What is a Cash-Secured Put? | Cash-Secured Put Strategy

Cash-secured puts are one of the best ways to learn about options trading.

What is a Cash-Secured Put?

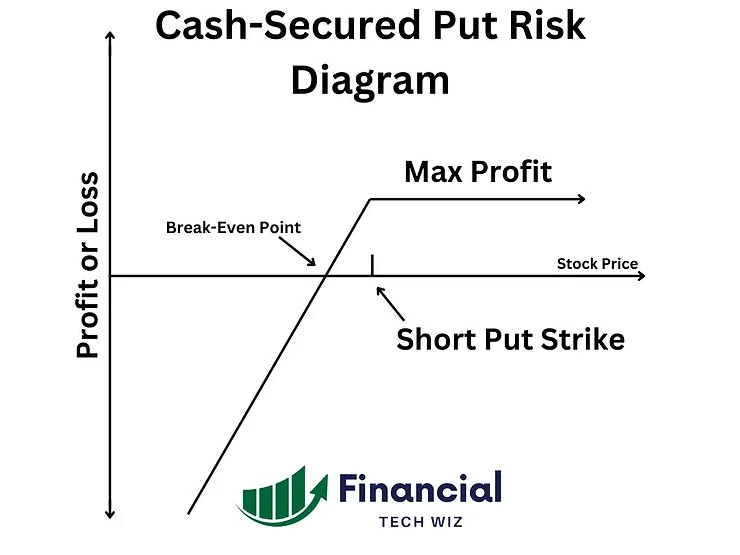

A cash-secured put involves selling a put option and holding cash equivalent to the option’s strike price. If the stock’s price falls below the strike price, the investor is obligated to buy the stock, hence the need for reserved cash.

The cash-secured put (CSP) strategy is simple to understand because you are just promising to buy shares of stock at a specific price. If you know how to buy 100 shares of stock, you essentially understand how a cash-secured put works.

The only difference is that when you sell a put, you collect a cash premium in exchange for your promise to buy 100 shares.

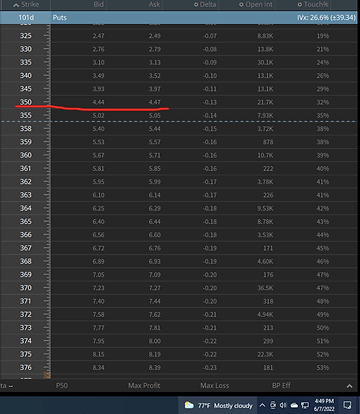

Using the above options chain on SPY as an example, if you promise to buy SPY shares at 350/share by selling a cash-secured put, you will also be paid a 4.45 per share premium, or $445.

Potential Outcomes With Cash-Secured Puts

- Stock Price Stays Above Strike Price: If the stock price remains above the strike price until the expiration of the option, the put option will expire worthless. The seller keeps the $445 premium received for selling the put as profit.

- Stock Price Falls Below Strike Price: If the SPY falls below the 350 strike price, the seller might be obligated to buy the stock at the strike price, which is higher than the current market price. However, since the put was cash-secured, the seller already has the funds set aside for this purchase.

Upon assignment, you will see 100 shares of SPY and a cash balance of $445, not including commissions, in your account. This sounds great now, but if SPY is trading at 300 when this happens, you will be down $5,000 on the shares.

Why the cash-secured put strategy is excellent for beginners

While options trading may seem daunting to new investors, cash-secured puts are a great way to start learning.

The worst-case scenario with a cash-secured put is the ownership of the stock. You can hold a stock forever, and there is a good chance it won’t go to 0. Selling cash-secured puts on ETFs like $SPY is especially safe because you are investing in a basket of stocks.

If you get assigned shares of a stock you sell a put on, you can even sell covered calls against the 100 shares. The process of being assigned on a cash-secured put and then selling covered calls is called the wheel strategy.

If you are buying options, you should know that they will lose value each day due to the nearing of the expiration date. The time decay effect is called theta.

If you own an options contract and take it to expiration, there is a chance you will lose all of your money. If the option is out of the money (OTM) at expiration, it will expire worthless at 0. This is why it can be dangerous for beginners to buy options for swing trading.

Example of a Cash-Secured Put

The cash-secured put strategy is easy to understand if we examine an example. Let’s say the stock $MSFT is trading at $200 per share. You can promise to buy 100 shares of it at $180 per share and collect a premium by selling a cash-secured put with a strike price of $180.

If $MSFT stays above your strike price of $180 at expiration, you will keep the premium and not have to buy the shares. However, if $MSFT falls below your strike price of $180, you may have to purchase 100 shares of $MSFT at $180 per share and still keep the premium.

Benefits of Using Cash Secured Puts

– Lower Risk Compared to Other Options Strategies

One of the main advantages is the reduced risk, especially when compared to buying naked call options. The risk is lower because you receive shares in the worst case, whereas calls can go to 0.

– Income Generation Potential

Selling put options generates immediate income in the form of premiums, making this an attractive strategy for income-focused investors.

Cash-Secured Put Strategy vs. Buying a Call

Buying a call option and selling a cash-secured put are similar trades, but they have critical differences. Buying a call option is a speculative bet that a stock will increase in price before the expiration date.

On the other hand, a cash-secured put is a promise to buy shares of stock. The critical difference is that shares of stock do not expire, while the call option does. Therefore, if the stock does not rise before the expiration you pick, you can lose all of your money as the buyer of a call option.

Bottom line | Cash Secured Put Strategy

Selling cash-secured puts is probably the most successful options trading strategy. If you manage your risk and are trading a strategy with a positive EV, you should make a profit over many occurrences.

The cash-secured put strategy is not any riskier than purchasing 100 shares of stock. Selling puts is only risky if you use margin and sell more puts than you can afford. If you are using margin and the stock market crashes, you may be forced to close your options at a loss and won’t have enough capital to accept assignment.

Cash-secured puts are the first step to the options wheel strategy. Once you are assigned 100 shares from a cash-secured put, you will sell a covered call to complete the wheel strategy.

Before you go

If you want to keep educating yourself about personal finance and discover other deals on Amazon, you must check out these posts as well: This article contains affiliate links I may be compensated for if you click them.

What is the Most Successful Options Strategy

Options Trading for Income: The Complete Guide

Mark Minervini’s Trading Strategy: 8 Key Takeaways

The Best Options Trading Books

– Free trading journal template

– Custom indicators, watchlists, & scanners

– Access our free trading community