Are you overwhelmed with the massive amount of TradingView indicators to choose from? Figuring out which ones work best takes time, so I compiled a list of the top indicators to improve your trading in this article. All of the indicators on this list are native to TradingView, and do not require you to pay a third-party. They are also all indicators I have used personally over my years of trading.

What are the Best Indicators on TradingView?

There are tons of indicators on TradingView. However, the best ones include:

- Volume Profile – view volume by price instead of by time

- Ichimoku Clouds – quick “one look” indicator to identify entries and exits

- Auto Fib Retracement – draws Fibonacci retracements automatically

- Market Profile – view how much time is spent at various price levels

- VWAP – a smooth line showing you the average trading price for one day weighted by volume

- MACD – moving average convergence divergence determines momentum

- Moving Averages – view EMA and SMA lines such as the 50 and 200-day moving average lines

- Relative Strength Index (RSI) – quick way to tell if a stock is overvalued or undervalued on a scale of 0-100

- Anchored VWAP – VWAP anchored to a specific date

- IV Rank and Percentile – detrmines whether a stock’s implied volatility is high or low

- Footprint Charts – view filled order volume by price for each candle

Clicking the links above will bring you to the detailed descriptions of the indicators within this article.

- The best TradingView indicators to use are the volume profile, anchored VWAP, Ichimoku, and Fibonacci retracements.

- Continue reading to view the 11 best TradingView indicators and how you can use them to improve your trading strategy.

