TradingView vs. TC2000: Which Platform is Better for You?

If you are looking for a powerful and versatile platform to analyze and trade stocks and options, you may have come across TradingView and TC2000.

In this article, we will review TradingView and TC2000 in detail and help you decide which platform suits your needs and preferences.

TradingView

- Price: Free-$60/month

- Extensive charting tools

- Custom indicators with Pine Script

- Connects with various brokers

TC2000

- Price: $8-$50/month

- Basic volume profile and indicators

- Several chart types available

- Commissions for stock & options

Overview of TradingView

TradingView is a web-based platform that combines multi-asset charting, screening, backtesting, and trading. TradingView covers stocks, bonds, forex, commodities, indices, and cryptocurrencies, making it suitable for traders and investors of different markets and styles. TradingView also integrates with several brokers, allowing you to trade directly from the charts with real-time data and execution.

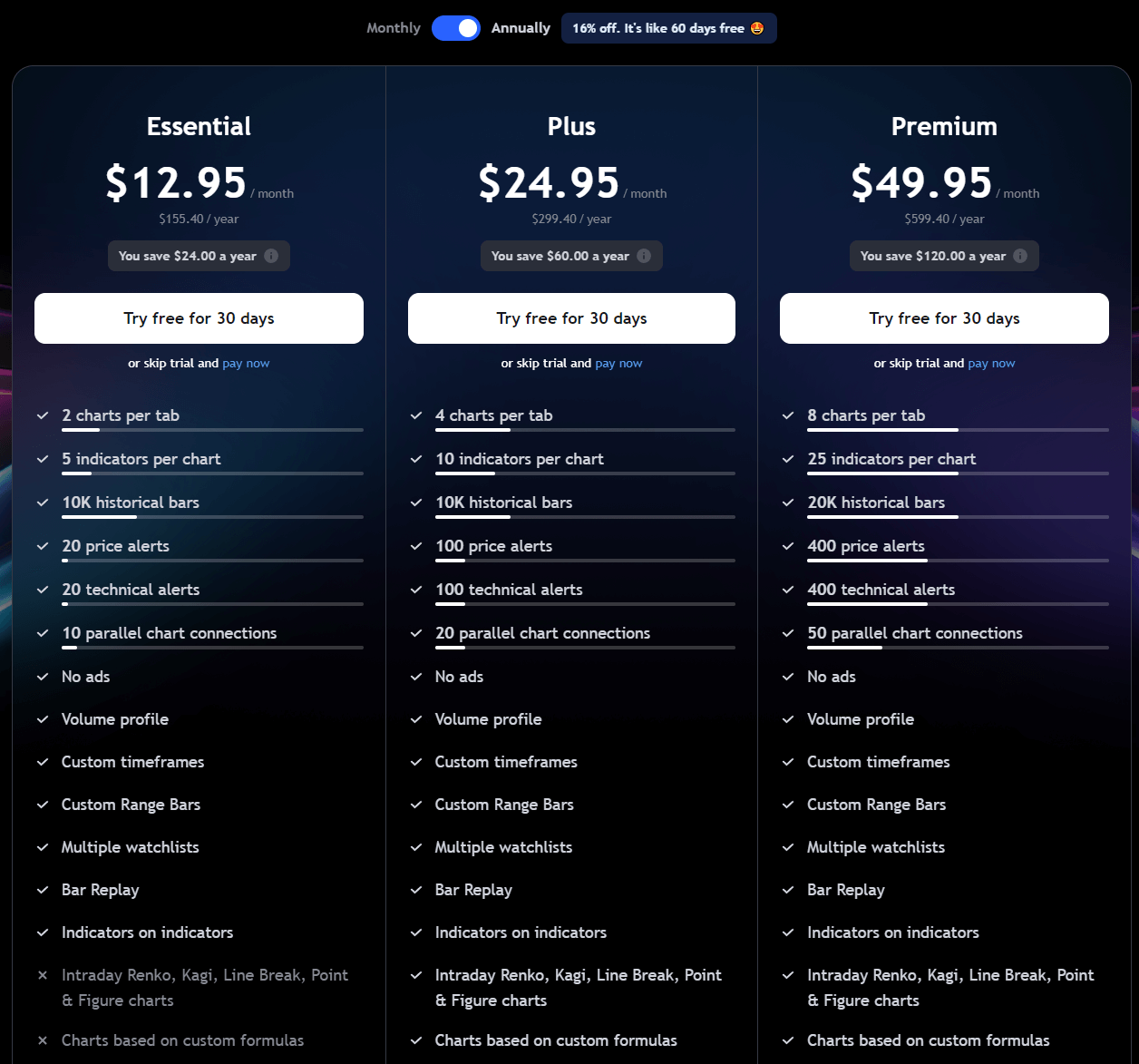

TradingView has a freemium model, meaning you can use some of its features for free, but you need to upgrade to a paid plan to access more advanced tools and functionalities.

TradingView offers four subscription plans: Basic (free), Essential ($14.95/month), Plus ($29.95/month), and Premium ($59.95/month). The main differences between the plans are the number of indicators, alerts, charts, watchlists, and devices you can use simultaneously, as well as the availability of features like extended trading hours, custom intervals, intraday data, volume profile indicators, priority customer support, and more.

