professional desks.

Pricing Comparison 2026

| Feature | Tradezella Basic | Tradezella Pro | Tradervue Silver | Tradervue Gold |

|---|---|---|---|---|

| Monthly price | $29 | $49 | $29.95 | $49.95 |

| Annual price | $288 | $399 | $323 | $480 |

| Account limit | 1 account | Unlimited | Unlimited | Unlimited |

| Free tier | No | No | Yes (100 trades/mo) | Yes (100 trades/mo) |

| Trade replay | Yes | Yes (Sessions) | No | No |

| Playbooks | 3 | Unlimited | Tags only | Tags only |

| Broker support | 20-50 brokers | 20-50 brokers | 80-100+ brokers | 80-100+ brokers |

| Risk analytics (MAE/MFE) | Basic | Basic | Basic | Advanced |

| Liquidity reports | No | No | No | Yes |

| Mobile app | Web/PWA only | Web/PWA only | Web/PWA only | Web/PWA only |

Key pricing insights:

- Tradezella Pro ($399/yr) is 17% cheaper than Tradervue Gold ($480/yr)

- Tradervue Silver ($323/yr) offers unlimited accounts for less than Tradezella Pro ($399/yr)

- Tradervue has free tier (100 trades/month), Tradezella has no free option

Feature Breakdown

Tradezella Strengths

Trade Replay Engine Tick-by-tick reconstruction of price action. Watch candles form exactly as they did live, with playback controls. Sessions replay shows entire trading days including missed opportunities.

Playbook System Strategies are containers, not just tags. Separate win rates for “Gap and Go” vs “Afternoon Reversal” prevent data pollution. Track missed trades to quantify hesitation cost.

Zella Score 0-100 gamified rating normalizing performance quality regardless of volume. Encourages improvement through positive reinforcement.

Visual Dashboard Clean, modern interface. Heatmaps, P/L curves, and charts prioritized over tables. Reduces analysis paralysis for traders overwhelmed by spreadsheets.

Zella AI Pattern recognition assistant flags behavioral deviations: “You lose 15% more often on trades within 5 minutes of market open.”

Unlimited Backtesting Included even on Basic plan. Test strategies against historical data before risking capital.

Tradervue Strengths

Institutional Analytics Maximum Adverse Excursion (MAE) and Maximum Favorable Excursion (MFE) analysis on Gold plan. Optimize stop placement based on actual price movement data.

Liquidity Reports (Gold Only) Visualize maker vs taker execution. Scatter plot shows correlation between passive entries (limit orders) and winning trades. Critical for optimizing spreads and rebates.

Broker Compatibility 80-100+ brokers supported vs Tradezella’s 20-50. Includes institutional prime brokers (Sterling, Lightspeed), diverse forex/futures platforms, and robust API for custom pipelines.

Free Tier 100 trades/month at $0 makes Tradervue viable for swing traders. Tradezella has no free option.

Shared Trades Ecosystem Public trade sharing creates verifiable execution records used across Discord, Twitter, and mentorship programs. Can share technical details while masking financial data.

Data Density Spreadsheet-style interface displays maximum information with minimum scrolling. Efficient for high-volume traders scanning hundreds of executions.

Where Both Fall Short

No Native Mobile Apps Neither offers iOS/Android apps. Both rely on mobile web browsers. TraderSync’s native app provides superior mobile experience.

No Free Trial (Tradezella) Tradezella requires $288+ commitment without testing. Tradervue’s free tier allows evaluation before paying.

Limited AI (Tradervue) Tradervue lacks AI assistant. TraderSync’s Cypher AI performs counterfactual analysis: “If you moved profit target to 2R, P&L would increase $4,500.”

Replay Gap (Tradervue) No native trade replay. Users supplement with external tools (Sierra Chart, TradingView), creating disjointed workflow.

Who Should Choose Tradezella?