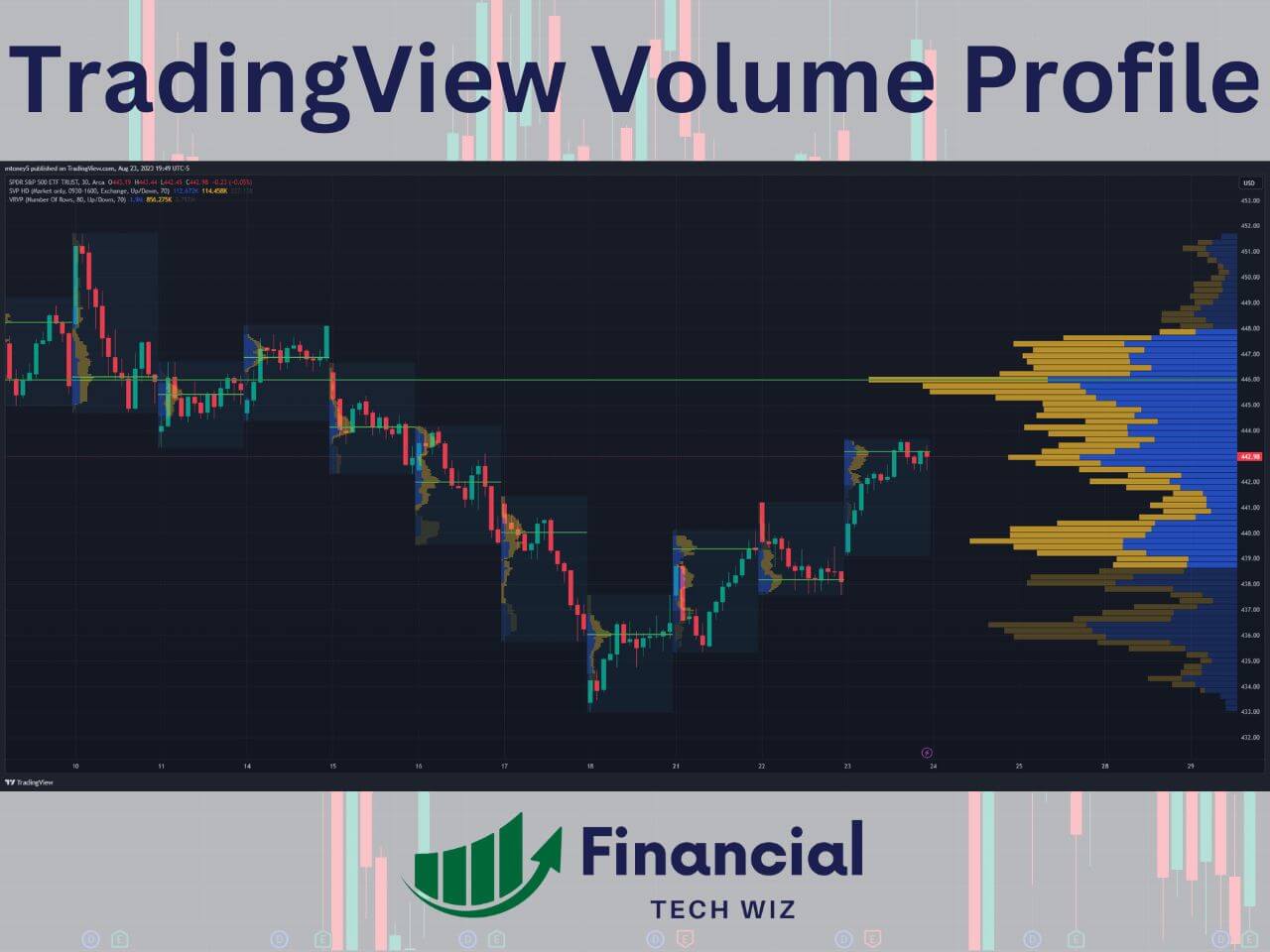

1- Volume Profile Indicator

The volume profile shows you volume by price for a defined time period. Traditional volume charts show you volume by time, which is not nearly as valuable. Traders can determine what price has the most supply and demand, which is extremely helpful in determining support and resistance levels on a chart.

TradingView offers a few different types of volume profile indicators:

- Visible Range Volume Profile: view the profile for the visible candles on the chart, which adjusts dynamically as you zoom in and out.

- Session Volume Profile: view a unique profile that resets each trading day (session), which is great for day traders.

- Volume Profile Fixed Range: pick a range of candles to view a volume profile for that doesn’t change as you move around your charts.

My favorite way to use the volume profile indicators on TradingView is to combine the session volume profile with the visible range volume profile so you can view profiles for each day and the entire visible chart.

The volume profile indicator on TradingView is an advanced tool that requires you to have a premium subscription. However, new users can usually get a TradingView free trial to test it out for 30 days.

Full Indicator Review: Learn more about the volume profile

TradingView Limited Time Offer!

Exclusive Deal: 30-Day FREE Premium Access + Bonus Credit

Don’t Miss Out – Sign up for TradingView Now!

- Advanced Charts

- Real-Time Data

- Track all Markets

2- Ichimoku Clouds

The Ichimoku Cloud is a dynamic trend following indicator involving several moving average lines. It consists of five lines and a “cloud” formed by the interaction of two of these lines.

A green cloud signals an uptrend, while a red cloud signals a downtrend.

Additionally, you can use the baseline and conversion line crossovers to determine entry and exit points.

The baseline and conversion lines are similar to a 9EMA and a 26EMA, another common indicator traders use.

The Ichimoku Cloud allows you to identify trends easily and determine entry and exit points based on TK crossovers.

