TrendSpider vs. thinkorswim: Which Platform is Better?

TrendSpider and thinkorswim are both powerful trading platforms, but they’re built for different types of traders.

TrendSpider is a premium charting platform focused on automated technical analysis, multi chart workflows, and built-in real-time data. thinkorswim is Schwab’s trading platform, known for deep charting customization, paper trading, robust options tools, and a full brokerage experience through Schwab.

To make your research easier, we compiled the key differences between TrendSpider and thinkorswim in one place so you can choose the platform that fits how you trade.

- Pricing: $74 to $149 per month

- Up to 16 charts per layout

- Real-time data included

- Highly customizable charting tools

- Paper trading and strategy testing

- Free with Schwab accounts

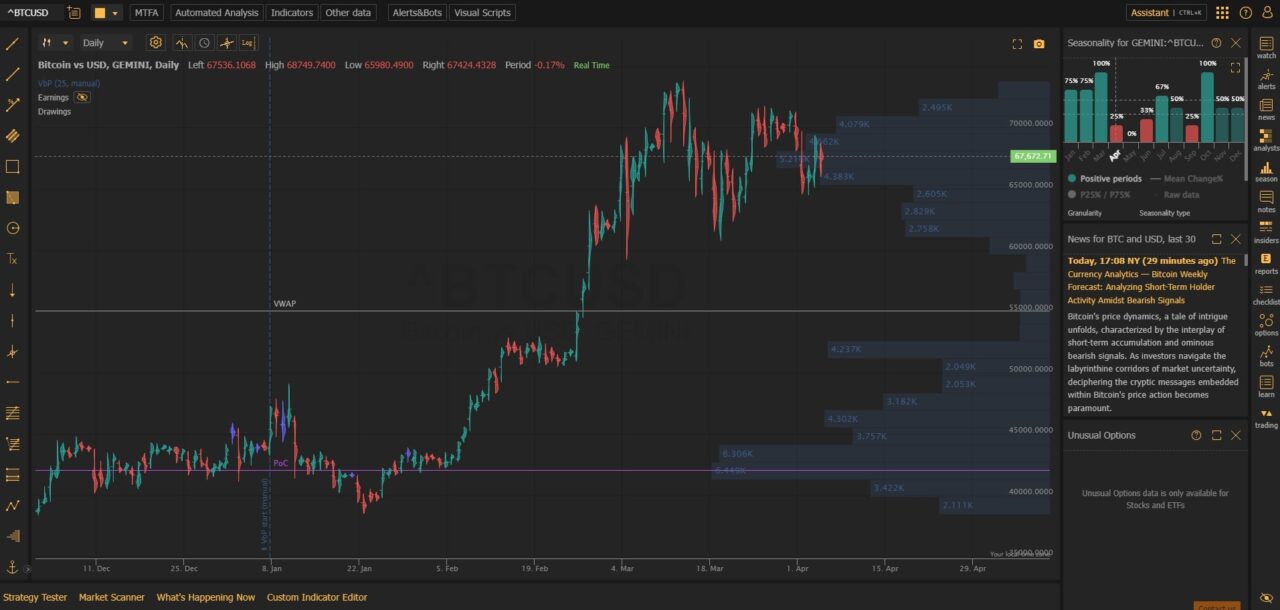

TrendSpider Overview

TrendSpider is a charting and technical analysis platform designed for traders who want to move faster without doing everything manually. It’s best known for automated trendline detection, multi timeframe analysis, advanced chart types, and toolsets like volume profile.

TrendSpider highlights

- Pricing: $74 to $149 per month

- Up to 16 charts per layout

- Real-time data included with your subscription

TrendSpider is Best For

TrendSpider is best for traders who want a premium charting workflow and rely heavily on technical analysis. It’s especially useful if you want automation layered on top of charting, like automatic trendlines, multi timeframe views, and advanced toolsets such as volume profile.

