Interactive Brokers vs. TradingView Compared & Integration Details

Choosing between Interactive Brokers and TradingView can significantly impact your trading success, whether you’re an experienced trader or just starting out. This detailed comparison examines pricing, features, and integration capabilities to help you determine which platform best fits your needs. We’ve compiled key data from across the web to make your research easier.

Key Takeaways

- TradingView integrates with Interactive Brokers – You can chart on TradingView and execute trades directly through your IBKR account.

- Different platforms, different purposes – Interactive Brokers is a brokerage for trade execution, while TradingView is a charting and analysis platform.

- Pricing differs significantly – Interactive Brokers charges per-trade commissions with no platform fees, while TradingView uses a subscription model ($0-$60/month).

- Low-cost trading: $0.65 per options contract

- Global market access across 150+ markets

- Integrates directly with TradingView charts

- Advanced charting with broker integration

- Alert-based strategies and indicators

- Free plan available, premium from $12/month

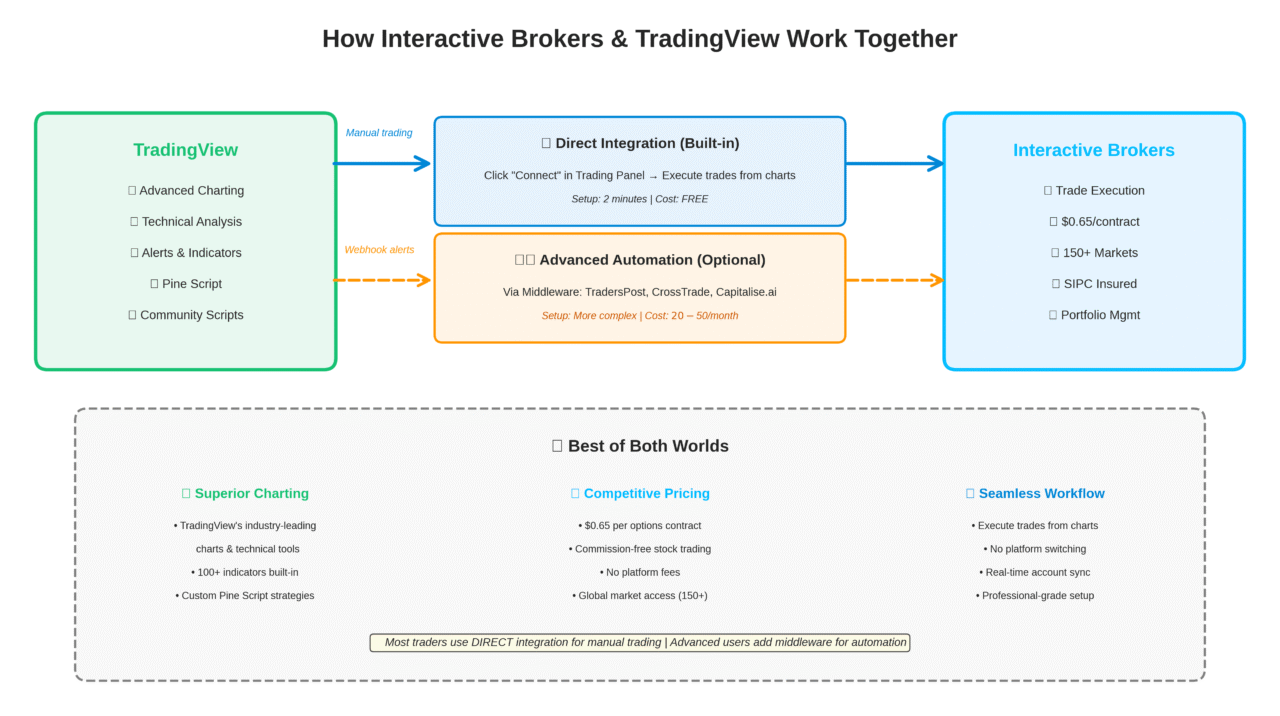

HOW INTERACTIVE BROKERS AND TRADINGVIEW WORK TOGETHER

One of the most powerful aspects of this comparison is that Interactive Brokers and TradingView aren’t mutually exclusive—they integrate directly with each other. This means you can use TradingView’s advanced charting and analysis tools while executing trades through your Interactive Brokers account, combining the strengths of both platforms.

