TradingView vs Tradovate: Charting Platform vs Futures Brokerage

TradingView and Tradovate are often compared, but they are not trying to solve the same problem. TradingView is a charting and analysis platform used across nearly every market. Tradovate is a futures focused brokerage built for execution, pricing efficiency, and active traders.

This comparison breaks down how TradingView and Tradovate differ in purpose, features, pricing, and ideal use cases so you can decide which one actually fits your workflow. All information below was manually researched from platform documentation and public sources.

Key Takeaways

- TradingView and Tradovate serve different roles: TradingView is built for charting and analysis across all markets, while Tradovate is designed specifically for futures execution and pricing.

- TradingView is the better all around analysis platform: it offers best in class charting, screeners, and market tools without locking you into a single broker.

- Tradovate is best used as a futures execution layer: many traders chart on TradingView and place futures trades through Tradovate to combine analysis with low cost execution.

- Free to premium plans available

- Works across all major markets

- Best overall charting platform

- Futures focused trading platform

- Native TradingView integration

- Advanced volume based tools

TradingView Overview

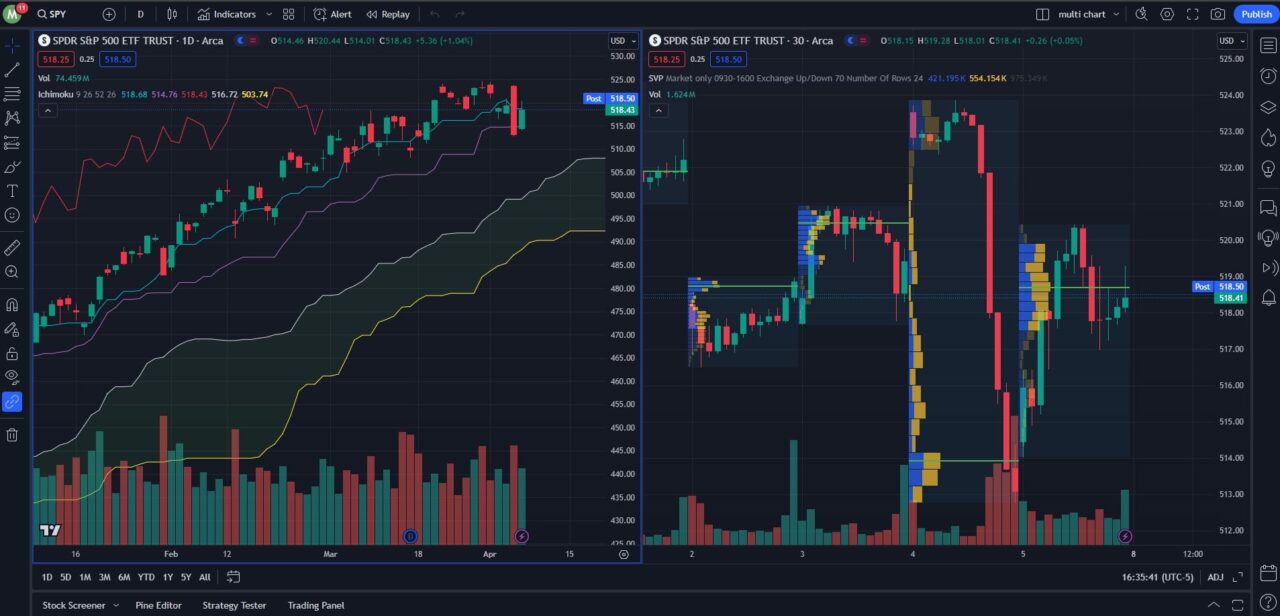

TradingView is a web based charting and social platform used by millions of traders worldwide. It supports advanced technical analysis, custom indicators, strategy backtesting, and community built scripts through its proprietary Pine Script language.

Based on extensive hands on use across nearly every major trading platform, TradingView stands out as the best all around charting solution currently available. It combines powerful tools with a clean interface and works across virtually every market.

Key Strengths

- Free to premium pricing ranging from basic to professional

- Integrates with many brokers for direct trading

- Best free charting platform on the market

Who TradingView Is Best For

TradingView is ideal for traders and investors who want premium charting, powerful screeners, heatmaps, and economic calendars in one place. You can analyze stocks, ETFs, crypto, forex, and futures from a single platform and connect a supported broker to place trades directly from the charts.