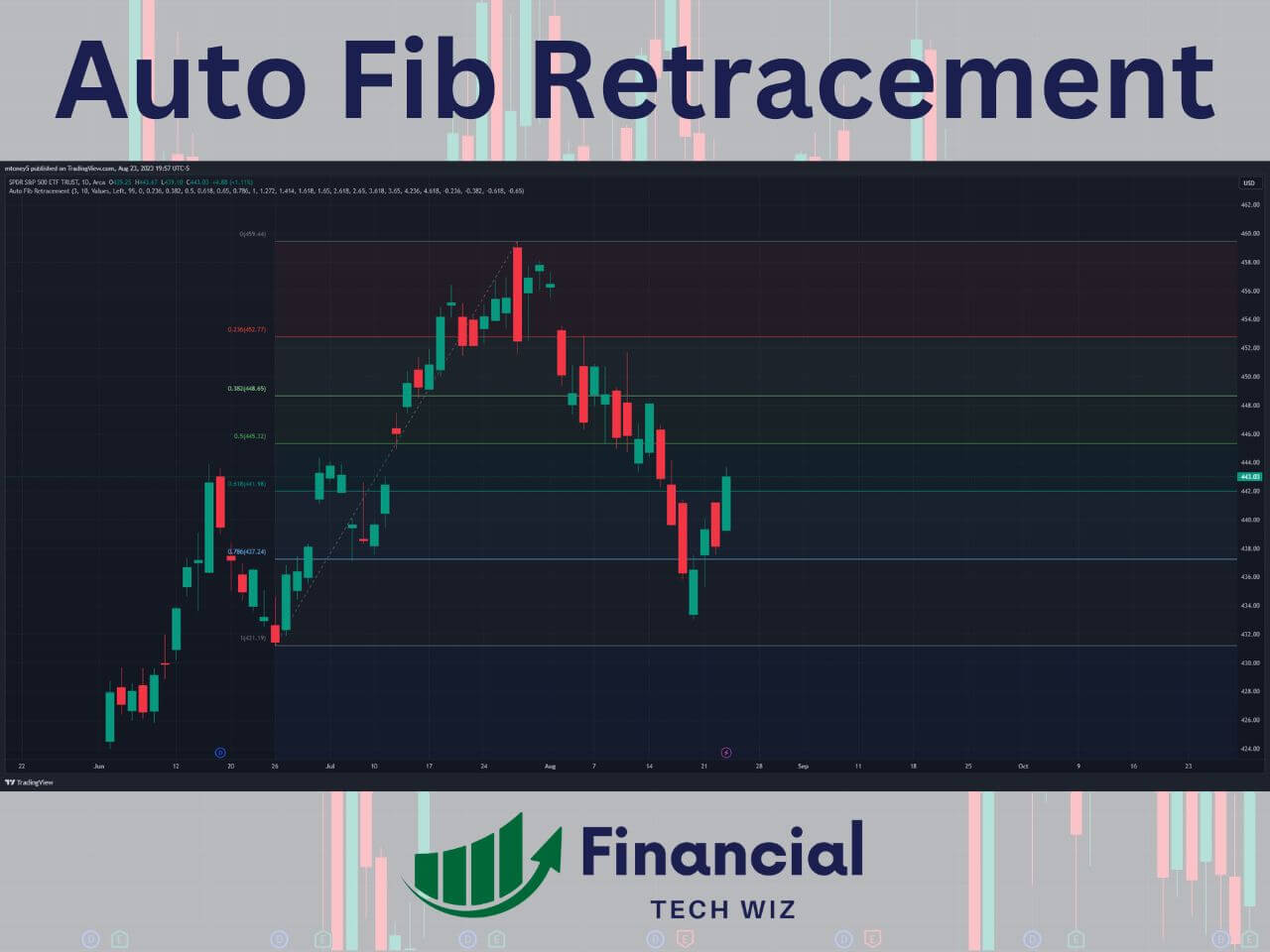

3- Auto Fib Retracement

The Auto Fib Retracement indicator automatically plots Fibonacci retracement levels on a chart, helping traders identify potential support and resistance zones based on the key Fibonacci ratios (23.6%, 38.2%, 50%, 61.8%, and 78.6%).

While traders often draw their own Fib Retracement lines manually, the Auto Fib tool is a great way to save time and view retracement levels on several time frames.

You can also change the depth to a larger number if the indicator is drawing the lines too close to the current stock price.

Auto fib retracement tools are also available on Trendspider. To learn more, check out my article on TrendSpider vs. TradingView!

