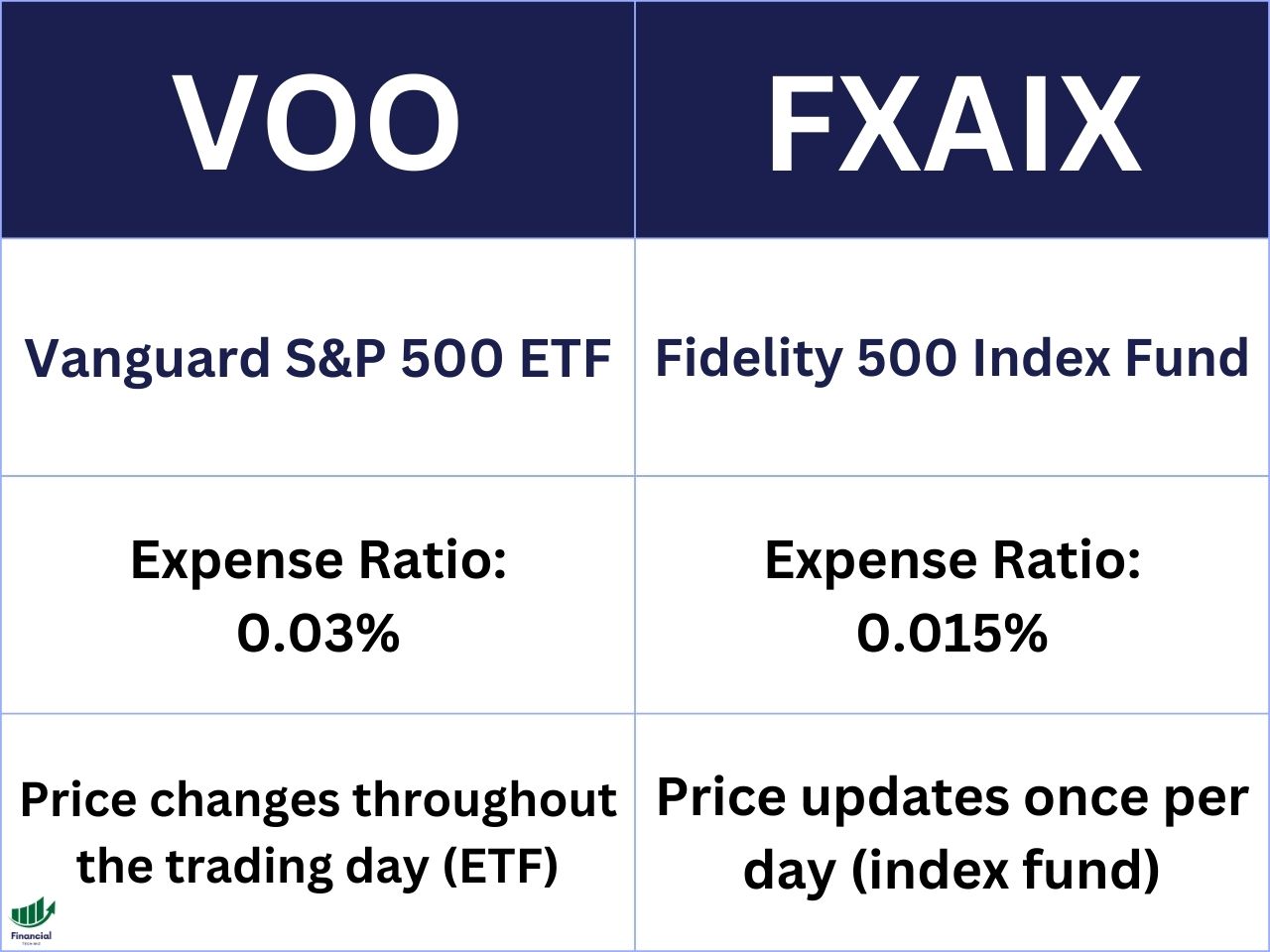

Two of the most popular funds that track the S&P 500 are the Fidelity 500 Index Fund (FXAIX) and the Vanguard S&P 500 ETF (VOO). Both funds aim to replicate the performance of the index by holding the same stocks in the same proportions.

But which fund is better for investors who want to invest in the S&P 500? Let’s compare FXAIX vs. VOO on several key factors and see how they stack up.

Overview of FXAIX and VOO

FXAIX is a mutual fund that was launched by Fidelity in 1988. It has an expense ratio of 0.015%, which is one of the lowest among mutual funds. It has over $300 billion in assets under management (AUM).

VOO is an exchange-traded fund (ETF) that was launched by Vanguard in 2010. It has an expense ratio of 0.03%, which is also very low among ETFs. It has over $800 billion in AUM.

As you can see in the image above, both VOO and FXAIX provide similar returns. If you want to compare the performance of other stocks and ETFs, you can sign up for a free TradingView account to view the returns of multiple stocks and ETFs on a single chart.

You can even adjust the returns to include dividends, making TradingView the best way to compare the returns of various stocks. When you use my link above, new users can also get a free trial and a discount on their upgraded membership.

