The Wheel Strategy Explained | 3 Things You Must Know

The wheel strategy, also known as the triple income strategy, is a consistent way to generate income on the stock market. The wheel combines trading options with stocks to outperform the classic buy-and-hold investing strategy.

What is the Wheel Strategy

The wheel options strategy is a method that combines the cash-secured put and the covered call. The wheel strategy is a bullish trade, meaning it will make money if the stock you pick moves up.

Cash Secured Puts

A cash-secured put is an options trading strategy that allows you to purchase shares of stock at a discount. When you sell a put option, you promise to buy 100 shares at the strike price of the put option you sold. In exchange for taking on the obligation to purchase shares, you receive a cash premium, similar to a dividend.

Covered Calls

A covered call is an options trading strategy that allows you to get paid a premium for promising to sell your shares of stock. Instead of selling your shares on the open market, you can sell a covered call and receive an extra premium for selling your shares.

Covered calls are also a fantastic hedge for your investment portfolio since they provide income when stocks decrease in price or stay flat. In addition, you can collect cash payments from option premiums and dividends if you sell a covered call on a stock that pays a dividend.

The Wheel Strategy Explained

The triple income strategy is composed of just three simple steps to follow. Regardless of your skill level, the wheel strategy is not complex and is a great way to generate income on the stock market.

1- Sell cash secured puts until you are assigned.

To start the wheel options strategy, you must pick a stock you wouldn’t mind owning and sell a cash secured put on it.

Then, continue selling puts until you get assigned stock. If the option expires before you get assigned, simply sell another one.

2- Sell covered calls until you are assigned.

Once you have 100 or more shares of the stock, you will sell covered calls on them until you get assigned again. When you get assigned on a covered call, the shares will automatically get removed from your account, and you will keep the premium as income.

3- Restart the wheel strategy by selling another cash secured put.

Now that you have completed the wheel and have no shares in your account, you can repeat the same steps. The goal of the wheel strategy is to generate income from the options you are selling. Any capital gains you make from the stock are just a bonus.

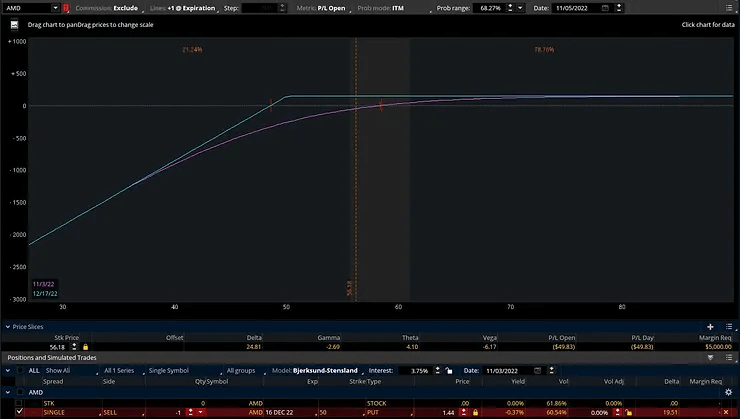

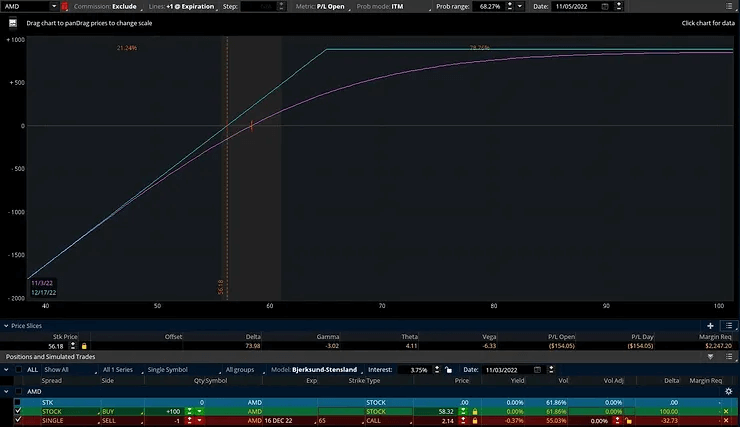

Cash Secured Puts and Covered Calls are the Same Thing

As you can see in the risk diagrams above, there is no difference between a covered call and a cash secured put.

Buying 100 shares and selling a $50 strike call is the same as simply selling a $50 strike put. However, the wheel strategy is great because it is a systematic way to combine these two effective strategies.