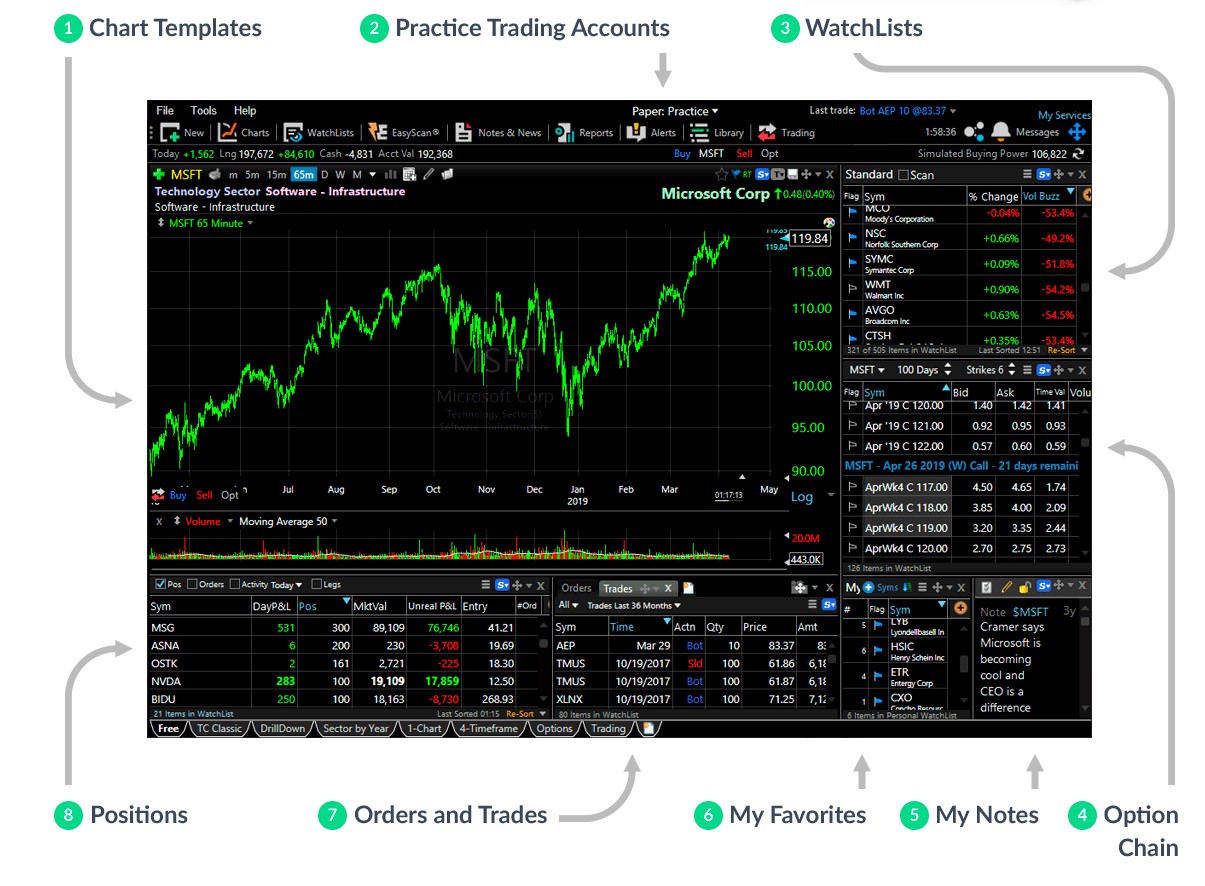

Overview of TC2000

TC2000 is a desktop-based platform that specializes in stock and options charting, scanning, and trading. It was created by Worden Brothers in 1993 and has won several awards for its software quality and customer service. TC2000 covers US and Canadian stocks and options, as well as some ETFs and mutual funds.

TC2000 has a subscription-based model, meaning that you need to pay a monthly or annual fee to use the platform. TC2000 offers three subscription plans: Silver ($9.99/month), Gold ($29.99/month), and Platinum ($89.99/month). You will get a discount if you purchase an annual subscription. TC2000 also still charges a fee for each stock and option trade you make.

You can read my full review of TC2000 to learn more.

TradingView vs. TC2000 Features Compared

| Feature | TradingView Free Trial | TC2000 Get $25 Off |

|---|---|---|

| Pricing | $0-$59.95 per month + free trial with my affiliate link | $8-$50 per month + $25 off with my affiliate link |

| Assets and Markets | Stocks, bonds, forex, commodities, indices, and cryptocurrencies from around the world | US and Canadian stocks and options, as well as some ETFs and mutual funds |

| Charting | Hundreds of indicators, drawing tools, and chart types; custom intervals; volume profile indicators; Pine Script for creating custom indicators and strategies | Hundreds of indicators, drawing tools, and chart types; standard intervals; PCF for creating conditions and formulas |