FXAIX vs. VOO Dividend Yield

| Fund | Dividend Yield |

| FXAIX | 1.52% |

| VOO | 1.53% |

Both FXAIX and VOO pay dividends to their shareholders from the earnings of their underlying stocks.

FXAIX has a dividend yield of 1.52%, while VOO has a dividend yield of 1.53%. The difference between them is negligible and not a significant factor for choosing one over the other.

Both funds have similar dividend yields because they hold the same stocks that pay dividends.

FXAIX vs. VOO Expense Ratios

The expense ratio represents the drag on a fund’s performance that investors have to bear. Lower expense ratios mean higher returns for investors, all else being equal.

As mentioned earlier, FXAIX has an expense ratio of 0.015%, while VOO has an expense ratio of 0.03%.

| Fund | Expense Ratio | Annual Fee per $10,000 |

| FXAIX | 0.015% | $1.50 |

| VOO | 0.03% | $3 |

This means that for every $10,000 invested in FXAIX, investors pay $2 in fees per year, while for every $10,000 invested in VOO, investors pay $3 in fees per year. The difference between them is minimal and not likely to have a significant impact on their long-term performance.

FXAIX vs. VOO Performance

Both FXAIX and VOO track the same index, so their performance should be very similar, barring any tracking errors or deviations.

Looking at their historical performance over the past 5 years, FXAIX and VOO had a total return of about 75%.

FXAIX vs. VOO Holdings

Holdings are the individual stocks that make up a fund’s portfolio. They determine the fund’s exposure to different sectors, industries, and market segments. Both FXAIX and VOO hold essentially the same stocks that constitute the S&P 500 index, with the same weights and proportions.

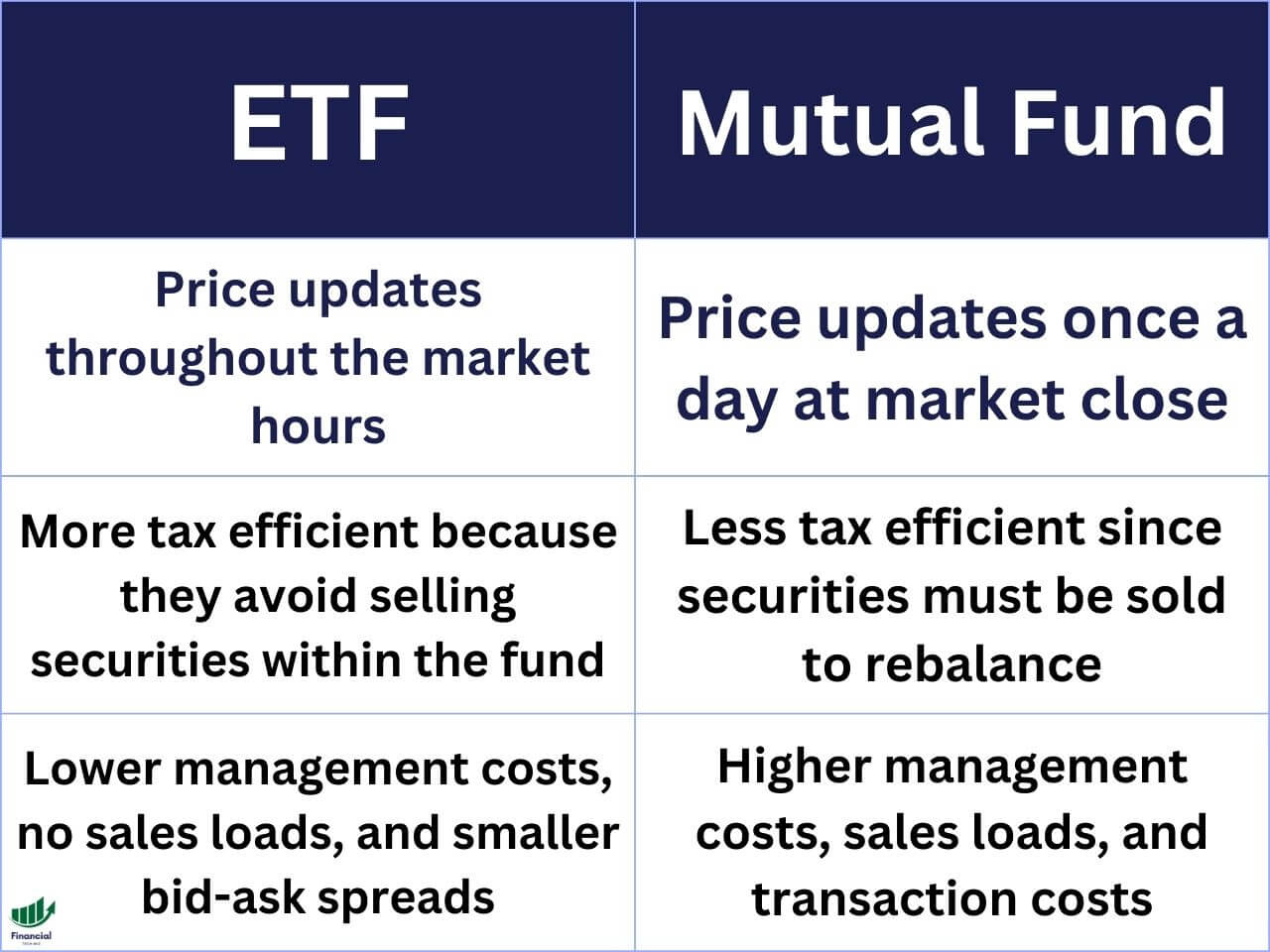

Mutual Funds vs. ETFs

One of the main differences between FXAIX and VOO is that FXAIX is a mutual fund, while VOO is an ETF. ETFs are much easier to actively trade, while mutual funds usually only update once per day.