Direct Integration Benefits

When you connect Interactive Brokers to TradingView, you can execute orders with just a few clicks directly from TradingView’s charts. This eliminates the need to switch between platforms and reduces the risk of missed trades or execution errors.

How to Connect the Platforms

The connection process is straightforward: go to TradingView’s website, open the Trading Panel tab, click the Interactive Brokers logo, and select “Connect.” You’ll be prompted to log in to your Interactive Brokers account and choose between live trading or paper trading. Once connected, you’ll see your Interactive Brokers account details and real-time trading stats displayed directly below your TradingView charts, marked with a green indicator.

Advanced Automation Options

For traders interested in automation, TradingView alerts can trigger automated trading strategies, though this requires third-party middleware services like TradersPost, CrossTrade, or similar platforms ($20-$50/month typically). These services bridge TradingView’s webhook alerts with Interactive Brokers’ API, enabling semi-automated or fully automated strategy execution. This setup is more technically complex but allows sophisticated traders to automate their trading rules while maintaining Interactive Brokers’ execution infrastructure.

Best of Both Worlds

This integration is ideal for traders who want Interactive Brokers’ competitive pricing ($0.65 per options contract, commission-free stock trading) and global market access across 150+ markets, combined with TradingView’s superior charting capabilities, community-made indicators, and Pine Script coding environment. You get professional-grade analysis tools without sacrificing execution quality or cost efficiency.

Overview of Interactive Brokers

Interactive Brokers (IBKR) is a well-established brokerage firm founded in 1978, known for providing advanced trading and investing services to a diverse clientele, including individual investors, institutions, and professional traders. IBKR offers competitive pricing for options and futures, but lacks when it comes to charting and ease of use.

✓ Advanced order types

✓ Best for automated trading

✓ Low options commissions

Interactive Brokers is Best For

Interactive Brokers is best for advanced traders who prefer to automate their trading strategies. IBKR is far from beginner-friendly, as the platforms are advanced and require some technical knowledge to utilize effectively. If you are looking for a modern, easy-to-use investing platform, IBKR is not your best option.

