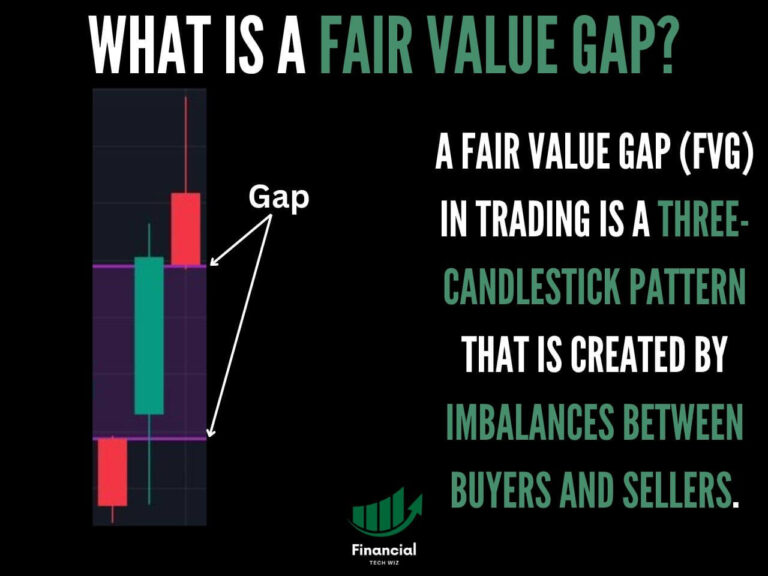

What is a Fair Value Gap (FVG) in Trading?

This article will show you how to identify, trade, and understand the fair value gap in trading. Fair Value Gaps Meaning Explained for Traders A fair value gap (FVG) in trading is a three-candlestick pattern that is created by imbalances between buyers and sellers. Like a regular gap, the fair value gap acts as a…