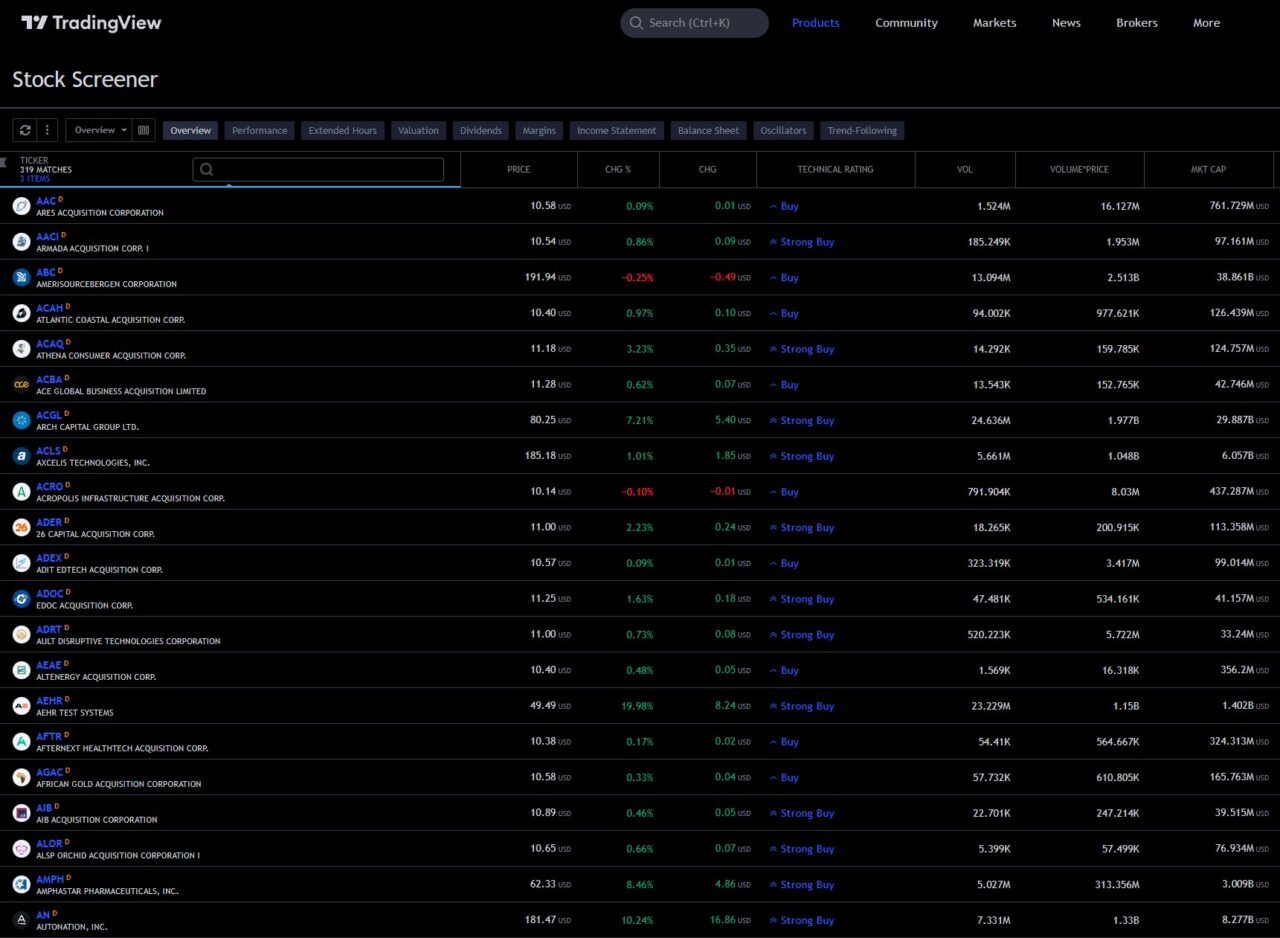

| Screening | Predefined filters and indicators; Pine Script for creating custom screens | Custom conditions and formulas using PCF; EasyScan for scanning multiple watchlists and conditions simultaneously |

| Trading | Supports multiple brokers that offer commission-free or low-cost trading for different assets; paper trading feature | Charges $1 + $0.005 per share and $1 + $0.65 per contract for options |

| Backtesting | Pine Script for creating and backtesting strategies; detailed report with performance metrics, trades list, equity curve, drawdowns, etc.; optimization feature | PCF for creating and backtesting strategies; detailed report with number of trades, win rate, average gain/loss, maximum drawdown, etc.; optimization feature |

TradingView and TC2000 have many features in common, but they also have some significant differences that may affect your choice depending on your trading goals and preferences. Here are some of the main features that distinguish these two platforms:

Assets and Markets

TradingView covers a wider range of assets and markets than TC2000. TradingView supports stocks, bonds, forex, commodities, indices, and cryptocurrencies from around the world, while TC2000 only supports US and Canadian stocks and options, as well as some ETFs and mutual funds. This means that if you want to trade or invest in other markets or assets than stocks and options, TradingView may be a better option for you.

Charting

Both platforms offer excellent charting capabilities, with hundreds of indicators, drawing tools, and chart types to choose from. However, TradingView has some advantages over TC2000 in terms of charting. For example,

TradingView allows you to create custom intervals, such as 2-minute or 7-hour charts, while TC2000 only offers standard intervals, such as 1-minute or 1-day charts. TradingView also supports footprint and market profile charts, which show the distribution of volume at different price levels, while TC2000 does not.

Screening

Both platforms have powerful screening tools that allow you to scan the market for stocks and options that meet your criteria. However, TC2000 has some advantages over TradingView in terms of screening. You can read my full article about the TradingView stock screener for more information.

For example, TC2000 allows you to create custom conditions and formulas using PCF, while TradingView only lets you use predefined filters and indicators. TC2000 also has a feature called EasyScan, which lets you scan multiple watchlists and conditions simultaneously and see the results in real-time.

TradingView does not have a similar feature. Moreover, TC2000 has a feature called Options Scanner, which lets you scan the market for options strategies that meet your criteria, such as covered calls, naked puts, bullish spreads, etc. TradingView does not have a similar feature.

