TC2000 vs Trade Ideas: Which Platform Fits Your Trading Style?

TC2000 and Trade Ideas are both popular platforms among active traders, but they are built for very different purposes. One focuses on charting and execution within a brokerage environment, while the other is a pure scanning and idea generation engine designed for speed.

In this guide, we compare TC2000 and Trade Ideas across pricing, features, data access, and ideal use cases so you can decide which platform makes sense for how you trade.

Quick Takeaways

- TC2000 blends charting with brokerage execution, but charges commissions and monthly platform fees

- Trade Ideas is a pure idea generation platform, built around real-time scanning and AI-driven alerts

- Your trading timeframe matters: swing traders may prefer TC2000, while day traders often lean toward Trade Ideas

- All-in-one charting and trading platform

- Integrated stock and options execution

- Core technical indicators included

- Real-time AI powered stock scanning

- Momentum and volatility alerts

- Built for active day traders

Overview of TC2000

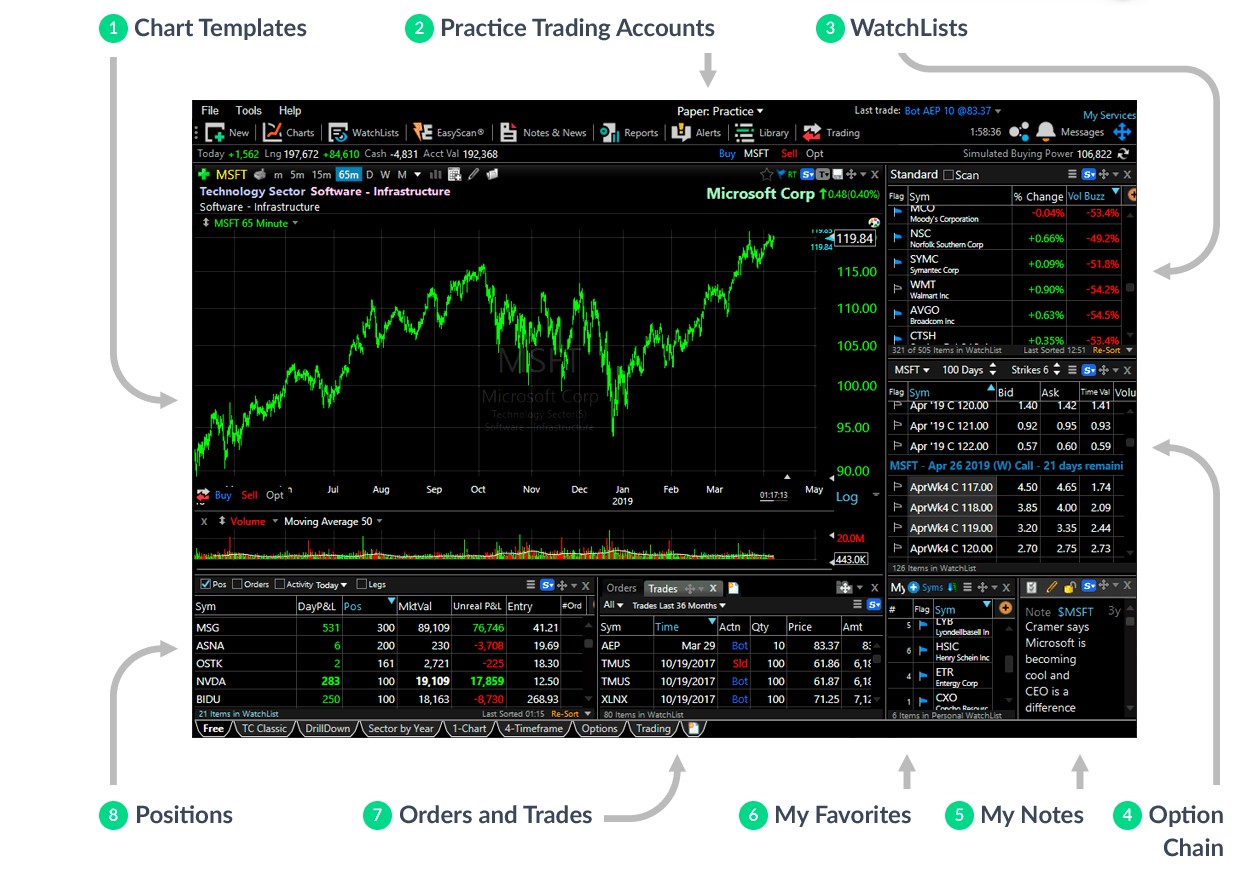

TC2000 is a charting and trading platform that combines technical analysis tools with built-in brokerage functionality. It supports stocks, ETFs, and options, and includes features like scanning, options chains, and basic volume-based indicators.

