John Schneider Net Worth – $200,000

What is John Schneider’s net worth?

As of 2024, John Schneider’s net worth is estimated to be $200,000. While this might not seem like a staggering figure for a celebrity, Schneider’s financial journey has been filled with ups and downs, which has impacted his overall net worth.

Nevertheless, his dedication to the arts and continuous contributions to the entertainment world have earned him immense respect and admiration from his fans.

Where does Schneider live today?

John Schneider currently resides in Holden, Louisiana, where he owns and operates John Schneider Studios. The property serves as both his home and a creative hub, boasting a fully equipped film studio, a recording studio, and beautiful outdoor settings.

Schneider’s love for the Southern lifestyle is evident in the way he has embraced and nurtured this unique space, making it a go-to spot for artistic collaborations and creative endeavors.

Who made the most money on Dukes of Hazzard?

“The Dukes of Hazzard” was a massive hit during its run from 1979 to 1985, and its popularity brought financial success to the cast members. However, information regarding the exact earnings of each cast member, including John Schneider, is not publicly available. It’s known that Schneider, along with his co-star Tom Wopat (who played Luke Duke), became the faces of the series and were among the show’s highest-paid actors.

At the time, merchandising also played a significant role in the earnings associated with the show. The series spawned a plethora of merchandise, including toys, lunchboxes, and clothing. It is unclear how much of the revenue from merchandise sales went to the actors, but it’s safe to say that “The Dukes of Hazzard” had a considerable financial impact for those involved.

Does John Schneider get royalties from the Dukes of Hazzard?

While specific information on royalties and residual income from “The Dukes of Hazzard” is not publicly available, it’s not uncommon for actors in successful television shows to receive residual payments for reruns, syndication, and distribution.

As the show continues to be a beloved classic with a dedicated fan base, it’s possible that John Schneider and other cast members may receive royalties from the continued airing and distribution of “The Dukes of Hazzard.”

John Schneider’s wife

John Schneider was married to Alicia Allain, a talented filmmaker and music producer. The couple had a strong bond and worked together on multiple projects. Tragically, Alicia Allain passed away in 2023 after a battle with breast cancer. John paid tribute to his late wife and expressed his deep love and admiration for her.

She was remembered as a loving and supportive partner and a creative and passionate individual.

Who is John Schneider married to now?

As of 2024, John Schneider is widowed, having lost his beloved wife, Alicia Allain. He has not remarried since her passing, and he continues to honor her memory through his work and dedication to their shared passions.

How many kids does John Schneider have?

John Schneider is a proud father of four children. He has one biological daughter, Karis Schneider, whom he shares with his ex-wife, Elly Castle.

In addition to Karis, he became a father to Elly’s three children from her previous relationship—Mandy, Leah, and Chasen. John considers all four children as his own and has embraced the joys and challenges of fatherhood.

John Schneider Biography

Early Life

Born on April 8, 1960, in Mount Kisco, New York, John Richard Schneider developed an early interest in the arts. His passion for performing and storytelling paved the way for a dynamic career in the entertainment industry.

Acting Career

John Schneider’s career took off in 1979 when he landed the iconic role of Bo Duke in “The Dukes of Hazzard,” which brought him widespread recognition. Over the years, he has appeared in various films and TV shows, including “Smallville” and “The Haves and the Have Nots.”

Schneider is not only a skilled actor but also a successful country music singer, screenwriter, film producer, and director. He has actively pursued a career in music, releasing several albums and singles.

Personal Life

John Schneider’s love for country music extends beyond his professional career, as he enjoys performing and writing songs. Additionally, he is a passionate filmmaker and producer, and he operates John Schneider Studios in Louisiana, a hub for independent filmmakers and creatives.

Divorce and Financial Problems

John Schneider has experienced both personal and financial challenges. He went through a public divorce from his ex-wife, Elly Castle, which was accompanied by legal and financial struggles. Schneider’s openness about these challenges has resonated with fans and allowed him to connect with others who have faced similar hardships.

Before you go

If you want to keep educating yourself about personal finance, you must check out these posts as well:

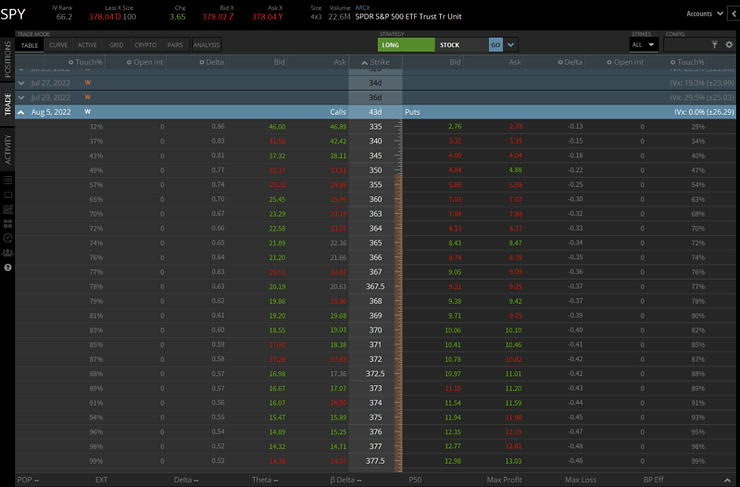

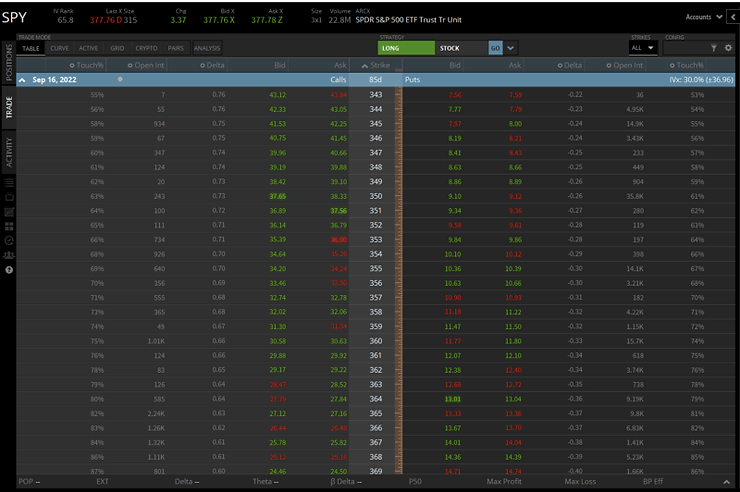

What is the Most Successful Options Strategy

Options Trading for Income: The Complete Guide

Mark Minervini’s Trading Strategy: 8 Key Takeaways

The Best Options Trading Books

The Best Laptops and Computers for Trading