Mutual funds are pooled investment vehicles that are managed by a fund company or an investment advisor. They issue and redeem shares directly to investors at the end of each trading day based on their net asset value (NAV). Investors can buy and sell mutual fund shares through the fund company or a broker.

ETFs are also pooled investment vehicles that are managed by a fund company or an investment advisor. However, they trade like stocks on an exchange throughout the trading day at market prices that may differ from their NAV. Investors can buy and sell ETF shares through a broker.

Some of the advantages and disadvantages of mutual funds vs ETFs are:

- Mutual funds may offer more convenience and flexibility for investors who want to invest a fixed amount of money or set up automatic investments or withdrawals.

- Mutual funds may require a larger minimum investment.

- ETFs may incur bid-ask spreads and premiums or discounts to their NAV, which can affect their trading efficiency and performance.

- Mutual funds may be less tax-efficient than ETFs, as they may distribute more capital gains to their shareholders due to their redemption mechanism.

- ETFs may be more tax-efficient than mutual funds, as they may avoid realizing capital gains through their creation and redemption mechanism.

Comparing ETFs With TradingView

When comparing ETFs, it is crucial that you are comparing the total return to include dividend payments. TradingView allows you to compare several stocks and ETFs at once on a single chart adjusted for dividends.

You can simply sign up for a free TradingView account and type the stock ticker you want to compare. Next, click the plus sign next to the ticker at the top left of the chart to add symbols to compare.

Finally, ensure you click the ‘ADJ’ at the bottom to adjust the returns for dividends!

As you can see in the TradingView chart below, you can compare multiple funds and ETFs on a single chart, making your research much easier. Feel free to compare any ETFs you’d like using the widget.

FXAIX vs VOO: Bottom Line

FXAIX and VOO are both excellent choices for investors who want to invest in the S&P 500 index with low costs.

The main difference between them is that FXAIX is a mutual fund, while VOO is an ETF. This means that they have different implications for investors in terms of transaction costs, tax efficiency, tradability, and convenience.

Ultimately, the choice between FXAIX vs VOO depends on the investor’s personal preferences, goals, and circumstances. There is no clear winner or loser between these two funds, as they both offer exposure to the same index with minimal differences.

You can also consider my other comparison articles as part of your research, including VOO vs. SCHD, VOO vs. SPY, JEPI vs. JEPQ, VTI vs. VOO, and JEPI vs. SCHD.

The Financial Tech Wiz ETF Comparison Tool

You can use the ETF comparison tool below to compare over 2,000 ETFs and mutual funds with data I manually collected:

FAQ

What is Fidelity’s equivalent to VOO?

Fidelity’s equivalent to VOO is the Fidelity 500 Index Fund (FXAIX). FXAIX is a mutual fund that tracks the S&P 500 index, just like VOO. It has the same holdings, performance, dividends, and risk profile as VOO. It also has a slightly lower expense ratio of 0.015%, compared to VOO’s 0.03%.

Does FXAIX track the S&P 500?

Yes, FXAIX tracks the S&P 500 index, which is a large-cap index of 500 stocks from leading companies in various industries and sectors. FXAIX aims to replicate the performance of the index by holding the same stocks in the same proportions.

Is FXAIX an index fund or ETF?

FXAIX is an index fund, which is a type of mutual fund that passively follows a specific market index, such as the S&P 500. FXAIX is not an ETF, which is a type of fund that trades like a stock on an exchange throughout the trading day.

What is the Vanguard equivalent to FXAIX?

The Vanguard equivalent to FXAIX is the Vanguard S&P 500 ETF (VOO). VOO is an ETF that tracks the S&P 500 index, just like FXAIX. It has the same holdings, performance, dividends, and risk profile as FXAIX. It also has a very low expense ratio of 0.03%.

What is Fidelity S&P 500 called?

Fidelity S&P 500 is called the Fidelity 500 Index Fund (FXAIX). It is one of the largest and most popular index funds that track the S&P 500 index.

Is Vanguard or Fidelity better for ETFs?

Both Vanguard and Fidelity offer high-quality ETFs with low costs and high returns. The choice between them is simply a choice of which is easiest to buy on your brokerage.

Before you go

If you want to keep educating yourself about personal finance, you must check out these posts as well:

What is the Most Successful Options Strategy

Options Trading for Income: The Complete Guide

Mark Minervini's Trading Strategy: 8 Key Takeaways

The Best Options Trading Books

The Best Laptops and Computers for Trading