While TC2000’s charting engine is solid, it is no longer the low-cost option it once was. Traders must pay a monthly platform fee and still incur commissions on stock and options trades, which puts it at a disadvantage compared to modern commission-free brokers.

Key strengths of TC2000

- Clean and responsive charting interface

- Integrated brokerage for stocks and options

- Includes basic indicators like volume profile

TC2000 is Best For

TC2000 works best for swing traders and position traders who want charts, scanning, and execution inside a single desktop platform and are comfortable paying for convenience. If your primary goal is charting only, platforms like TradingView often provide more flexibility at a lower cost. TradingView since most of its features are free to use.

Overview of Trade Ideas

Trade Ideas is a professional-grade stock scanning and market intelligence platform. It is not a brokerage and does not support trade execution. Instead, it focuses entirely on identifying opportunities in real time.

The platform continuously scans the market for unusual activity such as breakouts, momentum shifts, volume spikes, and gap moves. Its AI engine, Holly, generates statistically driven trade ideas throughout the trading day, making it especially appealing to active day traders.

Key strengths of Trade Ideas

- Real-time AI-powered stock scanning

- Advanced filters for momentum and volatility

- Designed specifically for intraday traders

Trade Ideas is Best For

Trade Ideas is best suited for day traders and momentum traders who need fast, actionable alerts and are willing to pay a premium for speed and signal quality. It is less useful for long-term investors or traders who only need basic screening tools.

Platform Capabilities Compared

Platform Scope and Market Access

| Platform | Platform Type | Tradable Markets |

|---|---|---|

| TC2000 | Brokerage + charting platform | Stocks, ETFs, options |

| Trade Ideas | Scanning and analytics platform | Stocks, ETFs (analysis only) |

Trade Ideas does not execute trades, while TC2000 allows you to trade directly from the platform.

Charting and Data Access

| Platform | Charting Features | Market Data |

|---|---|---|

| TC2000 | Desktop charting with core indicators | Requires paid real-time data |

| Trade Ideas | Web and desktop charts plus heatmaps | Real-time data included |

Trade Ideas includes real-time data with its subscription, while TC2000 requires additional costs to unlock full data access.

Trading Features and Account Tools

| Feature | TC2000 | Trade Ideas |

|---|---|---|

| Margin trading | Yes | Not applicable |

| DRIP | No | Not applicable |

| SIPC insurance | Yes | Not a broker |

| Mobile app | Yes | No |

Costs and Fees Compared

| Fee Type | TC2000 | Trade Ideas |

|---|---|---|

| Platform pricing | $8 to $50 per month | $89 to $179 per month |

| Equity commissions | $1 + $0.005 per share | Not supported |

| Options commissions | $1 + $0.65 per contract | Not supported |

| Real-time data | Extra cost | Included |

TC2000 is cheaper upfront, but costs can add up once commissions and data fees are included. Trade Ideas is expensive, but pricing is all-in.

TC2000 vs Trade Ideas: Final Verdict

The decision between TC2000 and Trade Ideas comes down to how you find trades.

- Choose TC2000 if you want charting, scanning, and execution in one platform and primarily swing trade stocks or options

- Choose Trade Ideas if you are an active day trader who relies on real-time momentum scans and AI-driven alerts

They are not direct replacements for each other and are often used together, with Trade Ideas for idea generation and another platform for execution.

Related Trading Platform Comparisons

Get Your Free Trading Resources

Grab the free trading journal template plus the same tools we use to stay organized, consistent, and objective.

- Free trading journal template

- Custom indicators, watchlists, and scanners

- Access our free trading community

Enter your email below to get instant access.

No spam. Unsubscribe anytime.