Wheel Strategy Example

Let’s say stock XYZ is trading at $100 per share. You are bullish on the stock and wouldn’t mind owning it at this price, so you decide to start the wheel by selling a put.

- Sell -1 $90 strike put for $100 in premium

After you sold the $90 strike put, the stock tanked to $80, so you got assigned and received your $100 premium. Therefore, you currently own the shares at $89 per share, including the premium.

- Sell -1 $100 strike call option for $100 in premium

The next move you make is selling a covered call with a strike price above your $89 cost basis at the $100 strike. If you pick a strike price for the covered call below your cost basis, you could be forced to sell at a loss.

After you sell the $100 strike call, the stock rises to $110 per share, and you are called away. The shares automatically get sold at the strike price of $100, and you keep the $100 premium.

Therefore, this trade generated a profit of $1,200. In addition, you made $1,000 from buying the shares at $90 and selling them at $100. Additionally, you collected a total of $200 premium.

4 Things to Know About the Wheel Strategy

- Only trade stocks you are willing to hold forever.

If you pick a stock only because it has high option premiums, you may feel inclined to sell at a loss if the stock price declines. If you do not want to pick individual stocks, you can utilize the wheel strategy on ETFs like SPY.

- Keep track of your cost basis.

When you are selling options, you will collect a lot of option premiums. Therefore, you should keep track of all the premiums you collect and subtract them from your cost basis when you are assigned shares.

For example, if you sell a $100 strike put for $0.50 ($50) in premium and get assigned, you will own 100 shares at $99.50 per share instead of $100 per share. You must add the premiums you collect and subtract them from the price you own the shares to determine your actual cost basis. In this case, you would do $100 – $0.50 to get your cost basis of $99.50.

- Only sell covered calls at or above your cost basis.

If you own shares of a stock at $99.50 and sell a $90 strike call option, you risk selling the stock at a loss. However, if the stock is trading at a much lower price than your cost basis, it may be best to hold it until it goes higher.

Worst case, you can bite the bullet and accept that you may need to take a loss. However, if you are okay with holding the stock forever, you can be patient and wait for it to recover.

- Trade with a reliable broker

Commission free brokerages like Robinhood may be appealing due to the low fees, but they are not a good choice for options trading. Brokers like tastytrade and thinkorsiwm will give you better fill prices and do not exercise options early like Robinhood.

Ultimately, the choice is up to you, but tastytrade has a great desktop platform and mobile app. Additionally, the requirements to get a margin account on tastytrade are much lower, making it much more option-friendly.

If you are an options trader, signing up for tastytrade is probably the best bet overall, as it is much newer than thinkorswim.

The Best Stocks for the Wheel Strategy

To start trading the wheel options strategy, you must find stocks you can afford to trade. Since options require you to trade 100 shares at a time, you will be limited if you have a smaller trading account.

For example, if you have a $5,000 trading account, you can only sell puts on stocks and ETFs that are $50 per share or less. You can get around this if you have a margin account, but as a beginner, it is best to stay away from leverage until you have more experience.

Best Stocks to Wheel Under $50

A reminder that this is not financial advice, and I am only providing these stocks to show you an example of companies that trade for less than $50 per share.

- Bank of America ($BAC)

- Intel ($INTC)

- Financial Sector ETF ($XLF)

- Coca-Cola ($KO)

- Kroger ($KR)

- Walgreens ($WBA)

- Ford ($F)

Bottom Line: The Wheel Strategy

While the wheel strategy looks impressive in theory, there are always pros and cons to any system on the stock market. One of the downsides of the wheel strategy is when the stock you are trading increases in value rapidly.

You will still make money when the stock moves up, but you would make more if you simply owned 100 shares of stock. Additionally, if you get assigned on a stock, and it drops hard, you may not be able to sell covered calls above your cost basis.

You must understand implied volatility when trading options because it will determine how expensive options are trading for.

Before you go

If you want to keep educating yourself about personal finance, you must check out these posts as well:

What is the Most Successful Options Strategy

Options Trading for Income: The Complete Guide

Mark Minervini’s Trading Strategy: 8 Key Takeaways

The Best Options Trading Books

The Best Laptops and Computers for Trading

How to Get a TradingView Free Trial

The Best TradingView Indicators

The Best Keyboards For Trading

Get Your Free Trading Resources

Grab the free trading journal template plus the same tools we use to stay organized, consistent, and objective.

- Free trading journal template

- Custom indicators, watchlists, and scanners

- Access our free trading community

Enter your email below to get instant access.

No spam. Unsubscribe anytime.