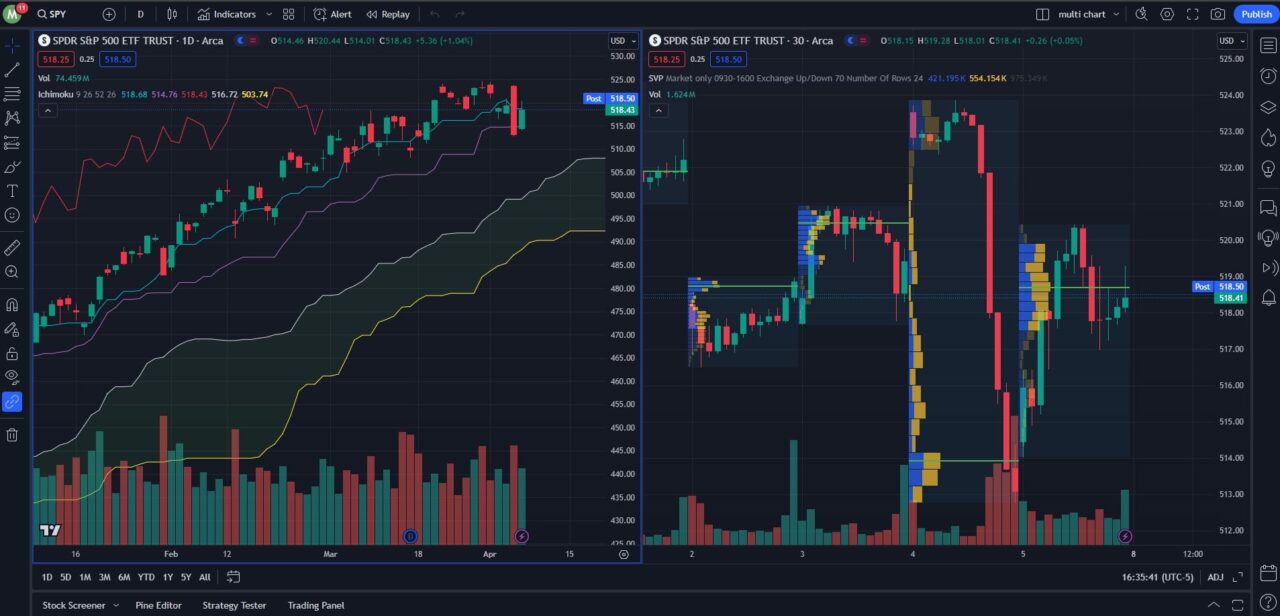

Overview of TradingView

TradingView is an advanced charting and social platform for traders. You can build custom indicators, backtest strategies, and utilize community scripts with its proprietary Pine Script coding language. TradingView is my top pick as the best overall charting platform, based on my experience of using nearly every trading and charting software available.

✓ Pricing: Free-$60/month

✓ Integrates with various brokers

✓ Best free charting software

TradingView is Best For

TradingView is best for traders and investors who want access to premium charting and community-made scripts. It provides everything you need to make informed trading decisions including screeners, heatmaps, economic calendars, plus you can integrate various brokers to trade directly from the charts.

PRICING AND COSTS COMPARISON

Understanding the cost structure of Interactive Brokers versus TradingView is crucial because they operate on fundamentally different pricing models. Interactive Brokers uses a traditional brokerage model where you pay per-trade commissions—$0.65 per options contract, and futures contracts at $0.85 commission plus exchange fees (totaling approximately $2.00-$2.50 per side for standard contracts like E-mini S&P 500). Stock trading is commission-free for U.S. exchange-listed equities. There are no monthly platform fees or subscription costs to access Interactive Brokers’ trading platforms. However, you must purchase real-time market data subscriptions separately if you want live quotes, which can add $5-$20+ monthly depending on which exchanges you need.

TradingView, on the other hand, operates on a subscription-based software model. The platform offers a free tier with basic charting capabilities, but premium plans range from $12.95 to $59.95 per month and unlock features like multiple chart layouts, advanced technical indicators, alerts, and faster data refresh rates. TradingView provides real-time data for free when possible (particularly for crypto and forex), though you can purchase additional exchange data subscriptions if needed. Since TradingView isn’t a brokerage, there are no trading commissions—but you’ll still pay commissions to whichever broker you connect for trade execution.

Key Characteristics of Interactive Brokers and TradingView

| Platform | Platform Type | Tradeable Assets | Charting Features | Data | Premium Pricing |

|---|---|---|---|---|---|

| Interactive Brokers | Brokerage Platform | Stocks, ETFs, Mutual Funds, Options, Futures, Futures Options, Crypto, Bonds | Downloadable desktop platforms, web platform, mobile app | Must buy real-time data | No premium features |

| TradingView | Charting Software | Not a broker, but you can chart stocks, ETFs, futures, crypto, and forex | Advanced web-based charting platform, downloadable desktop app, and mobile app | Provides real-time data for free when possible, and you can purchase real-time data subscriptions from exchanges | $12-$60 per month |

The key distinction is that Interactive Brokers charges you based on trading activity, while TradingView charges for access to its software and features regardless of how much you trade. For active traders placing dozens or hundreds of trades monthly, Interactive Brokers’ per-contract fees can add up quickly. For example, an active futures trader executing 50 E-mini S&P 500 contracts monthly would pay approximately $112.50 in total costs ($2.25 per contract), while an options trader placing 100 contracts monthly would pay $65 in commissions. For casual traders or investors who make just a few trades per month, Interactive Brokers’ commission structure may be more economical since you’re only paying when you actually execute trades.

Important Note on Market Data: When connecting Interactive Brokers to TradingView, you may see an “Orange D” (delayed data warning) in the order panel even if you have real-time data subscriptions. This occurs because exchange regulations distinguish between chart data and order execution data. The most reliable setup is subscribing to market data through Interactive Brokers for order execution compliance, while understanding that TradingView charts may require separate data subscriptions for full real-time display across all exchanges.