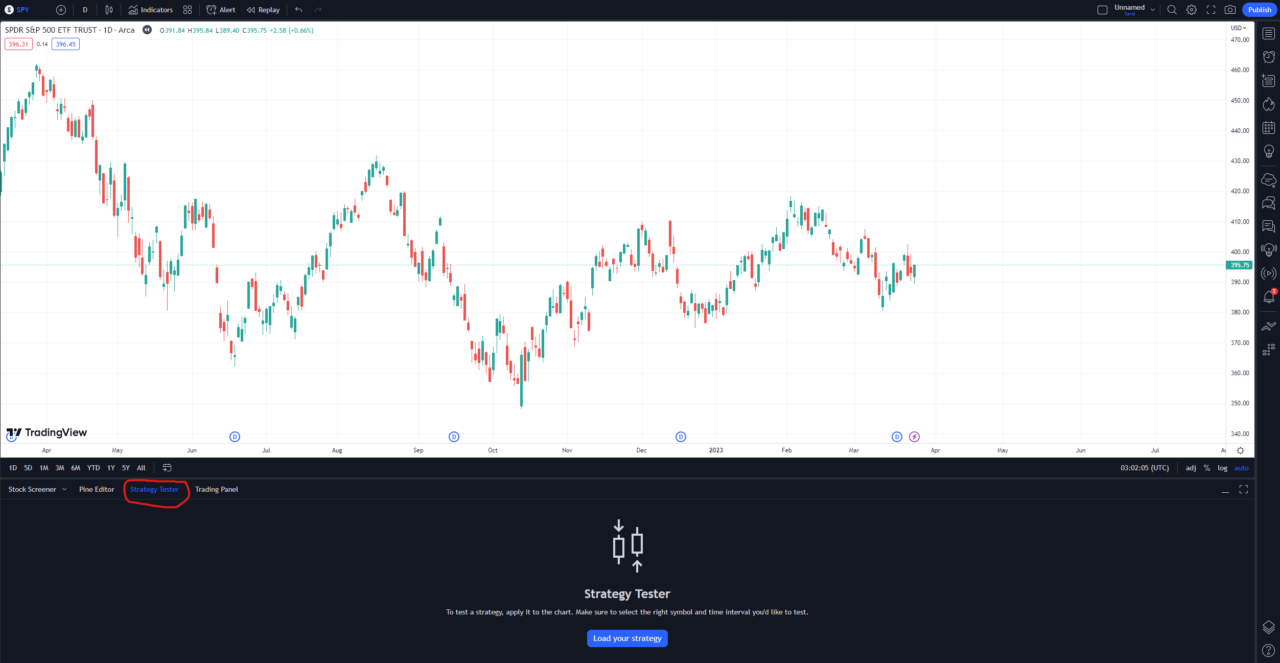

Backtesting

TradingView has a clear edge over TC2000 in terms of backtesting. TradingView allows you to backtest your strategies using Pine Script and see the results in a detailed report that shows the performance metrics, trades list, equity curve, drawdowns, etc. You can also optimize your strategies using different parameters and see how they affect the results. TC2000 also allows you to backtest your strategies using PCF, but the results are more limited and less informative than TradingView’s. You can only see the number of trades, win rate, average gain/loss, maximum drawdown, etc. You cannot optimize your strategies or see the equity curve or trades list.

Trading

Both platforms allow you to trade directly from the charts using real-time data and execution. However, TradingView has some advantages over TC2000 in terms of trading. For example, TradingView supports multiple brokers, such as TradeStation, Oanda, Interactive Brokers, Webull, etc. This means that you have more choices and flexibility when it comes to choosing a broker with TradingView.

TC2000 itself is a broker, but it does not offer free equity trading like most modern brokers. TradingView also supports trading stocks, forex, futures, and crypto globally, while TC2000 only supports trading stocks and options in the US and Canada. Moreover, TradingView has a feature called Paper Trading, which lets you practice your trading skills and strategies with virtual money and real-time data. TC2000 does not have a similar feature.

Usability

Both platforms are easy to use and have intuitive and user-friendly interfaces. However, TradingView has some advantages over TC2000 in terms of usability. For example, TradingView is web-based, meaning that you can access it from any device and browser without downloading or installing anything. TC2000 is desktop-based, meaning that you need to download and install it on your PC or Mac.

TradingView also has a mobile app for iOS and Android devices, while TC2000 does not. Moreover, TradingView has a feature called Social Network, which lets you interact with other traders and investors from around the world. You can share your charts and ideas, follow other users, comment on their posts, join groups and chat rooms, etc. TC2000 does not have a similar feature.