Best for:

- Visual learners who find spreadsheets overwhelming

- Prop firm traders managing multiple funded accounts (Pro plan)

- Traders needing integrated trade replay for execution review

- Beginners wanting gamification and educational content (Zella University)

Skip if:

- You need to test before $288+ commitment (no free trial)

- You’re a quant requiring liquidity analysis and MAE/MFE optimization

- You trade with niche brokers (only 20-50 supported)

- You need native mobile apps

Who Should Choose Tradervue?

Best for:

- Quantitative analysts comfortable with data-dense interfaces

- Professional desks requiring institutional-grade analytics

- Scalpers optimizing maker/taker execution (Gold plan)

- Swing traders who can use free tier (100 trades/month)

- Mentorship groups utilizing shared trades ecosystem

Skip if:

- You’re a visual learner needing trade replay (Tradervue lacks native replay)

- You want AI-driven insights (no AI assistant)

- You need unlimited accounts but want lower cost ($323 Silver vs $399 Tradezella Pro)

The Cost-Effective Multi-Account Strategy

Counterintuitive finding:

For traders managing multiple prop accounts who DON’T need trade replay, Tradervue Silver at $323/year beats Tradezella Pro at $399/year by $76 annually. Both offer unlimited accounts, but Tradervue is 19% cheaper.

However, if you need trade replay, Tradezella Pro’s $399 is justified since Tradervue lacks native replay entirely.

Better Alternative: Free First, Paid If Needed

Instead of committing $288-$480/year to either platform, start with the Financial Tech Wiz free trading journal:

Free Google Sheets journal:

- Performance charts vs S&P 500 benchmark

- Win rate, profit factor, holding period metrics

- Full data ownership and customization

- Zero financial risk to test if journaling improves results

Upgrade to AI-powered app when ready:

- AI trading coach trained on your trades

- Live P/L visualization on TradingView charts

- Daily performance insights without manual calculations

- Multiple benchmark comparisons

Technical Friction Points

Tradezella Limitations

1-Account Bottleneck on Basic: Modern traders juggle personal + multiple prop accounts. Basic plan’s single account limit forces $49/mo Pro upgrade.

Broker Sync Issues: Only 20-50 brokers supported. Weekly Schwab token re-authentication creates recurring friction.

Tradervue Limitations

No Visual Replay: Static charts generated at import. Cannot “re-live” trades to reconnect with execution emotions. Must supplement with external replay tools.

Complex Setup: Institutional-grade features require technical knowledge. IBKR Flex Query setup remains barrier for less tech-savvy traders.

The AI Gap

Tradezella’s Zella AI: Pattern recognition and behavioral alerts. Identifies when you deviate from historical baseline.

Tradervue’s AI: None. Relies on user-generated reports without AI assistance.

The bar in 2026: TraderSync’s Cypher AI performs counterfactual optimization, mathematically showing how parameter changes would have affected results. Both Tradezella and Tradervue lag behind this capability.

Final Verdict

Tradezella wins for:

- Trade replay quality

- Gamification and motivation

- Visual learners

- All-in-one ecosystem (journal + simulator)

Tradervue wins for:

- Broker compatibility (80-100+ vs 20-50)

- Institutional analytics (MAE/MFE, liquidity)

- Free tier existence

- Lower cost for multi-account without replay ($323 vs $399)

Neither platform is “best”—they serve different traders.

However, neither offers free trials, and both lack native mobile apps, creating unnecessary barriers.

Recommendation: Start Free

Most traders don’t know if journaling will actually improve their results. Risking $288-$480 before testing the habit makes no sense.

Start with a free journal, validate the process works for you, then upgrade only if automation adds measurable value.

After signing up, you’ll receive the free spreadsheet and can explore the AI-powered app with a free trial if you want automation.

Get Your Free Trading Resources

Grab the free trading journal template plus the same tools we use to stay organized, consistent, and objective.

- Free trading journal template

- Custom indicators, watchlists, and scanners

- Access our free trading community

Enter your email below to get instant access.

No spam. Unsubscribe anytime.