Trading Costs and Commissions Compared

| Fee Type | Interactive Brokers | TradingView |

|---|---|---|

| Equity Commission | Free | Not a broker |

| Option Commission | $0.65 per contract | Not a broker |

| Futures Commission | $0.85 per contract, $0.25 micro | Not a broker |

| Futures Options Commission | $0.85 per contract, $0.25 micro | Not a broker |

| Option Exercise Fee | None | Not a broker |

Your cost-effectiveness ultimately depends on your trading frequency and style. High-volume futures traders should factor in the complete cost including exchange fees—not just the $0.85 commission—when calculating total expenses. Many traders find the optimal solution is using both: paying for TradingView’s charting capabilities ($12-$60/month) while executing trades through Interactive Brokers’ competitive commission structure. This combination provides professional-grade analysis tools with cost-effective execution.

Features and Tools Comparison

When comparing features, it’s essential to recognize that Interactive Brokers and TradingView serve different primary functions. Interactive Brokers excels at trade execution and portfolio management features like margin trading, dividend reinvestment (DRIP), advanced order types, and account protections. As a registered broker-dealer, Interactive Brokers provides SIPC insurance (up to $500,000 including $250,000 for cash claims) and offers robust account management tools, tax reporting, and customer support for account-related issues.

TradingView’s strength lies entirely in analysis and charting capabilities. The platform offers superior technical analysis tools including 100+ built-in indicators, custom indicator creation via Pine Script, multi-timeframe analysis, extensive drawing tools, and a social community where traders share ideas and scripts. TradingView’s charting interface is widely considered the industry standard for visual analysis, with an intuitive design that makes complex technical analysis accessible. However, since TradingView isn’t a brokerage, it doesn’t offer portfolio management features, insurance, or direct customer support for trade execution issues.

Trading Features and Tools

| Platform | DRIP | Margin Trading | Insurance | Mobile App |

|---|---|---|---|---|

| Interactive Brokers | Yes, but with fees | Yes | SIPC Insured | Yes |

| TradingView | Not a broker | Not a broker | Not a broker | Yes |

The table above illustrates the fundamental difference: Interactive Brokers provides comprehensive brokerage services including margin trading and regulatory protections, while TradingView focuses exclusively on charting and analysis. TradingView users must connect an external broker (like Interactive Brokers) to actually execute trades, meaning you’re relying on that broker’s features for margin access, insurance coverage, and portfolio tools. The mobile app situation is interesting—both platforms offer excellent mobile applications, but Interactive Brokers’ app focuses on account management and order entry, while TradingView’s app prioritizes chart viewing and alert management. For traders who need both sophisticated analysis and comprehensive trading features, the integration between these platforms creates a powerful combination where each handles what it does best.

Where They Differ

While Interactive Brokers and TradingView integrate well together, they’re fundamentally different tools designed for different purposes. Understanding these key distinctions will help you determine which platform (or combination of platforms) best suits your trading needs.

Platform Type

Interactive Brokers is a regulated brokerage firm that holds your funds, executes trades, and provides account custody with SIPC insurance protection. TradingView is charting software—a subscription-based analysis tool that connects to external brokers for trade execution but doesn’t hold your money or provide regulatory protections.

Primary Use Case

Interactive Brokers focuses on trade execution and portfolio management with advanced order types, margin trading, and account administration. While IBKR offers charting, it’s functional but dated. TradingView exists solely for market analysis, offering superior technical analysis tools, Pine Script programming, and social idea sharing. It integrates with brokers like IBKR to handle execution.

Target Audience

Interactive Brokers targets serious traders needing global market access, low-cost options/futures trading, and professional-grade tools. The platform appeals to active traders, hedge funds, and experienced investors managing substantial portfolios. TradingView serves everyone from beginners learning technical analysis to professional traders, with particular appeal to chart-focused traders and those who value community insights.

Learning Curve

Interactive Brokers has a steep learning curve—Trader Workstation intimidates beginners with complex windows and configurations. TradingView offers intuitive, beginner-friendly charting that you can start using immediately, though mastering advanced features like Pine Script takes time.