TradingView vs. TC 2000 Charting

Both TradingView and TC2000 offer excellent charting capabilities, with hundreds of indicators, drawing tools, and chart types to choose from. However, TradingView has some advantages over TC2000 in terms of charting that make it superior.

First of all, TradingView allows you to create custom intervals, such as 2-minute or 7-hour charts, while TC2000 only offers standard intervals, such as 1-minute or 1-day charts. Custom intervals can help you fine-tune your analysis and trading according to your preferred time frame and style.

Secondly, TradingView supports volume profile indicators, which show the distribution of volume at different price levels. Volume profile indicators can help you identify areas of support and resistance, as well as gauge the strength and weakness of price movements. TC2000 does not support volume profile indicators.

TradingView vs. TC2000 Pricing

Both TradingView and TC2000 have similar pricing ranges, but TradingView offers more value for money than TC2000.

TradingView has a freemium model, meaning that you can use some of its features for free, but you need to upgrade to a paid plan to access more advanced tools and functionalities.

TradingView offers four subscription plans: Basic (free), Essential ($14.95/month), Plus ($29.95/month), and Premium ($59.95/month). The main differences between the plans are the number of indicators, alerts, charts, watchlists, and devices you can use simultaneously, as well as the availability of features like extended trading hours, custom intervals, intraday data, volume profile indicators, priority customer support, and more.

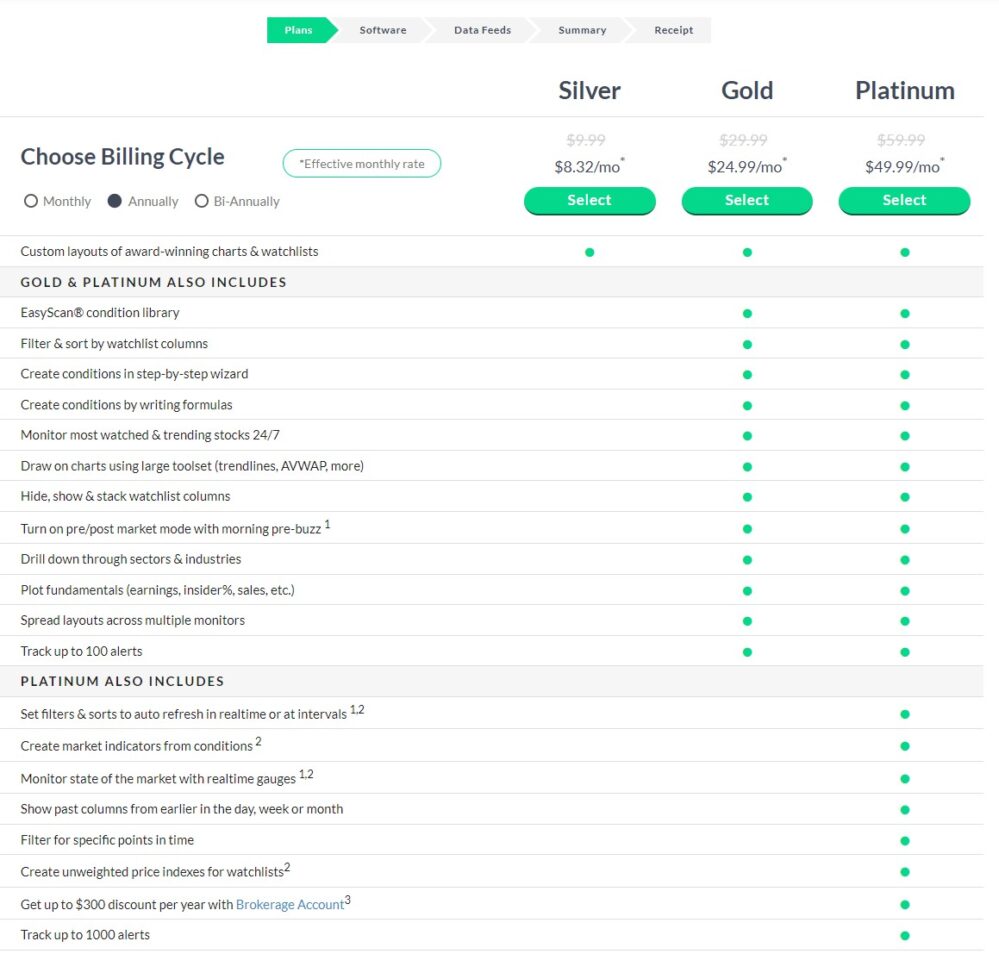

TC2000 has a subscription-based model, meaning that you need to pay a monthly or annual fee to use the platform. TC2000 offers three subscription plans: Silver ($9.99/month), Gold ($29.99/month), and Platinum ($89.99/month).