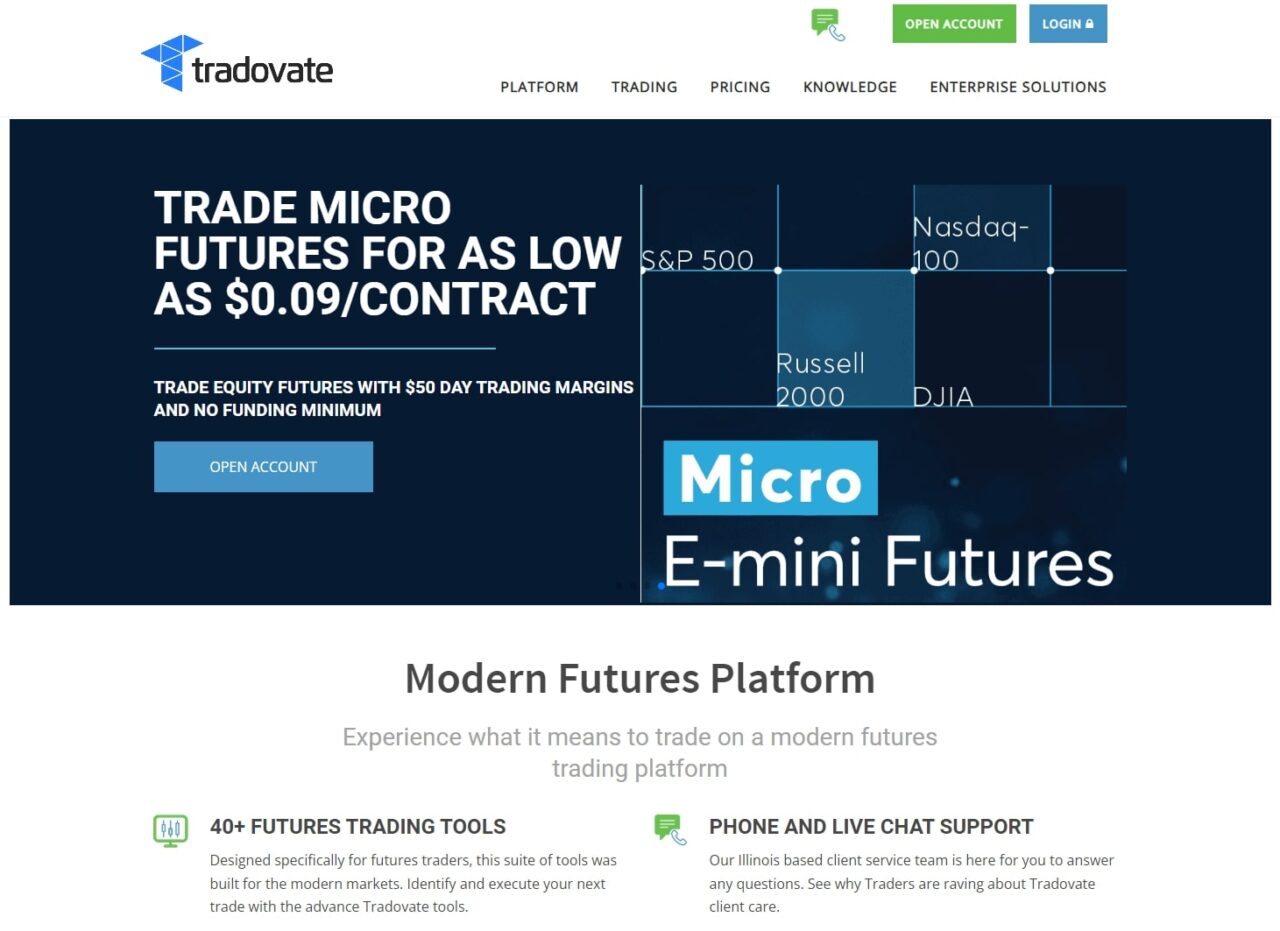

Tradovate Overview

Tradovate is a futures brokerage platform designed specifically for active traders. It offers competitive commissions and the ability to reduce costs further through monthly or lifetime pricing plans.

Traders can access micro futures contracts, making it possible to trade futures with relatively low capital. Tradovate also integrates directly with TradingView, allowing traders to combine professional charting with futures execution.

Key Strengths

- Low cost futures commissions

- Direct TradingView integration

- Built in volume profile and market profile tools

Who Tradovate Is Best For

Tradovate is best for traders who focus primarily on futures and trade frequently enough to benefit from reduced commission plans. It is not designed for equities or long term investing, so it works best as a specialized futures platform rather than an all in one solution.

Key Differences Between TradingView and Tradovate

Platform Capabilities

| Feature | TradingView | Tradovate |

|---|---|---|

| Platform Type | Charting and analysis software | Futures brokerage |

| Broker Included | No | Yes |

| Tradable Markets | Stocks, ETFs, futures, crypto, forex | Futures, futures options, forex |

| Charting | Web, desktop, and mobile apps | Charting with volume and market profile |

| Market Data | Free real time data when available, paid exchange data optional | Real time data with funded account |

| Premium Pricing | $12 to $60 per month | $99 per month or $1,499 lifetime for reduced commissions |

Trading Tools and Account Features

| Feature | TradingView | Tradovate |

|---|---|---|

| DRIP | Not applicable | Not available |

| Margin Trading | Broker dependent | Yes |

| Insurance | Broker dependent | Not insured |

| Mobile App | Yes | Yes |

Trading Costs and Commissions

| Fee Type | TradingView | Tradovate |

|---|---|---|

| Stock Trades | Not a broker | Not supported |

| Options | Not a broker | Not supported |

| Futures | Not a broker | $1.29 per contract, $0.35 micro |

| Futures Options | Not a broker | Typically same as futures |

| Option Exercise Fees | Not a broker | None |

TradingView vs Tradovate – Bottom Line

TradingView and Tradovate are not direct competitors. They serve different roles in a trader’s stack.

TradingView is the best choice for charting, market analysis, and multi asset research. It works across nearly every market and does not lock you into a single broker.

Tradovate is a strong execution platform for futures traders who care about commissions, speed, and access to micro contracts. Many traders use both platforms together by charting on TradingView and executing futures trades through Tradovate.

Choosing the right platform comes down to understanding whether you need analysis, execution, or both.

Related Trading Platform Comparisons

Interactive Brokers vs Ninjatrader

Get Your Free Trading Resources

Grab the free trading journal template plus the same tools we use to stay organized, consistent, and objective.

- Free trading journal template

- Custom indicators, watchlists, and scanners

- Access our free trading community

Enter your email below to get instant access.

No spam. Unsubscribe anytime.