Full Indicator Review: Learn more about the Fibonacci retracements on TradingView

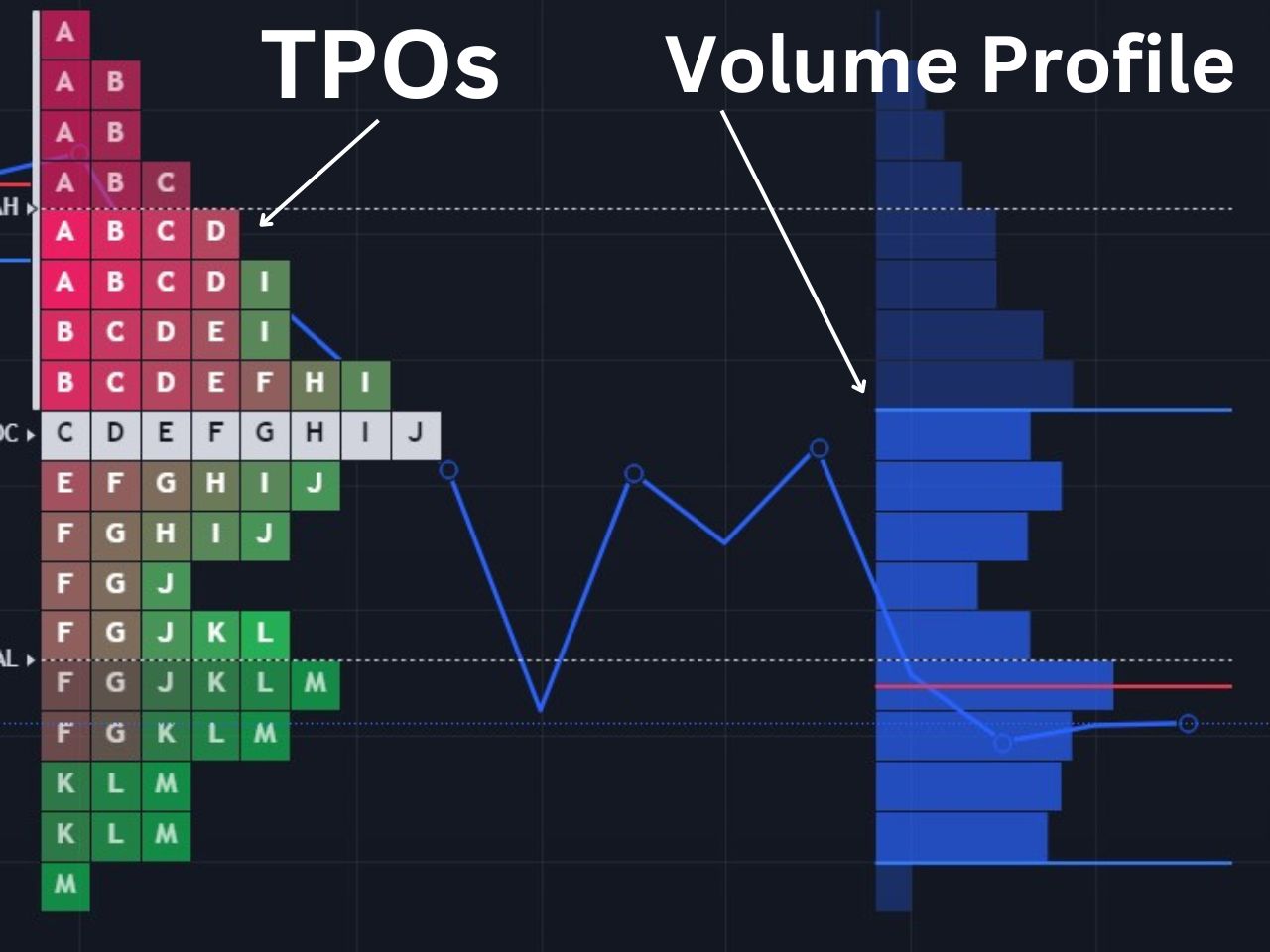

4- Market Profile (Time Price Opportunity TPO Charts)

The market profile is similar to the volume profile, except it also shows time spent at prices on top of volume by price. The market profile is commonly used by futures traders to interpret the market structure and identify trading opportunities.