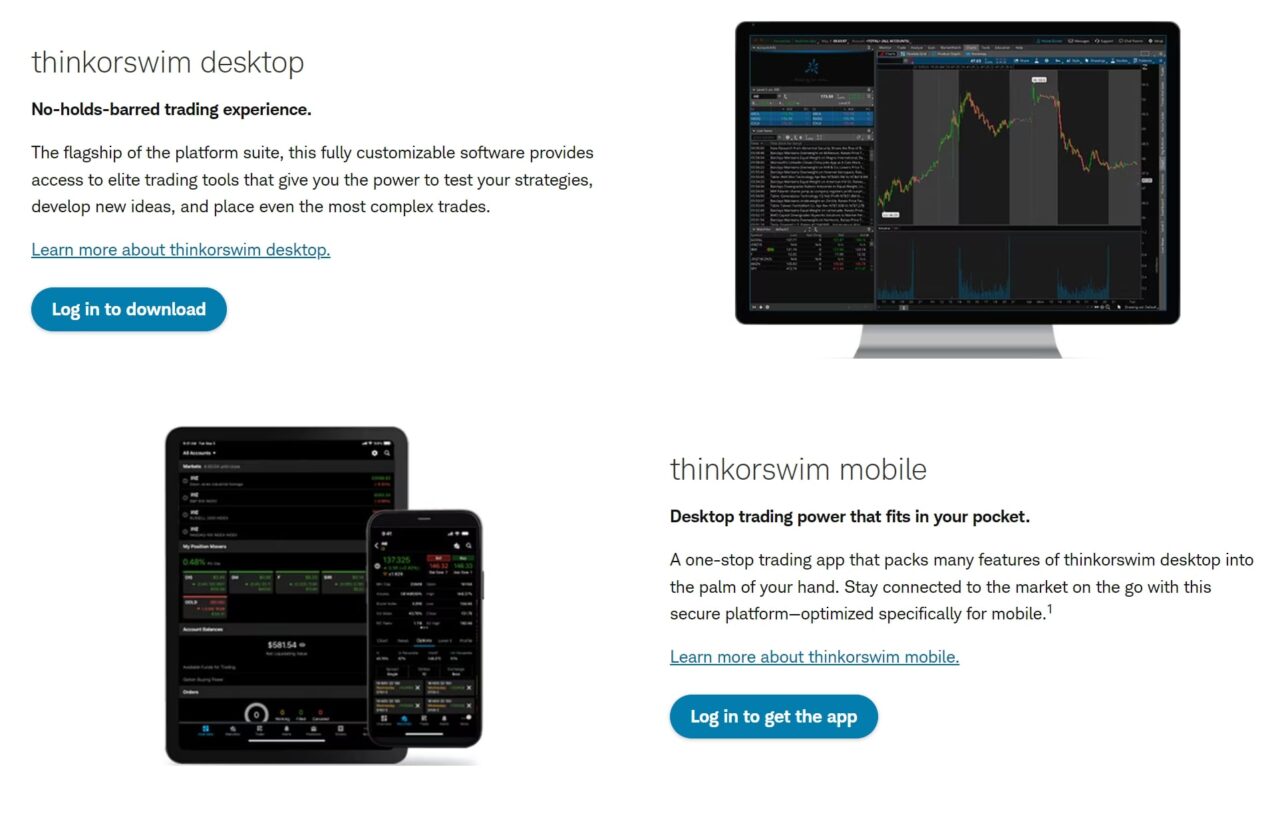

thinkorswim Overview

thinkorswim is Schwab’s advanced trading platform. It offers highly customizable charting, strong built-in screeners, news, and some of the best options trading tools available on a mainstream brokerage platform. It also includes paper trading and is free to use with a Schwab brokerage account.

thinkorswim highlights

- Customizable charting tools

- Paper trading features

- Free with Schwab accounts

thinkorswim is Best For

thinkorswim is best for traders who want a complete trading platform bundled with a brokerage account. It’s a great fit for active traders who care about options tools, built-in analytics, scanning, and a mature desktop platform that can be customized heavily.

Key Differences Between TrendSpider and thinkorswim

Platform Type and Core Use Case

- TrendSpider: Charting and technical analysis platform (not a broker)

- thinkorswim: Schwab trading platform (brokerage platform experience)

If you primarily want charting, TrendSpider is built around that. If you want charting plus execution, account tools, and brokerage features, thinkorswim has the advantage.

Markets and Tradeable Assets

- TrendSpider: Not a broker, but you can chart stocks, ETFs, futures, crypto, and forex

- thinkorswim: Stocks, ETFs, mutual funds, options, index options, futures, futures options, and bonds through Schwab

Charting and Technical Analysis

- TrendSpider: Strong automation for technical analysis, multi chart layouts, and advanced tools like volume profile

- thinkorswim: Extremely customizable charting with a mature indicator ecosystem, plus strong options analysis tools

In general:

- Pick TrendSpider if you want charting automation and multi chart workflows.

- Pick thinkorswim if you want deep customization and trading focused tooling, especially for options.

Data

- TrendSpider: Real-time data included in the subscription

- thinkorswim: Real-time data is available with a funded Schwab account

Trading Features and Tools

| Feature | TrendSpider | thinkorswim |

|---|---|---|

| DRIP | Not a broker | Yes |

| Margin trading | Not a broker | Yes |

| Insurance | Not a broker | Platform only (broker is Schwab) |

| Mobile app | Yes | Yes |

TrendSpider is purpose built for analysis. thinkorswim is built for analysis plus execution and account management.

Costs and Commissions

TrendSpider is subscription-based because it’s not a brokerage.

thinkorswim is part of Schwab, so the platform itself is free, and you pay typical Schwab trading costs depending on what you trade.

| Fee Type | TrendSpider | thinkorswim |

|---|---|---|

| Equity commission | Not a broker | Free |

| Options commission | Not a broker | $0.65 per contract |

| Futures commission | Not a broker | $2.25 per contract |

| Futures options commission | Not a broker | $2.25 per contract |

| Option exercise fee | Not a broker | None |

TrendSpider vs thinkorswim: Bottom Line

Choose TrendSpider if you want a premium charting platform with automation baked into technical analysis. It’s a strong option for traders who live in charts, use multi timeframe workflows, and want real-time data included.

Choose thinkorswim if you want a full trading platform tied to a Schwab brokerage account, with excellent charting, strong scanning, paper trading, and some of the best options tools available.

Both are excellent. The best choice comes down to whether you want a dedicated charting platform (TrendSpider) or a broker platform with a powerful desktop terminal (thinkorswim).

Related Trading Platform Comparisons

Interactive Brokers vs Tradestation

Get Your Free Trading Resources

Grab the free trading journal template plus the same tools we use to stay organized, consistent, and objective.

- Free trading journal template

- Custom indicators, watchlists, and scanners

- Access our free trading community

Enter your email below to get instant access.

No spam. Unsubscribe anytime.