Another thing to consider is the trading commissions. Some of the brokers that TradingView supports offer commission-free trading for stocks and ETFs and low fees for options and other assets. For example, TradeStation charges $0 per trade for stocks and ETFs and $0.50 per contract for options.

On the other hand, TC2000 charges $4.95 per trade for stocks and ETFs and $2.95 plus $0.65 per contract for options. This means that if you trade frequently or in large volumes, TradingView may save you a lot of money in commissions compared to TC2000.

TC2000 Special Offer!

Exclusive Deal: $25 Off Your First Month

Limited Time Offer – Join TC2000 Today!

- Powerful Charting

- EasyScan Technology

- Custom Indicators

TradingView vs. TC2000 – Which is Best For You?

Both TradingView and TC2000 are excellent platforms that offer advanced charting, screening, and trading features. However, TradingView is clearly superior based on pricing and charting.

TradingView offers free plans and a wide range of brokers you can trade from that charge much lower fees than TC2000. Additionally, if you want to trade or invest in other markets or assets than stocks and options, such as forex, commodities, or cryptocurrencies, TradingView may be a better option for you.

TradingView is also better If you want to backtest and optimize your strategies using a simple and user-friendly programming language. TradingView has a feature called Pine Script, which lets you create your own indicators and strategies using a simple programming language.

You can also backtest and optimize your strategies using different parameters and see how they affect the results. TC2000 also has a scripting language called PCF (Personal Criteria Formula), but it is less user-friendly than Pine Script.

How to Get a TradingView Free Trial

If you are interested in trying out TradingView for yourself, you can sign up for a free trial using my affiliate link. You will get access to all the features and functionalities of the platform for 30 days. You can also cancel your subscription at any time if you are not satisfied with the service.

TradingView Limited Time Offer!

Exclusive Deal: 30-Day FREE Premium Access + Bonus Credit

Don’t Miss Out – Sign up for TradingView Now!

- Advanced Charts

- Real-Time Data

- Track all Markets

FAQ

Q: What is the difference between TradingView and TC2000?

A: TradingView is a charting platform, while TC2000 is a brokerage. However, you can connect some brokers to trade directly on TradingView.

Q: Is TC2000 good for day trading?

A: TC2000 can be a good platform for day trading stocks and options in the US and Canada, as it offers one of the best live trading platforms available anywhere.

Q: Is TradingView the best charting tool?

A: TradingView is widely regarded as one of the best charting tools in the industry, offering hundreds of indicators, drawing tools, and chart types to choose from.

Q: Do you need a broker with TradingView?

A: TradingView is not a standalone broker, meaning that you cannot trade directly with TradingView without connecting to a broker. TradingView supports multiple brokers that offer trading for different assets and markets. However, you do not need one to use the charting, backtesting, or screener.

Q: Can I backtest on TC2000?

A: TC2000 allows you to backtest your strategies using PCF (Personal Criteria Formula), a scripting language that lets you create custom conditions and formulas. You can apply your PCF to any watchlist or scan it and see how it performed in the past.

However, TC2000’s backtesting capabilities are more limited and less informative than other platforms, such as TradingView. You can only see the number of trades, win rate, average gain/loss, maximum drawdown, etc. You cannot optimize your strategies or see the equity curve or trades list.

Q: Is TC2000 screener free?

A: TC2000 screener is not free. You need to pay a monthly or annual fee to use the platform and access its screening features.

Before you go

If you want to keep educating yourself about trading, you must check out these posts as well:

How to Get a TradingView Free Trial

The Best TradingView Indicators

– Free trading journal template & cheat sheet PDFs

– Custom scanners, watchlists, & market commentary

– Access our free trading course and community