What is a Poor Man’s Covered Call?

The poor man’s covered call strategy (PMCC) is a fantastic method if you want to trade options for income with minimal capital requirements. The PMCC strategy is a bullish trade; therefore, you should use this strategy when you believe an underlying stock will increase in price.

Selling Covered Calls

The traditional covered call strategy involves owning 100 shares of stock and then selling a call option against them to collect a premium. You simply promise to sell your shares to the call buyer for a cash premium.

However, 100 shares of some stocks are a big chunk of change. Therefore, the poor man’s covered call is an excellent alternative if you want to trade a similar strategy with much less money.

How to Enter a Poor Man’s Covered Call (PMCC)

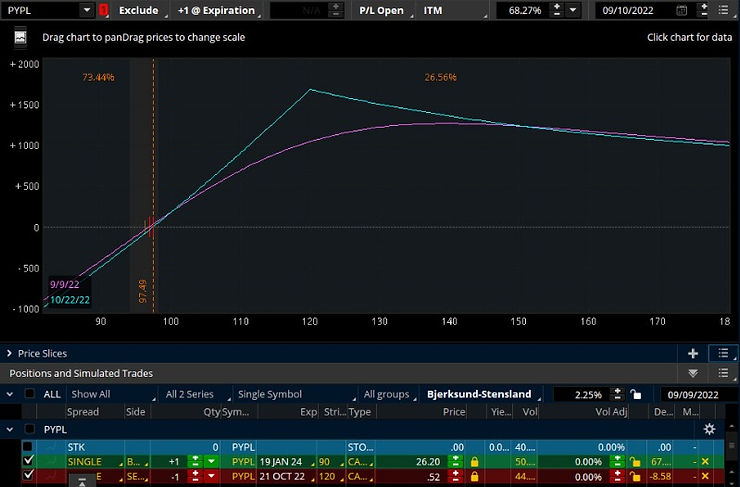

You can construct the PMCC strategy by purchasing a deep ITM (in the money) call and selling a shorter dated OTM (out of the money) call against it.

Many traders buy the long call with 300+ days until expiration (DTE) with a delta of 70 or higher. The delta determines how many shares the call option currently simulates, meaning a 70 delta call option is like owning 70 shares.

The short call can be within any expiration date shorter than the long one. However, option selling educators like Tastytrade prefer to sell options with an expiration of around 45 days until expiration (DTE). Tastytrade conducts various backtests and concludes that 45 DTE is the optimal timeframe to sell options.

How to Calculate Max Profit / Breakeven

The most important part of setting up a poor man’s covered call is ensuring you do not have any upside risk. If the call option you sell is not high enough, it may limit your profit when the stock moves up.

The rule you must follow is to make sure the width of your two strike prices is larger than the debit you pay. Let’s take a look at an example in the image below.

In the image above, we have created an order to purchase the 280 strike SPY call and sell the 400 strike call with a shorter expiration. The difference between these strikes is 120.

The debit we must pay for this PMCC is 114.53, meaning there is no upside risk. You can also tell on the risk diagram that if the stock continues up, there is no chance of losing money. The breakeven is shown on the chart as well at 370.91.

However, it is impossible to compute an exact breakeven price of this strategy since many factors will change daily.

Poor Man’s Covered Call Example

To clarify the PMCC strategy, let’s look at a hypothetical example. We will pretend that stock XYZ is trading at $100 per share, and you believe it will increase to $115 per share in the next two months.

PMCC example:

- Buy +1 $90 strike call option for $20.00 ($2,000) at 500 DTE

- Sell -1 $120 strike call option for $0.50 ($50) at 45 DTE

If you are correct in your assumption, and stock XYZ rises to $115 in 45 days, you will make money on both call options.

The $90 strike call option you purchased will go from about $20.00 to about $35.00, while the $120 call option you sold will expire worthless, allowing you to keep the $50 premium as income.

Poor Man’s Covered Call Risks

The PMCC strategy is a fantastic strategy when you are right. However, if you are wrong, you must understand the risks involved. A few scenarios can happen that will make you lose money with a PMCC strategy.

1- Stock XYZ falls to $50 per share

If stock XYZ falls after you enter a PMCC, you will lose money on the $90 strike long call option. Since the stock is below the strike price, there is no more intrinsic value, meaning the option can go to $0 if you hold it until expiration. You will still make the $50 from the call you sold, but this only covers a fraction of the losses incurred from the $90 strike call option.

2- Stock XYZ goes sideways

If stock XYZ doesn’t move, you will watch your long call option slowly bleed due to time decay (theta). You will make a little bit of money from the $120 call option that you sold, but you will likely lose more on the $90 call option.

Poor Man’s Covered Call vs. Covered Call

A regular covered call involves purchasing 100 shares of stock and selling a call against them. In comparison, a PMCC is when you buy a call option instead of 100 shares and sell a call option against the long call option.

The benefit of using the PMCC over the traditional covered call is that you need much less capital. If you are using a smaller trading account, you may not be able to afford 100 shares, making the PMCC a better method.

However, the benefit of the traditional covered call strategy is that equity does not come with an expiration date. You can hold shares of stock forever with no worries, but call options will eventually expire.

Therefore, if the stock does not increase before expiration, you may lose all of your investment with a PMCC strategy. You can buy to close the short call before expiration to lock in profits, but there is never a guarantee to make a profit.

Alternative Strategies to Consider

Another strategy to consider other than the poor man’s covered call is the wheel strategy, cash-secured puts, and covered calls. These three strategies are safer because you hold shares rather than a long call option.

Call options can expire worthless, but you can hold a stock forever. If the trade goes sideways, you will be much better off if you are trading a covered call rather than a poor man’s covered call.

PMCC Strategy: Bottom Line

The PMCC strategy can make you a lot of money if the underlying stock moves up for you. Additionally, you can use the strategy with small accounts since you don’t need to purchase 100 shares of stock like a traditional covered call strategy.

Overall, the traditional covered call strategy is safer since you can hold the shares forever without worrying about them expiring. The conventional covered call is safer but requires more capital which is the tradeoff.

The PMCC options strategy is beneficial because you can utilize it with little capital and take advantage of leverage. For example, if you use margin to buy stocks, you will pay margin interest, while options give you leverage for free in exchange for an expiration date.

This article contains affiliate links I may be compensated for if you click them.

Get Your Free Trading Resources

Grab the free trading journal template plus the same tools we use to stay organized, consistent, and objective.

- Free trading journal template

- Custom indicators, watchlists, and scanners

- Access our free trading community

Enter your email below to get instant access.

No spam. Unsubscribe anytime.