I recommend you learn to identify market structures like poor highs, poor lows, single prints, and understand the mechanics of auction market theory to make the best use of the TPO charts. TradingView’s TPO charts aren’t available to free users, but you can use my affiliate link to get a free trial to test it out for 30 days with no commitment.

Full Indicator Review: Learn more about the TradingView TPO charts

5- VWAP (Volume Weighted Average Price)

The VWAP is a TradingView indicator for day traders that shows you where the most volume has occurred through a particular trading day. It is considered about the fair price for a stock since it is where the most shares have been traded.

VWAP strategies include buying when the price breaks over the VWAP for a continuation play. Alternatively, you can wait for the stock price to be far away from the VWAP and use a mean reversion strategy. You can also check out the anchored VWAP if you are not a day trader.

Full Indicator Review: Learn more about the VWAP on TradingView

6- Moving Averages

There are two types of moving averages, SMA (simple moving average) and EMA (exponential moving average). The most common ones for swing traders and investors to utilize are the 50 and 200 SMA lines on the daily chart. Otherwise known as the 50 and 200-day moving averages.

Short-term traders use EMA lines such as the 9 and 26-period lines on shorter-term time frames like the 5-minute and 1-minute charts for day trading and short-term swing trading.

Full Indicator Review: Learn more about TradingView moving averages

7- MACD

The MACD (Moving Average Convergence Divergence) is a popular trend-following indicator. It is the result of two lines: the MACD line and the signal line.

- MACD Line: The MACD line is the result of subtracting the 26-period EMA by the 12-period EMA, typically for days when used on the daily timeframe.

- Signal Line: The signal line is the 9-period EMA of the MACD line.

When the MACD line crosses above the signal line, it’s considered a bullish signal (suggesting it might be a good time to buy). Conversely, when the MACD line crosses below the signal line, it’s viewed as a bearish signal (suggesting it might be a good time to sell).

Full Indicator Review: Watch our video on the TradingView MACD

8- Relative Strength Index (RSI)

The RSI indicator is a popular tool for identifying whether an asset is overbought or oversold. It is a momentum oscillator that measures the speed and change of price movements on a scale from 0 to 100.

Typically, a stock with an RSI reading over 70 is considered overvalued, while a reading under 30 is considered undervalued. However, it is best to combine the RSI with other indicators to determine optimal entry and exit points.

The RSI is calculated based on an asset’s price movements over a certain period, typically 14 days. It compares the magnitude of recent gains to recent losses to determine the speed and change of price movements.

Full Indicator Review: Learn more about the TradingView RSI

9- Anchored VWAP

The Anchored VWAP (Volume Weighted Average Price) is a trading indicator that gives traders a comprehensive look at a stock’s price in relation to its volume over a specific time frame.

Generally, traders will set the anchor point at a swing high or a swing low. For example, if a stock made a 52-week low a few weeks back, you can set the anchored VWAP here to determine a good medium term support level.

The regular VWAP is the average price of a stock weighted by its volume. The unique feature of the Anchored VWAP is that it allows traders to choose a specific starting point (or “anchor”) from which to calculate the VWAP.

Full Indicator Review: Learn more about the anchored VWAP

10- Implied Volatility Rank and Percentile

Implied volatility represents how much volatility the market is pricing for a specific asset. When implied volatility is high, options are generally more expensive to account for the perception of large price movements in the future. It is a key factor in options pricing and trading strategies.

Implied volatility rank and percentile help you determine whether a stock’s implied volatility is high or low based on the last year of data. Implied volatility rank is free to use on TradingView but is not native to the platform. You can use the IV Rank and Percentile custom indicator by Martin Shkreli for free.

Full Indicator Review: Learn more about IV Rank & Percentile on TradingView

11- Volume Footprint Charts

TradingView’s volume footprint chart type allows you to view how many orders have been filled on both the buy and sell side.