WHICH PLATFORM IS BEST FOR YOU?

Choose Interactive Brokers if you need low-cost trade execution with global market access. It’s ideal for active options/futures traders ($0.65 and $0.85 per contract), international investors accessing 150+ markets, and experienced traders comfortable with complex platforms who prioritize cost over simplicity.

Use TradingView when advanced charting and technical analysis drive your trading decisions. It’s perfect for traders who use multiple brokers, beginners learning technical analysis (free plan available), or anyone who values community-shared strategies and ideas. The platform shines for automated trading via alerts and webhooks.

When to Use Both Together

Combining both creates a professional setup: TradingView’s superior charting plus Interactive Brokers’ low-cost execution. This works best for active traders making 20+ monthly trades who rely on technical analysis. You get world-class charting tools while maintaining competitive execution costs—the optimal balance for serious traders.

Frequently Asked Questions

Can you use TradingView with Interactive Brokers?

Yes, TradingView integrates directly with Interactive Brokers. Simply open TradingView’s Trading Panel, click the Interactive Brokers logo, and log in to your IBKR account to connect the platforms. Once connected, you can execute trades directly from TradingView charts while the trades route through your Interactive Brokers account.

Is Interactive Brokers better than TradingView?

They serve different purposes, so one isn’t inherently better than the other. Interactive Brokers is a brokerage platform for executing trades with low costs and global market access, while TradingView is charting software for technical analysis and market research. Most serious traders use both together to leverage each platform’s strengths.

What is the difference between Interactive Brokers and TradingView?

Interactive Brokers is a regulated broker-dealer that holds your funds and executes trades, charging per-trade commissions with no platform fees. TradingView is subscription-based charting software ($0-$60/month) that provides analysis tools but doesn’t execute trades or hold your money—it must connect to a broker like Interactive Brokers for trade execution.

Can Interactive Brokers replace TradingView?

Interactive Brokers cannot replace TradingView for traders who prioritize advanced charting and technical analysis. While IBKR offers basic charting through Trader Workstation, its charting capabilities are dated and limited compared to TradingView’s sophisticated tools, community scripts, and Pine Script programming capabilities.

Which is better for beginners?

TradingView is more beginner-friendly with its intuitive interface and free plan that lets you start charting immediately. Interactive Brokers has a steep learning curve with complex platforms like Trader Workstation that can overwhelm newcomers. However, beginners who plan to trade actively should eventually learn Interactive Brokers for its competitive pricing and market access.

Does Interactive Brokers charge for TradingView integration?

No, Interactive Brokers doesn’t charge any additional fees to connect your account to TradingView. You’ll pay Interactive Brokers’ standard trading commissions when executing trades, and TradingView’s subscription fees if you use a premium plan, but there’s no separate integration fee. If you have real-time data subscriptions through Interactive Brokers, you can also access that data in TradingView without paying twice.

Interactive Brokers vs TradingView – Bottom Line

Choosing between Interactive Brokers and TradingView depends on your specific trading needs, preferred trading tools, and the type of assets you’re interested in.

Both platforms offer distinct advantages, but by considering the detailed comparison above, you can select the one that aligns best with your trading strategy and goals.

For more detailed reviews and comparisons, continue exploring our other articles on brokerage platform comparisons.

Exclusive Deal: 30-Day FREE Premium Access + Bonus Credit

Don’t Miss Out – Sign up for TradingView Now!

- Advanced Charts

- Real-Time Data

- Track all Markets

If you sign up for a TradingView account using my affiliate link, you can get a 30-day free trial of its premium features plus a $15 credit toward your subscription. However, signing up for a free trial is not required, and you can use nearly all of its features with a basic free account. You can read my full review of TradingView to learn more.

Related Trading Platform Comparisons

Interactive Brokers vs tastytrade

Get Your Free Trading Resources

Grab the free trading journal template plus the same tools we use to stay organized, consistent, and objective.

- Free trading journal template

- Custom indicators, watchlists, and scanners

- Access our free trading community

Enter your email below to get instant access.

No spam. Unsubscribe anytime.