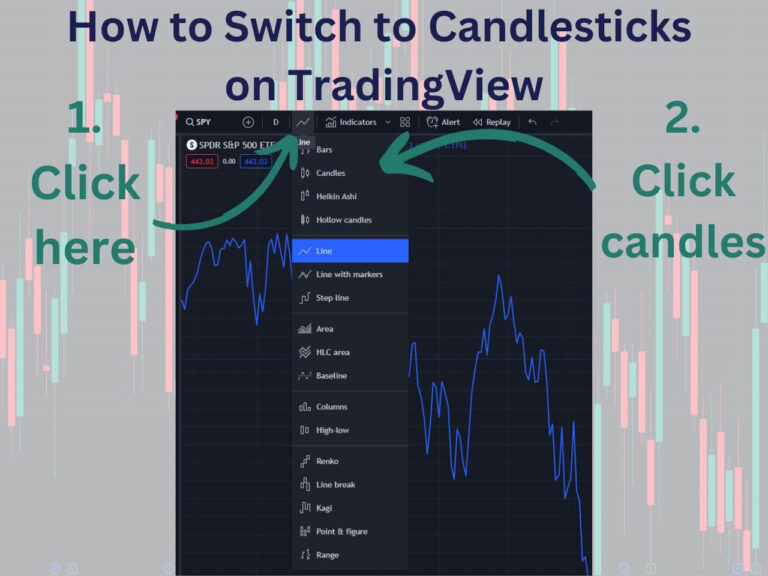

How to Get Candlesticks on TradingView: A Comprehensive Guide

Candlestick patterns are powerful tools for traders and investors looking to analyze price movements and make informed trading decisions. However, there are times when you may find that candlesticks have disappeared from your TradingView chart. In this article, we’ll explore what candlestick patterns are, how to get them on TradingView, and how to unhide them…