On the left side of the candle, you can see how many shares were sold by price in red. On the right side of the candle, you can see how many shares were bought within that candle and at what price.

The bottom of the candle also shows you the delta and total volume traded during the candle you are analyzing. The volume footprint feature requires you to have a TradingView paid subscription, but you can use my affiliate link to get a free trial to test it out for free.

Full Indicator Review: Learn more about the TradingView footprint charts

How to get a TradingView free trial

If you don’t want to spend your hard-earned money testing out some of these indicators, new users can usually get a 30-day TradingView free trial.

TradingView is one of the most widely used charting tools available, and it is great for beginners and advanced traders. We have an entire article explaining how to get a TradingView free trial you can read if you have any questions.

TradingView Limited Time Offer!

Exclusive Deal: 30-Day FREE Premium Access + Bonus Credit

Don’t Miss Out – Sign up for TradingView Now!

- Advanced Charts

- Real-Time Data

- Track all Markets

Which indicator is best for entry and exit?

There isn’t a single indicator that is “best” for determining entry and exit points. However, the Ichimoku indicator provides traders clear signals when the baseline and conversion lines crossover.

When the conversion line cross above the baseline, it is a signal to buy. On the other hand, when the baseline crosses below the baseline, it is a signal to sell.

Once you are in a position, you can use one of the several lines to determine your stop loss and take profit levels.

What indicator do most traders use?

There are tons of indicators to use on Tradingview, and each trader must find the one that works best for their trading strategy.

However, the most common indicators include Fibonacci Retracements, simple moving averages (SMAs), and exponential moving averages (EMAs).

The Best TradingView Indicators | Bottom Line

Selecting and utilizing the appropriate indicators is crucial for successful trading. The right indicators can provide valuable information on market trends, support and resistance levels, and potential trade opportunities.

By understanding how each indicator works and using them in conjunction with other technical analysis tools, traders can enhance their market analysis skills and improve their overall trading performance. Check out our article on the best TradingView indicators for day trading to learn more!

FAQs

What are TradingView indicators?

- TradingView indicators are tools or mathematical calculations applied to price data on the TradingView platform.

How do I access indicators on TradingView?

- To access indicators on TradingView, simply open the platform and select the “Indicators” button located at the top of the charting window. This will open a menu where you can search for and select various indicators based on your trading needs.

Are the best TradingView indicators free?

- TradingView offers a wide range of both free and paid indicators. While there are many excellent free indicators available, some more advanced or specialized indicators like the volume profile that may require a paid subscription or purchase. However, there are plenty of powerful indicators that can be utilized at no cost. You can learn more in our TradingView pricing article.

How can I determine the best TradingView indicators for my trading strategy?

- Selecting the best TradingView indicators for your trading strategy depends on your individual preferences, trading style, and goals. It’s essential to consider factors such as your preferred timeframes, market conditions, and the specific insights you need from indicators. Experimenting with different indicators and analyzing their performance in relation to your strategy can help you determine which ones work best for you.

Can I create custom indicators on TradingView?

- Yes, TradingView provides a feature called Pine Script that allows users to create their own custom indicators. Pine Script is a domain-specific scripting language designed for creating and modifying indicators and strategies on the TradingView platform. It offers a flexible and powerful framework for traders who want to develop their own unique indicators.

How can I install and use custom indicators on TradingView?

- To install and use custom indicators on TradingView, follow these steps:

- Write or obtain the Pine Script code for the custom indicator.

- Open TradingView and go to the chart where you want to apply the custom indicator.

- Click on the “Indicators” button and select “Invite-Only Scripts” or “Pine Editor” depending on your TradingView subscription plan.

- Open the Pine Editor and paste the custom indicator’s code into the editor.

- Click “Add to Chart” to apply the custom indicator to your chart.

Before you go

If you want to keep educating yourself about TradingView, you must check out these posts as well: